This form is an official United States District Court - California Central District form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

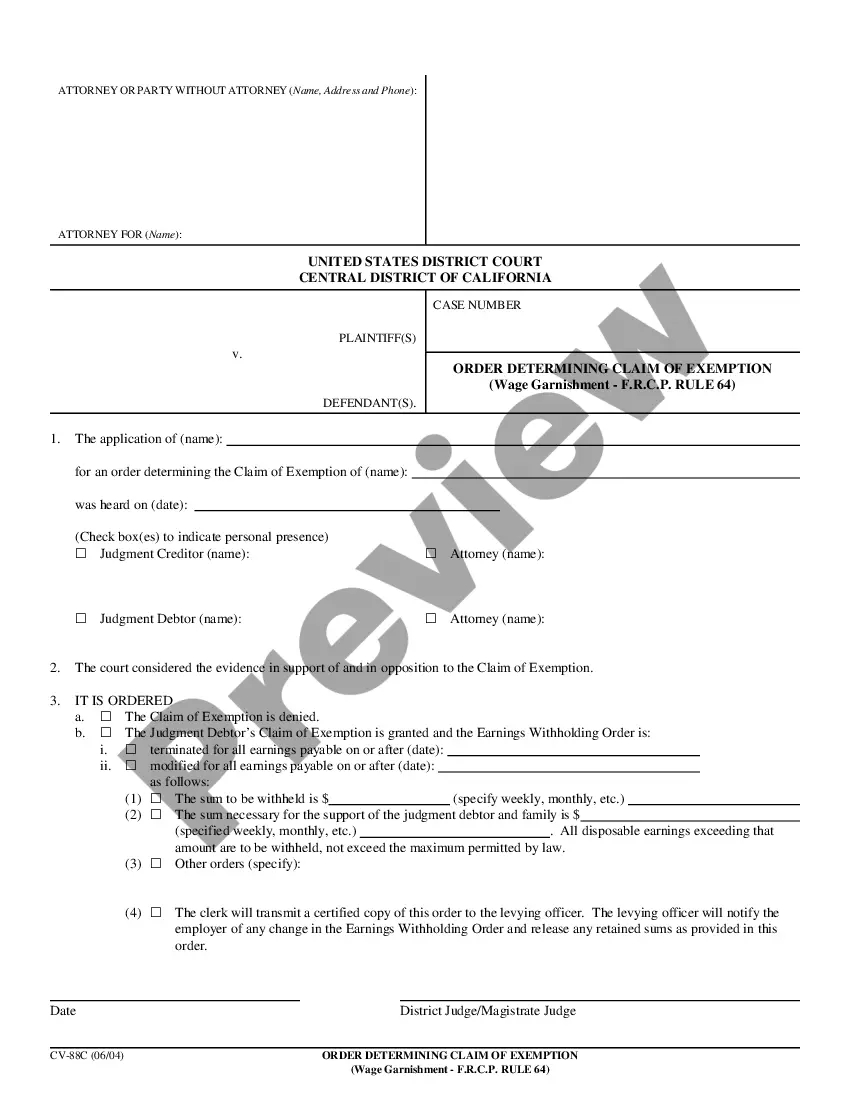

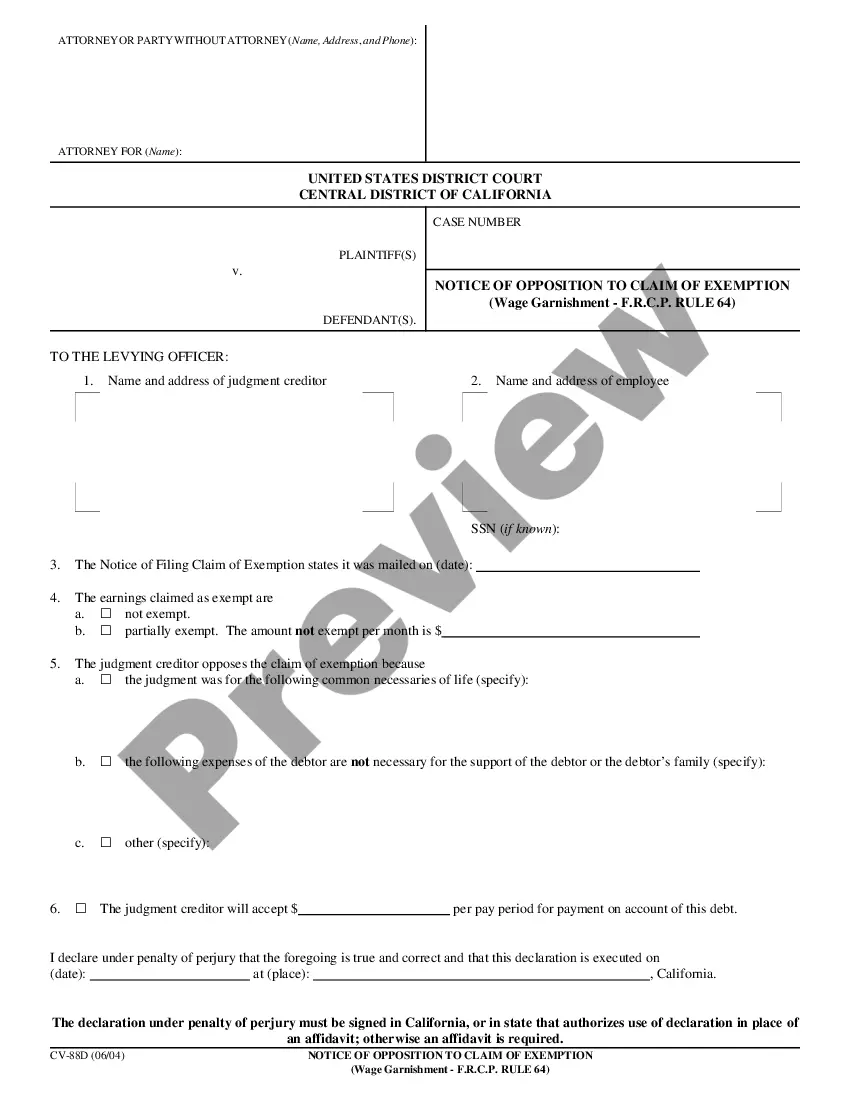

