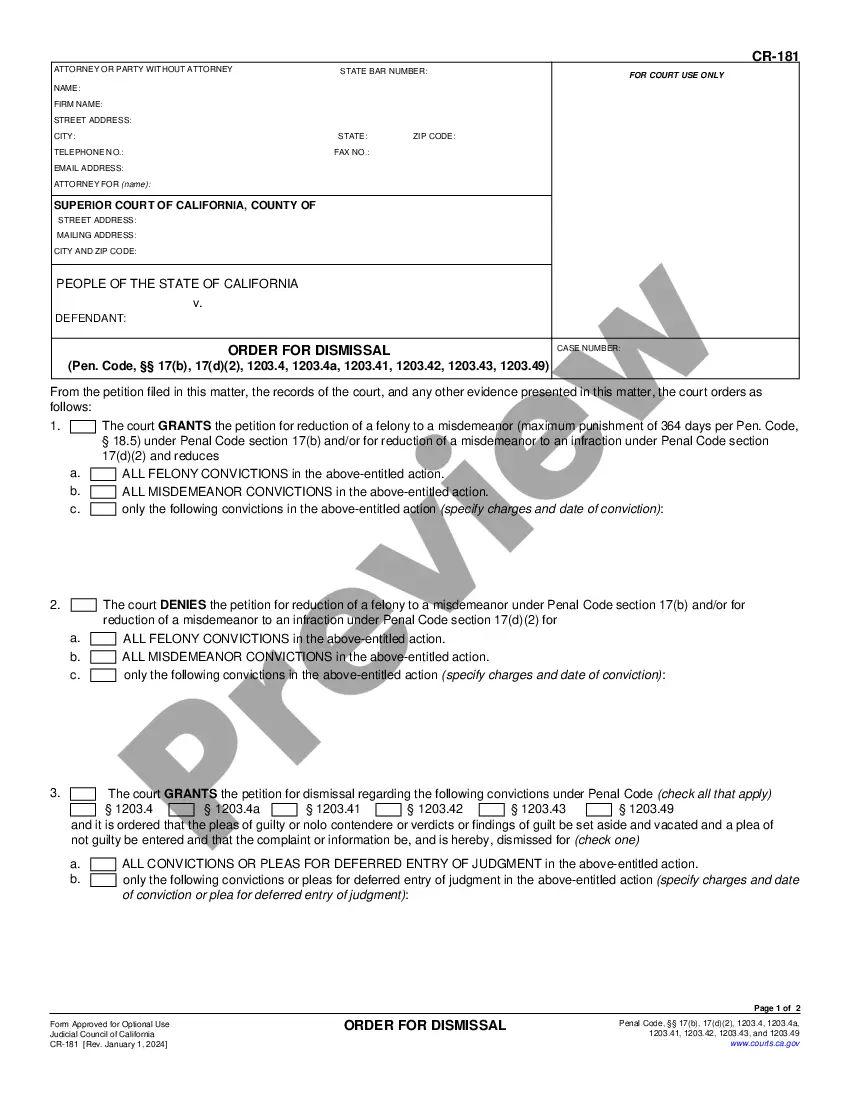

The Rialto California Amendment to Living Trust is a legal document that allows individuals to make changes or updates to an existing living trust. This amendment is specifically designed for residents of Rialto, California, ensuring compliance with the relevant laws and regulations of the state. A living trust is a legal document that enables individuals to transfer their assets, such as real estate, bank accounts, or investments, into a trust during their lifetime. The trust serves as a vehicle for managing and distributing these assets upon the individual's death, avoiding probate and providing privacy for beneficiaries. The Rialto California Amendment to Living Trust is crucial for individuals who already have a living trust in place and need to modify certain provisions or add new instructions. It allows flexibility in addressing changes such as modifications to beneficiaries, assets included in the trust, or the appointment of different trustees. There may be different types of Rialto California Amendments to Living Trust, each catering to specific needs or circumstances. Some common variants include: 1. Beneficiary Amendment: This type of amendment allows individuals to add or remove beneficiaries listed in their living trust. It accommodates changes due to births, deaths, marriages, divorces, or any change in personal circumstances. 2. Asset Amendment: This amendment provides the opportunity to include or exclude specific assets from the living trust. Individuals may acquire new assets or sell existing ones, necessitating an update to ensure proper inclusion or removal of these assets. 3. Trustee Amendment: In the event of a change in the designated trustee (the person responsible for managing the trust), this amendment allows individuals to appoint a new trustee or remove an existing one. 4. Instruction Amendment: This type of amendment allows individuals to modify the instructions or terms of the living trust. It may encompass changes to the distribution of assets, setting up charitable donations, or establishing provisions for special needs beneficiaries. 5. Administrative Amendment: This amendment primarily deals with minor administrative changes, such as updating contact information for the trustee, successor trustees, or beneficiaries. By utilizing the Rialto California Amendment to Living Trust, individuals can ensure that their living trust accurately reflects their current wishes and circumstances. It provides peace of mind knowing that their assets and beneficiaries are well protected and in line with their intentions. Consulting with an attorney knowledgeable in estate planning and California laws is highly recommended drafting a legally valid amendment and ensure comprehensive coverage of any modifications.

Rialto California Amendment to Living Trust

Description

How to fill out Rialto California Amendment To Living Trust?

If you are searching for a valid form, it’s difficult to find a more convenient service than the US Legal Forms site – probably the most comprehensive online libraries. With this library, you can find a large number of document samples for company and individual purposes by categories and regions, or keywords. With the high-quality search function, discovering the latest Rialto California Amendment to Living Trust is as easy as 1-2-3. Furthermore, the relevance of each record is proved by a team of expert lawyers that on a regular basis check the templates on our platform and revise them according to the most recent state and county requirements.

If you already know about our platform and have a registered account, all you should do to receive the Rialto California Amendment to Living Trust is to log in to your profile and click the Download option.

If you utilize US Legal Forms for the first time, just follow the guidelines listed below:

- Make sure you have discovered the sample you need. Read its explanation and use the Preview function to explore its content. If it doesn’t suit your needs, use the Search field near the top of the screen to discover the proper document.

- Confirm your selection. Select the Buy now option. Following that, choose the preferred pricing plan and provide credentials to register an account.

- Make the transaction. Utilize your bank card or PayPal account to complete the registration procedure.

- Obtain the form. Pick the format and download it on your device.

- Make changes. Fill out, edit, print, and sign the obtained Rialto California Amendment to Living Trust.

Every form you save in your profile has no expiration date and is yours permanently. You always have the ability to gain access to them using the My Forms menu, so if you want to receive an extra version for modifying or creating a hard copy, you can come back and save it once more at any moment.

Take advantage of the US Legal Forms extensive library to gain access to the Rialto California Amendment to Living Trust you were seeking and a large number of other professional and state-specific templates on a single website!