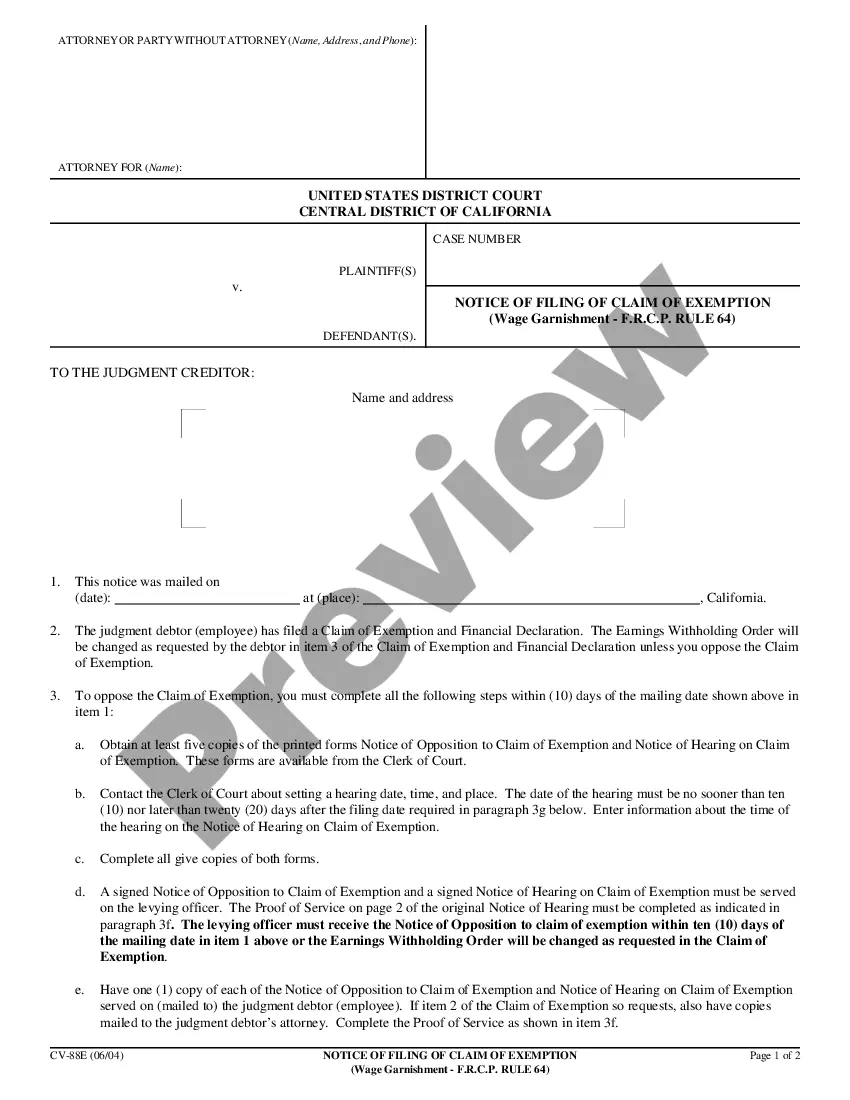

This form is an official United States District Court - California Central District form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

Irvine California Employer's Return - Wage Garnishment - F.R.C.P. Rule 64

Description

How to fill out California Employer's Return - Wage Garnishment - F.R.C.P. Rule 64?

Obtaining certified templates tailored to your regional legislation can be challenging unless you utilize the US Legal Forms repository.

This is an online collection of over 85,000 legal documents suited for both personal and professional requirements as well as various real-world scenarios.

All forms are accurately organized by type of use and legal territories, making your search for the Irvine California Employer's Return - Wage Garnishment - F.R.C.P. Rule 64 as straightforward as 1-2-3.

Ensure your credit card information is entered or utilize your PayPal account for payment. Download the Irvine California Employer's Return - Wage Garnishment - F.R.C.P. Rule 64 to store it on your device for completion and access it from the My documents section of your profile whenever you need it again.

- Review the Preview mode and form details.

- Ensure you’ve selected the correct version that fulfills your needs and aligns with your local legal standards.

- Look for a different template, if necessary.

- If you identify any discrepancies, use the Search tab above to find the appropriate one. If it meets your needs, proceed to the next step.

- Purchase the document.

Form popularity

FAQ

Paying the debt in full stops the wage garnishment. However, if you cannot pay the debt in full, you might be able to negotiate with the creditor for a settlement. For example, the creditor may agree to accept a lower amount to pay off the wage garnishment if you pay the amount in one payment within 30 to 60 days.