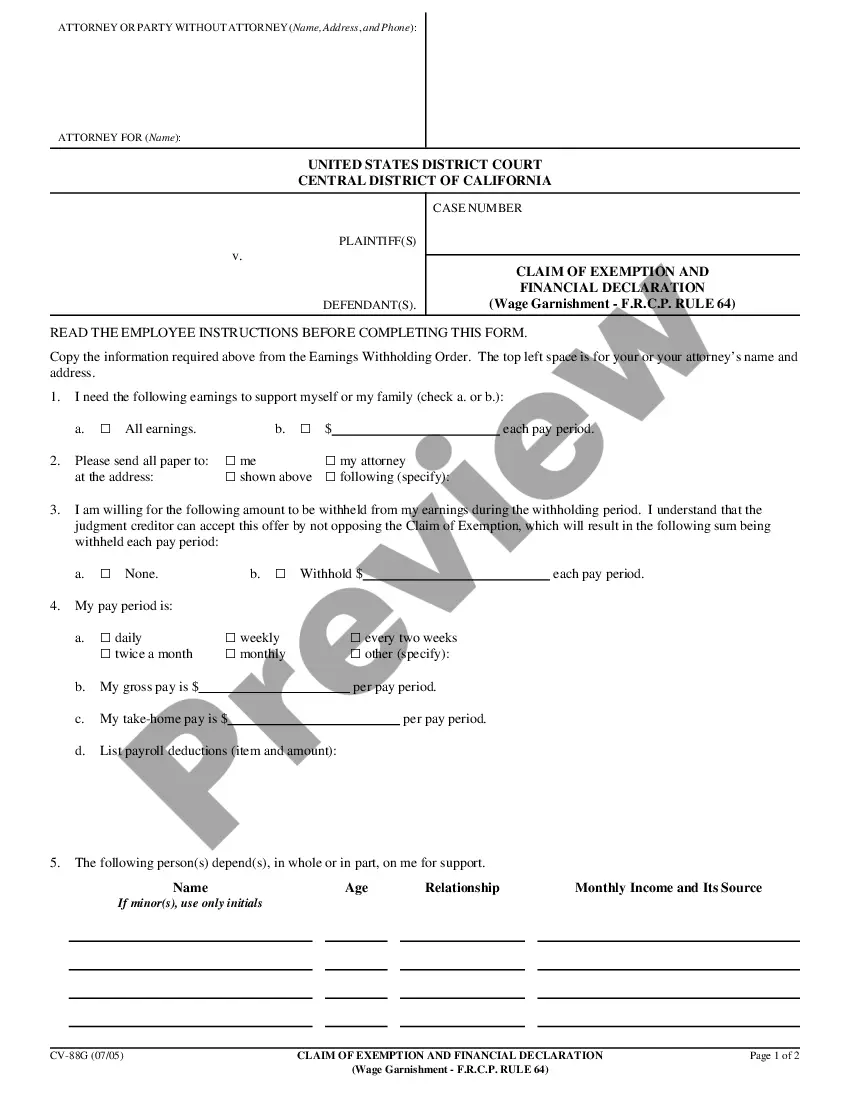

Sacramento California Notice of Filing of Claim of Exemption - Wage Garnishment - F.R.C.P. Rule 64

Description

How to fill out California Notice Of Filing Of Claim Of Exemption - Wage Garnishment - F.R.C.P. Rule 64?

