Hayward California Financial Account Transfer to Living Trust

Description

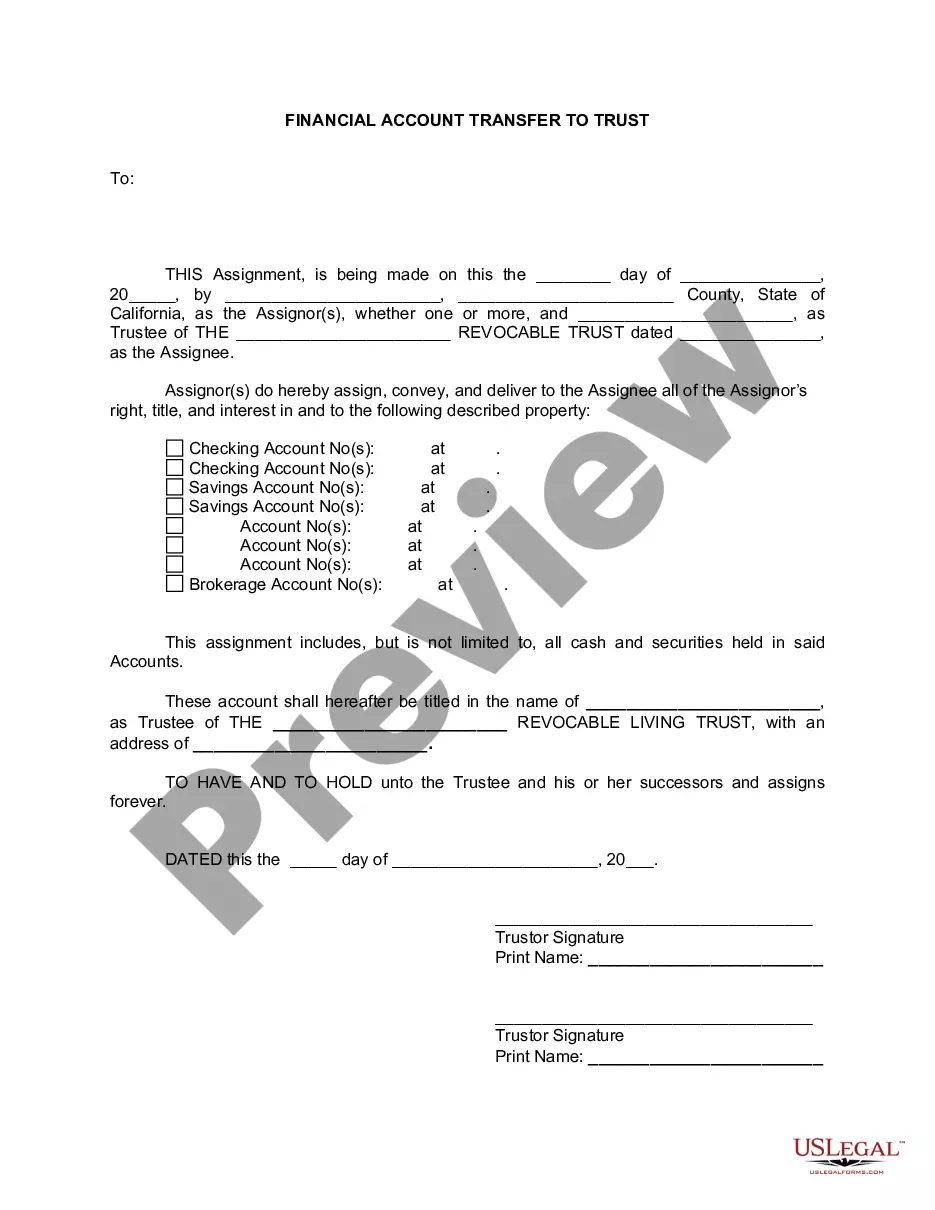

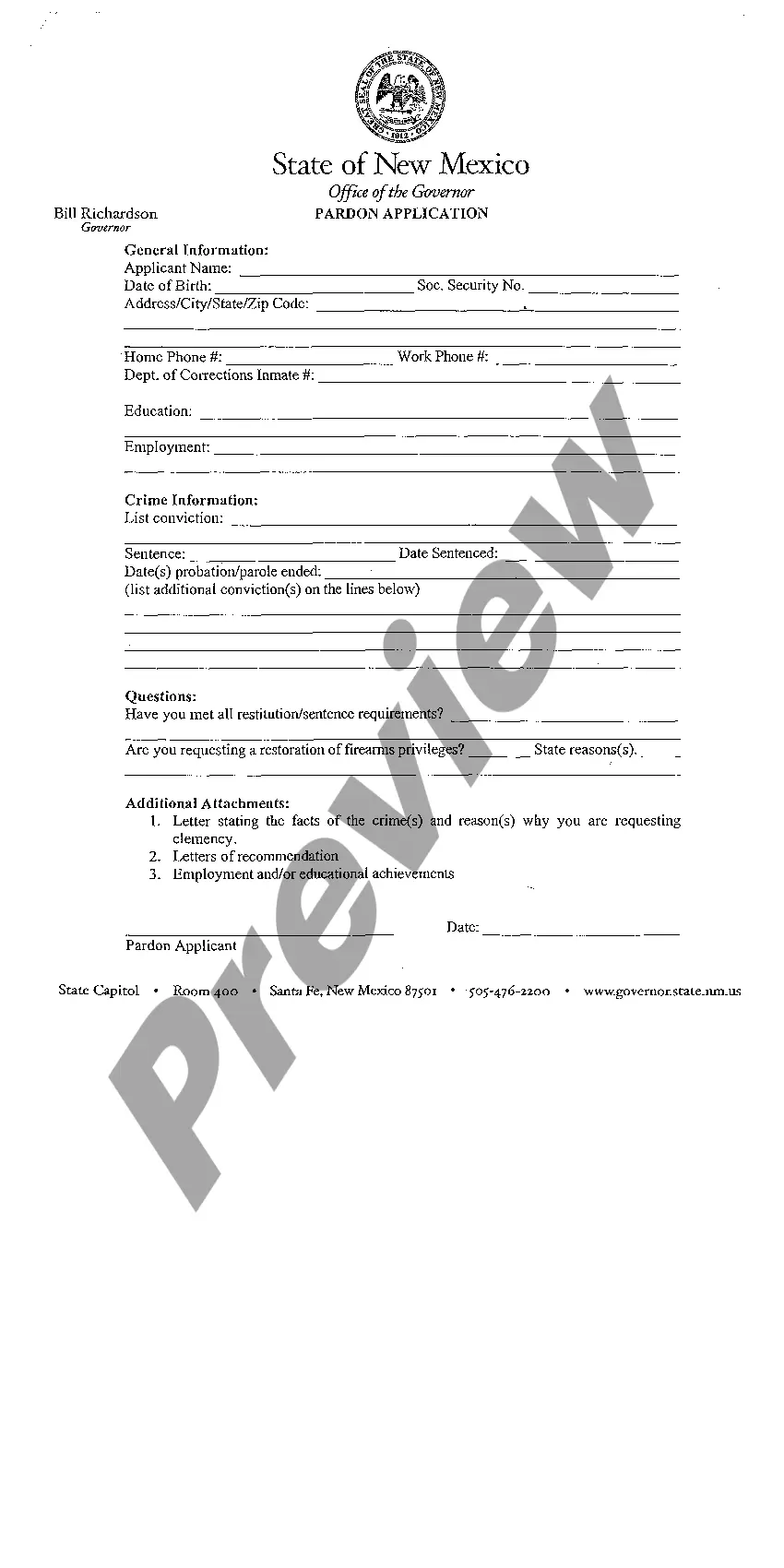

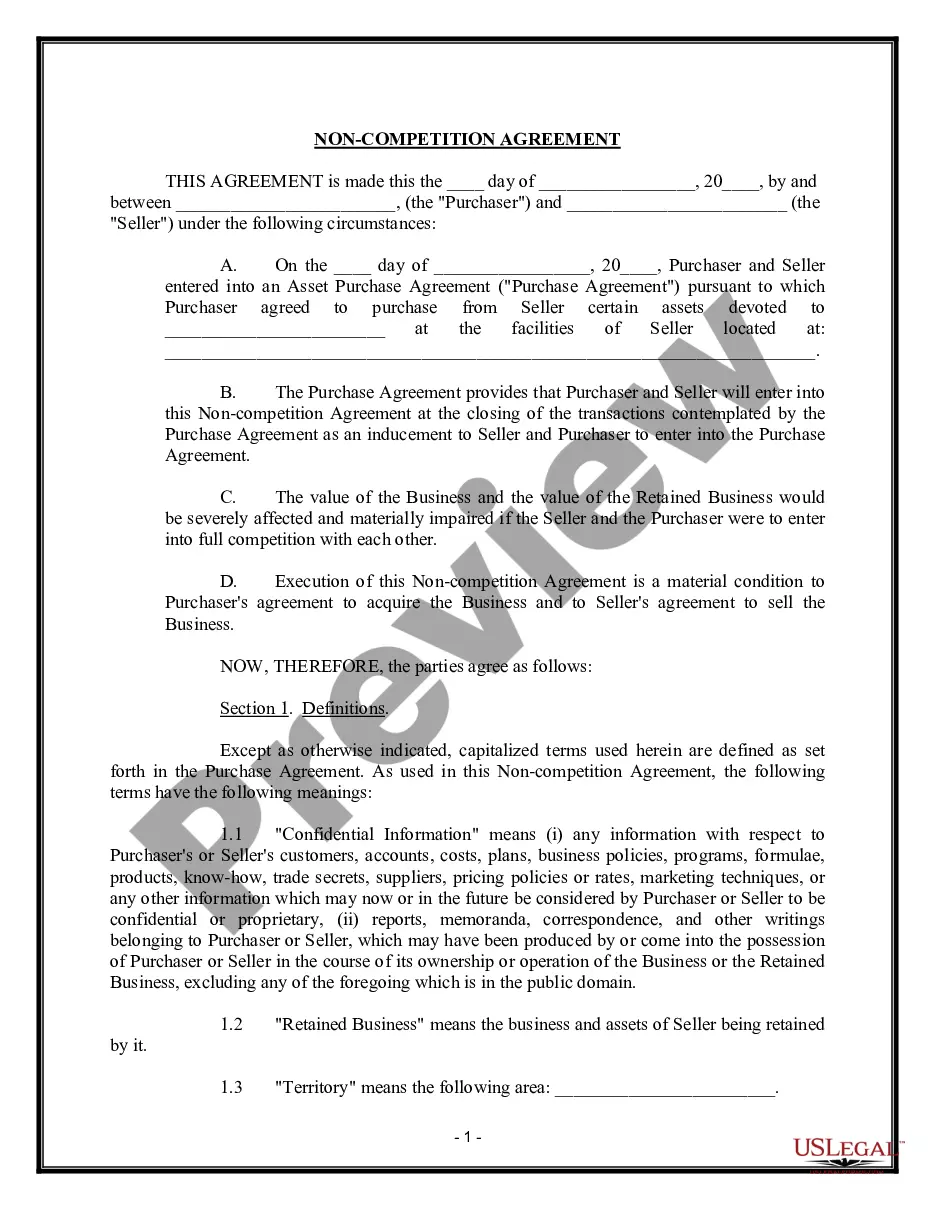

How to fill out California Financial Account Transfer To Living Trust?

Obtaining validated templates tailored to your regional regulations can be difficult unless you utilize the US Legal Forms library.

It’s an online repository of over 85,000 legal documents for both personal and professional requirements and various real-world scenarios.

All the forms are correctly categorized by field of use and jurisdiction, making it as quick and simple as ABC to find the Hayward California Financial Account Transfer to Living Trust.

Maintaining paperwork organized and compliant with legal standards is crucial. Leverage the US Legal Forms library to always have vital document templates readily available for any needs!

- Review the Preview mode and document description.

- Ensure you’ve selected the appropriate one that satisfies your needs and fully aligns with your local jurisdiction criteria.

- Search for an alternative template, if required.

- If you notice any discrepancies, use the Search tab above to locate the correct one. If it meets your criteria, proceed to the next step.

- Purchase the document. Click on the Buy Now button and choose the subscription plan that you prefer.

Form popularity

FAQ

The best way to transfer property title between family members is often through a formal deed, like a quitclaim deed or a grant deed. This method allows for clear documentation of the transfer, reducing potential disputes later. When considering your options, think about how this transfer fits within your broader estate planning, including your Hayward California Financial Account Transfer to Living Trust, to ensure everything aligns with your future intentions.

