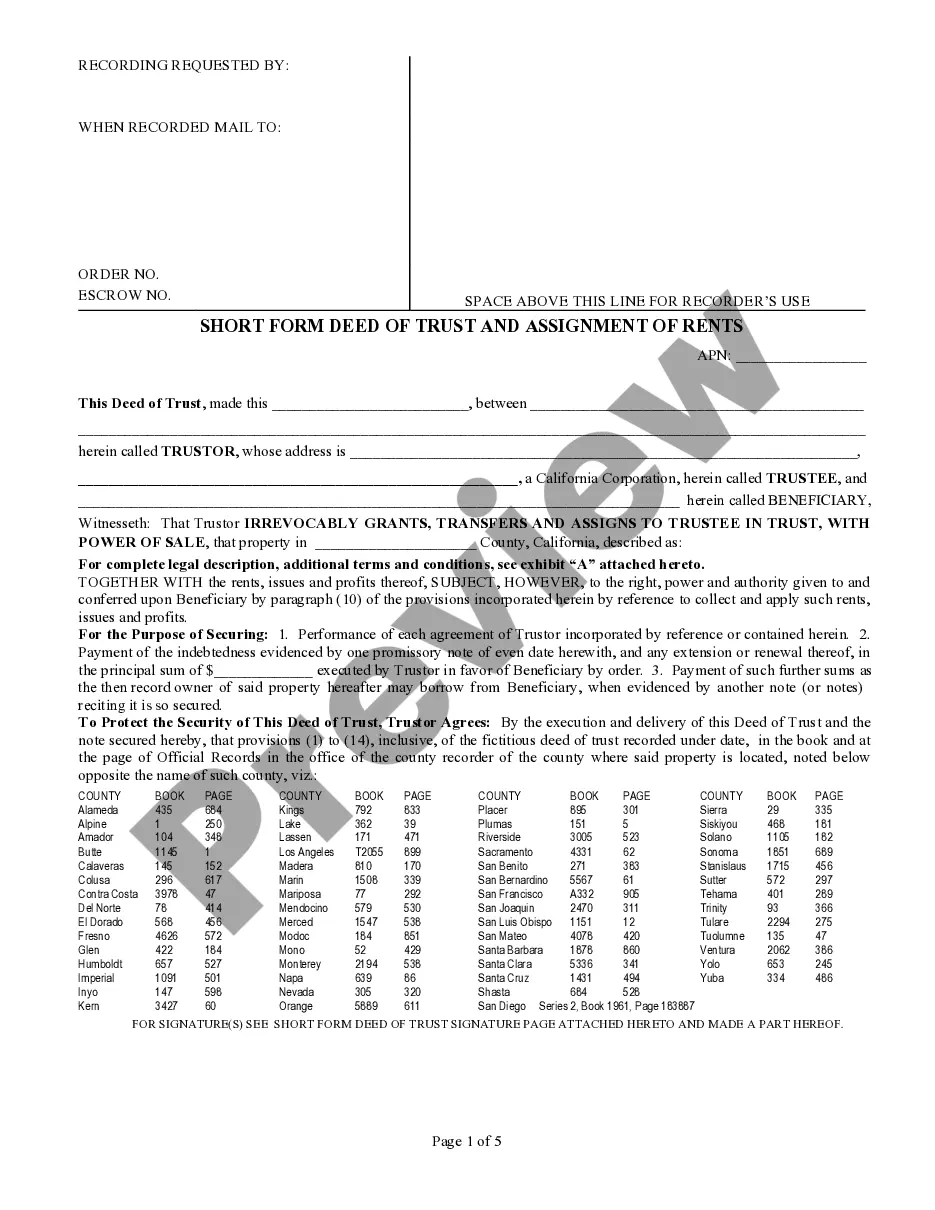

This deed, or deed-related form, is for use in property transactions in the designated state. This document, a sample Short Form Deed of Trust and Assignment of Rents - San Diego District Court Only, can be used in the transfer process or related task. Adapt the language to fit your circumstances. Available for download now in PDF format.

