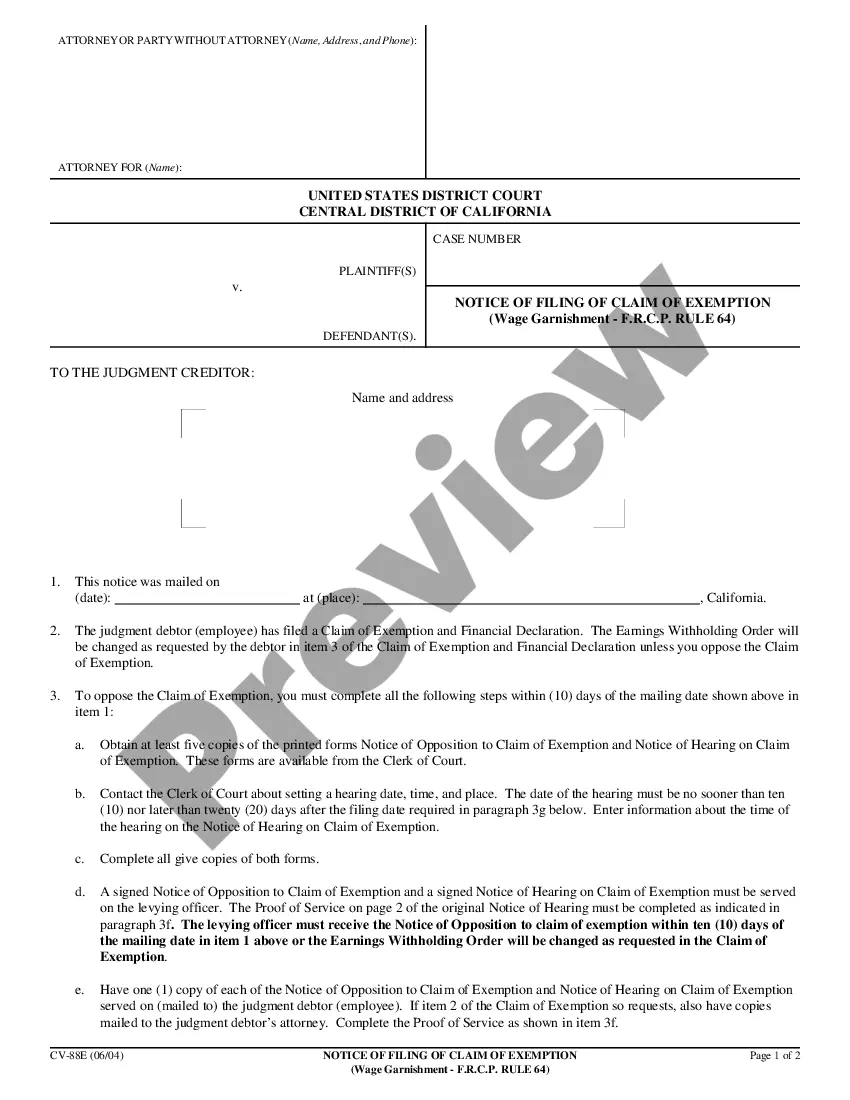

This form is an official United States District Court - California Central District form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

Santa Ana California Employer's Return - Wage Garnishment - F.R.C.P. Rule 64

Description

How to fill out California Employer's Return - Wage Garnishment - F.R.C.P. Rule 64?

No matter one’s societal or occupational position, completing legal documents is a regrettable requirement in the current era.

Too frequently, it’s nearly impossible for an individual lacking any legal expertise to compile such documents from scratch, primarily due to the intricate terminology and legal subtleties they entail.

This is where US Legal Forms can be a lifesaver.

Ensure the form you have located is pertinent to your area considering that the regulations of one region do not apply to another.

Examine the document and read a brief overview (if available) of situations the form may be applicable for.

- Our service provides a vast repository with over 85,000 ready-to-utilize state-specific documents that cater to nearly any legal circumstance.

- US Legal Forms is also an excellent resource for associates or legal advisors aiming to enhance their efficiency time-wise by using our DIY forms.

- Whether you need the Santa Ana California Employer's Return - Wage Garnishment - F.R.C.P. Rule 64 or any other documentation that will be recognized in your state or locality, with US Legal Forms, everything is at your fingertips.

- Here’s how you can quickly obtain the Santa Ana California Employer's Return - Wage Garnishment - F.R.C.P. Rule 64 using our trustworthy service.

- If you are currently a member, you can proceed to Log In to your account to access the required form.

- However, if you are new to our platform, ensure you follow these steps before downloading the Santa Ana California Employer's Return - Wage Garnishment - F.R.C.P. Rule 64.

Form popularity

FAQ

Get form EJ-100 and fill it out. File it with the court and send a copy to the debtor. Keep a copy for your records. Notify the levying officer (i.e., the sheriff's department) that the judgment has been paid and ask them to release the garnishment.

