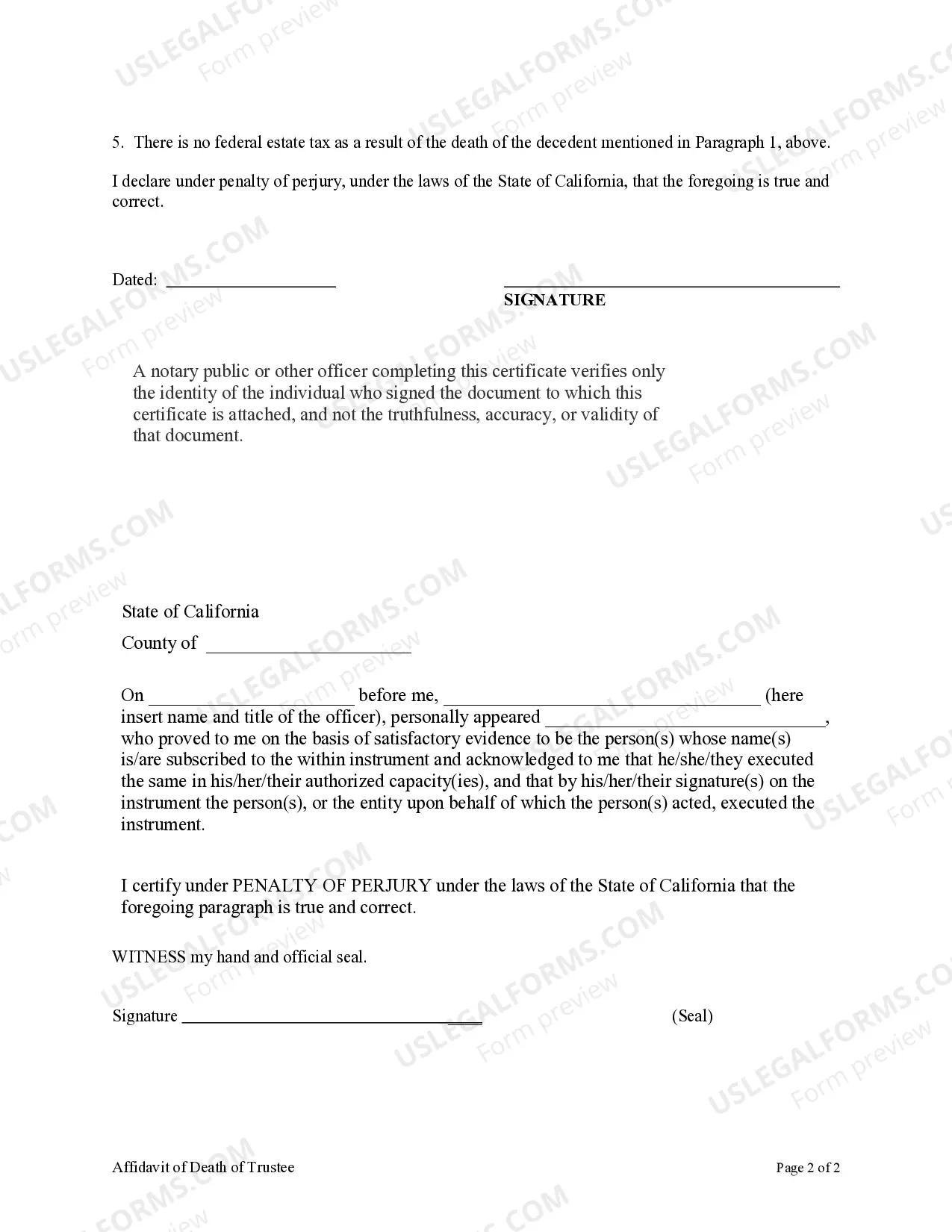

The San Diego California Affidavit of Death of Trustee is a legal document used to verify the death of a trustee and establish the transfer of the trustee's assets to the designated beneficiaries or successor trustee. This affidavit is a crucial step in the trust administration process and is required to ensure the smooth transfer of assets and distribution of the estate. Keywords: San Diego California, Affidavit of Death of Trustee, trust administration, legal document, verify death, transfer assets, designated beneficiaries, successor trustee, distribution of estate There are various types of San Diego California Affidavit of Death of Trustee that may be used depending on the specific circumstances: 1. General San Diego California Affidavit of Death of Trustee: This is the most commonly used type of affidavit, used when the trustee passes away, and there is a need to transfer the trust assets to the beneficiaries or successor trustee. 2. San Diego California Affidavit of Death of Trustee for Irrevocable Trusts: This type of affidavit is used when the trust is irrevocable, meaning that the terms and conditions of the trust cannot be changed. It is required to establish the transfer of assets according to the predetermined provisions of the trust. 3. San Diego California Affidavit of Death of Trustee with Minor Beneficiaries: In the case where minor beneficiaries are involved, this type of affidavit is used to ensure that the transfer of assets and distribution comply with legal requirements regarding minors. 4. San Diego California Affidavit of Death of Co-Trustee: If the trust has multiple trustees and one of them passes away, this affidavit is utilized to establish the transfer of authority and responsibilities to the surviving trustee(s) or successor trustee. 5. San Diego California Affidavit of Death of Trustee for Testamentary Trusts: This type of affidavit is specific to testamentary trusts, which are created through a will and come into effect after the death of the testator. It is used to transfer assets according to the provisions stated in the will and the trust. It is important to consult with an experienced attorney or legal professional to ensure the correct type of San Diego California Affidavit of Death of Trustee is used and to accurately complete the document in compliance with state and local laws.

San Diego Trustee

Description

How to fill out San Diego California Affidavit Of Death Of Trustee?

If you’ve already used our service before, log in to your account and download the San Diego California Affidavit of Death of Trustee on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple steps to obtain your file:

- Make sure you’ve located a suitable document. Read the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t fit you, utilize the Search tab above to get the proper one.

- Purchase the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Get your San Diego California Affidavit of Death of Trustee. Opt for the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to each piece of paperwork you have bought: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to quickly find and save any template for your personal or professional needs!

Form popularity

FAQ

An original certificate of death must be submitted in support of the affidavit. When the affidavit is filed and recorded with the county recorder, the successor trustee can sell the property or transfer ownership to the decedent's children.