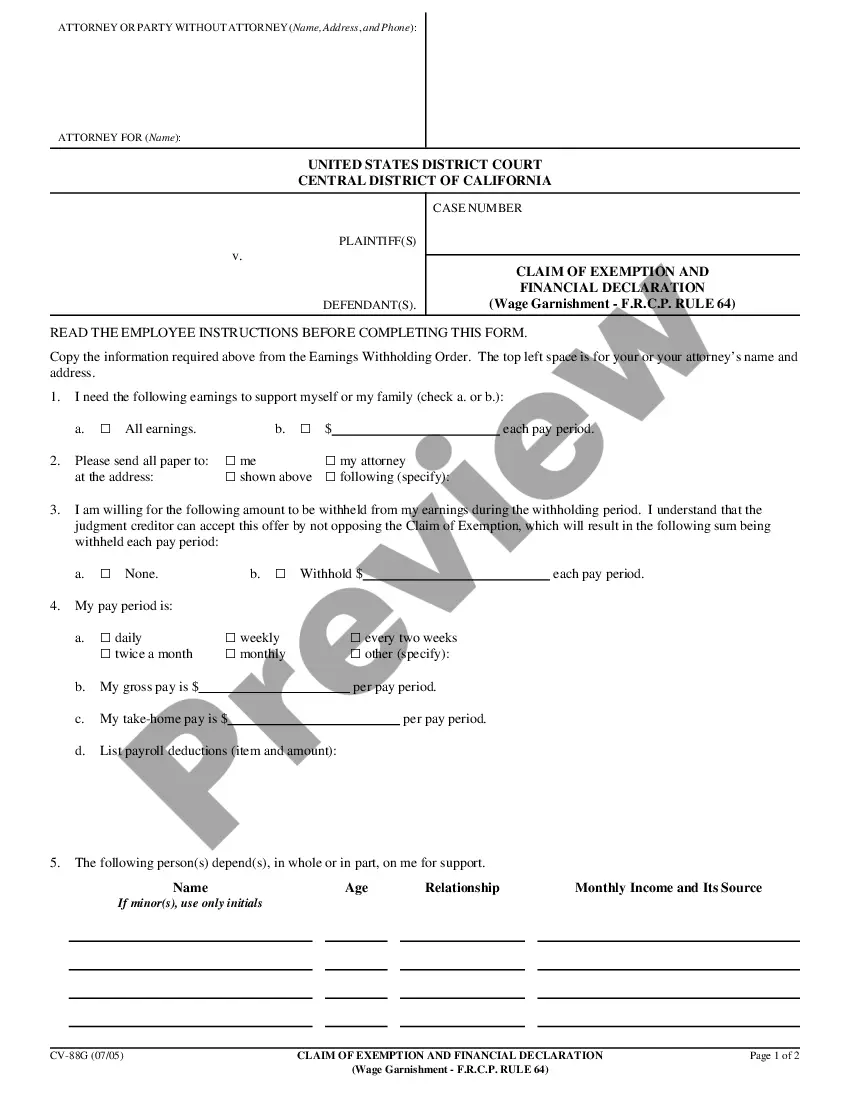

File an Exemption ? In California you may be able to stop the Wage Garnishment through filing an exemption. You may be able to have the wage garnishment stop or reduce the amount being garnished if you can show that the money is needed to support you or your family.

Here are some possible options: Debt Negotiation and Working with Your Creditor. One thing to remember, your creditors usually prefer not to go through the court system to try to recoup the money you owe.Filing a Claim of Exemption.Filing for Bankruptcy to Avoid Wage Garnishment.Vacating A Default Judgment.

