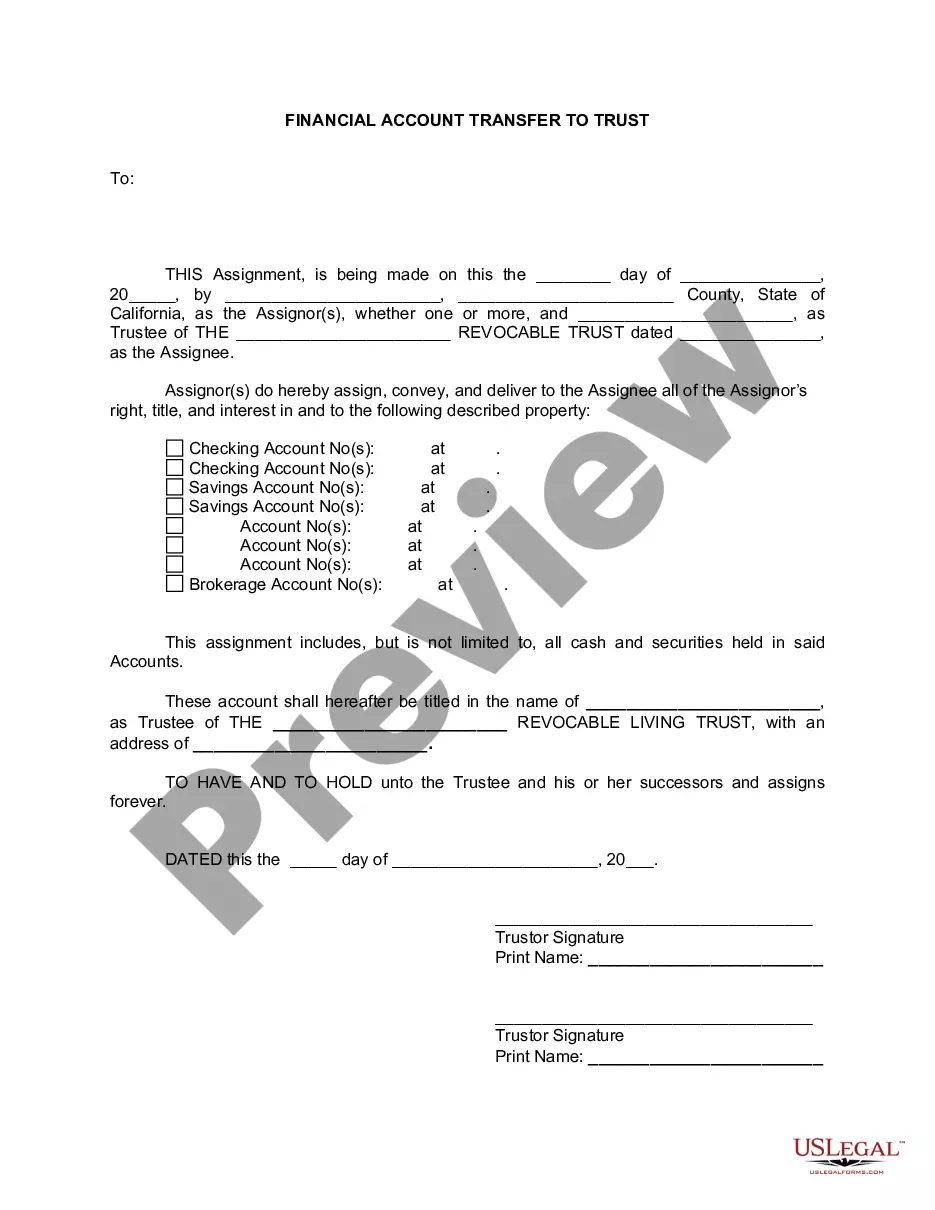

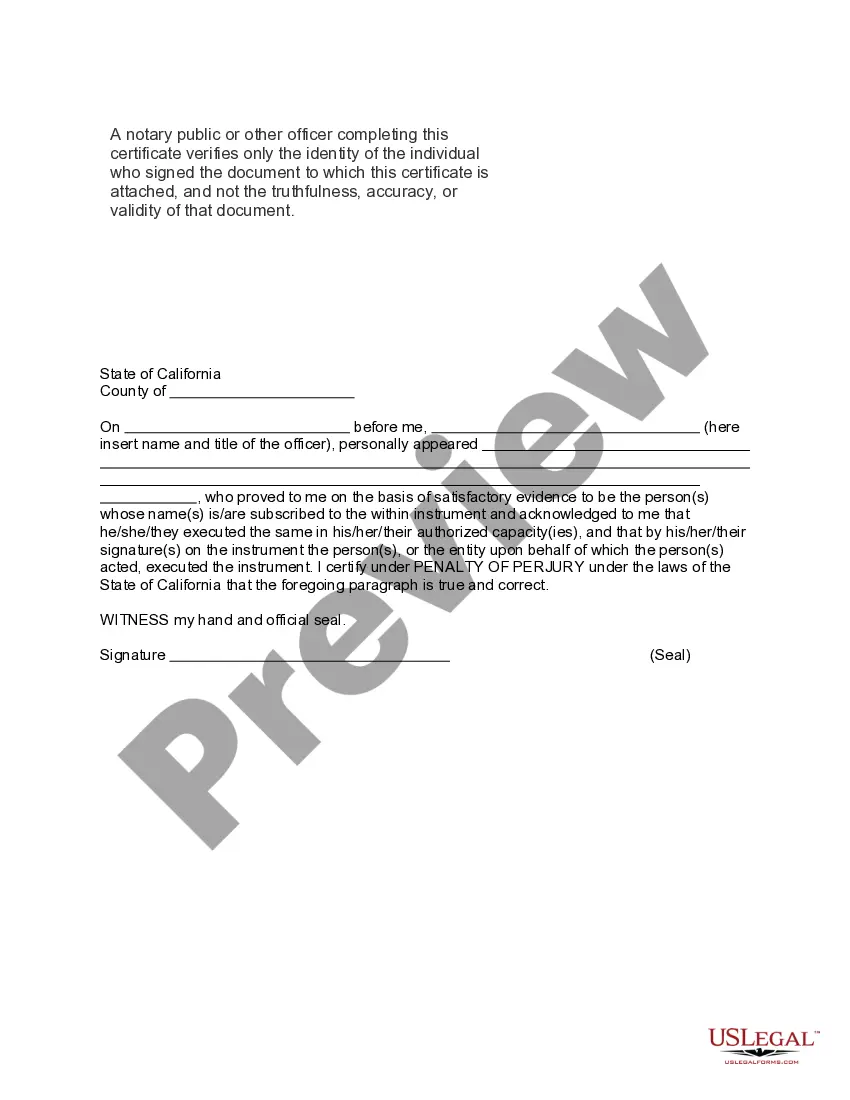

Norwalk California Financial Account Transfer to Living Trust: A Comprehensive Guide Keywords: Norwalk California, financial account transfer, living trust, estate planning, probate, beneficiary, asset protection Introduction: In Norwalk, California, financial account transfer to a living trust is a crucial part of comprehensive estate planning. By establishing a living trust, individuals can ensure the smooth transfer of their financial accounts, avoiding probate and providing asset protection for beneficiaries. This article provides detailed insights into the process, its benefits, and various types of Norwalk California financial account transfers to living trusts. 1. Living Trust and its Importance: A living trust serves as a legal document that allows individuals (granters) to transfer their financial accounts and other assets to a trust for the benefit of themselves and their designated beneficiaries. The trust becomes effective while the granter is alive, and upon their death, the trust assets are transferred to the beneficiaries without going through probate court. 2. Benefits of Financial Account Transfer to a Living Trust: 2.1. Avoiding Probate: A crucial advantage of a living trust is that it bypasses the lengthy and costly probate process. This means that financial accounts held within the trust can be transferred directly to beneficiaries, ensuring a smooth and efficient transfer of assets. 2.2. Privacy: Unlike probate proceedings, living trusts are private, ensuring that the details of the financial accounts and beneficiaries' identities remain confidential. 2.3. Asset Protection: By transferring financial accounts to a living trust, individuals can protect their assets from potential creditors and lawsuits, providing added security for their beneficiaries' inheritance. 3. Types of Norwalk California Financial Account Transfers to Living Trusts: 3.1. Bank Account Transfers: These include savings accounts, checking accounts, money markets, certificates of deposit (CDs), and any other financial accounts held within a bank or credit union. 3.2. Investment Account Transfers: This type entails transferring stocks, bonds, mutual funds, retirement accounts (such as IRAs or 401(k)s), and other investment assets into the living trust. 3.3. Real Estate Transfers: While not a financial account per se, individuals often include real estate property within their living trusts, ensuring seamless transfer of ownership to beneficiaries upon the granter's passing. 