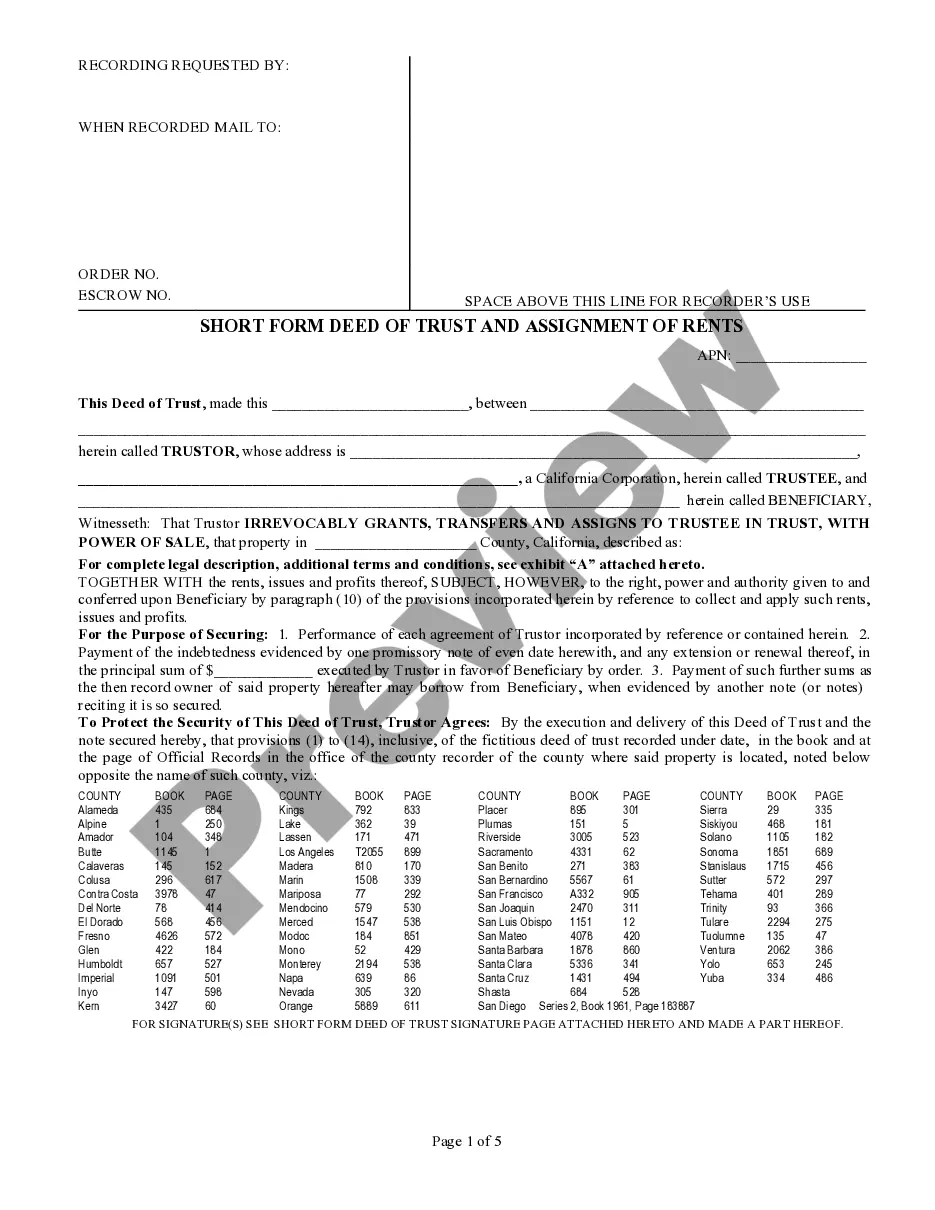

This deed, or deed-related form, is for use in property transactions in the designated state. This document, a sample Short Form Deed of Trust and Assignment of Rents - San Diego District Court Only, can be used in the transfer process or related task. Adapt the language to fit your circumstances. Available for download now in PDF format.

