Fullerton California Petition to Determine Succession to Real and Personal Property - Small Estates - Estates $184,500 or Less

Description

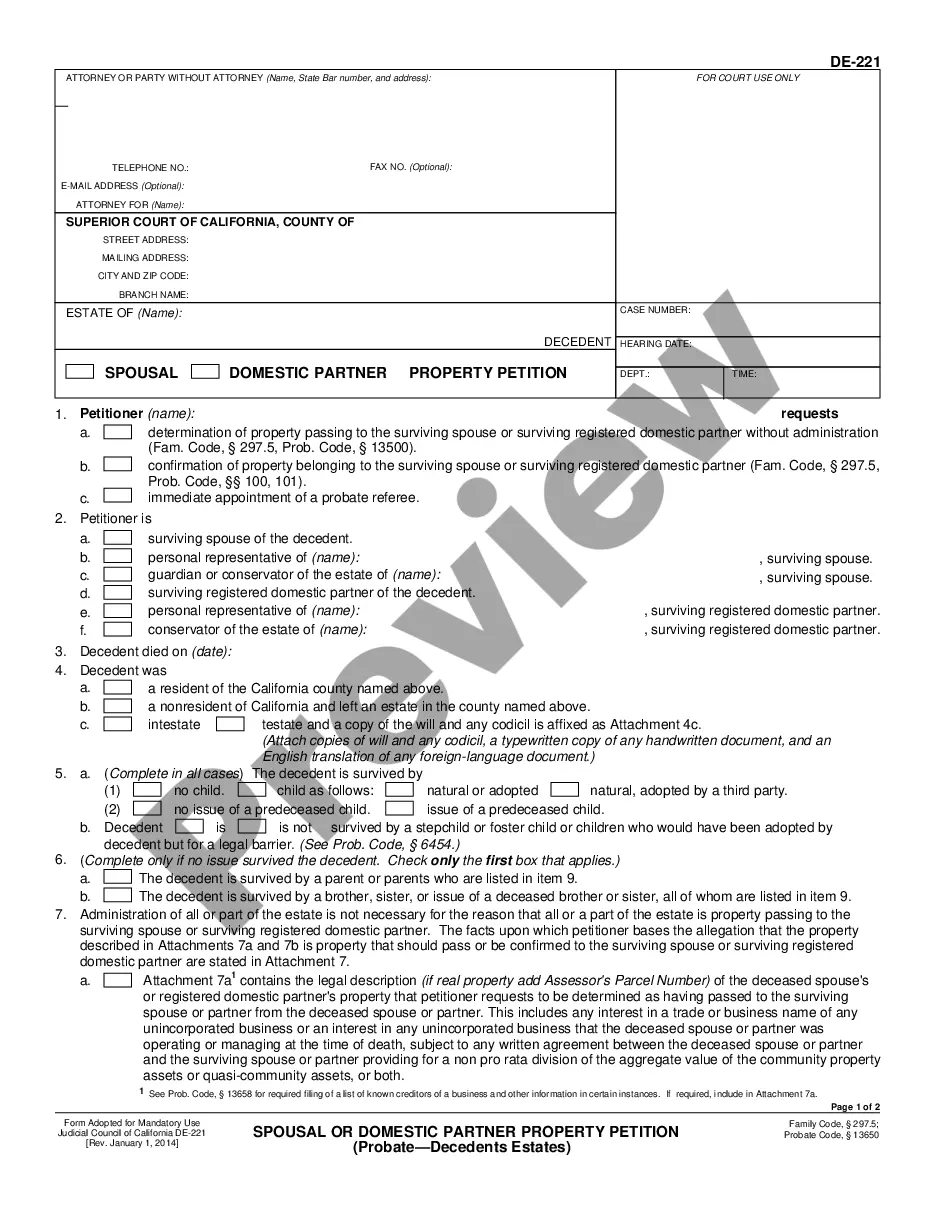

How to fill out California Petition To Determine Succession To Real And Personal Property - Small Estates - Estates $184,500 Or Less?

Are you searching for a trustworthy and affordable supplier of legal forms to obtain the Fullerton California Petition to Determine Succession to Real and Personal Property - Small Estates - Estates $166,250 or Less? US Legal Forms is your ideal choice.

