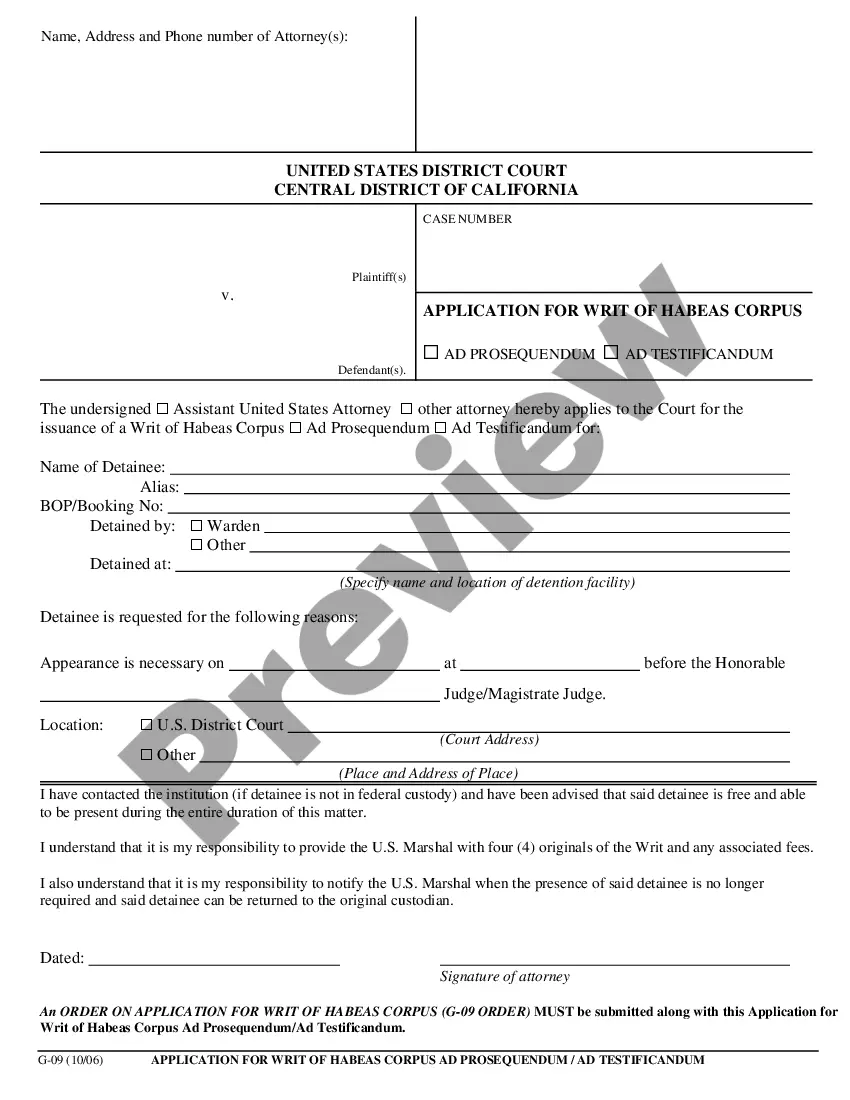

This form is an official United States District Court - California Central District form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

