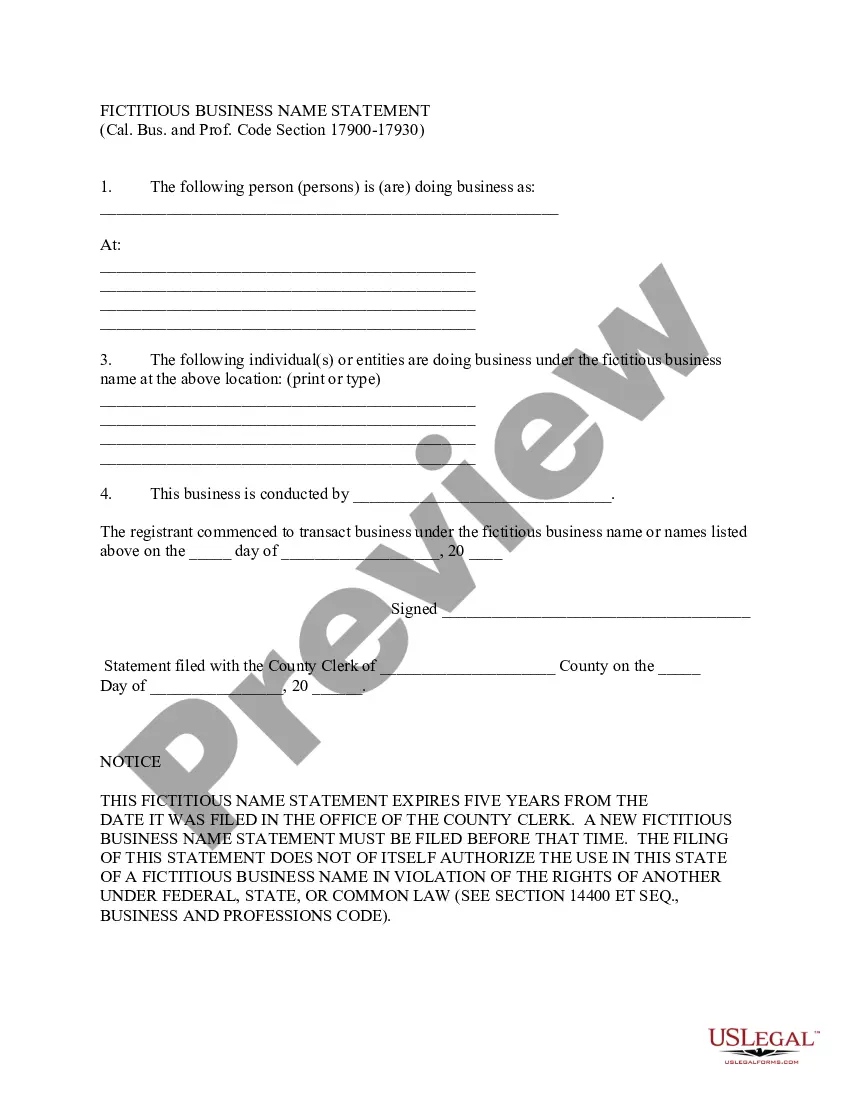

Fictitious Business Name Statement: This statement simply tells the state of California that a business has been incorporated, and the fictitious name of said business. Further, the statement lists both the owners of the business, the type of business and the address of the business. This form is available in both Word and Rich Text formats.

