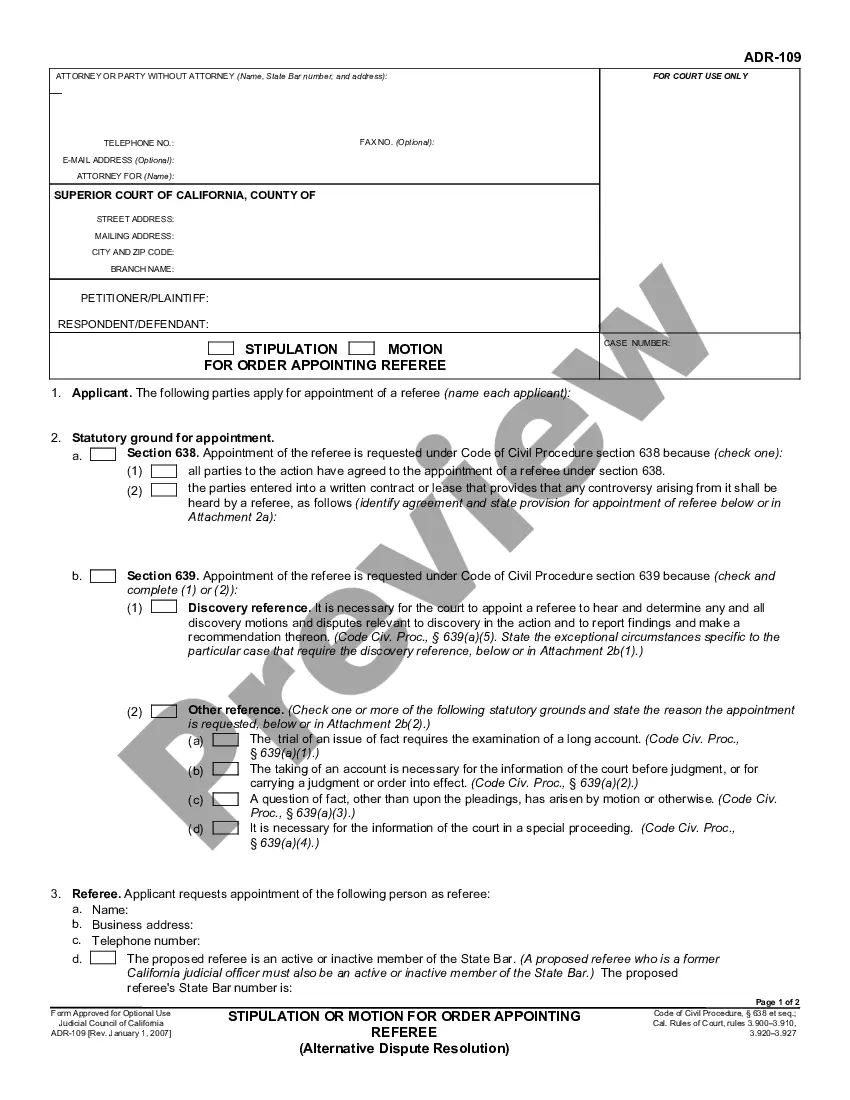

This form is an official United States District Court - California Central District form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