Whether you require a simple agreement to establish guidelines for living with your partner or a collection of forms to facilitate your separation or divorce through the court system, we’ve got you covered. Our platform offers over 85,000 current legal document templates for personal and business use. All templates that we provide are tailored and comply with the standards of specific states and counties.

To download the form, you must Log In to your account, locate the necessary template, and click the Download button beside it. Please keep in mind that you can access your previously purchased form templates anytime from the My documents tab.

Is this your first visit to our platform? No problem. You can create an account in just a few minutes, but before doing so, make sure to.

Now you can create your account. Then choose the subscription option and proceed to payment. Once the payment is completed, download the Fullerton California Petition to Determine Succession to Real and Personal Property - Small Estates - Estates $166,250 or Less in any available file format. You can revisit the website whenever needed and redownload the form at no additional cost.

Finding current legal forms has never been simpler. Try US Legal Forms today, and stop wasting hours searching for legal documents online once and for all.

- Check if the Fullerton California Petition to Determine Succession to Real and Personal Property - Small Estates - Estates $166,250 or Less meets the regulations of your state and local jurisdiction.

- Review the form’s description (if available) to understand who the form is intended for and its purpose.

- Restart your search if the template does not suit your legal situation.

Form popularity

FAQ

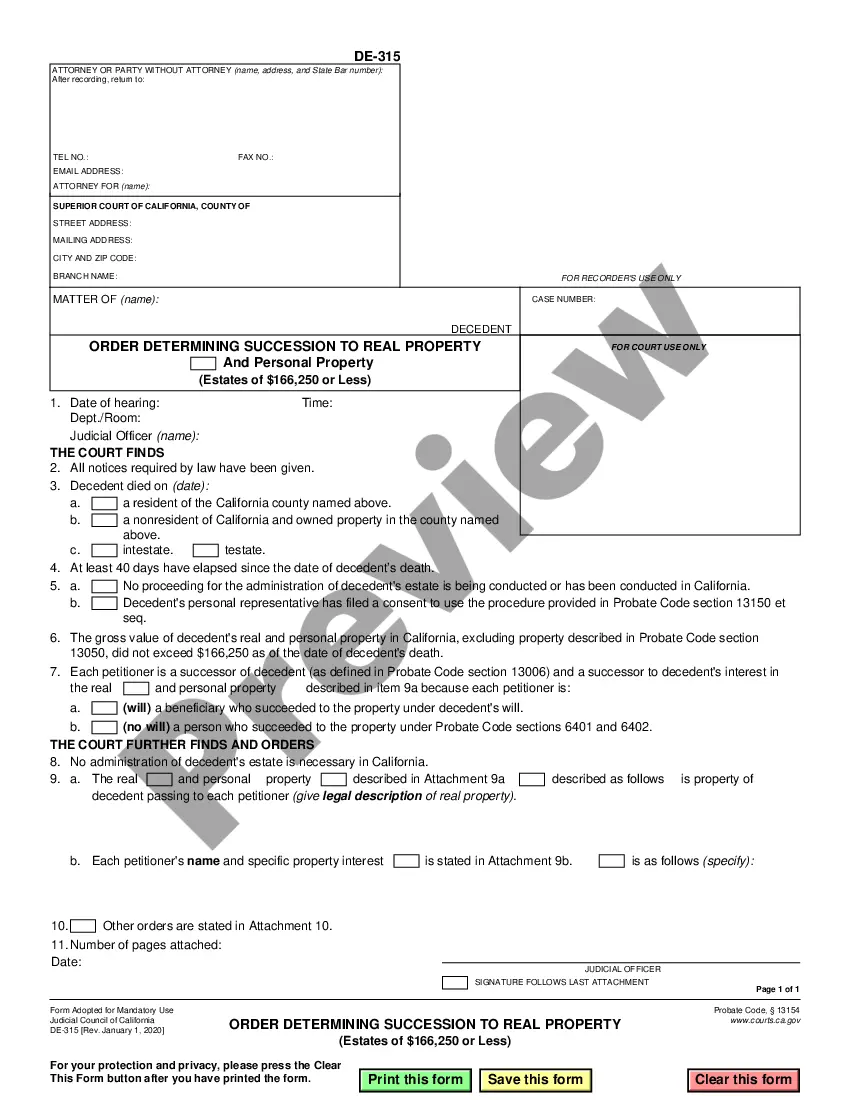

A petition to determine claim to property is a legal document that seeks court approval for the distribution of a deceased person's assets. In Fullerton, California, this petition specifically addresses small estates valued at $184,500 or less. It allows heirs or beneficiaries to establish their rights to the decedent’s property. For more guidance, consider US Legal Forms as a solution to assist with your Fullerton California Petition to Determine Succession to Real and Personal Property - Small Estates - Estates $184,500 or Less.

The duration to obtain a small estate affidavit in Fullerton, California, varies based on several factors. Typically, the process can take anywhere from a few weeks to a couple of months. The time frame often depends on court schedules and the complexity of the case. By using US Legal Forms, you can access streamlined resources to help speed up your Fullerton California Petition to Determine Succession to Real and Personal Property - Small Estates - Estates $184,500 or Less.

Typically, a small estate affidavit does not need to be filed with the court in California. Instead, you present the affidavit directly to the institutions holding the assets, such as banks or property offices. However, be mindful that using the Fullerton California Petition to Determine Succession to Real and Personal Property - Small Estates - Estates $184,500 or Less can help outline your rights and responsibilities clearly. Always consider consulting with a legal expert to ensure you follow correct procedures.

