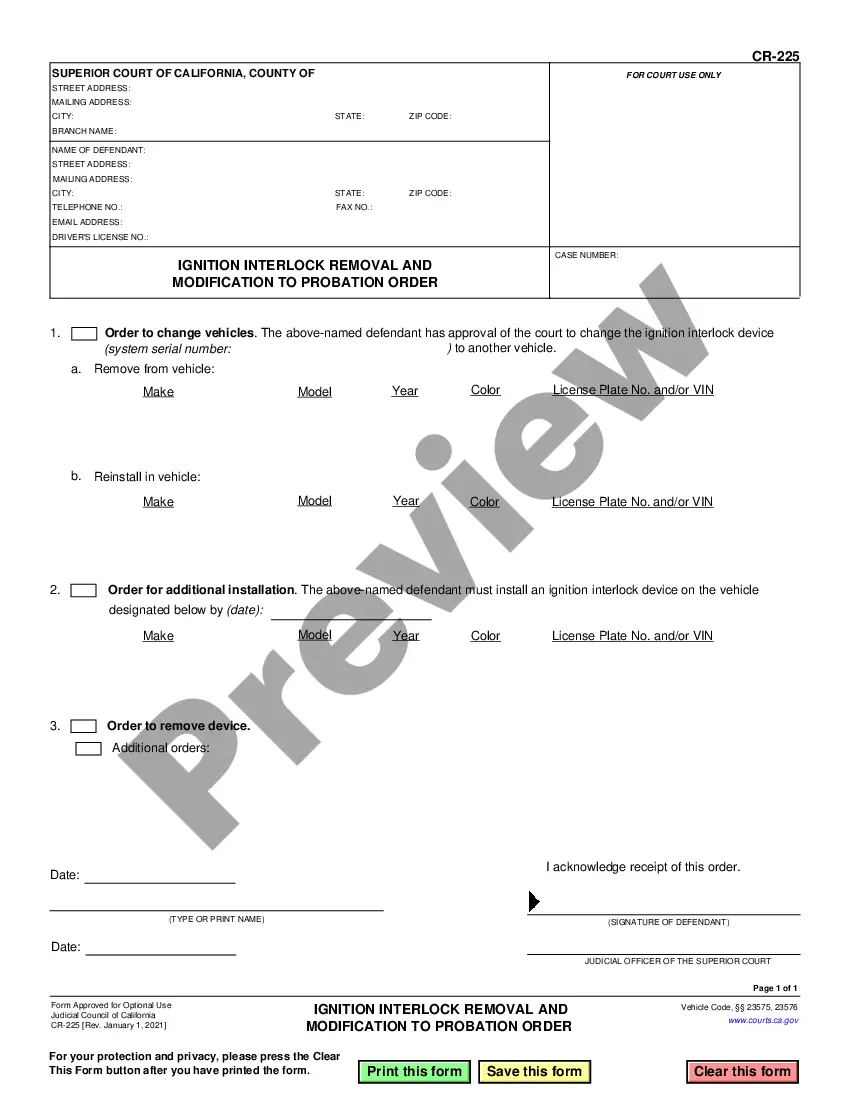

This form is an official United States District Court - California Central District form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

Rialto California Employer's Return — WagGarnishmenten— - F.R.C.P. Rule 64 is a legal process through which a judgment creditor can collect unpaid debts from a judgment debtor's wages. This procedure is governed by Federal Rules of Civil Procedure (F.R.C.P.) Rule 64, which outlines the guidelines and requirements for wage garnishment. When a judgment creditor obtains a court order to garnish someone's wages for unpaid debts, they serve the order on the judgment debtor's employer. The employer then becomes responsible for calculating and withholding a portion of the debtor's wages to satisfy the debt. This process is known as an Employer's Return. Some relevant keywords associated with Rialto California Employer's Return — WagGarnishmenten— - F.R.C.P. Rule 64 include: 1. Rialto, California: Refers to the specific location where the wage garnishment enforcement takes place. Rialto is a city in San Bernardino County, California. 2. Employer's Return: This term denotes the responsibility assigned to the judgment debtor's employer to calculate and withhold a portion of the employee's wages as directed by the court order. 3. Wage Garnishment: The legal process of deducting a portion of an employee's wages to satisfy outstanding debts. This garnishment is done by the employer under court order. 4. F.R.C.P. Rule 64: Stands for the Federal Rules of Civil Procedure Rule 64, which provides the guidelines for various legal procedures, including wage garnishment, to ensure fair execution and compliance with the law. It's important to note that Rialto California Employer's Return — WagGarnishmenten— - F.R.C.P. Rule 64 applies to any judgment debtor residing or employed within the jurisdiction. This process assists judgment creditors in collecting overdue debts by involving the employer in the recovery process.