The Downey California Order Determining Succession to Real Property and Personal Property — Small Estates $166,425 or Less is a legal process in Downey, California that allows for the efficient transfer of real and personal property to the rightful heirs of a deceased person when the estate is valued at $166,425 or less. This order is a simplified probate procedure designed to simplify the process and reduce administrative costs for smaller estates, providing a practical solution for families and beneficiaries. Types of Downey California Order Determining Succession to Real Property and Personal Property — Small Estates $166,425 or Less: 1. Real Property Succession — This type of order specifically deals with the transfer and distribution of real estate properties, such as land, houses, or buildings, when the total value of the estate does not exceed $166,425. The order determines the rightful successors who are entitled to these real properties based on the deceased person's will, if available, or the state's intestacy laws. 2. Personal Property Succession — This order focuses on the distribution of personal belongings and assets, excluding real estate, such as cash, bank accounts, vehicles, jewelry, and household items. It establishes the legal and rightful beneficiaries who are entitled to these personal properties of the deceased person, ensuring a smooth transition of assets. 3. Small Estates Affidavit — In certain cases, instead of obtaining an order from the court, a small estates' affidavit may be used to determine the succession of both real and personal property. This affidavit, signed by the rightful heirs, establishes their entitlement to the estate and allows for the transfer of assets without court intervention. However, this method is only applicable when certain criteria are met, such as the estate value being below $166,425 and a minimum waiting period after the individual's passing. 4. Spousal Succession — Downey California recognizes the rights of a surviving spouse to succeed to real and personal property, even without a formal order determining succession. In cases where the deceased person did not leave a will, or the will is invalid, the surviving spouse may be entitled to the entirety of the estate or a portion of it, depending on various factors, including community property laws. The Downey California Order Determining Succession to Real Property and Personal Property — Small Estates $166,425 or Less provides an accessible and streamlined legal process for the transfer of assets, ensuring a fair distribution among the rightful heirs of smaller estates. Whether it involves real property or personal property, this order offers an efficient resolution for families during the difficult time of losing a loved one.

Downey California Order Determining Succession to Real Property and Personal Property - Small Estates $184,500 or Less

Description

How to fill out Downey California Order Determining Succession To Real Property And Personal Property - Small Estates $184,500 Or Less?

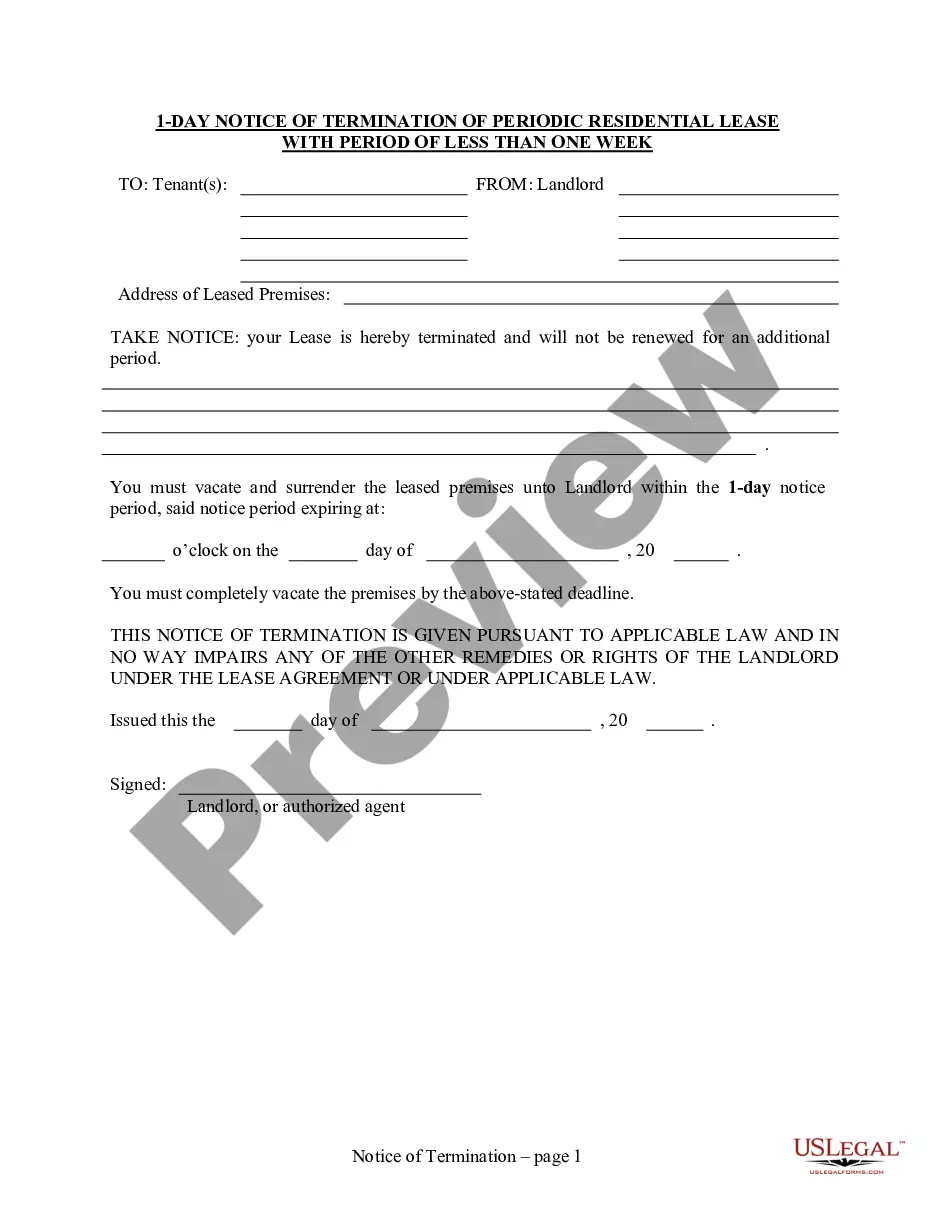

Do you need a trustworthy and inexpensive legal forms provider to buy the Downey California Order Determining Succession to Real Property and Personal Property - Small Estates $166,425 or Less? US Legal Forms is your go-to solution.

Whether you need a simple arrangement to set rules for cohabitating with your partner or a package of documents to move your divorce through the court, we got you covered. Our platform offers more than 85,000 up-to-date legal document templates for personal and business use. All templates that we give access to aren’t universal and framed in accordance with the requirements of particular state and area.

To download the document, you need to log in account, locate the required template, and click the Download button next to it. Please remember that you can download your previously purchased document templates anytime from the My Forms tab.

Is the first time you visit our platform? No worries. You can set up an account in minutes, but before that, make sure to do the following:

- Check if the Downey California Order Determining Succession to Real Property and Personal Property - Small Estates $166,425 or Less conforms to the laws of your state and local area.

- Read the form’s details (if provided) to learn who and what the document is good for.

- Start the search over if the template isn’t good for your specific scenario.

Now you can create your account. Then select the subscription option and proceed to payment. Once the payment is done, download the Downey California Order Determining Succession to Real Property and Personal Property - Small Estates $166,425 or Less in any provided file format. You can get back to the website at any time and redownload the document free of charge.

Finding up-to-date legal documents has never been easier. Give US Legal Forms a try today, and forget about spending your valuable time learning about legal paperwork online once and for all.