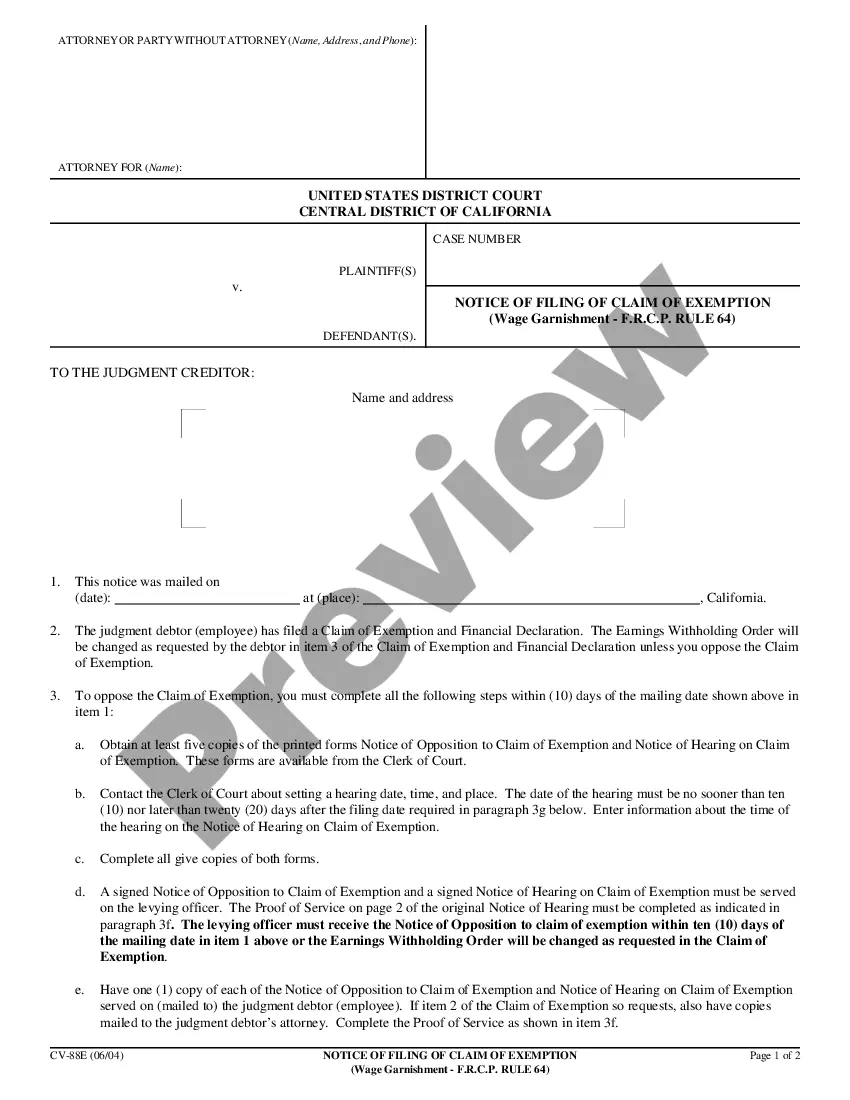

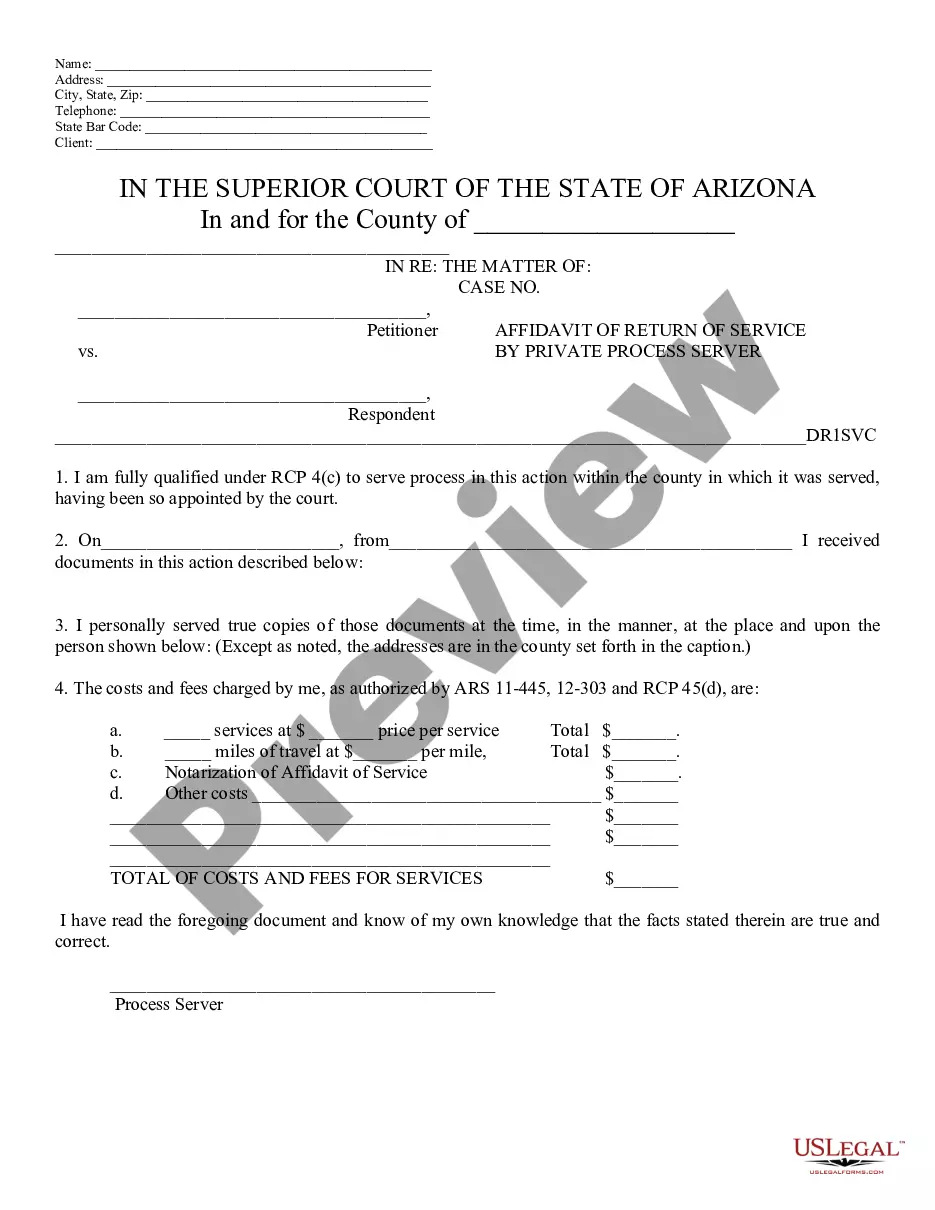

This form is an official United States District Court - California Central District form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

Palmdale California Employer's Return - Wage Garnishment - F.R.C.P. Rule 64

Description

How to fill out California Employer's Return - Wage Garnishment - F.R.C.P. Rule 64?

If you have previously employed our service, sign in to your account and retrieve the Palmdale California Employer's Return - Wage Garnishment - F.R.C.P. Rule 64 onto your device by selecting the Download button. Ensure your membership is active. If not, renew it according to your billing plan.

If this is your initial encounter with our service, adhere to these straightforward steps to acquire your document.

You have ongoing access to every document you have acquired: you can find it in your profile under the My documents section whenever you need to reuse it. Utilize the US Legal Forms service to effortlessly discover and retain any template for your individual or business requirements!

- Ensure you’ve identified the correct document. Review the description and utilize the Preview feature, if available, to ascertain if it fits your criteria. If it fails to meet your needs, leverage the Search option above to locate the suitable one.

- Purchase the template. Click the Buy Now button and select a monthly or yearly subscription plan.

- Create an account and process payment. Use your credit card information or the PayPal method to finalize the purchase.

- Obtain your Palmdale California Employer's Return - Wage Garnishment - F.R.C.P. Rule 64. Choose the file format for your document and download it to your device.

- Finalize your document. Print it or utilize professional online editing tools to complete and sign it digitally.

Form popularity

FAQ

A wage garnishment requires employers to withhold and transmit a portion of an employee's wages until the balance on the order is paid in full or the order is released by us. We issue 3 types of wage garnishments: Earnings withholding orders (EWO): Earnings Withholding Order for Vehicle Registration (FTB 2204)

Who Can Garnish My Wages in California? If you work in California, creditors, debt collectors, and debt buyers can garnish your wages for past-due consumer debt, such as credit card debt, back rent, car loans, medical bills, or payday loans. Generally, creditors must get a court order judgment to collect consumer debt.

