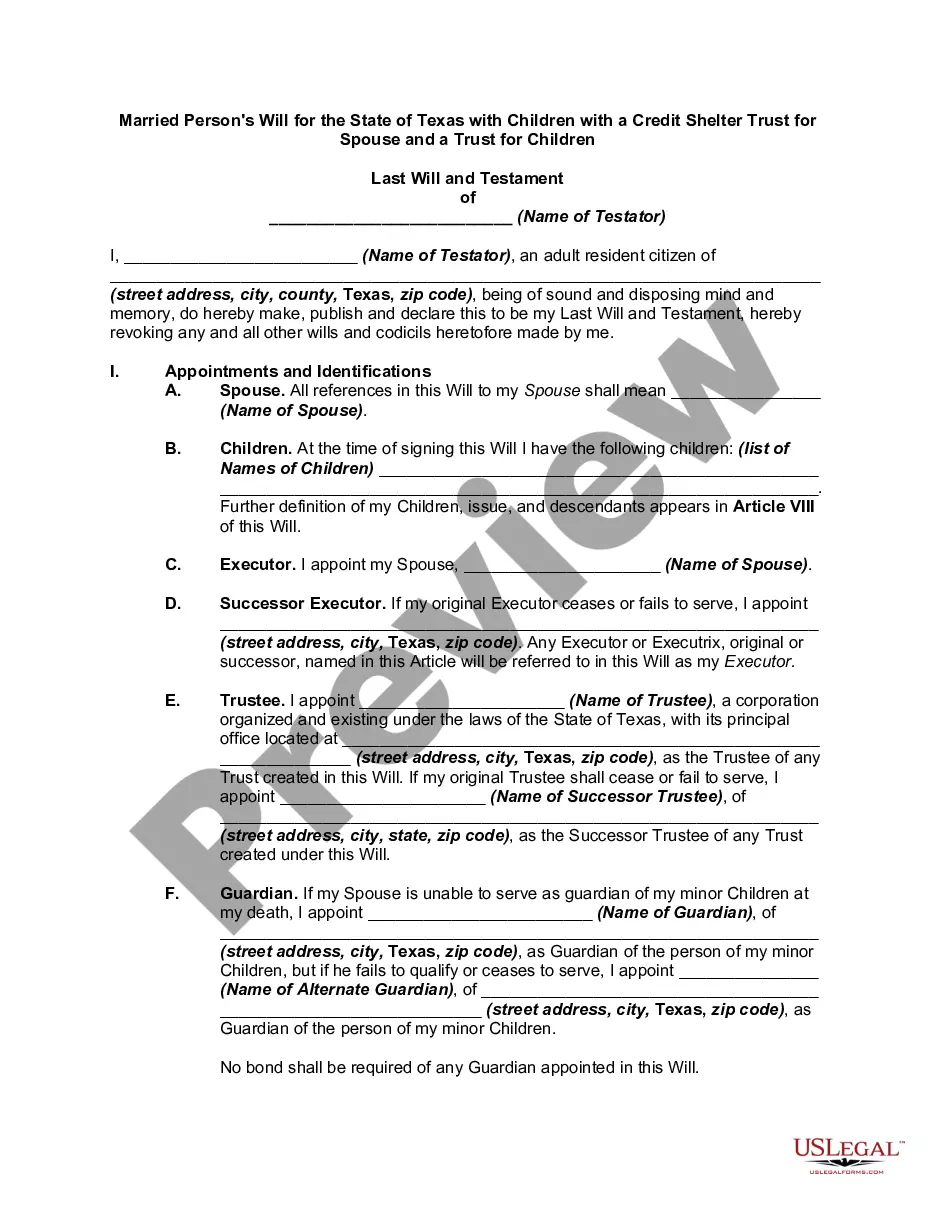

This form is a living trust form prepared for your state. It is for a Husband and Wife with one child. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

Los Angeles California Living Trust for Husband and Wife with One Child

Description

How to fill out California Living Trust For Husband And Wife With One Child?