Clovis California Employer's Return — WagGarnishmenten— - F.R.C.P. Rule 64: A Comprehensive Overview Keywords: Clovis California Employer's Return, Wage Garnishment, F.R.C.P. Rule 64, types Introduction: Clovis, California Employer's Return — WagGarnishmenten— - F.R.C.P. Rule 64 refers to the legal process through which a creditor can collect a debt owed by an individual by obtaining a court order that allows them to garnish the debtor's wages. This process is governed by the Federal Rules of Civil Procedure (F.R.C.P.) Rule 64 and specifically applies to employers located in Clovis, California. Several types of wage garnishment may exist under this rule, offering various means through which creditors can recover their debts. Types of Clovis California Employer's Return — WagGarnishmenten— - F.R.C.P. Rule 64: 1. Judicial Wage Garnishment: Under this type, a creditor initiates the garnishment process by filing a lawsuit against the debtor. Upon obtaining a court judgment in their favor, the creditor can request the court to issue an order, allowing them to collect a portion of the employee's wages to satisfy the debt. The employer must comply with this court order and withhold the designated amount from the employee's paycheck. 2. Child Support Garnishment: In cases where the debtor is delinquent on child support payments, the custodial parent or relevant child support enforcement agency can initiate wage garnishment proceedings. By obtaining a court order, this type of garnishment allows the deduction of a specific amount from the employee's wages, ensuring regular child support payments are made. 3. Tax Garnishment: In situations where the debtor owes unpaid taxes to the Internal Revenue Service or the California Franchise Tax Board, the government can invoke wage garnishment to collect the outstanding debts. The employer is required to withhold a portion of the employee's wages as specified under the court-issued garnishment order until the tax liability is satisfied. Procedure for Clovis California Employer's Return — WagGarnishmenten— - F.R.C.P. Rule 64: 1. Creditor's Petition: The creditor files a petition or lawsuit against the debtor, outlining the outstanding debt owed and the need for wage garnishment. 2. Court Judgment: Upon reviewing the petition, the court evaluates the creditor's claim and grants a judgment in favor of the creditor if it deems the debt valid. 3. Garnishment Order: Once the court judgment is in place, the creditor can request a garnishment order from the court, specifying the amount and duration of wage garnishment. 4. Employer Notification: The garnishment order is served to the employer who is then legally obligated to comply with the order. They must begin withholding the designated amount from the employee's wages until the debt is satisfied or the order expires. 5. Employee Notification: The employer informs the employee about the wage garnishment, providing details such as the amount being withheld and the timeframe for which garnishment will occur. Conclusion: Clovis California Employer's Return — WagGarnishmenten— - F.R.C.P. Rule 64 encompasses various types of wage garnishment that allow creditors to collect outstanding debts from an employee's wages. It operates under the guidelines of the Federal Rules of Civil Procedure Rule 64 and ensures that employers in Clovis, California comply with the court-issued garnishment orders. Understanding these procedures and types of wage garnishment can help both employers and employees navigate this legal process effectively.

Clovis California Employer's Return — WagGarnishmenten— - F.R.C.P. Rule 64: A Comprehensive Overview Keywords: Clovis California Employer's Return, Wage Garnishment, F.R.C.P. Rule 64, types Introduction: Clovis, California Employer's Return — WagGarnishmenten— - F.R.C.P. Rule 64 refers to the legal process through which a creditor can collect a debt owed by an individual by obtaining a court order that allows them to garnish the debtor's wages. This process is governed by the Federal Rules of Civil Procedure (F.R.C.P.) Rule 64 and specifically applies to employers located in Clovis, California. Several types of wage garnishment may exist under this rule, offering various means through which creditors can recover their debts. Types of Clovis California Employer's Return — WagGarnishmenten— - F.R.C.P. Rule 64: 1. Judicial Wage Garnishment: Under this type, a creditor initiates the garnishment process by filing a lawsuit against the debtor. Upon obtaining a court judgment in their favor, the creditor can request the court to issue an order, allowing them to collect a portion of the employee's wages to satisfy the debt. The employer must comply with this court order and withhold the designated amount from the employee's paycheck. 2. Child Support Garnishment: In cases where the debtor is delinquent on child support payments, the custodial parent or relevant child support enforcement agency can initiate wage garnishment proceedings. By obtaining a court order, this type of garnishment allows the deduction of a specific amount from the employee's wages, ensuring regular child support payments are made. 3. Tax Garnishment: In situations where the debtor owes unpaid taxes to the Internal Revenue Service or the California Franchise Tax Board, the government can invoke wage garnishment to collect the outstanding debts. The employer is required to withhold a portion of the employee's wages as specified under the court-issued garnishment order until the tax liability is satisfied. Procedure for Clovis California Employer's Return — WagGarnishmenten— - F.R.C.P. Rule 64: 1. Creditor's Petition: The creditor files a petition or lawsuit against the debtor, outlining the outstanding debt owed and the need for wage garnishment. 2. Court Judgment: Upon reviewing the petition, the court evaluates the creditor's claim and grants a judgment in favor of the creditor if it deems the debt valid. 3. Garnishment Order: Once the court judgment is in place, the creditor can request a garnishment order from the court, specifying the amount and duration of wage garnishment. 4. Employer Notification: The garnishment order is served to the employer who is then legally obligated to comply with the order. They must begin withholding the designated amount from the employee's wages until the debt is satisfied or the order expires. 5. Employee Notification: The employer informs the employee about the wage garnishment, providing details such as the amount being withheld and the timeframe for which garnishment will occur. Conclusion: Clovis California Employer's Return — WagGarnishmenten— - F.R.C.P. Rule 64 encompasses various types of wage garnishment that allow creditors to collect outstanding debts from an employee's wages. It operates under the guidelines of the Federal Rules of Civil Procedure Rule 64 and ensures that employers in Clovis, California comply with the court-issued garnishment orders. Understanding these procedures and types of wage garnishment can help both employers and employees navigate this legal process effectively.