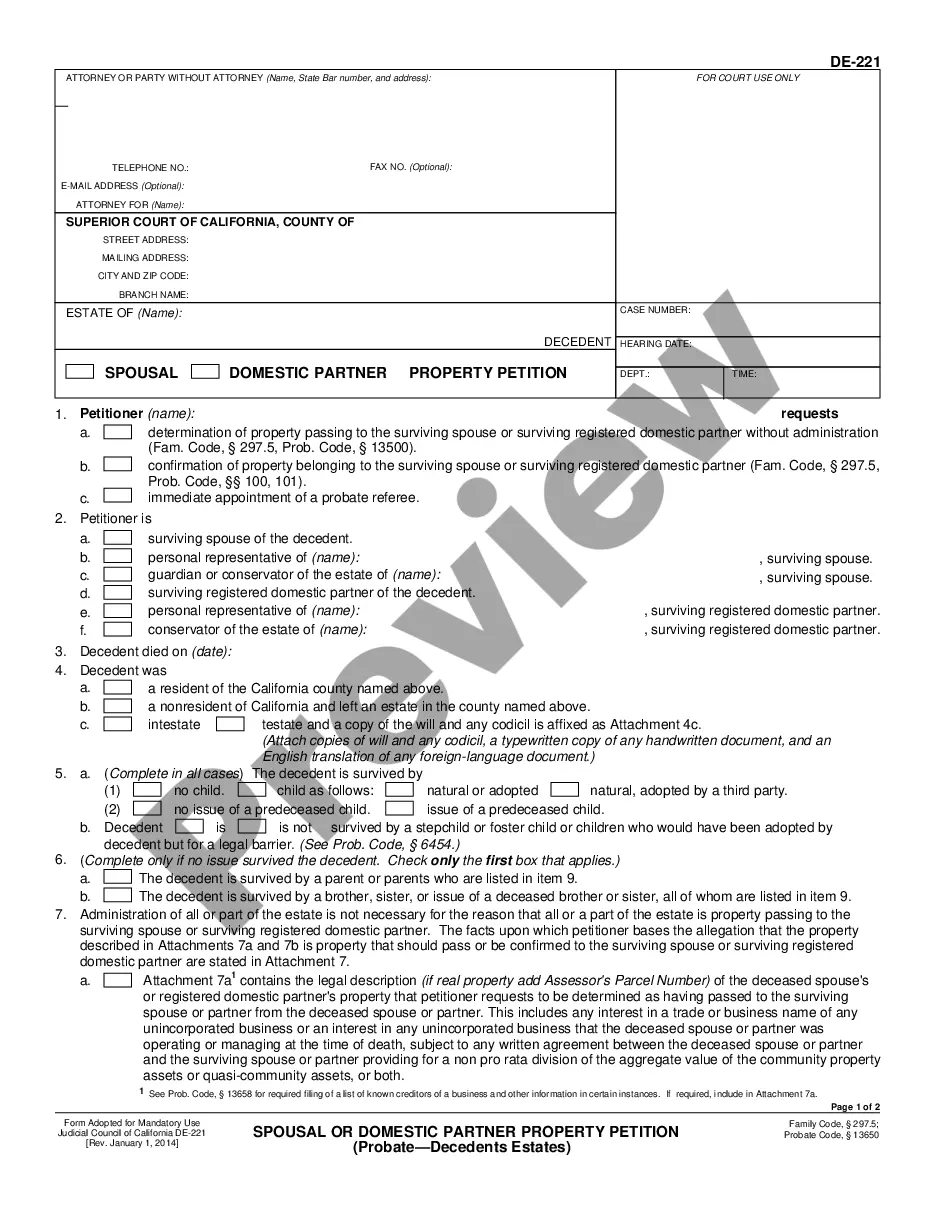

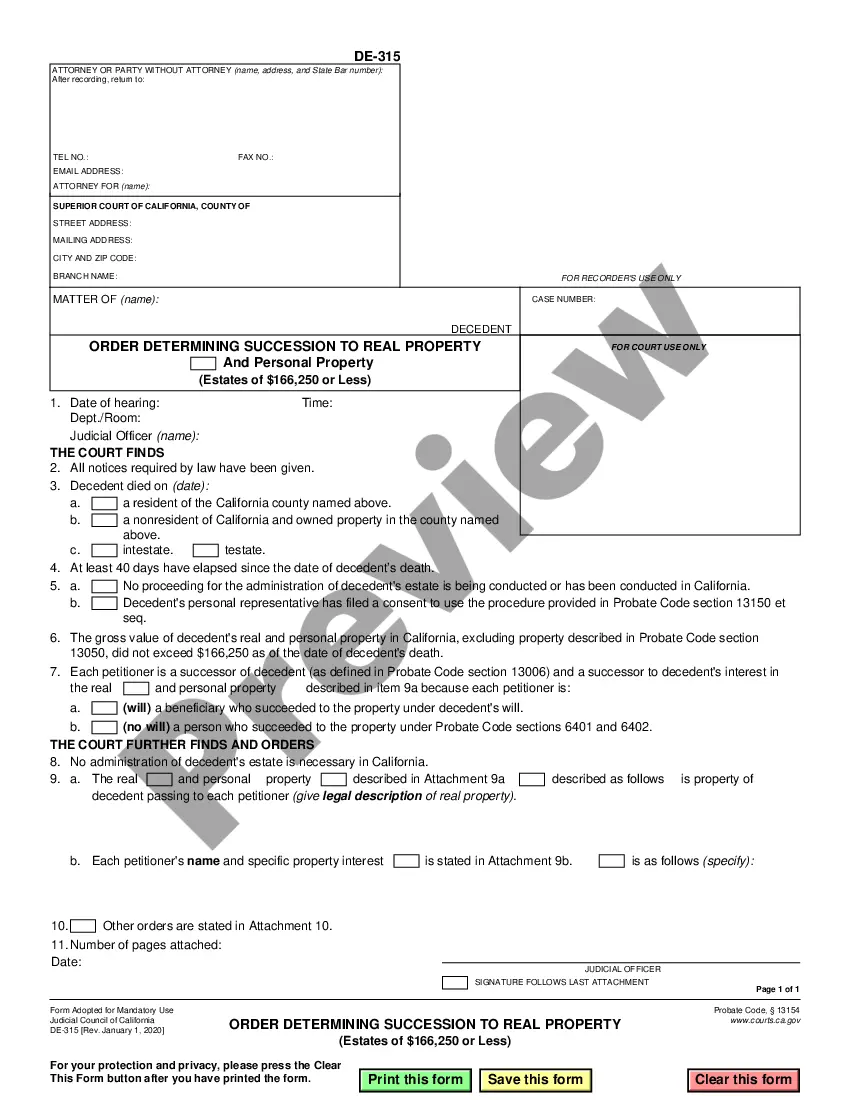

This form, Spousal Property Order, is an official form from the California Judicial Counsel, which complies with all applicable laws and statutes. USLF amends and updates the Judicial Counsel forms as is required by California statutes and law. This form is an order that addresses the delivery of legally required notices, the protection of creditors' interests and the transfer of property to the surviving spouse or surviving registered domestic partner. All property that is not determined to pass to the surviving spouse or surviving registered domestic partner shall be subject to administration of the estate.

Los Angeles California Spousal Property Order - Probate

Description

How to fill out California Spousal Property Order - Probate?

We consistently aim to reduce or evade legal repercussions when engaging with intricate legal or financial matters.

To achieve this, we seek legal solutions that are generally very expensive.

However, not all legal challenges are equally complicated.

Many of them can be handled by ourselves.

Benefit from US Legal Forms whenever you need to easily and securely locate and download the Los Angeles California Spousal Property Order - Probate or any other form.

- US Legal Forms is an online collection of current DIY legal templates covering everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

- Our platform empowers you to manage your affairs independently without requiring a lawyer's services.

- We provide access to legal form templates that are not always readily available to the public.

- Our templates are specific to regions and states, which greatly simplifies the search process.

Form popularity

FAQ

Yes, it is possible to settle an estate without going through probate in California under certain conditions. If the estate is below a specific value or consists solely of assets in joint tenancy or a trust, you may bypass probate. However, for assets requiring a Los Angeles California Spousal Property Order - Probate, you will need to engage in the probate process. Utilizing services like uslegalforms can simplify this process for you.

When a spouse dies in California, their property can either pass to the surviving spouse or become part of the probate process. Community property typically belongs to the surviving spouse, whereas separate property may require a Los Angeles California Spousal Property Order - Probate to ensure proper distribution. Understanding these processes can help you navigate the legal landscape effectively.

In California, when a husband dies, the wife is generally entitled to half of any community property accrued during the marriage. Additionally, the wife may claim some or all of the deceased’s separate property, depending on whether there is a will or trust in place. Navigating a Los Angeles California Spousal Property Order - Probate can clarify these entitlements and help ensure you receive your rightful share.