Carlsbad California Notice of Hearing on Claim of Exemption — WagGarnishmenten— - F.R.C.P. Rule 64: In Carlsbad, California, individuals facing wage garnishment have the opportunity to file a Claim of Exemption, protecting a portion of their income from being withheld by creditors. When a creditor seeks to garnish your wages, you have the right to request a hearing to present a Claim of Exemption, asserting that your income is exempt from garnishment according to the F.R.C.P. (Federal Rules of Civil Procedure) Rule 64. The Carlsbad California Notice of Hearing on Claim of Exemption — WagGarnishmenten— - F.R.C.P. Rule 64 serves as an official notification to inform the debtor of the scheduled hearing date and time. It is a crucial document that outlines the legal process and empowers individuals to protect their income by presenting valid grounds for exemption. There are various types of Carlsbad California Notice of Hearing on Claim of Exemption — WagGarnishmenten— - F.R.C.P. Rule 64, based on the specific circumstances or reasons one can claim an exemption. Some common types include: 1. Head of Household Exemption: This type of exemption recognizes that the debtor is the primary financial provider for their household and therefore exempts a certain portion of their wages from garnishment. 2. Low-Income Exemption: Individuals with a low income may qualify for an exemption based on their earnings falling below a certain threshold set by the state and federal guidelines. 3. Public Assistance Exemption: Debtors who receive public assistance, such as welfare benefits, disability payments, or unemployment benefits, may be eligible for an exemption to protect their limited income from garnishment. 4. Social Security or Veteran's Benefits Exemption: Social Security and veteran's benefits are often legally protected from wage garnishment, thus qualifying for an exemption. 5. Child Support or Alimony Exemption: In cases where a portion of the debtor's wages is already allocated towards child support or alimony obligations, an exemption may be applicable to ensure that these payments are preserved. These are just a few examples of the possible Claim of Exemption types that can be filed under Carlsbad California Notice of Hearing — WagGarnishmenten— - F.R.C.P. Rule 64. It is important to consult with an attorney or legal professional to understand the specific criteria and requirements applicable to your situation. By filing a Claim of Exemption and attending the hearing, individuals in Carlsbad, California, can assert their rights, present valid reasons for exemption, and protect a portion of their wages from garnishment. It is essential to gather all necessary documentation and legal advice to properly prepare for the hearing and increase the chance of a successful claim.

Carlsbad California Notice of Hearing on Claim of Exemption — WagGarnishmenten— - F.R.C.P. Rule 64: In Carlsbad, California, individuals facing wage garnishment have the opportunity to file a Claim of Exemption, protecting a portion of their income from being withheld by creditors. When a creditor seeks to garnish your wages, you have the right to request a hearing to present a Claim of Exemption, asserting that your income is exempt from garnishment according to the F.R.C.P. (Federal Rules of Civil Procedure) Rule 64. The Carlsbad California Notice of Hearing on Claim of Exemption — WagGarnishmenten— - F.R.C.P. Rule 64 serves as an official notification to inform the debtor of the scheduled hearing date and time. It is a crucial document that outlines the legal process and empowers individuals to protect their income by presenting valid grounds for exemption. There are various types of Carlsbad California Notice of Hearing on Claim of Exemption — WagGarnishmenten— - F.R.C.P. Rule 64, based on the specific circumstances or reasons one can claim an exemption. Some common types include: 1. Head of Household Exemption: This type of exemption recognizes that the debtor is the primary financial provider for their household and therefore exempts a certain portion of their wages from garnishment. 2. Low-Income Exemption: Individuals with a low income may qualify for an exemption based on their earnings falling below a certain threshold set by the state and federal guidelines. 3. Public Assistance Exemption: Debtors who receive public assistance, such as welfare benefits, disability payments, or unemployment benefits, may be eligible for an exemption to protect their limited income from garnishment. 4. Social Security or Veteran's Benefits Exemption: Social Security and veteran's benefits are often legally protected from wage garnishment, thus qualifying for an exemption. 5. Child Support or Alimony Exemption: In cases where a portion of the debtor's wages is already allocated towards child support or alimony obligations, an exemption may be applicable to ensure that these payments are preserved. These are just a few examples of the possible Claim of Exemption types that can be filed under Carlsbad California Notice of Hearing — WagGarnishmenten— - F.R.C.P. Rule 64. It is important to consult with an attorney or legal professional to understand the specific criteria and requirements applicable to your situation. By filing a Claim of Exemption and attending the hearing, individuals in Carlsbad, California, can assert their rights, present valid reasons for exemption, and protect a portion of their wages from garnishment. It is essential to gather all necessary documentation and legal advice to properly prepare for the hearing and increase the chance of a successful claim.