This form is a living trust form prepared for your state. It is for an individual who is either single, divorced or widowed with one or more children. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

Burbank California Living Trust for individual, Who is Single, Divorced or Widow (or Widower) with Children

Description

How to fill out California Living Trust For Individual, Who Is Single, Divorced Or Widow (or Widower) With Children?

If you are looking for a legitimate form template, it’s hard to find a superior service than the US Legal Forms website – one of the largest collections on the web.

Here you can discover a vast array of document samples for corporate and personal needs by categories and regions, or keywords.

With the enhanced search capability, locating the most current Burbank California Living Trust for individual, who is Single, Divorced or a Widow (or Widower) with Children is as simple as 1-2-3.

Obtain the form. Specify the format and download it onto your device.

Make edits. Complete, modify, print, and sign the acquired Burbank California Living Trust for individual, Who is Single, Divorced or a Widow (or Widower) with Children.

- If you are already familiar with our system and possess an account, all you need to obtain the Burbank California Living Trust for individual, who is Single, Divorced or a Widow (or Widower) with Children is to Log In to your user profile and click the Download option.

- If you are using US Legal Forms for the first time, just adhere to the instructions outlined below.

- Ensure you have opened the sample you require. Review its description and use the Preview feature to view its contents. If it doesn’t fulfill your requirements, employ the Search option at the top of the page to find the appropriate document.

- Confirm your choice. Click the Buy now button. After that, select your desired pricing plan and provide necessary information to create an account.

- Complete the payment process. Use your credit card or PayPal account to finalize the registration process.

Form popularity

FAQ

The major disadvantage of a family trust, particularly a Burbank California Living Trust for individuals who are single, divorced, or a widow (or widower) with children, is the impact it may have on qualifying for government benefits. If the trust holds significant assets, it might limit access to Medicaid or other aid. Additionally, misunderstandings about trust terms among family members can lead to disputes. It's crucial to plan appropriately and communicate clearly to avoid such issues.

A potential downfall of having a Burbank California Living Trust for individuals who are single, divorced, or a widow (or widower) with children is the possibility of ongoing administrative responsibilities. Trusts need regular updates to reflect changes in personal circumstances, such as the birth of a child or changes in assets. This continuous management can feel overwhelming for some. To navigate these complexities, consider utilizing platforms like US Legal Forms, which provide simple solutions for trust management.

Encouraging your parents to establish a Burbank California Living Trust could offer them financial security and peace of mind. A trust can simplify the transfer of assets to you and your siblings, preventing lengthy probate processes. Additionally, it can protect their estate from unnecessary taxes and legal hurdles. Ultimately, it's a conversation worth having, as a living trust can greatly benefit families with unique dynamics.

One drawback of a living trust in California is that it may require some upfront costs and time to set up compared to a basic will. For individuals in Burbank, California, who are single, divorced, or widowed with children, it is important to consider whether the benefits, like avoiding probate, outweigh these initial inconveniences. Additionally, while a living trust can protect your assets and provide for your children, you will need to maintain it as your life changes. To streamline this process, US Legal Forms provides resources that simplify the management of your living trust throughout your lifetime.

In California, a living trust does not need to be recorded to be valid; however, certain assets must be titled in the name of the trust. For individuals in Burbank, California, who are single, divorced, or widowed with children, a properly funded living trust can streamline the transfer of assets after your passing. It is essential to ensure that your assets, like real estate, are appropriately transferred to your trust for it to function correctly. If you seek guidance or assistance with the process, the US Legal Forms platform offers valuable resources and templates to help you establish your living trust.

Placing your house in a trust in California can lead to challenges such as loss of certain tax benefits and high costs for re-titling the property. Moreover, if the trust isn't properly managed, you may encounter complications regarding your estate and asset distribution. For those creating a Burbank California Living Trust for an individual who is single, divorced, or a widow (or widower) with children, consulting platforms like uslegalforms can offer valuable support to navigate these potential disadvantages effectively.

A notable downfall of a living trust is that it does not shield your assets from creditors or legal judgments during your lifetime. Additionally, some people mistakenly believe that having a trust means they no longer need a will, which can lead to complications if both documents do not align. As you consider a Burbank California Living Trust for an individual who is single, divorced, or a widow (or widower) with children, stay aware of these limitations and seek guidance to address them properly.

One of the biggest mistakes parents make when setting up a trust fund is not clearly defining their intentions or not fully communicating them to their children. This can lead to confusion and potential conflicts down the road, especially in a Burbank California Living Trust for an individual who is single, divorced, or a widow (or widower) with children. Be open with your family about your choices and ensure your trust reflects your values and goals.

