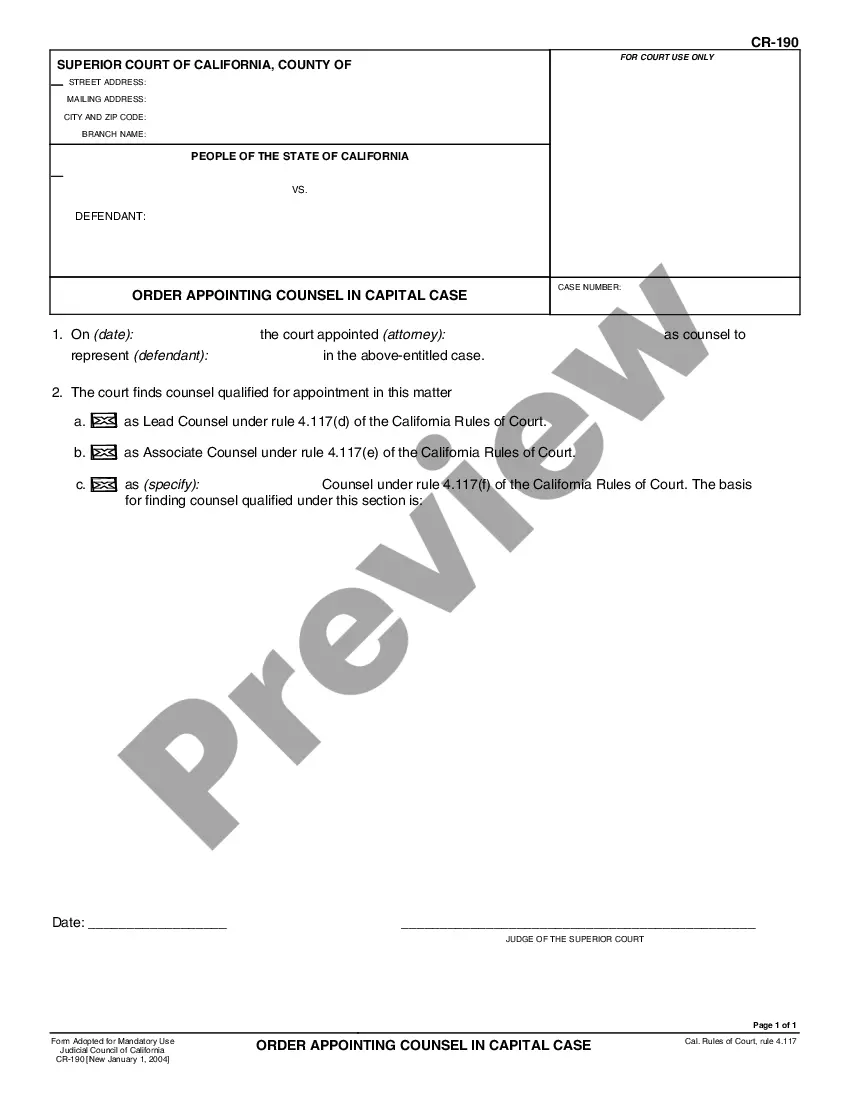

This form is an official United States District Court - California Central District form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

Oceanside, California is a beautiful coastal city located in San Diego County. Known for its stunning beaches and vibrant community, Oceanside offers a wide range of activities, attractions, and amenities for both residents and visitors alike. When it comes to legal matters, such as posting a Third Party Surety Appearance Bond in Oceanside, it's essential to understand the process and requirements involved. Posting this type of bond ensures that a party, other than the defendant, guarantees the defendant's appearance in court for a specific legal proceeding. To successfully navigate the Oceanside, California Instructions for Posting a Third Party Surety Appearance Bond, it is crucial to perform the following steps: 1. Familiarize yourself with the basic requirements: Understanding the bond's purpose and the obligations it entails is essential. Ensure that you meet the prerequisites necessary for posting the bond. 2. Locate a reputable surety bond company: Search for licensed and experienced surety bond providers in Oceanside, California. Consider factors such as their expertise, customer reviews, pricing, and overall reputation. Choosing an established and trustworthy company will ensure a smooth bonding process. 3. Gather required documentation: Before initiating the bond posting, gather all relevant paperwork and documents required by the surety bond company. This typically includes identification documents, financial statements, and any other supporting materials requested. 4. Fill out the bond application: Complete the bond application form provided by the surety bond company. Ensure that all information is accurate and comprehensive to avoid delays or complications. 5. Provide financial proof: Depending on the bond amount, the surety bond company may require financial proof to evaluate your ability to fulfill the bond's obligations. This may involve submitting bank statements, tax returns, or other relevant financial documents. 6. Pay the bond premium: Upon approval of the bond application, you will be required to pay the bond premium. The premium is typically a percentage of the total bond amount. Be sure to inquire about payment methods accepted by the surety bond company. 7. Sign the bond agreement: Once the bond premium is paid, you will be provided with the bond agreement. Carefully review the terms and conditions outlined in the document before signing it. Seek legal counsel if necessary. By following these steps, you can effectively navigate the process of posting a Third Party Surety Appearance Bond in Oceanside, California. As for different types of Oceanside California Instructions for Posting a Third Party Surety Appearance Bond, there aren't specific variations of this process exclusive to Oceanside. However, depending on the nature of the legal case or the court's requirements, additional documents or steps may be necessary. It is crucial to consult with the surety bond company and