Get form EJ-100 and fill it out. File it with the court and send a copy to the debtor. Keep a copy for your records. Notify the levying officer (i.e., the sheriff's department) that the judgment has been paid and ask them to release the garnishment.

Note that a levy is only effective on the balance in your accounts at the financial institution as of the date it's served. Calif. Code of Civil Procedure § 700.140(b). So as long as the amount you have in your accounts there on that date is no more than $1,826, all of your funds are protected.

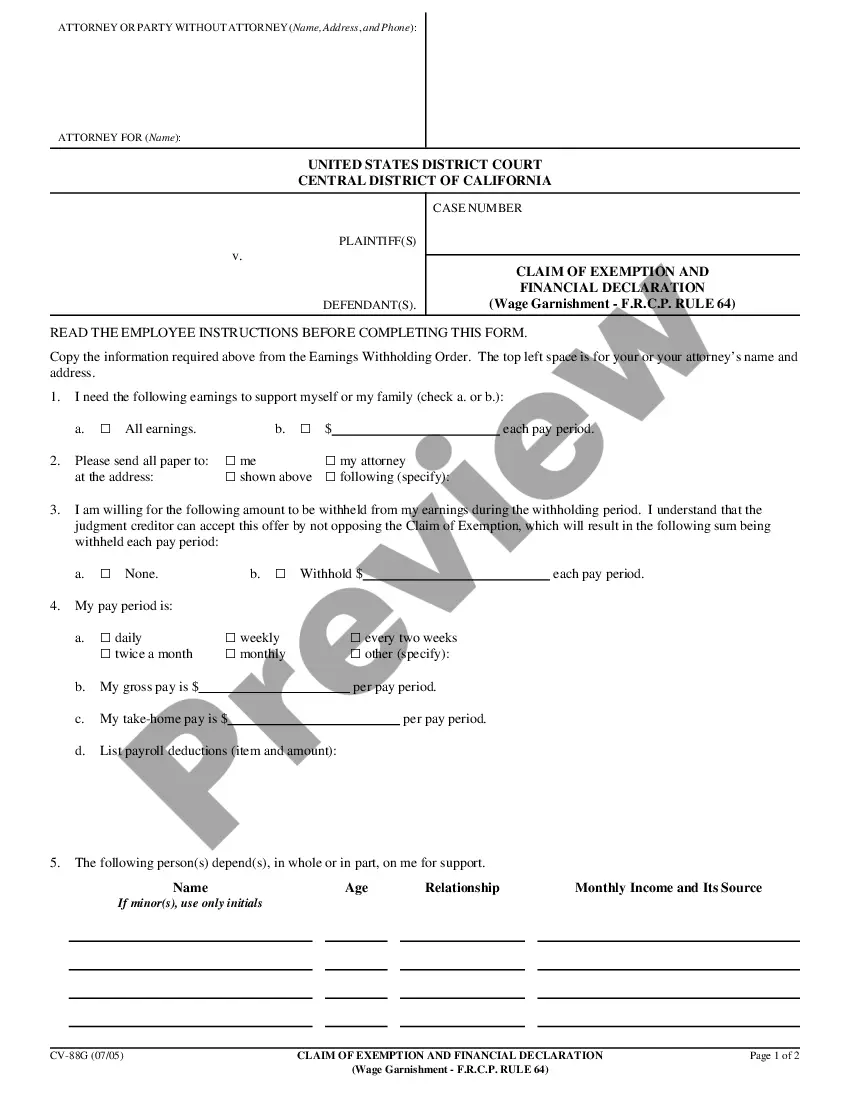

With the notice of garnishment, you should have been served with a form to claim the exemption for money necessary for support. To claim the exemption in wages, you need to also complete the form financial statement. Note that the financial statement asks for your monthly income.

Paying the debt in full stops the wage garnishment. However, if you cannot pay the debt in full, you might be able to negotiate with the creditor for a settlement. For example, the creditor may agree to accept a lower amount to pay off the wage garnishment if you pay the amount in one payment within 30 to 60 days.

Limits on Wage Garnishment in California Under California law, the most that can be garnished from your wages is the lesser of: 25% of your disposable earnings for that week or. 50% of the amount by which your weekly disposable earnings exceed 40 times the state hourly minimum wage.

Title III Protections against Discharge when Wages are Garnished. The CCPA prohibits an employer from firing an employee whose earnings are subject to garnishment for any one debt, regardless of the number of levies made or proceedings brought to collect that one debt.

A wage garnishment requires employers to withhold and transmit a portion of an employee's wages until the balance on the order is paid in full or the order is released by us. We issue 3 types of wage garnishments: Earnings withholding orders (EWO): Earnings Withholding Order for Vehicle Registration (FTB 2204)

File an Exemption ? In California you may be able to stop the Wage Garnishment through filing an exemption. You may be able to have the wage garnishment stop or reduce the amount being garnished if you can show that the money is needed to support you or your family.