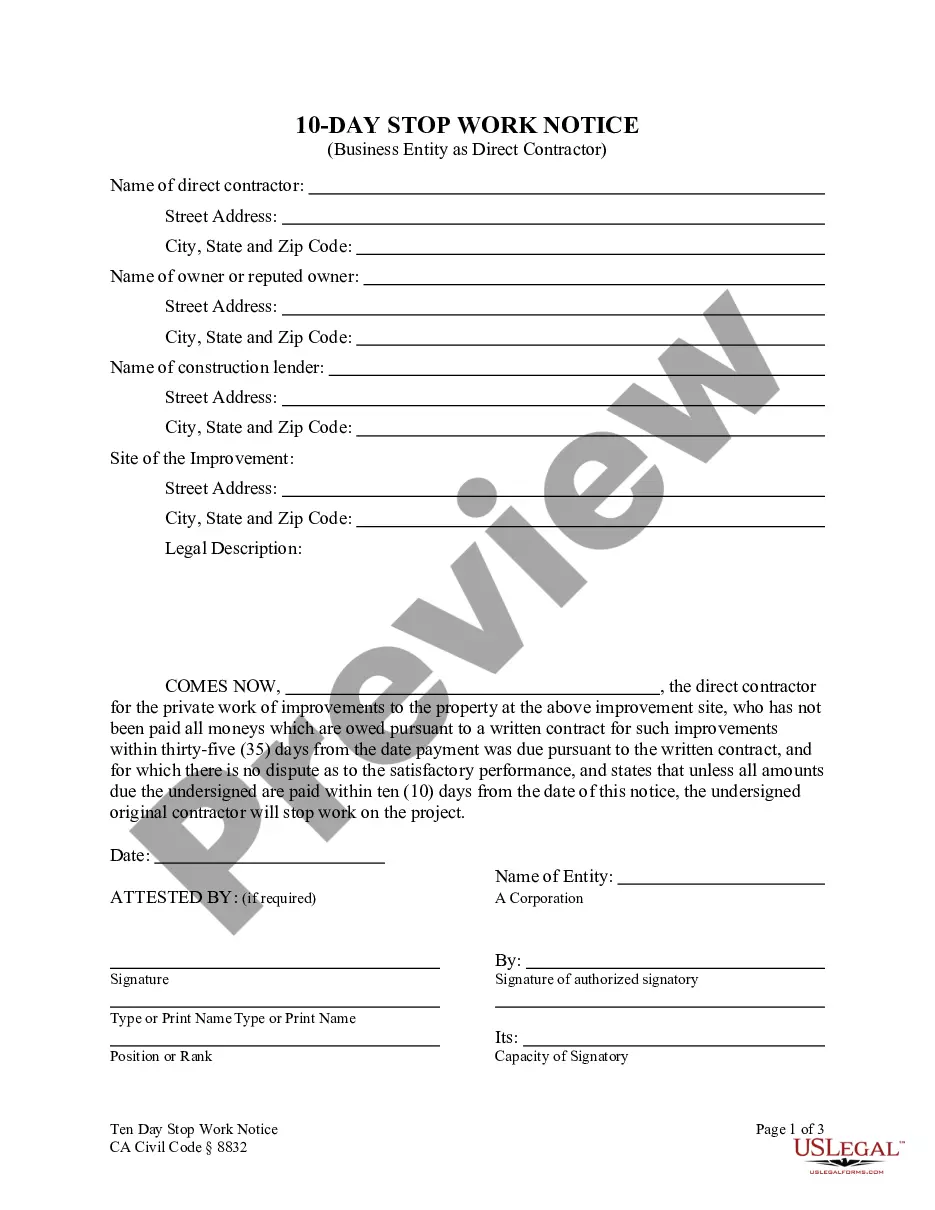

In California, an earnings withholding order carries the same force as a court order. If the employer fails to complete the memorandum of garnishee and withdraw the required wages from the debtor's paycheck, the creditor should immediately send a demand letter to the employer.

The most effective way to stop garnishments or other levies is to pay in full. After you have paid, contact the number listed on your order. Have your payroll, bank, or other payor fax number prior to calling.

Stop Wage Garnishment in California Call the Creditor ? There is nothing lost in trying to talk to the creditor and work out a different arrangement to repay the debt back.File an Exemption ? In California you may be able to stop the Wage Garnishment through filing an exemption.

An employee paid every other week has disposable earnings of $500 for the first week and $80 for the second week of the pay period, for a total of $580. In a biweekly pay period, when disposable earnings are at or above $580 for the pay period, 25% may be garnished; $145.00 (25% × $580) may be garnished.

Stopping A California FTB Bank Levy Before It Starts Pay In Full ? Pay off the debt completely. Payment Plan ? Paying off the debt in the monthly payment. Offer In Compromise ? Settling a tax debt for less than the amount owed. Hardship Request ? Tax debt collections are stopped for one year (six months in some cases)

The first way to stop wage garnishment is to pay your tax debt in full. The IRS is only garnishing your wages so that it can get the money that you owe. If you send the IRS payment for your tax debt, the IRS won't have any reason to garnish your wages.

We have 20 years to collect on a liability (R&TC 19255 ).