In California, the small estate affidavit applies to estates valued at $184,500 or less. This figure includes both real and personal property. When using the Fullerton California Petition to Determine Succession to Real and Personal Property - Small Estates - Estates $184,500 or Less, you can effectively simplify the estate transfer process. It is important to ensure your estate falls within this limit to utilize the affidavit.

To file a small estate affidavit in California, you typically head to the local probate court in the county where the deceased lived. In Fullerton, you'll need to visit the Orange County Superior Court, which handles matters related to the Fullerton California Petition to Determine Succession to Real and Personal Property - Small Estates - Estates $184,500 or Less. It’s essential to gather all necessary documents and ensure you meet all requirements beforehand. For a streamlined process, consider using USLegalForms to access the right forms and guidance tailored to your needs.

The duration for determining heirship in California can vary depending on several factors, like the complexity of the case and the court's schedule. Generally, the process can take anywhere from a few weeks to several months. For those filing a Fullerton California Petition to Determine Succession to Real and Personal Property - Small Estates - Estates $184,500 or Less, preparing all necessary documents accurately can help expedite the determination timeline.

To petition someone to determine heirship in California, you will need to file a petition in the appropriate superior court, providing evidence of your relationship to the deceased. This process may involve showing documentation like wills, trust documents, or affidavits as proof. With the Fullerton California Petition to Determine Succession to Real and Personal Property - Small Estates - Estates $184,500 or Less, this formal petition sets in motion the legal steps necessary for determining heirship.

A small estate affidavit 13101 in California is a legal document that allows heirs to claim property without going through probate, provided the estate's value does not exceed $184,500. This affidavit streamlines the process, allowing heirs to transfer real and personal property more efficiently. For those looking to file a Fullerton California Petition to Determine Succession to Real and Personal Property - Small Estates - Estates $184,500 or Less, understanding this affidavit is essential.

Yes, you can file an affidavit of heirship without an attorney in California. However, while it's possible to navigate the paperwork on your own, seeking professional guidance can simplify the process and ensure accuracy. If you decide to go this route, utilizing resources available on platforms like USLegalForms can be beneficial for accessing the necessary templates and guidance related to the Fullerton California Petition to Determine Succession to Real and Personal Property - Small Estates - Estates $184,500 or Less.

Proving heirship in California usually involves gathering vital documents such as birth certificates, marriage licenses, and death certificates that establish family relationships. These documents are essential for demonstrating who the rightful heirs are when filing a Fullerton California Petition to Determine Succession to Real and Personal Property - Small Estates - Estates $184,500 or Less. Additionally, an affidavit of heirship may help streamline the process, affirming your claim to inheritance.