Visalia California Order Determining Succession to Real Property and Personal Property — Small Estates $166,425 or Less In Visalia, California, individuals dealing with the succession of real property and personal property in small estates, which are valued at $166,425 or less, must adhere to specific legal procedures. This process involves obtaining an Order Determining Succession to Real Property and Personal Property from the court. By following these steps, heirs and beneficiaries can ensure a smooth transfer of assets while minimizing complicated legal procedures and costs. The Order Determining Succession to Real Property and Personal Property is a legal document issued by the court that establishes the rightful successors of a deceased person's assets. It outlines the distribution of both real property (such as land, homes, or commercial buildings) and personal property (such as bank accounts, vehicles, or belongings) according to California Probate Code Section 13150-13158. To initiate the Order Determining Succession to Real Property and Personal Property for small estates, interested parties should gather the necessary documents and follow these steps: 1. Eligibility — The estate must meet the criteria for a small estate, which means the value of the assets does not exceed $166,425. Additionally, the successors must be identified and agree on the distribution of the assets. 2. Proper Documentation — Obtain the necessary documents, which may include the original or certified copy of the decedent's will, death certificate, property documents, and an inventory of personal property. 3. Prepare the Petition — Draft a Petition for the Order Determining Succession to Real Property and Personal Property. This legal document contains detailed information, such as the decedent's personal details, description of the assets, identification of the successors, and a proposed distribution plan. 4. File the Petition — Submit the completed Petition to the Superior Court in Visalia, California, along with the required filing fee. The court clerk will provide a hearing date and time for the case. 5. Notice of Petition — Serve a Notice of Petition to all interested parties, including the decedent's heirs, beneficiaries, and creditors. This notice informs them about the pending court hearing and gives an opportunity to contest the petition if necessary. 6. Attend the Hearing — On the scheduled date, appear before the court and present the Petition for review. The judge will examine the documents, determine their validity, and ensure that the proposed distribution plan complies with California law. 7. Obtain the Order — If the court approves the Petition, the judge will issue an Order Determining Succession to Real Property and Personal Property. This document officially transfers the assets to the identified successors and grants them legal ownership. Variations of the Visalia California Order Determining Succession to Real Property and Personal Property — Small Estates $166,425 or Less may include cases with specific complexities or contested claims. In such instances, the process might involve additional documentation, court hearings, and negotiations between the parties involved. However, the core elements of the process remain consistent, aiming to simplify the estate succession process for small estates in Visalia, California.

Visalia California Order Determining Succession to Real Property and Personal Property - Small Estates $184,500 or Less

Description

How to fill out Visalia California Order Determining Succession To Real Property And Personal Property - Small Estates $184,500 Or Less?

We consistently seek to lessen or avert legal repercussions when navigating intricate legal or financial matters.

To achieve this, we seek legal expertise that is often quite costly.

Nevertheless, not every legal issue is similarly intricate; many can be managed independently.