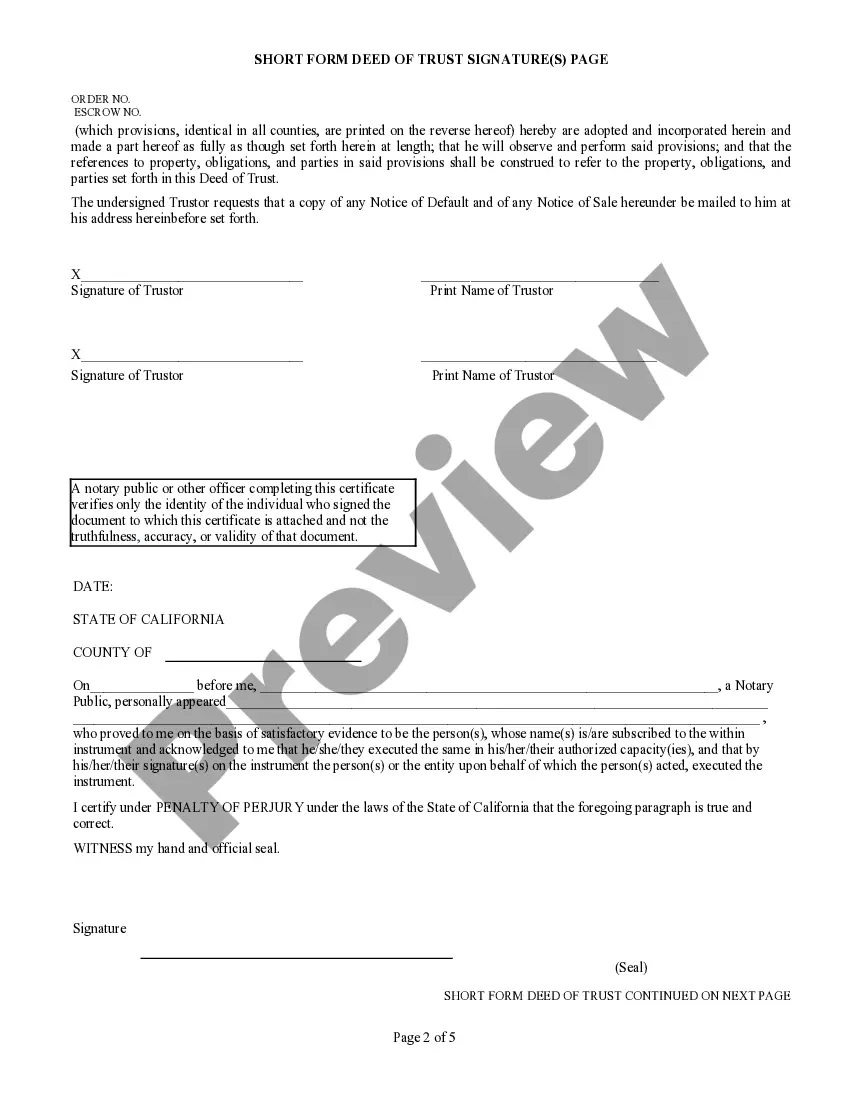

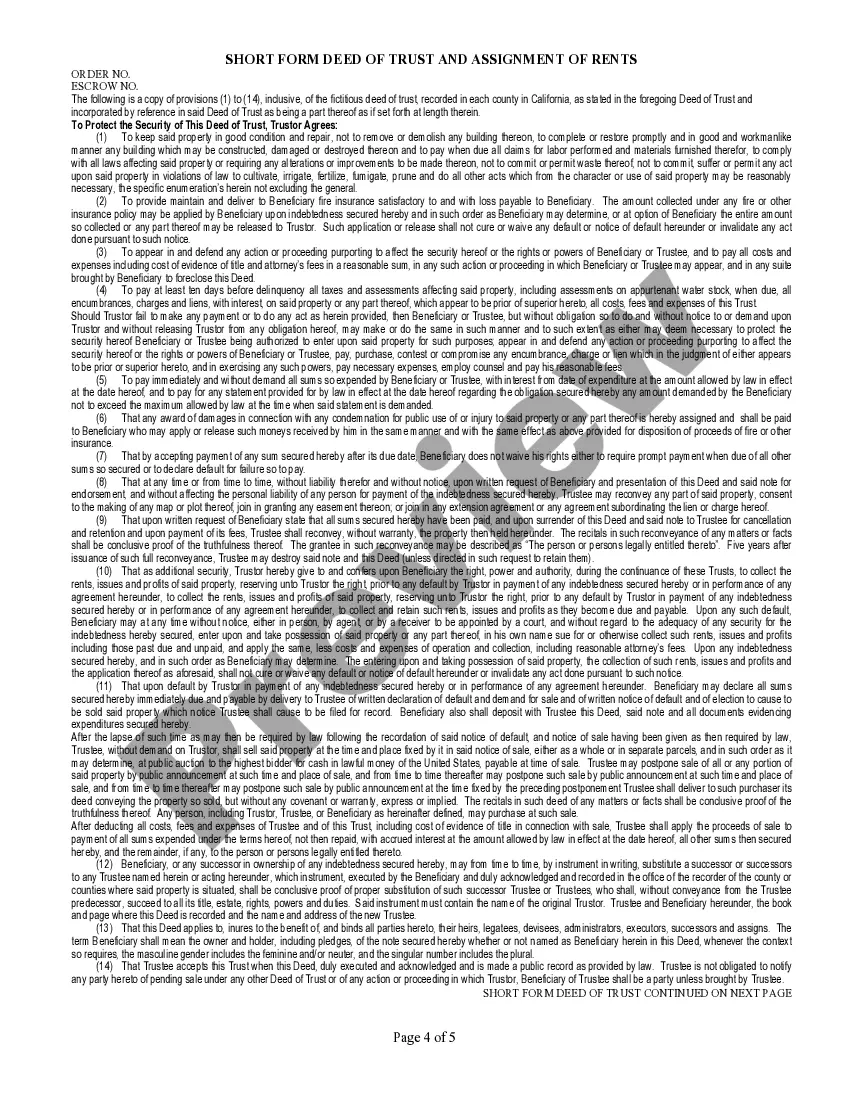

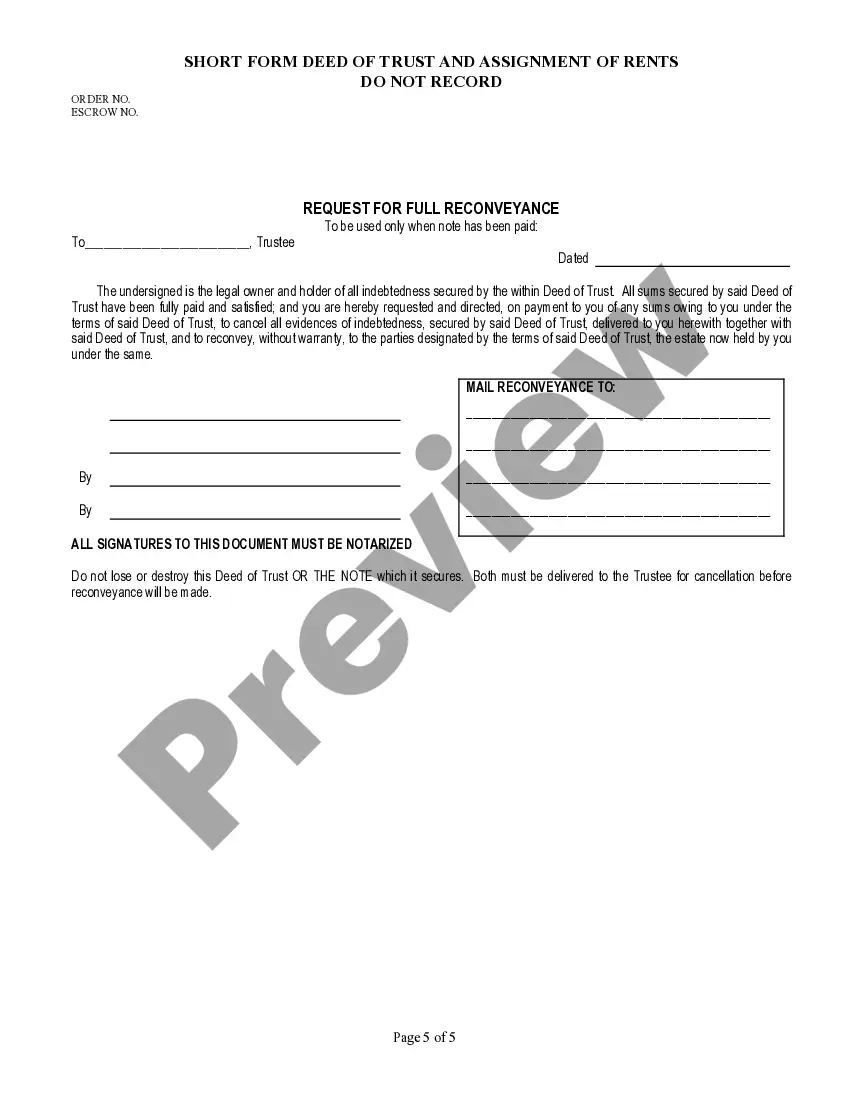

A Hayward California Short Form Deed of Trust and Assignment of Rents is a legal document used in real estate transactions to secure a loan for a property located in Hayward, California. This document serves as a form of collateral for the lender, offering protection in case the borrower defaults on the loan. The deed of trust portion of the document outlines the terms of the loan, including the principal amount, interest rate, and repayment schedule. It also specifies the property being used as collateral and includes details about any existing liens or encumbrances on the property. The assignment of rents component allows the lender to collect the rental income generated by the property if the borrower defaults on the loan. The borrower assigns the right to collect rents to the lender as an additional security measure. There are two main types of Hayward California Short Form Deed of Trust and Assignment of Rents: private party transactions and institutional lender transactions. Private party transactions refer to loans between individuals or non-institutional lenders, such as family members or friends. These transactions may have more flexible terms and requirements compared to institutional lender transactions. Institutional lender transactions