the court to ensure compliance with any specific instructions or variations that may apply.Oceanside, California is a beautiful coastal city located in San Diego County. Known for its stunning beaches and vibrant community, Oceanside offers a wide range of activities, attractions, and amenities for both residents and visitors alike. When it comes to legal matters, such as posting a Third Party Surety Appearance Bond in Oceanside, it's essential to understand the process and requirements involved. Posting this type of bond ensures that a party, other than the defendant, guarantees the defendant's appearance in court for a specific legal proceeding. To successfully navigate the Oceanside, California Instructions for Posting a Third Party Surety Appearance Bond, it is crucial to perform the following steps: 1. Familiarize yourself with the basic requirements: Understanding the bond's purpose and the obligations it entails is essential. Ensure that you meet the prerequisites necessary for posting the bond. 2. Locate a reputable surety bond company: Search for licensed and experienced surety bond providers in Oceanside, California. Consider factors such as their expertise, customer reviews, pricing, and overall reputation. Choosing an established and trustworthy company will ensure a smooth bonding process. 3. Gather required documentation: Before initiating the bond posting, gather all relevant paperwork and documents required by the surety bond company. This typically includes identification documents, financial statements, and any other supporting materials requested. 4. Fill out the bond application: Complete the bond application form provided by the surety bond company. Ensure that all information is accurate and comprehensive to avoid delays or complications. 5. Provide financial proof: Depending on the bond amount, the surety bond company may require financial proof to evaluate your ability to fulfill the bond's obligations. This may involve submitting bank statements, tax returns, or other relevant financial documents. 6. Pay the bond premium: Upon approval of the bond application, you will be required to pay the bond premium. The premium is typically a percentage of the total bond amount. Be sure to inquire about payment methods accepted by the surety bond company. 7. Sign the bond agreement: Once the bond premium is paid, you will be provided with the bond agreement. Carefully review the terms and conditions outlined in the document before signing it. Seek legal counsel if necessary. By following these steps, you can effectively navigate the process of posting a Third Party Surety Appearance Bond in Oceanside, California. As for different types of Oceanside California Instructions for Posting a Third Party Surety Appearance Bond, there aren't specific variations of this process exclusive to Oceanside. However, depending on the nature of the legal case or the court's requirements, additional documents or steps may be necessary. It is crucial to consult with the surety bond company and the court to ensure compliance with any specific instructions or variations that may apply.