The Vallejo California Order Determining Succession to Real Property and Personal Property — Small Estates $166,425 or Less is a legal process designed to address the transfer of ownership of real and personal property in small estates within the Vallejo jurisdiction. This order is applicable when the total value of the estate does not exceed $166,425. There are different types of Vallejo California Order Determining Succession to Real Property and Personal Property — Small Estates $166,425 or Less that can be pursued, depending on the specific circumstances: 1. Vallejo California Order Determining Succession to Real Property — Small Estates $166,425 or Less: This type of order focuses on the transfer of ownership for real property, such as land, houses, or commercial buildings, where the total value of the estate is below $166,425. 2. Vallejo California Order Determining Succession to Personal Property — Small Estates $166,425 or Less: This order specifically deals with the transfer of ownership for personal property, such as vehicles, furniture, jewelry, or other tangible possessions, within the set limit of $166,425. The process to obtain the Vallejo California Order Determining Succession to Real Property and Personal Property — Small Estates $166,425 or Less involves several steps: 1. Qualifications: Determine if the estate qualifies for the small estates process, ensuring the total assets (both real and personal property) do not exceed $166,425 in value. 2. Petition: File a petition with the appropriate local court, providing details about the deceased person's estate, heirs, and any existing debts or liabilities. 3. Supporting Documentation: Gather essential documents, such as the deceased person's will (if available), death certificate, proof of assets and their value, and any other relevant evidence necessary to support the petition. 4. Notice: Serve notice to all interested parties, including heirs, creditors, and other potential claimants, informing them about the pending petition and giving them an opportunity to respond. 5. Court Hearing: Attend the court hearing as scheduled, where the judge will review the petition and supporting documents and determine the transfer of ownership as per California state laws. 6. Distribution: If the court approves the petition, the assets will be distributed among the eligible heirs or beneficiaries as determined by the Order Determining Succession, ensuring compliance with state regulations. It is important to consult with an experienced attorney specializing in estate law or probate to navigate the Vallejo California Order Determining Succession to Real Property and Personal Property — Small Estates $166,425 or Less process efficiently and ensure compliance with all legal requirements and formalities.

Vallejo California Order Determining Succession to Real Property and Personal Property - Small Estates $184,500 or Less

State:

California

City:

Vallejo

Control #:

CA-DE-315

Format:

