This form is an official United States District Court - California Central District form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

Burbank California Employer's Return - Wage Garnishment - F.R.C.P. Rule 64

Description

How to fill out California Employer's Return - Wage Garnishment - F.R.C.P. Rule 64?

Irrespective of social or occupational rank, completing legal-related paperwork is a regrettable requirement in today’s workplace.

Too frequently, it’s virtually unfeasible for an individual without a legal education to develop such documents from the ground up, primarily owing to the intricate language and legal details they entail.

This is where US Legal Forms can be a lifesaver.

However, if you are new to our platform, make sure to follow these steps prior to downloading the Burbank California Employer's Return - Wage Garnishment - F.R.C.P. Rule 64.

Confirm that the form you have located is tailored to your specific area as the laws of one state or region may not be applicable to another state or region.

- Our platform offers a vast assortment of over 85,000 ready-to-use state-specific forms applicable to nearly any legal situation.

- US Legal Forms also acts as a valuable resource for associates or legal advisors seeking to save time with our DIY forms.

- Whether you require the Burbank California Employer's Return - Wage Garnishment - F.R.C.P. Rule 64 or any other document suitable for your state or locality, US Legal Forms provides everything you need.

- Here’s how you can swiftly obtain the Burbank California Employer's Return - Wage Garnishment - F.R.C.P. Rule 64 using our dependable platform.

- If you are already a member, proceed to Log In to access the relevant form.

Form popularity

FAQ

Even after a garnishment has started, you can still try and negotiate a resolution with the creditor, especially if your circumstances change.

The easiest way to release and stop a wage garnishment/levy by the IRS or the State is to pay your taxes in full plus any penalties and interest that may have been assessed as late fees.

The most effective way to stop garnishments or other levies is to pay in full. After you have paid, contact the number listed on your order. Have your payroll, bank, or other payor fax number prior to calling.

6 Options If Your Wages Are Being Garnished Try To Work Something Out With The Creditor.File a Claim of Exemption.Challenge the Garnishment.Consolidate or Refinance Your Debt.Work with a Credit Counselor to Get on a Payment Plan.File Bankruptcy.

Here are some possible options: Debt Negotiation and Working with Your Creditor. One thing to remember, your creditors usually prefer not to go through the court system to try to recoup the money you owe.Filing a Claim of Exemption.Filing for Bankruptcy to Avoid Wage Garnishment.Vacating A Default Judgment.

An employee paid every other week has disposable earnings of $500 for the first week and $80 for the second week of the pay period, for a total of $580. In a biweekly pay period, when disposable earnings are at or above $580 for the pay period, 25% may be garnished; $145.00 (25% × $580) may be garnished.

Paying the debt in full stops the wage garnishment. However, if you cannot pay the debt in full, you might be able to negotiate with the creditor for a settlement. For example, the creditor may agree to accept a lower amount to pay off the wage garnishment if you pay the amount in one payment within 30 to 60 days.

