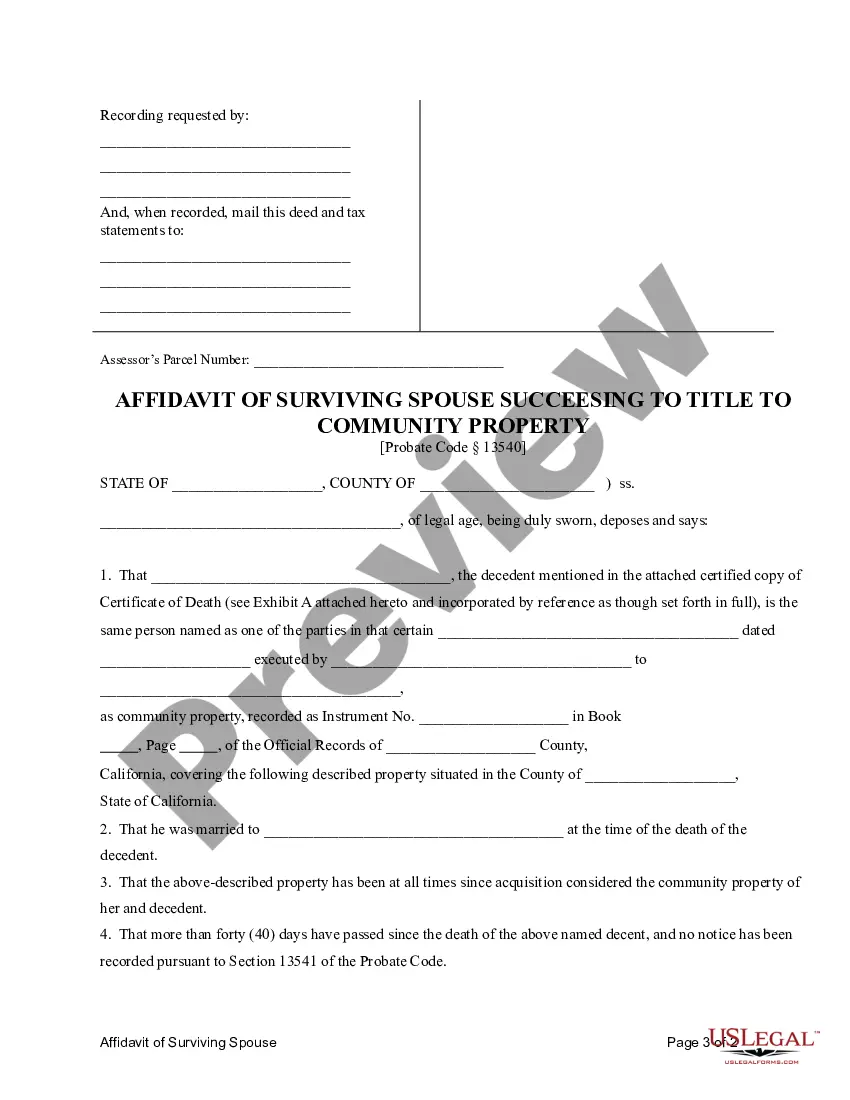

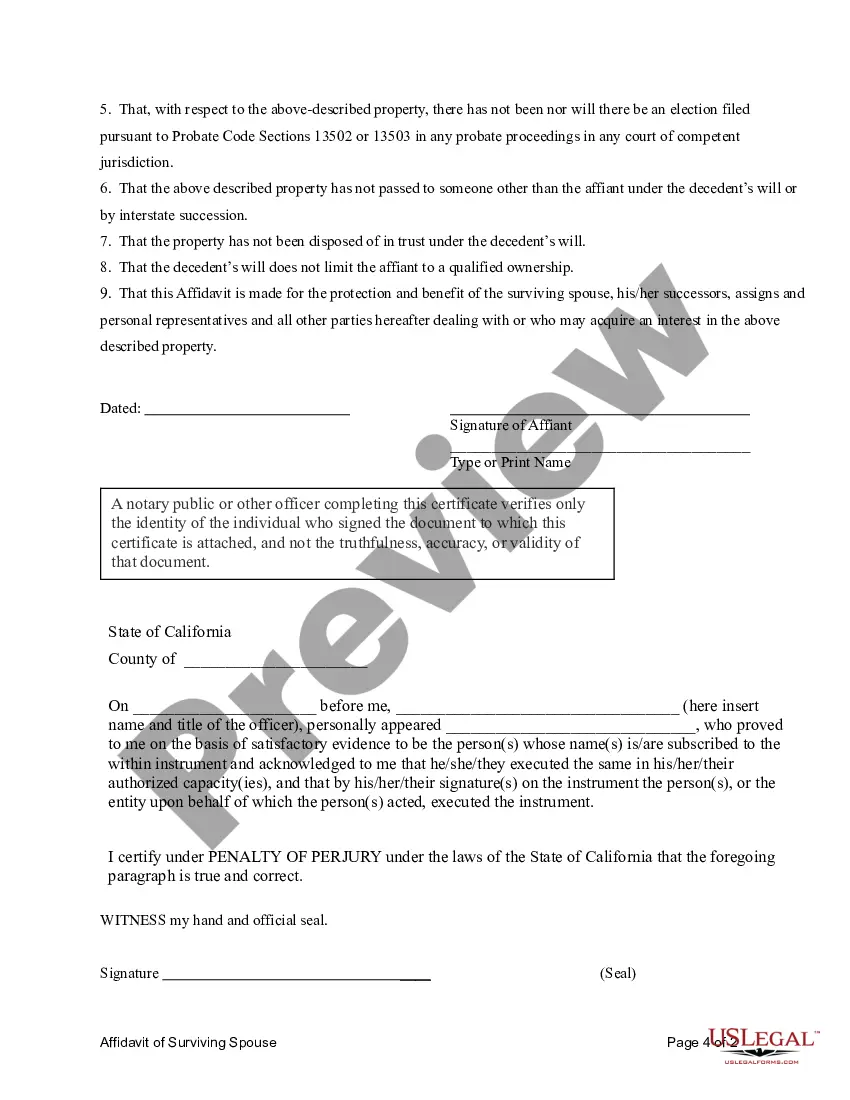

This form is an Affidavit of Surviving Spouse used to establish the right of the surviving spouse to succeed to the title of Community Property. The form is pursuant to California Probate Code Sections 13540.

The Thousand Oaks California Affidavit of Surviving Spouse Succeeding to Title to Community Property is a legal document that allows a surviving spouse to assume ownership of community property after the other spouse has passed away. This affidavit is recognized under California law and provides a streamlined process for transferring assets and protecting the rights of the surviving spouse. In Thousand Oaks, California, there are two primary types of Affidavit of Surviving Spouse Succeeding to Title to Community Property: 1. General Affidavit of Surviving Spouse Succeeding to Title to Community Property: This is the standard affidavit used when the surviving spouse wants to establish their sole ownership of community property assets after the death of their spouse. It requires the spouse to provide information about their marriage, the deceased spouse, and the community property in question. 2. Small Estate Affidavit of Surviving Spouse Succeeding to Title to Community Property: This affidavit is applicable when the total value of the community property does not exceed a certain threshold set by California law (typically around $150,000). It offers a simplified and expedited process for transferring assets without the need for probate court involvement. The surviving spouse must provide specific information about their eligibility to use the small estate affidavit and the value of the community property involved. By filing the Thousand Oaks California Affidavit of Surviving Spouse Succeeding to Title to Community Property, the surviving spouse can obtain legal documentation that confirms their ownership rights over community property assets. This document serves as proof of their rightful claim and can be useful for various purposes, including estate planning, property sales, or any future legal proceedings pertaining to the community property ownership. It is important to note that the specific requirements and procedures for the Thousand Oaks California Affidavit of Surviving Spouse Succeeding to Title to Community Property may vary slightly from other jurisdictions within the state of California. Therefore, it is advisable to consult with a qualified legal professional or refer to the relevant local laws and regulations to ensure compliance and accuracy when preparing and filing this affidavit.