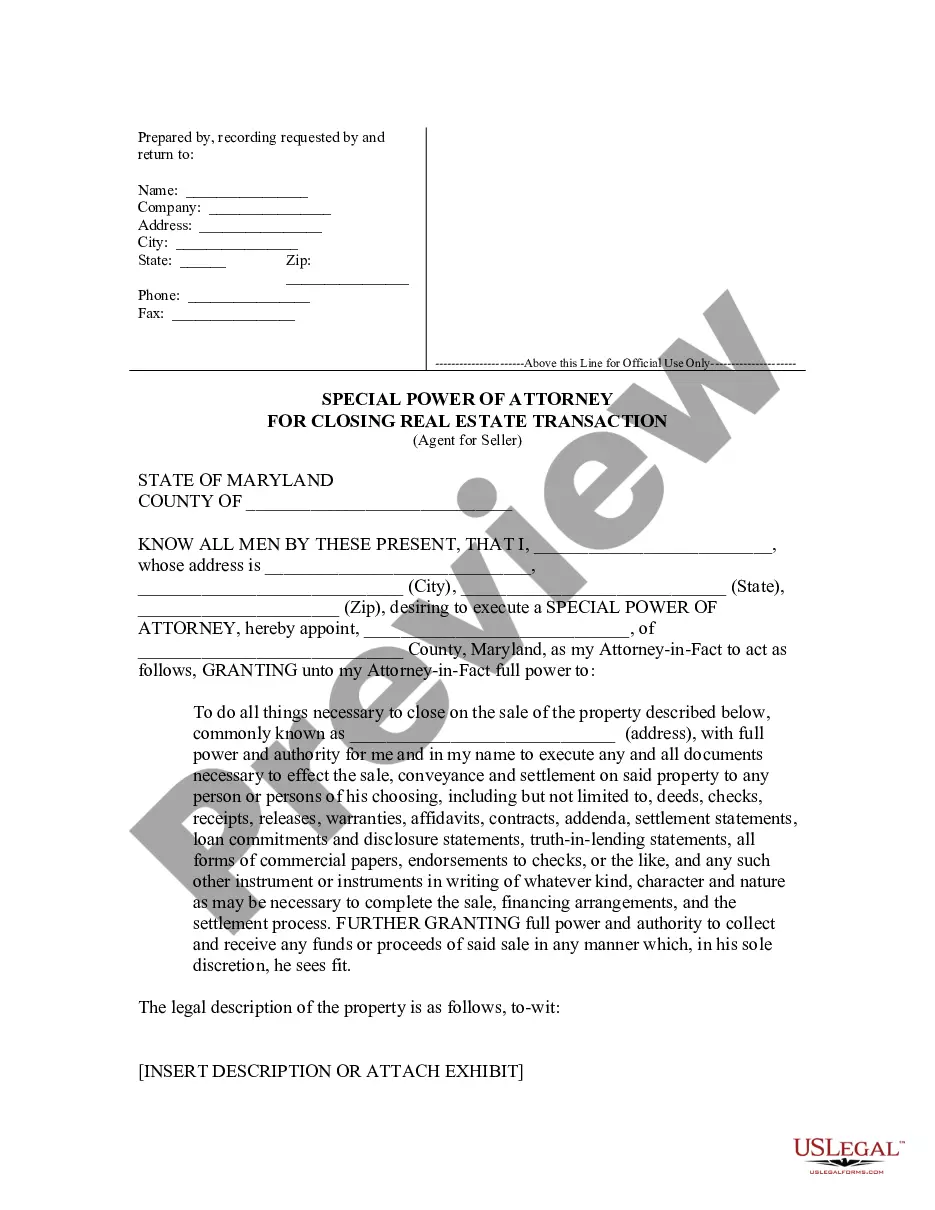

US Legal Forms is a digital repository of current DIY legal documents covering everything from wills and powers of attorney to incorporation articles and petitions for dissolutions.

Just Log In to your account and click the Get button beside it. Should you lose the form, you can always retrieve it again from the My documents section.

- Our collection empowers you to manage your affairs independently without relying on an attorney.

- We provide access to legal document templates that are not always readily available.

- Our templates are tailored to specific states and regions, simplifying the search process significantly.

- Utilize US Legal Forms whenever you require the Visalia California Order Determining Succession to Real Property and Personal Property - Small Estates $166,425 or Less or any other document swiftly and securely.

Form popularity

FAQ

As of 2025, the small estate limit in California for the Visalia California Order Determining Succession to Real Property and Personal Property - Small Estates $184,500 or Less remains relevant for estates valued at $184,500 or lower. Staying updated on these limits is essential for effective estate planning. Utilizing USLegalForms can help you navigate changes in legal processes and ensure your family's inheritance is handled smoothly. This knowledge empowers you to make informed decisions regarding your estate.

In California, the small estate threshold for the Visalia California Order Determining Succession to Real Property and Personal Property - Small Estates $184,500 or Less is currently set at $184,500. When an estate's total value is under this amount, the probate process may be simplified. This allows heirs to inherit property more quickly and with fewer legal hurdles. Understanding this threshold can save your family time and reduce stress during difficult times.

To prove heirship in California, you typically need to provide a combination of documentation, including a death certificate, a will if one exists, and evidence of familial relationships. You may also need to gather affidavits from relatives confirming heirship. Utilizing the Visalia California Order Determining Succession to Real Property and Personal Property - Small Estates $184,500 or Less can streamline this evidence collection process, ensuring a smoother transition of property.

Yes, you can file an affidavit of heirship without an attorney in California. Many individuals choose to manage this process themselves, especially for small estates. However, ensuring the forms are completed correctly is vital to avoid delays. The Visalia California Order Determining Succession to Real Property and Personal Property - Small Estates $184,500 or Less offers a straightforward approach to filing, making it easier for you.

To file an affidavit for real property of small value in California, you need to complete the necessary forms, including the affidavit itself and a declaration of the deceased’s estate. Next, you must submit these documents to the appropriate court along with any required fees. For individuals managing small estates, the Visalia California Order Determining Succession to Real Property and Personal Property - Small Estates $184,500 or Less simplifies this filing process.

The determination of heirship in California often takes around six months, but this can vary based on the complexity of the estate. If there are disputes among heirs, this process may take longer. During this period, the court will work to validate the heirs and distribute the property. Using the Visalia California Order Determining Succession to Real Property and Personal Property - Small Estates $184,500 or Less can sometimes expedite this process.

In California, heirs are determined by the state's probate laws. Generally, the heirs are the deceased person's spouse, children, siblings, and parents. When there is a valid will, the distributions outlined in the will take precedence. For those dealing with a Visalia California Order Determining Succession to Real Property and Personal Property - Small Estates $184,500 or Less, understanding the order of succession can help in the distribution of assets.

To avoid probate in California, an estate must be valued at $184,500 or less. This allows heirs to bypass the lengthy and often costly probate process. By using the Visalia California Order Determining Succession to Real Property and Personal Property - Small Estates $184,500 or Less, families can efficiently manage smaller estates while ensuring a smoother transition of assets for their loved ones.

To petition someone to determine heirship in California, you must file a petition with the probate court in your county. This legal process establishes the rightful heirs of an estate, ensuring that assets are distributed according to the law. Utilizing resources like US Legal Forms can simplify this process and help you navigate the complexities of the Visalia California Order Determining Succession to Real Property and Personal Property - Small Estates $184,500 or Less.

The amount for a small estate affidavit in California is capped at $184,500. If the estate's value is below this limit, heirs can utilize the small estate affidavit to claim assets without the need for probate. This efficient process, encapsulated in the Visalia California Order Determining Succession to Real Property and Personal Property - Small Estates $184,500 or Less, offers a straightforward solution for families dealing with estate matters.