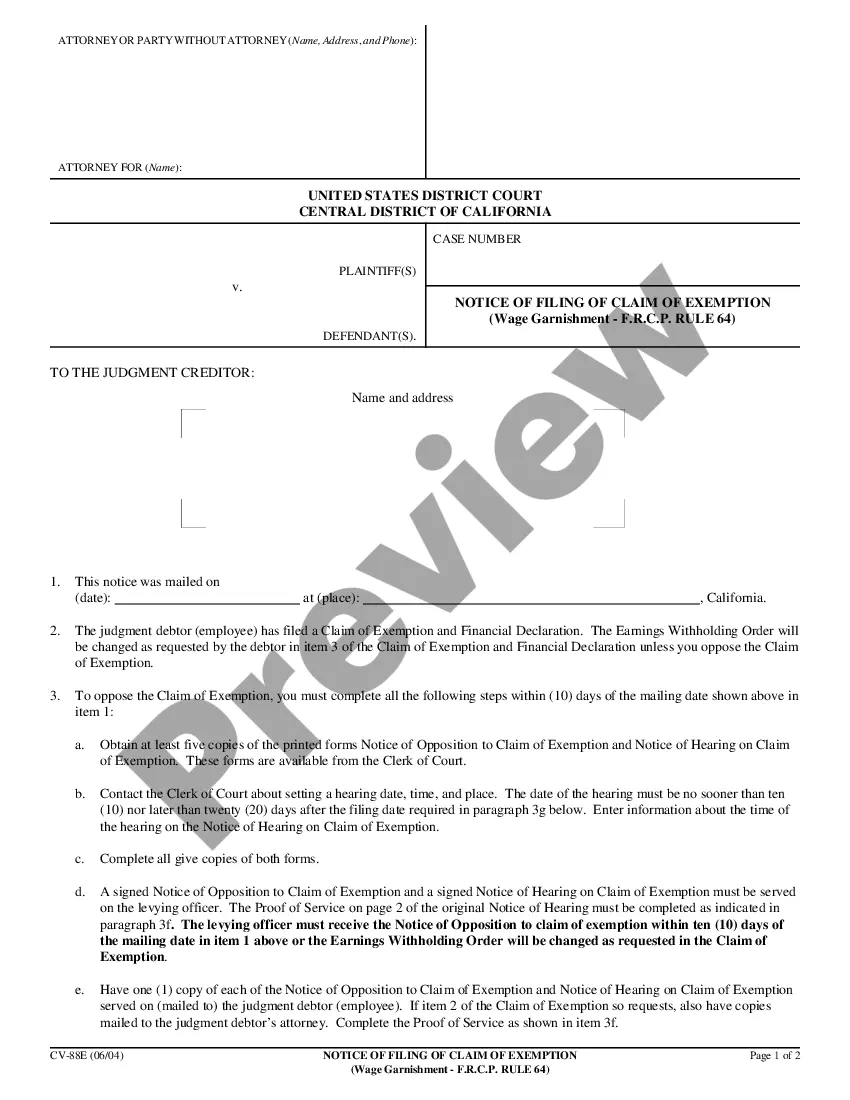

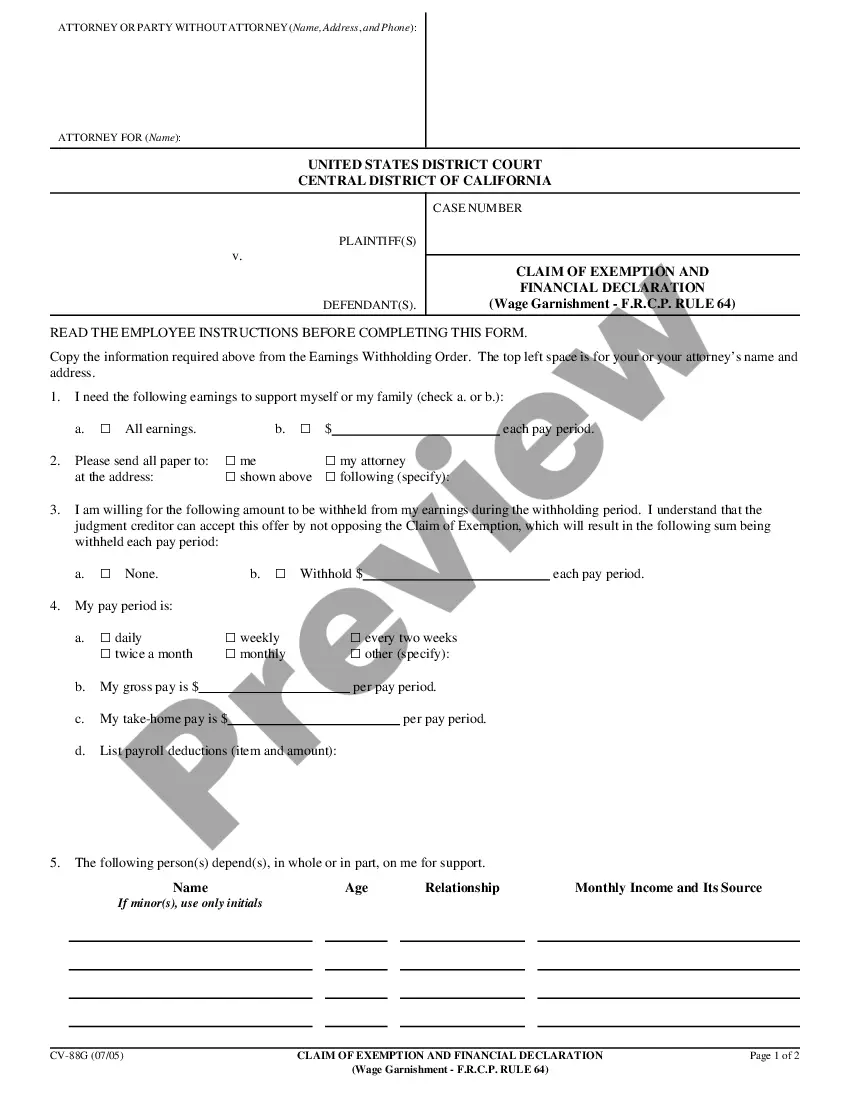

File an Exemption ? In California you may be able to stop the Wage Garnishment through filing an exemption. You may be able to have the wage garnishment stop or reduce the amount being garnished if you can show that the money is needed to support you or your family.

With the notice of garnishment, you should have been served with a form to claim the exemption for money necessary for support. To claim the exemption in wages, you need to also complete the form financial statement. Note that the financial statement asks for your monthly income.