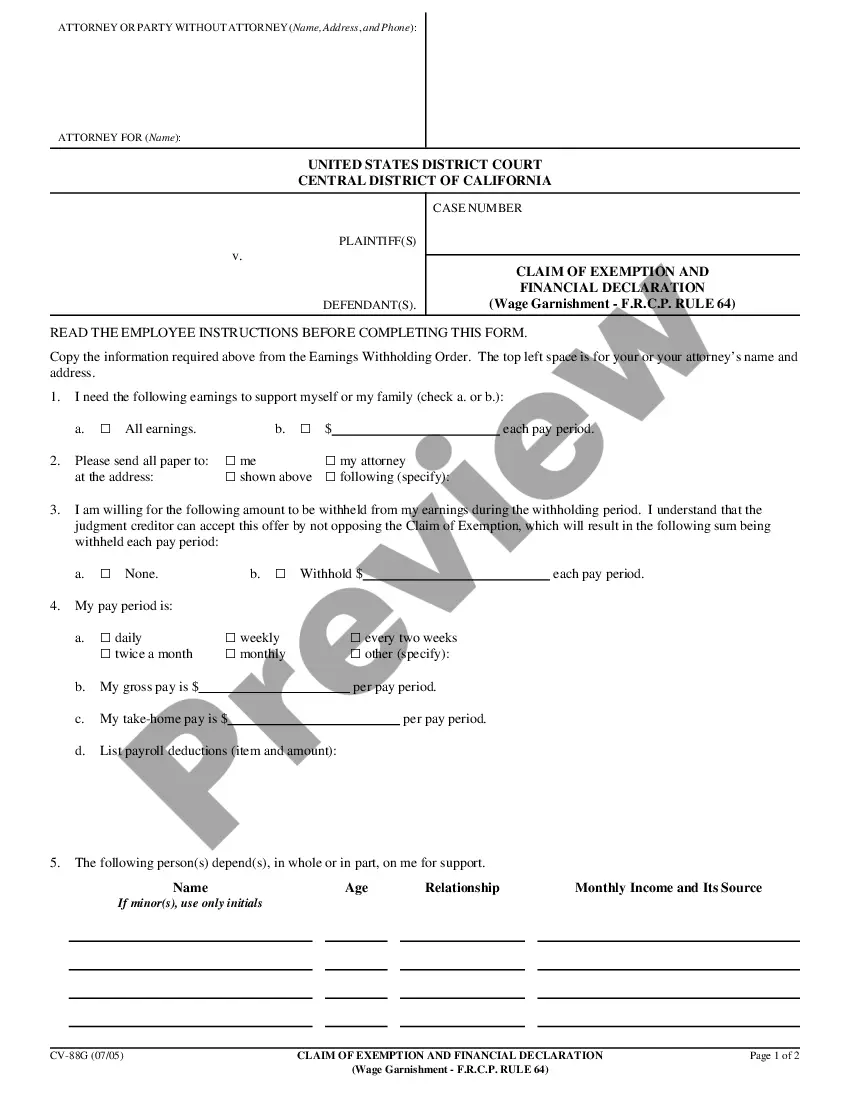

6 Options If Your Wages Are Being Garnished Try To Work Something Out With The Creditor.File a Claim of Exemption.Challenge the Garnishment.Consolidate or Refinance Your Debt.Work with a Credit Counselor to Get on a Payment Plan.File Bankruptcy.

Here are some possible options: Debt Negotiation and Working with Your Creditor. One thing to remember, your creditors usually prefer not to go through the court system to try to recoup the money you owe.Filing a Claim of Exemption.Filing for Bankruptcy to Avoid Wage Garnishment.Vacating A Default Judgment.

Paying the debt in full stops the wage garnishment. However, if you cannot pay the debt in full, you might be able to negotiate with the creditor for a settlement. For example, the creditor may agree to accept a lower amount to pay off the wage garnishment if you pay the amount in one payment within 30 to 60 days.

A wage garnishment requires employers to withhold and transmit a portion of an employee's wages until the balance on the order is paid in full or the order is released by us. We issue 3 types of wage garnishments: Earnings withholding orders (EWO): Earnings Withholding Order for Vehicle Registration (FTB 2204)

Limits on Wage Garnishment in California Under California law, the most that can be garnished from your wages is the lesser of: 25% of your disposable earnings for that week or. 50% of the amount by which your weekly disposable earnings exceed 40 times the state hourly minimum wage.

The CCPA prohibits an employer from firing an employee whose earnings are subject to garnishment for any one debt, regardless of the number of levies made or proceedings brought to collect that one debt. The CCPA does not prohibit discharge because an employee's earnings are separately garnished for two or more debts.

File an Exemption ? In California you may be able to stop the Wage Garnishment through filing an exemption. You may be able to have the wage garnishment stop or reduce the amount being garnished if you can show that the money is needed to support you or your family.