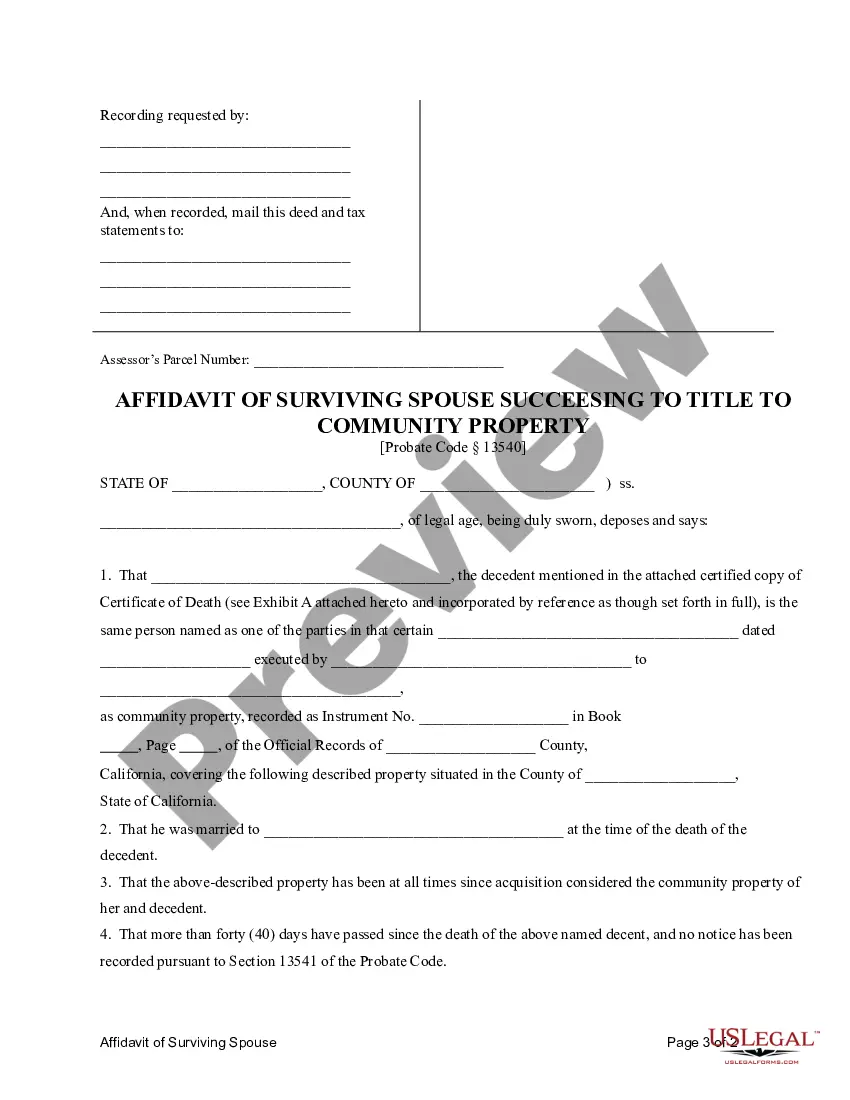

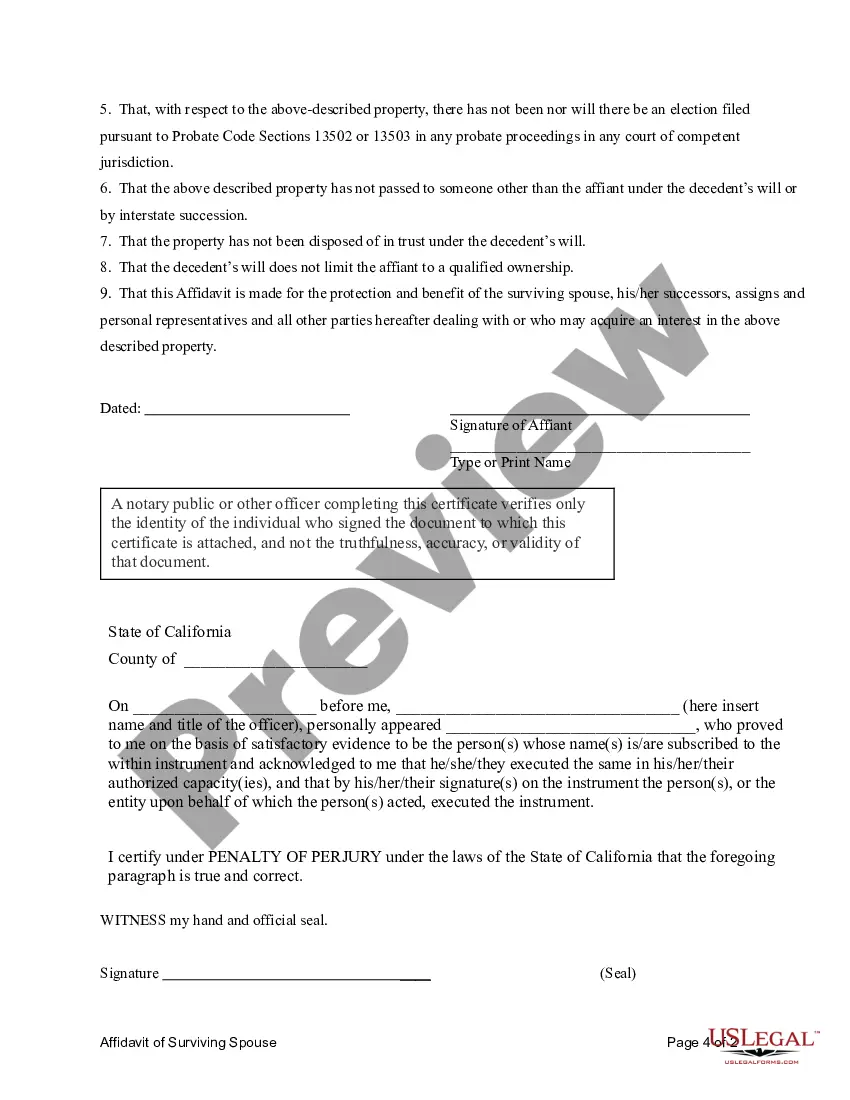

This form is an Affidavit of Surviving Spouse used to establish the right of the surviving spouse to succeed to the title of Community Property. The form is pursuant to California Probate Code Sections 13540.

Keywords: Rancho Cucamonga California, Affidavit of Surviving Spouse, Succeeding to Title, Community Property Title: A Comprehensive Guide to Rancho Cucamonga California's Affidavit of Surviving Spouse Succeeding to Title to Community Property Introduction: In Rancho Cucamonga, California, when a spouse passes away, the surviving spouse may be required to file an Affidavit of Surviving Spouse Succeeding to Title to Community Property. This legal document allows the surviving spouse to assume ownership of the community property left by the deceased spouse. In this guide, we will delve into the details of this vital affidavit, exploring its purpose, requirements, and different types that may exist. I. Understanding the Affidavit of Surviving Spouse Succeeding to Title to Community Property: The Affidavit of Surviving Spouse Succeeding to Title to Community Property is a legal document that enables the surviving spouse to establish their ownership rights to community property after the passing of their spouse. Community property refers to the assets and debts acquired during the marriage. II. Purpose of the Affidavit: The main purpose of the Affidavit of Surviving Spouse Succeeding to Title to Community Property in Rancho Cucamonga is to provide a streamlined process for the surviving spouse to transfer ownership of community property without going through probate court. By filing this affidavit, the surviving spouse can avoid the often lengthy and costly probate process. III. Requirements for Filing: 1. Eligibility: To file this affidavit, the surviving spouse must have been legally married to the deceased spouse at the time of their passing. 