If you have previously utilized our service, sign in to your account and save the Los Angeles California Living Trust for Husband and Wife with One Child to your device by clicking the Download button. Ensure your subscription is active. If not, renew it according to your payment plan.

In case this is your initial encounter with our service, follow these straightforward steps to acquire your document.

You have lifelong access to all documents you have bought: you can locate them in your profile under the My documents menu whenever you need to retrieve them. Utilize the US Legal Forms service to efficiently discover and save any template for your personal or business requirements!

- Verify you’ve found an appropriate document. Review the description and use the Preview option, if accessible, to ascertain if it aligns with your needs. If it’s unsuitable, use the Search tab above to find the correct one.

- Buy the template. Click the Buy Now button and select a monthly or yearly subscription plan.

- Create an account and submit payment. Use your credit card information or the PayPal option to finalize the purchase.

- Receive your Los Angeles California Living Trust for Husband and Wife with One Child. Select the file format for your document and save it on your device.

- Fill out your template. Print it or utilize professional online editors to complete it and sign it electronically.

Form popularity

FAQ

While some married couples opt for separate living trusts, a joint living trust usually offers greater advantages for most families. With a joint trust, both spouses share control and simplify the management of assets. Consider a Los Angeles California Living Trust for Husband and Wife with One Child to streamline your estate planning, ensuring that both partners are actively involved in caring for your child's future. Ultimately, the choice should align with your family's unique needs.

For married couples, a revocable living trust is typically appropriate and can be tailored to meet specific needs. This type of trust allows couples to retain control over their assets and make changes as necessary throughout their lives. When considering a Los Angeles California Living Trust for Husband and Wife with One Child, think about how it can facilitate asset management and ensure provisions for your child’s future.

One downside of a living trust is that it may incur initial setup costs that can be higher than traditional wills. Additionally, if you do not fund the trust properly, it could lead to complications during probate. However, the peace of mind from having a well-structured Los Angeles California Living Trust for Husband and Wife with One Child often outweighs these concerns. Understanding the potential pitfalls allows you to prepare effectively.

The best Living Trust for a married couple often balances simplicity and flexibility. For a husband and wife with one child, a joint revocable living trust is typically ideal. This trust allows both spouses to manage their assets together while providing for their child. Ultimately, choosing the right Los Angeles California Living Trust for Husband and Wife with One Child empowers you to control your family’s future.

A common mistake parents make when setting up a trust fund is failing to properly fund the trust. Many assume that simply creating a trust is enough, but without transferring assets into it, the trust will not function as intended. When establishing a Los Angeles California Living Trust for Husband and Wife with One Child, ensure that all relevant assets are included to avoid complications later.

Yes, you can write your own living trust in California. However, it’s essential to follow the legal requirements to ensure its validity. Using a platform like uslegalforms can help you craft a reliable and compliant Los Angeles California Living Trust for Husband and Wife with One Child, simplifying the process while providing peace of mind.

For a married couple, a revocable living trust is often considered the best type of trust. This allows for easy management of assets during the couple's lifetime and can smoothly transition those assets after death. If you're setting up a Los Angeles California Living Trust for Husband and Wife with One Child, this type of trust offers flexibility and control, ensuring assets are distributed according to your wishes.

A handwritten living trust can be legal in California, provided it meets specific legal requirements. However, it’s essential that it clearly indicates your intentions for the Los Angeles California Living Trust for Husband and Wife with One Child, and that all necessary formalities are observed. We recommend utilizing resources like uslegalforms to avoid potential pitfalls that could arise from a handwritten document.

Yes, you can create your own living trust in California. Many people choose to establish a Los Angeles California Living Trust for Husband and Wife with One Child to manage their assets effectively. However, it's crucial to ensure that your trust document complies with California laws, so you might want to consider using platforms like uslegalforms to simplify this process.

In California, co-trustees generally must act together when making decisions regarding trust management unless the trust document specifies otherwise. This means that if you create a Los Angeles California Living Trust for Husband and Wife with One Child, both parties need to agree on important matters. As a result, having clear communication between co-trustees is essential to avoid conflict and ensure effective management of the trust.