Not everything goes automatically to a spouse after death in California. While community property does typically pass to the surviving spouse, separate property may need to go through probate. A Los Angeles California Spousal Property Order - Probate could assist in transferring the appropriate assets to you in a clear manner. It's important to understand the distinction between these property types.

Not always. A surviving spouse may avoid probate for certain assets in California if they are held in joint tenancy or if they are designated as beneficiaries of a trust. However, if the deceased spouse’s assets require a Los Angeles California Spousal Property Order - Probate, you will need to follow the probate process. Consulting with a legal expert can clarify your specific situation.

In California, the probate code that governs spousal property petitions is found in Sections 13600 to 13603. This code outlines the process for a surviving spouse to claim property that was owned by their deceased partner. Understanding these regulations is essential when navigating a Los Angeles California Spousal Property Order - Probate. This will help ensure that you meet all legal requirements for a seamless petition.

A spousal property order refers to a legal document issued in the context of probate in Los Angeles, California. It allows a surviving spouse to claim property that is otherwise subject to probate court procedures. By obtaining this order, spouses can simplify the transfer of property, avoiding lengthy legal processes. This ensures that the surviving partner receives their rightful share of the couple's assets without unnecessary delays.

Yes, you can file for probate yourself in California, although the process can be complex. It is essential to understand the required forms and procedures, which are available through the probate court or platforms like uslegalforms. Many individuals prefer to seek legal assistance to navigate the Los Angeles California Spousal Property Order - Probate process more efficiently. This choice can prevent potential errors and save time.

To fill out a probate petition in California, you must follow the guidelines provided by your local probate court. Include essential details about the decedent and any wills. Using uslegalforms can help you navigate the required forms and ensure you include all necessary information. Properly completing the petition is vital for achieving a successful Los Angeles California Spousal Property Order - Probate.

Filling out a petition for probate in California involves providing key information, including details about the deceased, the heirs, and the assets of the estate. You will need to use specific forms, which can be found through the court’s website or platforms like uslegalforms. This petition plays a crucial role in initiating the probate process and achieving the Los Angeles California Spousal Property Order - Probate if applicable. Ensure accuracy to avoid delays.