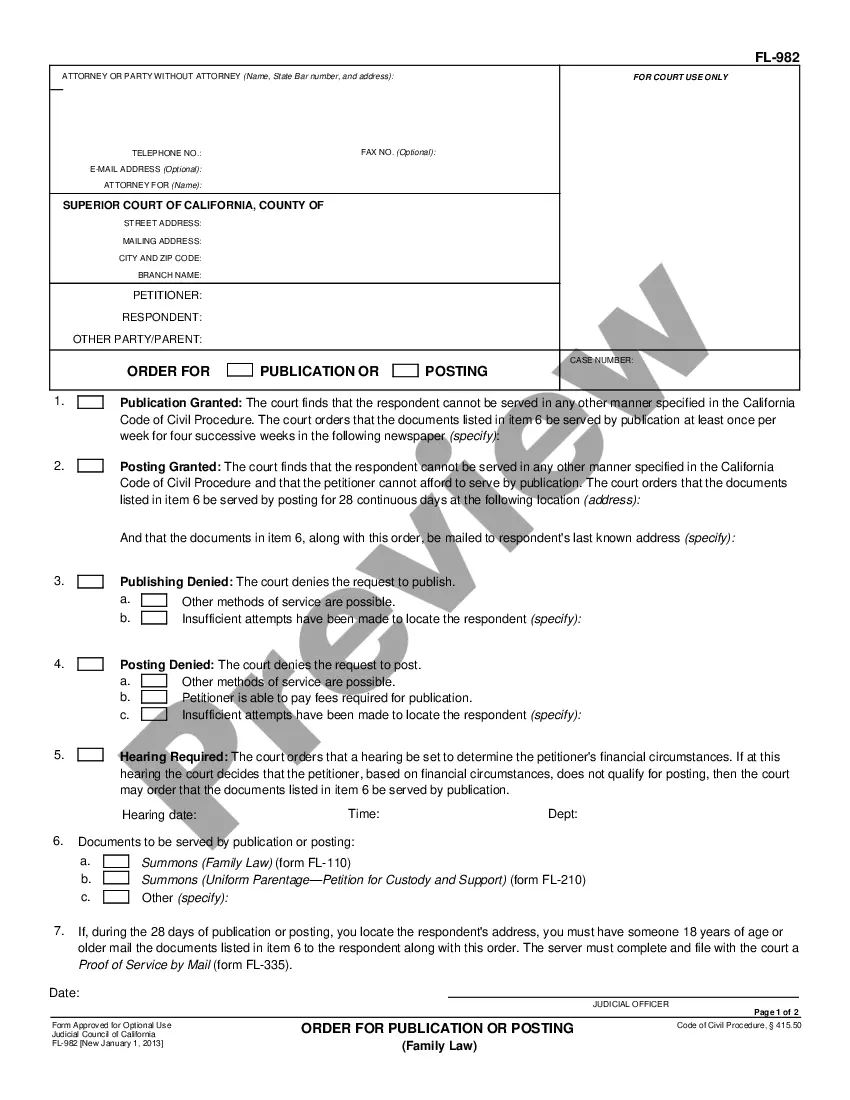

This is an Official form adopted by the California Judicial Council for use in California Courts.

Santa Maria, California is a city located in Santa Barbara County on the Central Coast of California. The city is known for its agricultural community, scenic beauty, and historic charm. Santa Maria offers a unique blend of suburban living, rural landscapes, and a thriving economy. When it comes to the legal forms related to domestic violence prevention in Santa Maria, California, two significant financial forms are typically used: FL-155 and FL-150. FL-155 is a financial form known as the "Income and Expense Declaration." This form is used to disclose a party's financial situation, including their income, expenses, assets, and debts. It provides insight into an individual's financial capabilities, helping the court determine appropriate spousal or child support amounts, if applicable in a domestic violence case. On the other hand, FL-150 is the financial form called the "Income and Expense Declaration for Wage Garnishment." This form serves a similar purpose to FL-155 but is specifically used for cases involving wage garnishment due to a domestic violence-related issue. It requires the party to provide detailed information about their income, expenses, and other financial obligations, all of which may impact the court's decision regarding wage garnishment. Both the FL-155 and FL-150 forms play a crucial role in domestic violence prevention cases in Santa Maria, California. They assist the court in understanding the financial circumstances of the parties involved, allowing for a fair and just resolution to be reached.