PDF

Instant download

Public form

Description

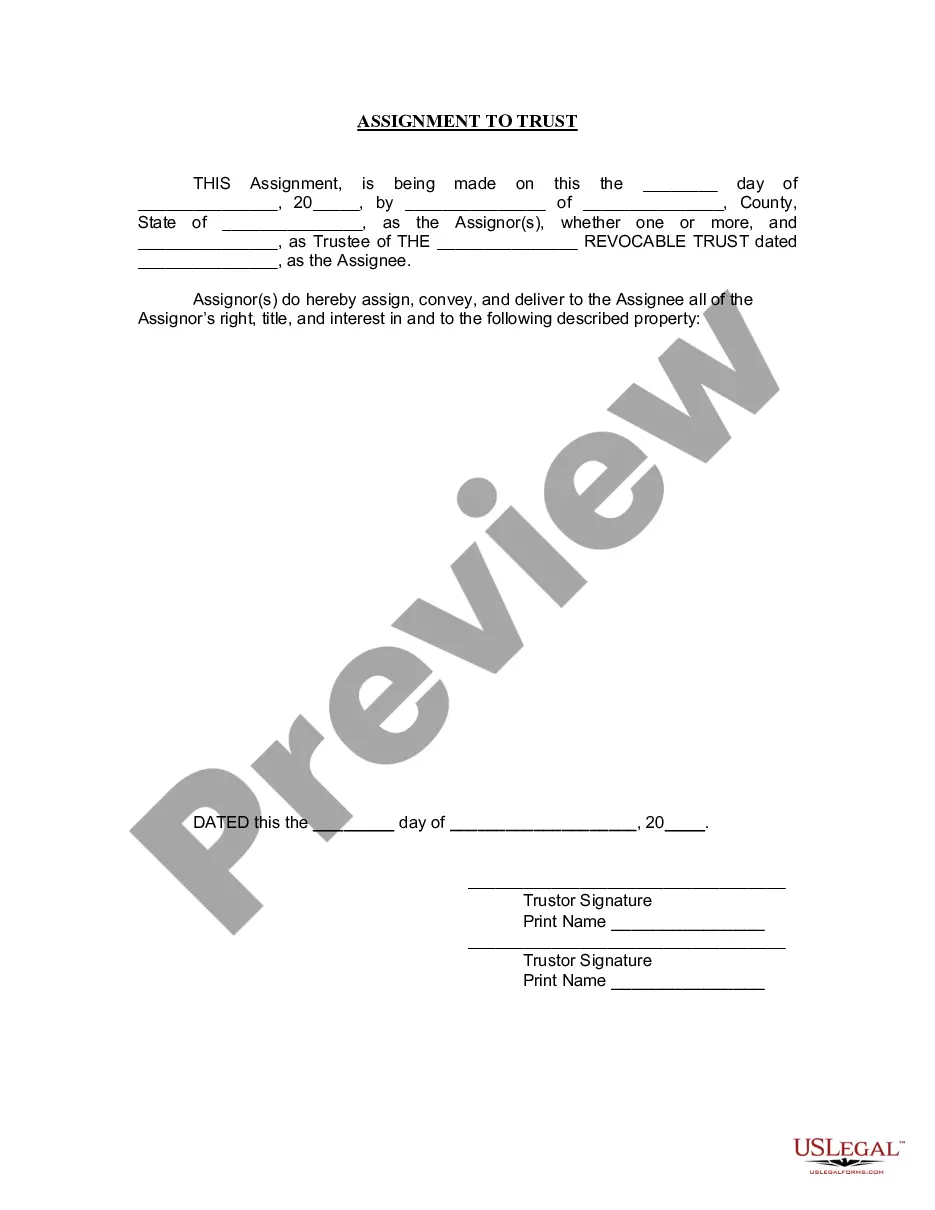

An Order is an official written statement from the court commanding a certain action, and is signed by the judge. Failure to comply with the order is unlawful and may result in contempt of court charges. This document, a sample Order Determining Succession to Real Property (and Personal Property) - Estates $184,500 or Less, can be used as a model to draft an order requested for submission by the court (the court often directs a party to draft an order).

The Vallejo California Order Determining Succession to Real Property and Personal Property — Small Estates $166,425 or Less is a legal process designed to address the transfer of ownership of real and personal property in small estates within the Vallejo jurisdiction. This order is applicable when the total value of the estate does not exceed $166,425. There are different types of Vallejo California Order Determining Succession to Real Property and Personal Property — Small Estates $166,425 or Less that can be pursued, depending on the specific circumstances: 1. Vallejo California Order Determining Succession to Real Property — Small Estates $166,425 or Less: This type of order focuses on the transfer of ownership for real property, such as land, houses, or commercial buildings, where the total value of the estate is below $166,425. 2. Vallejo California Order Determining Succession to Personal Property — Small Estates $166,425 or Less: This order specifically deals with the transfer of ownership for personal property, such as vehicles, furniture, jewelry, or other tangible possessions, within the set limit of $166,425. The process to obtain the Vallejo California Order Determining Succession to Real Property and Personal Property — Small Estates $166,425 or Less involves several steps: 1. Qualifications: Determine if the estate qualifies for the small estates process, ensuring the total assets (both real and personal property) do not exceed $166,425 in value. 2. Petition: File a petition with the appropriate local court, providing details about the deceased person's estate, heirs, and any existing debts or liabilities. 3. Supporting Documentation: Gather essential documents, such as the deceased person's will (if available), death certificate, proof of assets and their value, and any other relevant evidence necessary to support the petition. 4. Notice: Serve notice to all interested parties, including heirs, creditors, and other potential claimants, informing them about the pending petition and giving them an opportunity to respond. 5. Court Hearing: Attend the court hearing as scheduled, where the judge will review the petition and supporting documents and determine the transfer of ownership as per California state laws. 6. Distribution: If the court approves the petition, the assets will be distributed among the eligible heirs or beneficiaries as determined by the Order Determining Succession, ensuring compliance with state regulations. It is important to consult with an experienced attorney specializing in estate law or probate to navigate the Vallejo California Order Determining Succession to Real Property and Personal Property — Small Estates $166,425 or Less process efficiently and ensure compliance with all legal requirements and formalities.

How to fill out Vallejo California Order Determining Succession To Real Property And Personal Property - Small Estates $184,500 Or Less?

If you’ve already utilized our service before, log in to your account and save the Vallejo California Order Determining Succession to Real Property and Personal Property - Small Estates $166,425 or Less on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple steps to obtain your document:

- Make certain you’ve located an appropriate document. Read the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t suit you, use the Search tab above to get the appropriate one.

- Purchase the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Obtain your Vallejo California Order Determining Succession to Real Property and Personal Property - Small Estates $166,425 or Less. Select the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to each piece of paperwork you have purchased: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to rapidly find and save any template for your personal or professional needs!