Locating authenticated templates tailored to your regional regulations can be challenging unless you utilize the US Legal Forms collection.

It’s a digital repository of over 85,000 legal documents suited for both personal and business requirements and any practical situations.

All files are appropriately arranged by usage areas and jurisdiction types, making the search for the Sacramento California Notice of Filing of Claim of Exemption - Wage Garnishment - F.R.C.P. Rule 64 as simple as pie.

Maintaining documents organized and in accordance with legal requirements is crucial. Take advantage of the US Legal Forms library to always have crucial document templates for any needs right at your fingertips!

- Verify the Preview mode and form description.

- Ensure you’ve selected the correct one that fulfills your requirements and aligns perfectly with your local jurisdiction standards.

- Search for an alternative template, if necessary.

- If you notice any discrepancies, utilize the Search tab above to find the appropriate one. If it fits your needs, proceed to the following step.

- Buy the document.

Form popularity

FAQ

It is indeed possible for someone to garnish your wages without your prior knowledge. Typically, a court order authorizes this process, which may occur without your immediate awareness, particularly if you have not received earlier notifications. Under the Sacramento California Notice of Filing of Claim of Exemption - Wage Garnishment - F.R.C.P. Rule 64, you may receive information about your rights and any exemptions available. Staying informed and proactive is crucial, so consider consulting resources that provide guidance on wage garnishment.

Handling an employee's wage garnishment requires careful attention to legal requirements and company policies. First, notify the employee in writing about the Sacramento California Notice of Filing of Claim of Exemption - Wage Garnishment - F.R.C.P. Rule 64. Then, begin the necessary deductions based on the court's order while ensuring compliance with state and federal laws. It’s essential to offer support and information about resources, such as legal help through platforms like uslegalforms, which can assist employees in understanding their rights.

A letter to an employee about garnishment serves as an official notification regarding a legal process that affects their wages. This letter informs the employee of the wage garnishment due to a court order, specifically under the Sacramento California Notice of Filing of Claim of Exemption - Wage Garnishment - F.R.C.P. Rule 64. Such communication typically includes details about the amount to be garnished and the duration of the garnishment. The letter helps maintain transparency and ensures that employees understand their rights and obligations.

The best way to stop wage garnishment is to file a claim of exemption in line with the Sacramento California Notice of Filing of Claim of Exemption - Wage Garnishment - F.R.C.P. Rule 64. This process allows you to assert that part of your income is exempt from garnishment due to various factors like financial hardship or necessary living expenses. You may also consider negotiating with your creditors to establish a more manageable repayment plan that fits your budget.

Writing a convincing hardship letter involves clearly articulating your struggles and the necessity for understanding from your creditors. Frame your situation with specific examples and data that demonstrate your financial challenges. Highlight any efforts you have made to improve your situation. Remember to connect your circumstances to the protections offered under the Sacramento California Notice of Filing of Claim of Exemption - Wage Garnishment - F.R.C.P. Rule 64.

To write an objection letter for wage garnishment, begin with your contact information and the date. Clearly indicate your intent to object to the garnishment, and provide a concise explanation of your objections. Cite relevant laws, such as the Sacramento California Notice of Filing of Claim of Exemption - Wage Garnishment - F.R.C.P. Rule 64, to bolster your case. Make sure to sign and date the letter before submitting it to the appropriate court.

When writing a hardship letter for wage garnishment, start by clearly stating your financial situation and the impact the garnishment has on your ability to meet daily expenses. Include specific figures to illustrate your income, expenses, and any dependents. Express your willingness to work towards a solution, while underlining your need for relief based on the Sacramento California Notice of Filing of Claim of Exemption - Wage Garnishment - F.R.C.P. Rule 64.

To fill out a challenge to garnishment form, begin by obtaining the correct document from the court or a legal resource. Provide your personal information, details about the garnishment, and any relevant case numbers. Clearly state your reasons for challenging the garnishment and include any supporting evidence. Submitting this form promptly is crucial to protect your rights under the Sacramento California Notice of Filing of Claim of Exemption - Wage Garnishment - F.R.C.P. Rule 64.

In California, certain types of income and assets are exempt from garnishment. This includes government benefits, Social Security, and a portion of your wages, depending on how much you earn. To learn more about your rights and protections, refer to the Sacramento California Notice of Filing of Claim of Exemption - Wage Garnishment - F.R.C.P. Rule 64, which provides a comprehensive overview of applicable exemptions.

Informing an employee about wage garnishment requires transparency and professionalism. Provide them with a written notice detailing the garnishment, its reasons, and any action taken. Reference the Sacramento California Notice of Filing of Claim of Exemption - Wage Garnishment - F.R.C.P. Rule 64 to ensure your communication aligns with legal requirements.