Suze Orman emphasizes the importance of living trusts for ensuring your assets are distributed according to your wishes, especially for individuals like those in a Burbank California Living Trust, who are single, divorced, or widowed with children. She advocates that living trusts can help avoid probate, saving time and stress for your loved ones after your passing. Investing in a living trust provides peace of mind by clearly outlining your choices regarding asset management.

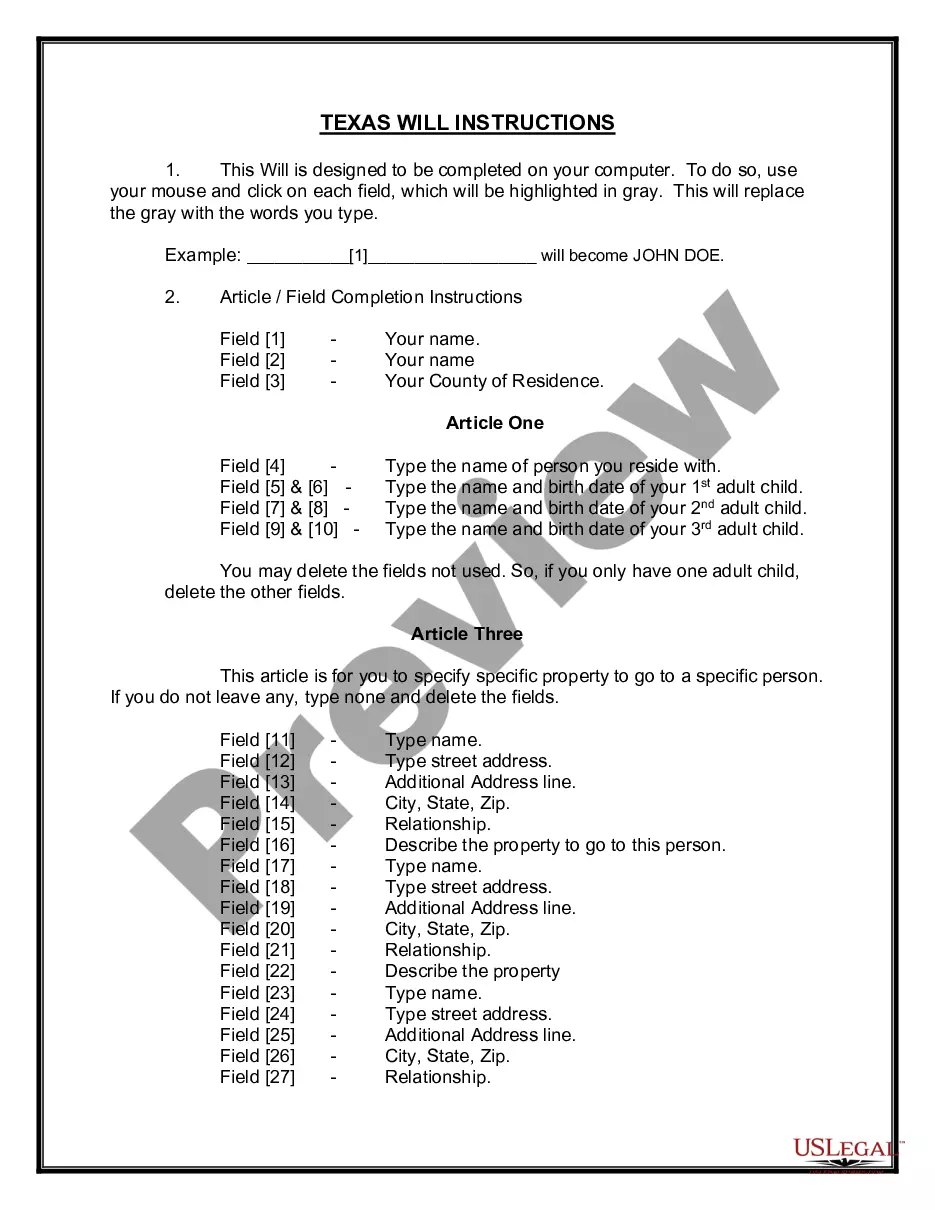

To set up a Burbank California Living Trust for an individual who is single, divorced, or a widow (or widower) with children, you'll need several key documents. First, prepare the trust deed that outlines your wishes. You will also need a list of your assets, including real estate and bank accounts, and any title documents for those assets. Finally, it's beneficial to have identification documents and any previously drafted wills on hand as you create your trust.