involve loans from banks, credit unions, or other financial institutions. These transactions usually follow standard industry practices and often require more detailed documentation and stricter compliance with regulations. It is important for both borrowers and lenders to thoroughly understand the Hayward California Short Form Deed of Trust and Assignment of Rents before entering into any real estate transaction. Consulting with a qualified real estate attorney or a trusted legal professional is highly recommended ensuring compliance with the applicable laws and regulations. By using this legal document, both borrowers and lenders can protect their interests and have a clear understanding of their rights and obligations in the real estate transaction.A Hayward California Short Form Deed of Trust and Assignment of Rents is a legal document used in real estate transactions to secure a loan for a property located in Hayward, California. This document serves as a form of collateral for the lender, offering protection in case the borrower defaults on the loan. The deed of trust portion of the document outlines the terms of the loan, including the principal amount, interest rate, and repayment schedule. It also specifies the property being used as collateral and includes details about any existing liens or encumbrances on the property. The assignment of rents component allows the lender to collect the rental income generated by the property if the borrower defaults on the loan. The borrower assigns the right to collect rents to the lender as an additional security measure. There are two main types of Hayward California Short Form Deed of Trust and Assignment of Rents: private party transactions and institutional lender transactions. Private party transactions refer to loans between individuals or non-institutional lenders, such as family members or friends. These transactions may have more flexible terms and requirements compared to institutional lender transactions. Institutional lender transactions involve loans from banks, credit unions, or other financial institutions. These transactions usually follow standard industry practices and often require more detailed documentation and stricter compliance with regulations. It is important for both borrowers and lenders to thoroughly understand the Hayward California Short Form Deed of Trust and Assignment of Rents before entering into any real estate transaction. Consulting with a qualified real estate attorney or a trusted legal professional is highly recommended ensuring compliance with the applicable laws and regulations. By using this legal document, both borrowers and lenders can protect their interests and have a clear understanding of their rights and obligations in the real estate transaction.