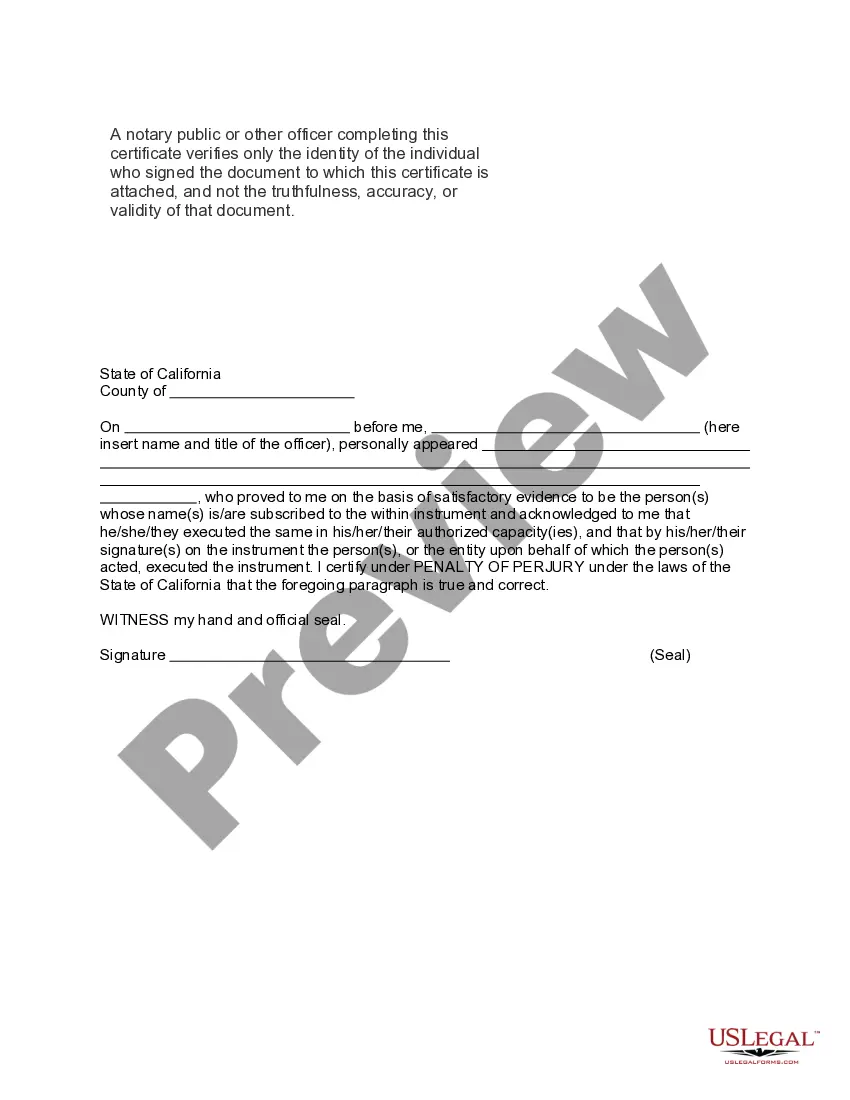

In California, transferring property to a living trust generally does not trigger property tax reassessment if structured correctly. The trust must be revocable and you should remain the trustee to maintain control over the property. By ensuring your transfer aligns with California's regulations, you can successfully manage your Hayward California Financial Account Transfer to Living Trust while avoiding additional property tax burdens.

To transfer your bank account to a living trust, you'll need to contact your bank and inform them of your intent. Typically, you will be required to fill out a form or provide documentation that establishes the trust and your role as the trustee. This process ensures that your Hayward California Financial Account Transfer to Living Trust is properly executed and that your assets are managed according to your wishes once you pass away.

Putting your house in a trust in California can have some disadvantages. You may face upfront fees for creating the trust, which include legal costs and possible ongoing administrative expenses. Additionally, transferring your property into the trust could involve title transfer paperwork, and it may also limit your control since you will be designating a trustee to manage the property. It's essential to weigh these factors in the context of your Hayward California Financial Account Transfer to Living Trust.

Deciding if your parents should put their assets in a trust can be beneficial, especially for estate planning. By doing so, they can streamline the Hayward California Financial Account Transfer to Living Trust and protect their assets from probate. It's important to consider their specific financial situation and goals. Consulting a professional can provide personalized guidance on the advantages of setting up a trust.

Trust funds may create unintended complications regarding beneficiary control and expectations. This issue can cause friction among heirs, especially during the Hayward California Financial Account Transfer to Living Trust. Furthermore, trust funds are often subject to taxation, sometimes leading to reduced value for the beneficiaries. It's crucial to navigate these concerns effectively to maintain family harmony.

When setting up a trust, one common pitfall is failing to fund it properly. If your assets aren’t transferred during the Hayward California Financial Account Transfer to Living Trust, it may defeat its purpose. Moreover, overlooking tax implications or missing necessary documentation can lead to future complications. Understanding these factors is vital to ensure effective management of your trust.

One downside of establishing a family trust involves the initial costs and time associated with setting it up. You might face legal fees and administrative tasks during the Hayward California Financial Account Transfer to Living Trust. Additionally, maintain security and access to assets can become complicated if not clearly defined. Navigating these intricacies is essential for a smooth transition.

One major mistake parents often make when setting up a trust fund is failing to fully fund the trust. If assets are not properly transferred into the trust, it may not serve its intended purpose. It's crucial to understand the Hayward California Financial Account Transfer to Living Trust process to ensure all assets are included, providing security for your beneficiaries.

To transfer your checking account to a trust, you need to talk to your bank representative about the process. They will guide you through filling out the required forms, which typically include required identification and trust documentation. US Legal Forms can assist by offering resources that simplify the Hayward California Financial Account Transfer to Living Trust journey.