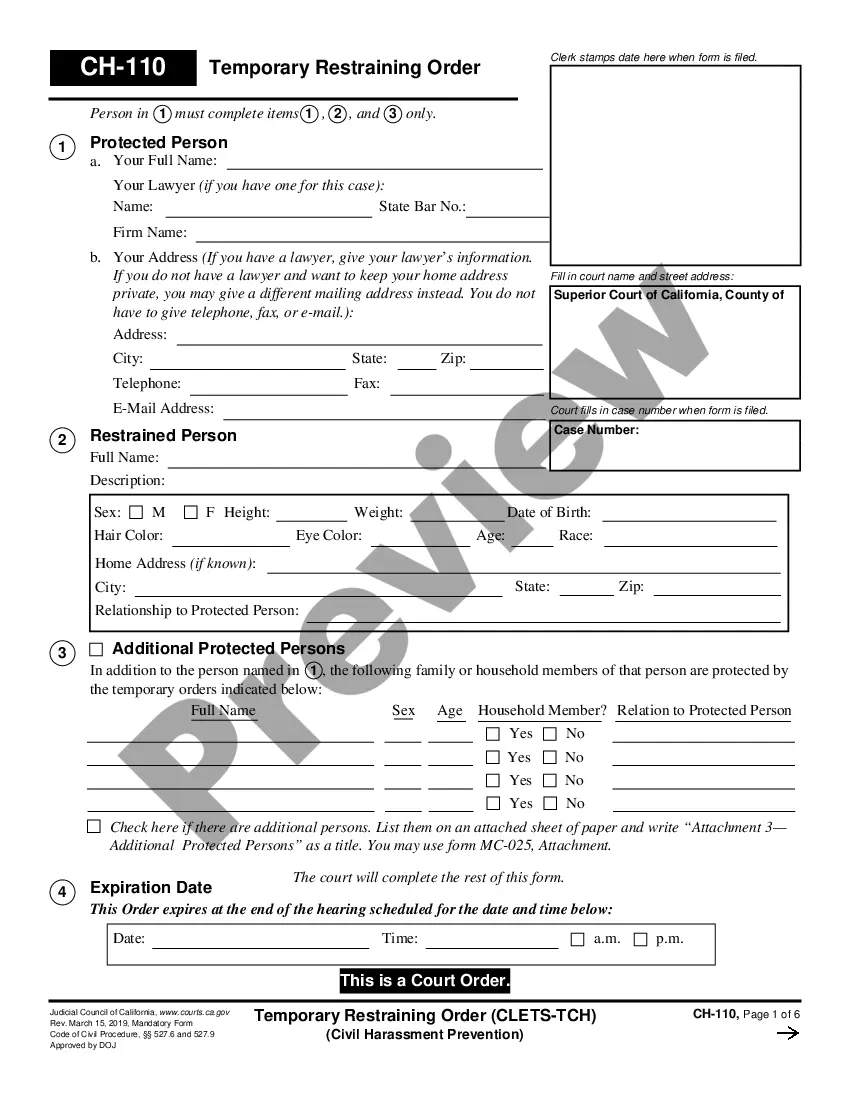

This form is an official United States District Court - California Central District form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

Simi Valley California Claim of Exemption and Financial Declaration — WagGarnishmenten— - F.R.C.P. Rule 64 is a legal document used in the state of California to protect individuals from having their wages garnished by creditors. This claim enables residents of Simi Valley and its surrounding areas to declare their exemption from wage garnishment and provide a detailed financial declaration to the court. Keywords: Simi Valley California, Claim of Exemption, Financial Declaration, Wage Garnishment, F.R.C.P. Rule 64 There are several types of Simi Valley California Claim of Exemption and Financial Declaration — WagGarnishmenten— - F.R.C.P. Rule 64, which include: 1. Personal Claim of Exemption and Financial Declaration: This is filed by an individual who wants to protect their wages from being garnished. In this claim, the individual provides detailed information about their income, expenses, and assets to prove their eligibility for exemption. 2. Joint Claim of Exemption and Financial Declaration: This type of claim is filed by two individuals, such as married couples or domestic partners, who share their income and expenses. It allows both parties to protect their joint wages from wage garnishment by submitting a combined financial declaration. 3. Head of Household Claim of Exemption and Financial Declaration: This claim is filed by individuals who qualify as the head of household. To be eligible, the individual must provide financial support to dependents and maintain a household. The claim provides a higher level of wage exemption to protect the individual's income. 4. Self-Employed Claim of Exemption and Financial Declaration: This claim is specifically designed for self-employed individuals residing in Simi Valley. It allows them to declare their exemption from wage garnishment and provide a comprehensive financial declaration that includes details of their business income, expenses, and assets. By filing a Simi Valley California Claim of Exemption and Financial Declaration — WagGarnishmenten— - F.R.C.P. Rule 64, individuals can protect their wages and financial stability from creditors seeking to garnish their income. It is crucial to complete the form accurately, providing truthful and detailed information about income, expenses, and assets to ensure a successful claim and exemption from wage garnishment.Simi Valley California Claim of Exemption and Financial Declaration — WagGarnishmenten— - F.R.C.P. Rule 64 is a legal document used in the state of California to protect individuals from having their wages garnished by creditors. This claim enables residents of Simi Valley and its surrounding areas to declare their exemption from wage garnishment and provide a detailed financial declaration to the court. Keywords: Simi Valley California, Claim of Exemption, Financial Declaration, Wage Garnishment, F.R.C.P. Rule 64 There are several types of Simi Valley California Claim of Exemption and Financial Declaration — WagGarnishmenten— - F.R.C.P. Rule 64, which include: 1. Personal Claim of Exemption and Financial Declaration: This is filed by an individual who wants to protect their wages from being garnished. In this claim, the individual provides detailed information about their income, expenses, and assets to prove their eligibility for exemption. 2. Joint Claim of Exemption and Financial Declaration: This type of claim is filed by two individuals, such as married couples or domestic partners, who share their income and expenses. It allows both parties to protect their joint wages from wage garnishment by submitting a combined financial declaration. 3. Head of Household Claim of Exemption and Financial Declaration: This claim is filed by individuals who qualify as the head of household. To be eligible, the individual must provide financial support to dependents and maintain a household. The claim provides a higher level of wage exemption to protect the individual's income. 4. Self-Employed Claim of Exemption and Financial Declaration: This claim is specifically designed for self-employed individuals residing in Simi Valley. It allows them to declare their exemption from wage garnishment and provide a comprehensive financial declaration that includes details of their business income, expenses, and assets. By filing a Simi Valley California Claim of Exemption and Financial Declaration — WagGarnishmenten— - F.R.C.P. Rule 64, individuals can protect their wages and financial stability from creditors seeking to garnish their income. It is crucial to complete the form accurately, providing truthful and detailed information about income, expenses, and assets to ensure a successful claim and exemption from wage garnishment.