Elk Grove California Fictitious Business Name Statement

Description

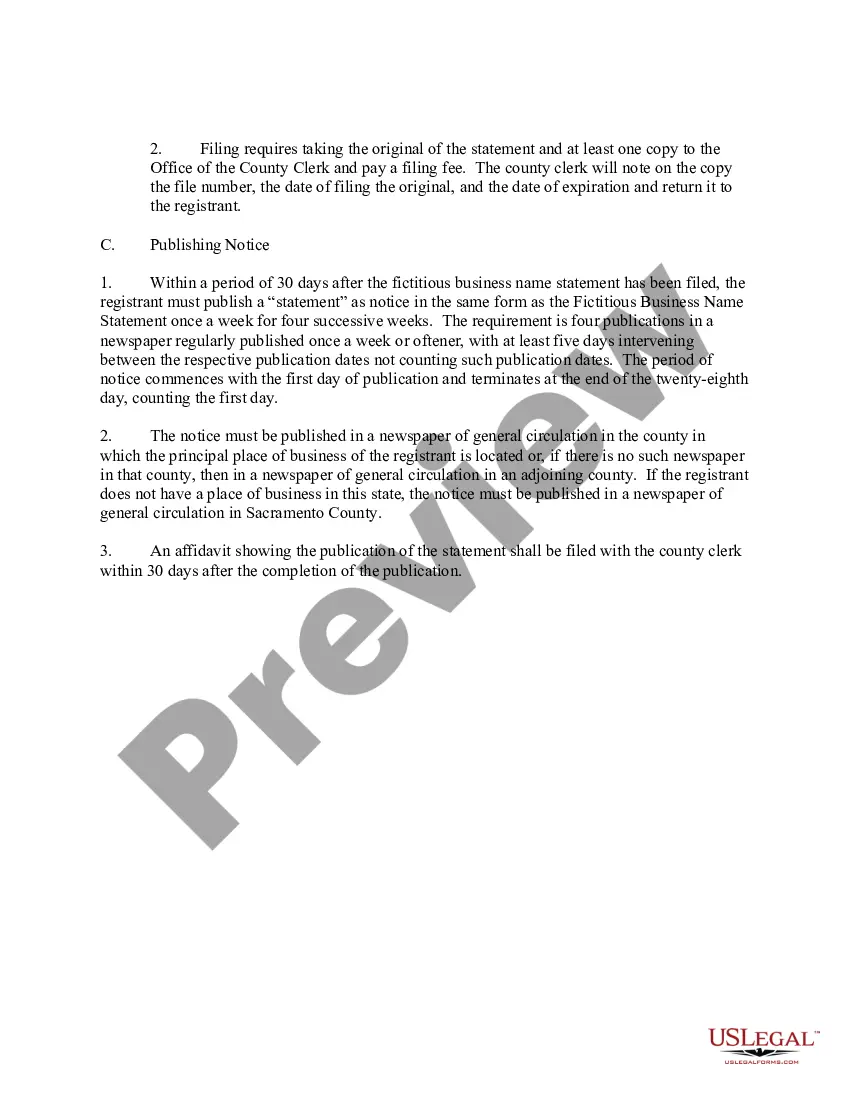

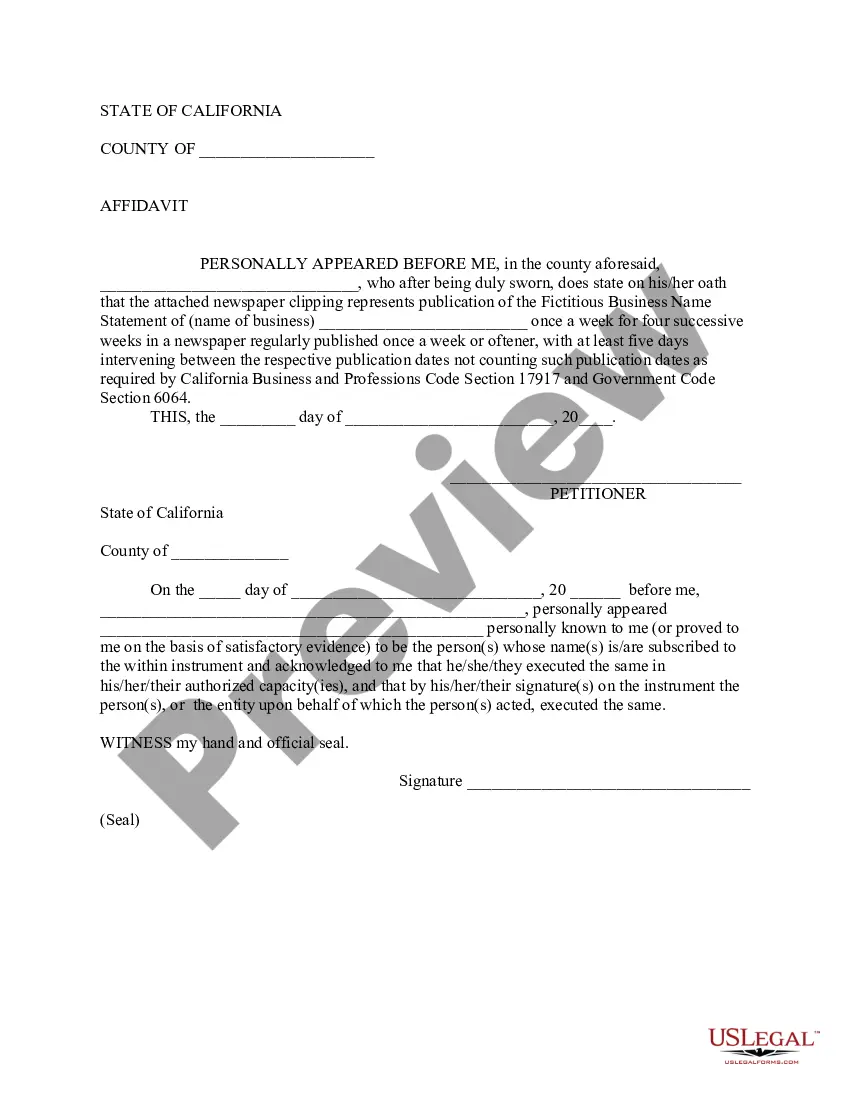

How to fill out California Fictitious Business Name Statement?

We consistently aim to minimize or evade legal complications when engaging with intricate legal or financial issues.

To achieve this, we seek legal solutions that are typically quite expensive.

However, not every legal issue is equally convoluted. Many can be managed independently.

US Legal Forms is an online repository of current do-it-yourself legal documents covering everything from wills and power of attorneys to articles of incorporation and petitions for dissolution.

Just Log In to your account and click the Get button next to it. If you lose the document, you can always re-download it in the My documents section. The process is equally simple if you are new to the website! You can establish your account in minutes. Ensure that the Elk Grove California Fictitious Business Name Statement meets the laws and regulations of your state and locality. Additionally, it’s vital that you review the form’s description (if available), and if you notice any inconsistencies with what you were initially seeking, look for a different template. Once you confirm that the Elk Grove California Fictitious Business Name Statement is suitable for your situation, choose the subscription plan and proceed with the payment. Then you can download the document in any supported format. For over 24 years, we’ve assisted millions by offering customizable and current legal forms. Leverage US Legal Forms now to conserve your time and resources!

- Our platform empowers you to handle your legal matters on your own without needing a lawyer.

- We offer access to legal form formats that aren’t always readily accessible.

- Our templates are specific to states and regions, which greatly simplifies the search process.

- Utilize US Legal Forms whenever you need to swiftly and securely obtain and download the Elk Grove California Fictitious Business Name Statement or any other necessary form.

