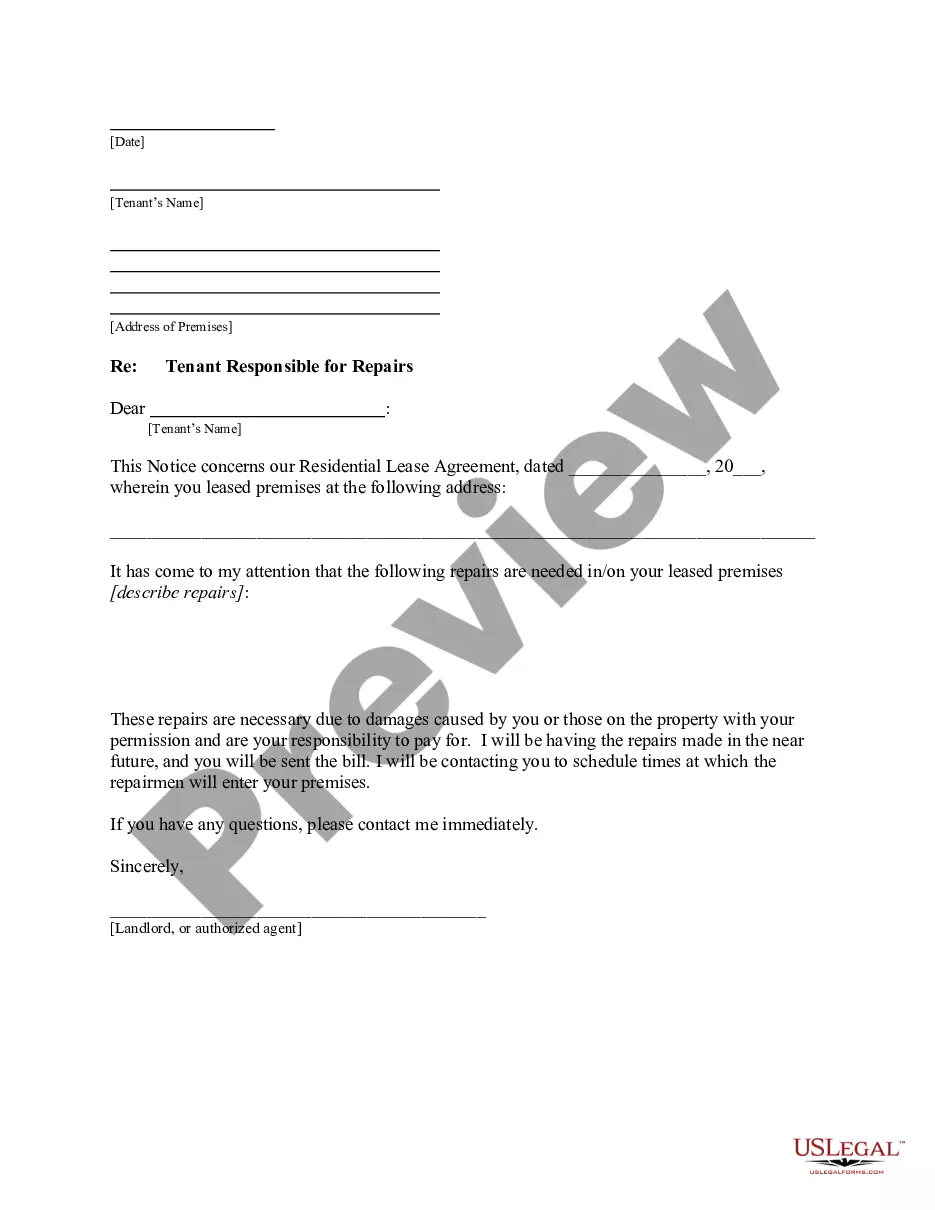

Use this form to file a declared homestead as a married couple at the County Recorder's Office in the county where the property is located.

Inglewood California Homestead Declaration for Husband and Wife

Description

How to fill out California Homestead Declaration For Husband And Wife?

Regardless of one’s social or occupational rank, fulfilling law-related documentation is a regrettable necessity in today’s working landscape.

Often, it’s nearly impossible for an individual lacking any judicial experience to create such documents from the ground up, primarily due to the complex jargon and legal subtleties they encompass.