2. Timely Filing: The affidavit must be filed within a specified timeframe, typically within 60 days after the death of the spouse. 3. Accurate Information: The affidavit must contain accurate information about the assets, debts, and property involved in the community property. IV. Types of Rancho Cucamonga California Affidavit of Surviving Spouse Succeeding to Title to Community Property: 1. General Affidavit: This is the most common type of affidavit used in Rancho Cucamonga. It covers the transfer of ownership for various types of community property, including real estate, bank accounts, vehicles, and personal belongings. 2. Real Estate Affidavit: This specific type focuses solely on the transfer of ownership for real estate properties, such as houses, condos, or vacant lands within the community property. 3. Financial Affidavit: This type of affidavit pertains to the transfer of ownership of financial assets, such as bank accounts, investment portfolios, and retirement funds, within the community property. 4. Personal Property Affidavit: This affidavit is utilized to transfer ownership of personal belongings, such as furniture, jewelry, artwork, and other valuable items that fall under the community property. Conclusion: When a loved one passes away in Rancho Cucamonga, California, the surviving spouse can utilize the Affidavit of Surviving Spouse Succeeding to Title to Community Property to smoothly transition ownership of the community property. By understanding the purpose, requirements, and different types of affidavits, surviving spouses can navigate this process effectively and efficiently, saving time, money, and emotional stress during a difficult period. Seek legal advice or consult with professionals to ensure compliance with specific laws and regulations regarding this affidavit.