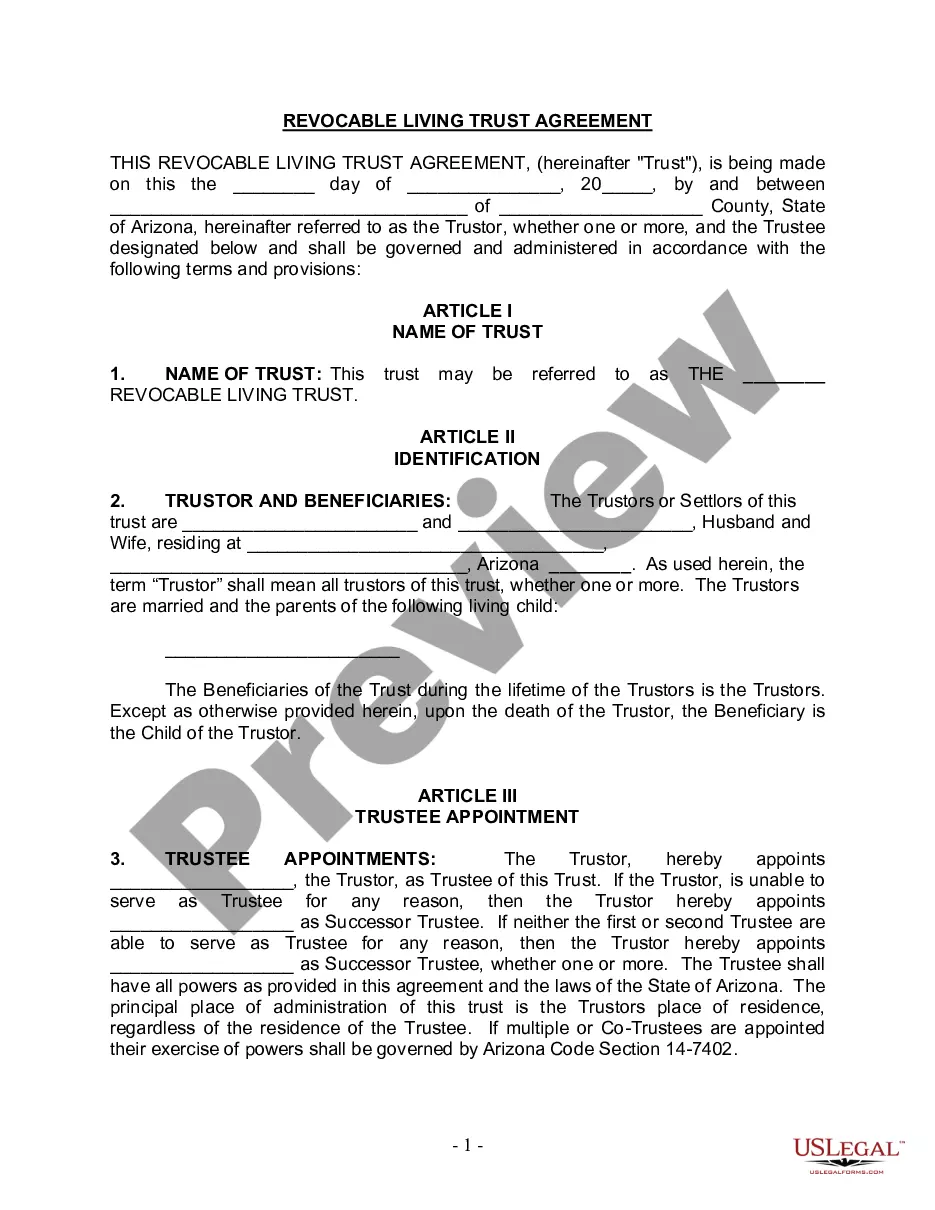

This form is a living trust form prepared for your state. It is for an individual who is either single, divorced or widowed with one or more children. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

Clovis California Living Trust is a legal document that provides individuals who are single, divorced, or widowed (or widowers) with children an effective estate planning tool to protect their assets during their lifetime and ensure their children's financial well-being after they pass away. The living trust allows individuals to have control over their assets, designate beneficiaries, and avoid the probate process. There are different types of Clovis California Living Trusts tailored to suit the unique circumstances of single individuals, divorced individuals, and widows/widowers with children. These variations have specific considerations and provisions that cater to the specific needs of each situation. Some notable types include: 1. Single Individual Living Trust: This type of trust is established by a single person who is not married and has children. It allows the individual to name their children as beneficiaries and outline how their assets should be distributed to them upon their passing. 2. Divorced Individual Living Trust: Divorce brings its own set of complex issues when it comes to estate planning. This type of trust allows a divorced individual with children to plan for the guardianship of their minor children, designate who will manage their assets on behalf of their children, and specify how and when their children will inherit their assets. 3. Widow/Widower with Children Living Trust: After the loss of a spouse, it is crucial for a widowed individual with children to create a living trust to ensure the smooth transition of their assets to their children. This type of trust allows them to provide for their children's immediate and long-term financial needs, establish guardianship for minor children, and outline how their assets should be distributed to their children or other beneficiaries. These specialized types of Clovis California Living Trusts provide the necessary legal framework to protect the interests of single individuals, divorced individuals, and widows/widowers with children. By customizing the trust to reflect their specific circumstances, individuals can ensure that their assets are safeguarded, their wishes are honored, and their children's financial future is secure. It is advisable to consult with an experienced estate planning attorney to determine the most suitable type of living trust based on individual circumstances and legal requirements.Clovis California Living Trust is a legal document that provides individuals who are single, divorced, or widowed (or widowers) with children an effective estate planning tool to protect their assets during their lifetime and ensure their children's financial well-being after they pass away. The living trust allows individuals to have control over their assets, designate beneficiaries, and avoid the probate process. There are different types of Clovis California Living Trusts tailored to suit the unique circumstances of single individuals, divorced individuals, and widows/widowers with children. These variations have specific considerations and provisions that cater to the specific needs of each situation. Some notable types include: 1. Single Individual Living Trust: This type of trust is established by a single person who is not married and has children. It allows the individual to name their children as beneficiaries and outline how their assets should be distributed to them upon their passing. 2. Divorced Individual Living Trust: Divorce brings its own set of complex issues when it comes to estate planning. This type of trust allows a divorced individual with children to plan for the guardianship of their minor children, designate who will manage their assets on behalf of their children, and specify how and when their children will inherit their assets. 3. Widow/Widower with Children Living Trust: After the loss of a spouse, it is crucial for a widowed individual with children to create a living trust to ensure the smooth transition of their assets to their children. This type of trust allows them to provide for their children's immediate and long-term financial needs, establish guardianship for minor children, and outline how their assets should be distributed to their children or other beneficiaries. These specialized types of Clovis California Living Trusts provide the necessary legal framework to protect the interests of single individuals, divorced individuals, and widows/widowers with children. By customizing the trust to reflect their specific circumstances, individuals can ensure that their assets are safeguarded, their wishes are honored, and their children's financial future is secure. It is advisable to consult with an experienced estate planning attorney to determine the most suitable type of living trust based on individual circumstances and legal requirements.