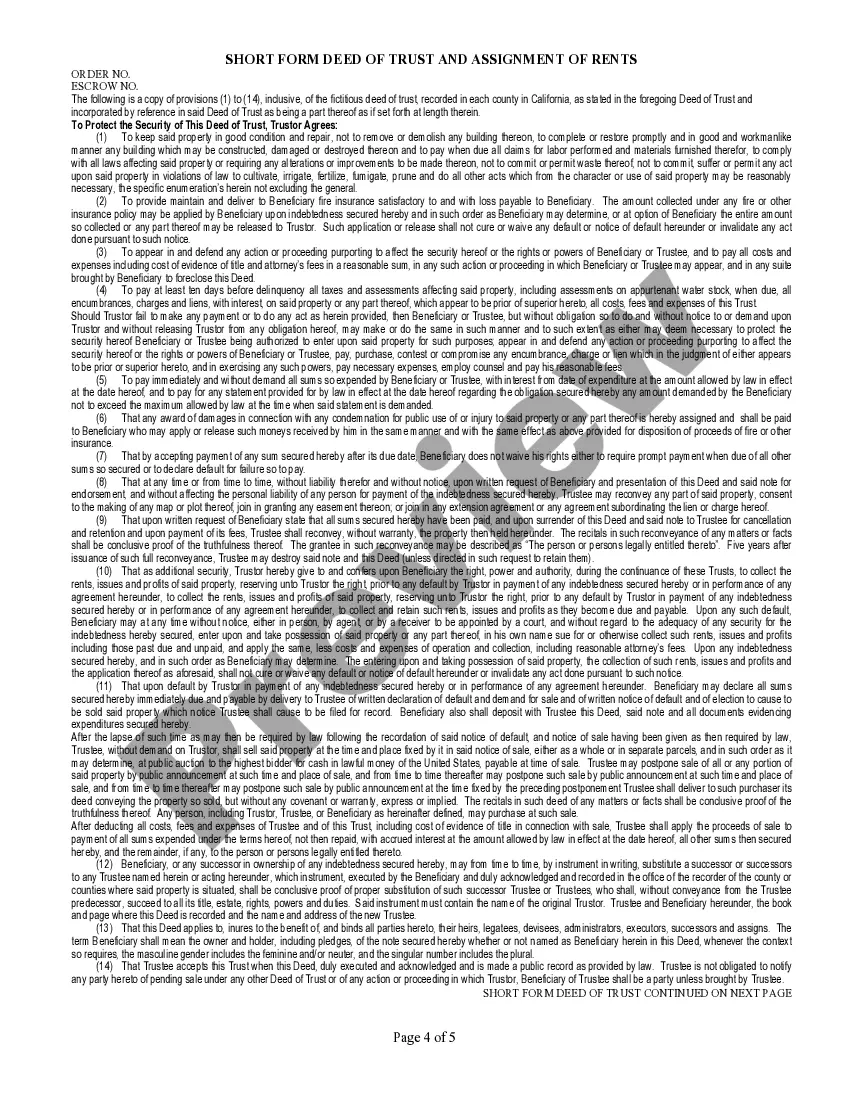

A San Diego California Short Form Deed of Trust and Assignment of Rents is a legal document that outlines the terms and conditions of a loan secured by real estate located in San Diego, California. This type of deed is commonly used in real estate transactions to establish a lien on the property and protect the lender's interests. The deed of trust serves as a security instrument, allowing the lender to foreclose on the property in the event of default or non-payment by the borrower. It typically includes important details such as the names of the borrower and lender, the property address, the loan amount, interest rate, and repayment terms. The Assignment of Rents provision is an additional component often included in the San Diego California Short Form Deed of Trust. This clause allows the lender to collect any rental income generated by the property in case of default. It provides an extra layer of security for the lender by ensuring a potential income stream to help cover the loan payments. There can be different variations of the San Diego California Short Form Deed of Trust and Assignment of Rents, depending on specific terms and conditions agreed upon by the parties involved. Some possible types may include: 1. Fixed-rate Deed of Trust: This type of deed establishes a fixed interest rate for the loan, ensuring that the borrower's monthly payments remain constant throughout the loan term. 2. Adjustable-rate Deed of Trust: In this case, the interest rate on the loan is adjustable, usually tied to an index such as the U.S. prime rate. The interest rate may change periodically, leading to potential fluctuations in the borrower's monthly payments. 3. Commercial Deed of Trust: This type of deed is used when the property being financed is intended for commercial purposes, such as an office building, retail space, or industrial property. 4. Residential Deed of Trust: This variation is specific to residential properties, including single-family homes, condominiums, or multifamily buildings. It is crucial to consult with a qualified attorney or real estate professional to understand the specific terms and provisions included in a San Diego California Short Form Deed of Trust and Assignment of Rents.A San Diego California Short Form Deed of Trust and Assignment of Rents is a legal document that outlines the terms and conditions of a loan secured by real estate located in San Diego, California. This type of deed is commonly used in real estate transactions to establish a lien on the property and protect the lender's interests. The deed of trust serves as a security instrument, allowing the lender to foreclose on the property in the event of default or non-payment by the borrower. It typically includes important details such as the names of the borrower and lender, the property address, the loan amount, interest rate, and repayment terms. The Assignment of Rents provision is an additional component often included in the San Diego California Short Form Deed of Trust. This clause allows the lender to collect any rental income generated by the property in case of default. It provides an extra layer of security for the lender by ensuring a potential income stream to help cover the loan payments. There can be different variations of the San Diego California Short Form Deed of Trust and Assignment of Rents, depending on specific terms and conditions agreed upon by the parties involved. Some possible types may include: 1. Fixed-rate Deed of Trust: This type of deed establishes a fixed interest rate for the loan, ensuring that the borrower's monthly payments remain constant throughout the loan term. 2. Adjustable-rate Deed of Trust: In this case, the interest rate on the loan is adjustable, usually tied to an index such as the U.S. prime rate. The interest rate may change periodically, leading to potential fluctuations in the borrower's monthly payments. 3. Commercial Deed of Trust: This type of deed is used when the property being financed is intended for commercial purposes, such as an office building, retail space, or industrial property. 4. Residential Deed of Trust: This variation is specific to residential properties, including single-family homes, condominiums, or multifamily buildings. It is crucial to consult with a qualified attorney or real estate professional to understand the specific terms and provisions included in a San Diego California Short Form Deed of Trust and Assignment of Rents.