Under California's ?Rule Against Perpetuities,? an interest in an irrevocable trust must vest or terminate either within 21 years after the death of the last potential beneficiary who was alive when the trust was created or within 90 years after the trust was created.

When a trustee dies, the successor trustee of the trust takes over. If there is no named successor trustee, the involved parties can turn to the courts to appoint a successor trustee. If the deceased Trustee had co-trustees, the joint trustees take over the trust without involving the courts.

The Trustee should include the following information in the notification package: The name of the Grantor and the date that the trust instrument execution date. Contact information for each Trustee, including name, address, county of residence, and phone number. Certified copy of the death certificate of the Grantor.

A living trust becomes irrevocable upon the death or incapacity of the last of the original trust creators. The trustee distributes assets to beneficiaries according to the decedents' instructions without having to go to court and without court supervision.

An affidavit or declaration signed under penalty of perjury at least 40 days after the death can be used to collect the assets for the beneficiaries or heirs of the estate. No documents are required to be filed with the Superior Court if the small estates law (California Probate Code Sections 13100 to 13116) is used.

If a Trustee dies and there are remaining Trustees, the surviving Trustees can appoint a replacement. If a Trustee dies and there are no remaining Trustees, the Personal Representatives of the last surviving Trustee can appoint new Trustees.

A living trust becomes irrevocable upon the death or incapacity of the last of the original trust creators. The trustee distributes assets to beneficiaries according to the decedents' instructions without having to go to court and without court supervision.

When a trustee dies in office, the remaining trustees carry on unaffected. There is no need to record the trustee's death in a deed; though if he is replaced, it should be noted as a recital in the deed affecting the new appointment.

Under California's ?Rule Against Perpetuities,? an interest in an irrevocable trust must vest or terminate either within 21 years after the death of the last potential beneficiary who was alive when the trust was created or within 90 years after the trust was created.

Interesting Questions

More info

A trustee shall, upon the death of the settler, be in a position to exercise control over the trust assets at the time of the settler's death and, subject to other legal requirements, shall exercise the right to grant all right, title and interest of the settler and all personal property that was acquired or acquired by the trust to the beneficiaries of the trust on or after the date of the settler's death. To be a trustee, a settler must not have been or is known by the trustee to have been under an obligation to account for the trust property or its proceeds in the state where he or she lived during the four years preceding the death of the settler. California Mortgages. Read more about Mortgages. California Retirement System.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.