3.4. Business Account Transfers: For entrepreneurs or business owners, transferring company accounts, shares, or partnerships into the living trust can help maintain continuity and ensure the smooth transition of business assets to beneficiaries. Conclusion: Norwalk California financial account transfer to a living trust is an essential step for individuals seeking to protect their assets, provide for their loved ones, and avoid the probate process. By opting for a living trust, individuals can maintain privacy, protect assets, and ensure the efficient transfer of their financial accounts to designated beneficiaries. Whether it's bank accounts, investments, real estate, or business assets, a living trust offers a comprehensive solution for lifelong financial planning in Norwalk, California.

Norwalk California Financial Account Transfer to Living Trust

Description

How to fill out Norwalk California Financial Account Transfer To Living Trust?

Take advantage of the US Legal Forms and have instant access to any form template you want. Our useful platform with thousands of documents allows you to find and obtain virtually any document sample you will need. You can save, complete, and certify the Norwalk California Financial Account Transfer to Living Trust in just a few minutes instead of browsing the web for hours trying to find a proper template.

Using our catalog is a wonderful way to increase the safety of your document submissions. Our experienced lawyers regularly check all the documents to make certain that the templates are relevant for a particular region and compliant with new laws and regulations.

How do you get the Norwalk California Financial Account Transfer to Living Trust? If you already have a subscription, just log in to the account. The Download option will be enabled on all the samples you look at. Additionally, you can find all the earlier saved records in the My Forms menu.

If you haven’t registered an account yet, stick to the tips listed below:

- Open the page with the form you need. Ensure that it is the template you were hoping to find: verify its headline and description, and take take advantage of the Preview function when it is available. Otherwise, use the Search field to find the needed one.

- Start the saving procedure. Click Buy Now and select the pricing plan that suits you best. Then, sign up for an account and pay for your order with a credit card or PayPal.

- Save the document. Indicate the format to obtain the Norwalk California Financial Account Transfer to Living Trust and modify and complete, or sign it for your needs.

US Legal Forms is probably the most extensive and trustworthy form libraries on the web. We are always happy to help you in virtually any legal process, even if it is just downloading the Norwalk California Financial Account Transfer to Living Trust.

Feel free to benefit from our service and make your document experience as straightforward as possible!