This is where US Legal Forms proves to be invaluable.

Ensure the template you’ve selected is tailored to your jurisdiction, as the regulations of one state or region do not apply to another.

Review the document and check a brief overview (if available) of situations the form can be utilized for.

- Our service provides a vast repository with over 85,000 ready-to-use, state-specific documents applicable to virtually any legal circumstance.

- US Legal Forms is also a valuable resource for associates or legal advisors seeking to enhance their time management through our DIY forms.

- Whether you need the Inglewood California Homestead Declaration for Husband and Wife or any other document suited for your region, US Legal Forms makes everything easily accessible.

- Here’s how you can swiftly obtain the Inglewood California Homestead Declaration for Husband and Wife using our reliable platform.

- If you are an existing user, feel free to Log In to your account to download the necessary form.

- However, if you are a newcomer to our service, follow these steps before downloading the Inglewood California Homestead Declaration for Husband and Wife.

Form popularity

FAQ

To file for a California homestead exemption, you must complete the required application form available from the local assessor's office. Providing all requested information, including property details and ownership status, is essential in this step. The Inglewood California Homestead Declaration for Husband and Wife serves as a key component in this filing, especially when both spouses are owners. Once you have filled out the application, submit it directly to the county to enjoy the protection it offers.

Filing a homestead exemption in California begins with obtaining the necessary application from your county's assessor's office. Ensure you meet the eligibility criteria, such as being the owner and occupant of the home, and fill out the application accurately. The Inglewood California Homestead Declaration for Husband and Wife can significantly enhance your filing process, especially for couples. Submit the completed application to your county assessor to receive your exemption and benefit from additional protection.

To record a homestead declaration in California, you must first complete the declaration form, ensuring you include details such as the property address and owners' names. After completing the form, take it to your local county recorder's office to have it officially recorded. This process helps protect your home from creditors, particularly for couples; hence, the Inglewood California Homestead Declaration for Husband and Wife is particularly beneficial. Once recorded, keep a copy for your records and use it as needed.

You can definitely homestead your home in California by filing the appropriate declarations. This option provides financial protection and security for your primary residence, helping to shield it from certain legal claims. For couples, an Inglewood California Homestead Declaration for Husband and Wife brings both partners under this protective umbrella. To ensure accuracy and compliance, consider using uslegalforms for filing.

Yes, you can still homestead in California by filing a homestead declaration. This process allows homeowners to safeguard their primary residence from creditors and financial distress. An Inglewood California Homestead Declaration for Husband and Wife further emphasizes the rights of both partners in this regard. Using a service like uslegalforms can make the paperwork easier to navigate.

The benefits of homesteading in California include protection of your home from creditors and providing a sense of stability for your family. An Inglewood California Homestead Declaration for Husband and Wife can also provide tax benefits in certain situations. Moreover, it can prevent homelessness due to bankruptcy, giving you peace of mind. Overall, it serves as an essential safety net for homeowners.

Homesteading as a formal government program effectively ended in California in the 1970s. However, the concept of protecting one's home through a homestead declaration remains very much alive. Residents can still file an Inglewood California Homestead Declaration for Husband and Wife to benefit from legal protections. This ensures you maintain your shelter against certain types of creditors.

Releasing homestead rights means formally giving up the protections that comes with a homestead declaration. This action allows creditors to pursue your home in the event of a financial default. For couples, understanding the implications of releasing your Inglewood California Homestead Declaration for Husband and Wife is crucial. It can affect both partners’ rights, which is why it is advisable to consult legal resources.

To declare homestead in California, you need to file a Homestead Declaration with your local county recorder's office. This form is essential for protecting your primary residence from creditors in certain legal situations. For couples, an Inglewood California Homestead Declaration for Husband and Wife ensures that both partners' rights are recognized. Using platforms like uslegalforms can simplify the process and provide you with the necessary forms.

Homesteading your home in California offers several benefits, such as protecting your property from creditors and preserving your equity. The Inglewood California Homestead Declaration for Husband and Wife is designed to provide legal shields for your primary residence. Furthermore, this declaration can provide peace of mind knowing that your home is safeguarded, even in case of financial hardships.