Form popularity

FAQ

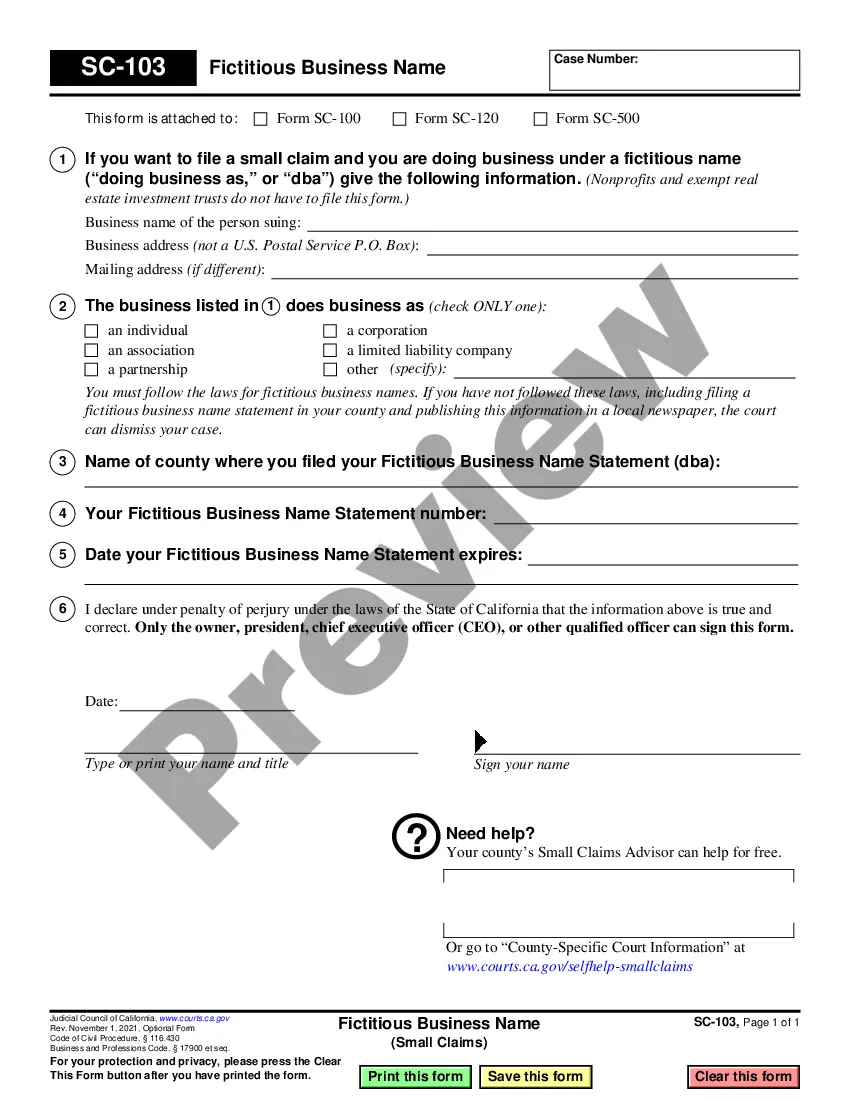

A fictitious name statement, often referred to as a 'DBA' (doing business as) registration, is necessary for businesses operating under a name different from their legal name. This statement helps inform the public about the business entity responsible for the operations associated with that name. In Elk Grove, California, filing your Elk Grove California Fictitious Business Name Statement is crucial for transparency and legal compliance. For convenience, consider using US Legal Forms to help streamline the filing process.

Yes, an assumed name certificate is effectively another term for a Doing Business As (DBA). This certificate allows you to legally operate under a name that is different from your business’s registered name. In Elk Grove, California, ensuring you have your Fictitious Business Name Statement filed correctly helps protect your business identity in the marketplace.

If you allow your fictitious business name to expire, you may lose exclusive rights to that name, and someone else could potentially register it. This could lead to confusion and potential legal issues for your business operations. To maintain your brand identity in Elk Grove, California, it’s crucial to renew your Fictitious Business Name Statement before it expires. Legal platforms like USLegalForms can guide you through this process.

A fictitious business name license is often called a fictitious name permit or DBA license. This permits you to conduct business under a name that isn’t your legal name. In Elk Grove, California, obtaining a Fictitious Business Name Statement not only gives you this license but also contributes to a solid business foundation and aligns with legal requirements.

A fictitious name certificate is a document that confirms your business is operating under a name that differs from your legal business name. In Elk Grove, California, when you file a Fictitious Business Name Statement, you obtain this certificate, which serves as proof that you are allowed to use the chosen name in your business activities. This certificate is important for transparency and helps consumers know who they are dealing with.

A DBA, which stands for 'Doing Business As,' is essentially a term used to describe a business operating under a name different from its legal name. On the other hand, a fictitious name is an official name registered with the state or county, allowing the business owner to operate without revealing their personal or legal business name. In Elk Grove, California, filing a Fictitious Business Name Statement is a key step to ensure your business operates legally and helps build customer trust.

Yes, you are required to renew your fictitious business name in California every five years. This requirement helps maintain accurate records of business ownership and prevents name squatting. If you're operating in Elk Grove, California, make sure to schedule your renewal filings to keep your Elk Grove California Fictitious Business Name Statement active and legally valid.

In California, you must file a fictitious business name initially when you start your business and every five years thereafter. This ensures that your business name is updated and remains compliant. For those in Elk Grove, California, keep track of your filing dates to avoid lapses and potential legal issues with your Elk Grove California Fictitious Business Name Statement.

To obtain a fictitious name certificate in California, you need to file a Fictitious Business Name Statement with your local county clerk's office. In Elk Grove, California, ensure you provide all necessary details about your business. After submitting your statement and paying the required fees, you will receive your certificate, allowing you to operate under your chosen name legally.

Yes, you can transfer a fictitious business name in California. However, the process is not automatic and requires specific steps. You must file a new Fictitious Business Name Statement in Elk Grove, California, reflecting the new ownership. This ensures that the business name remains registered correctly and transparently.