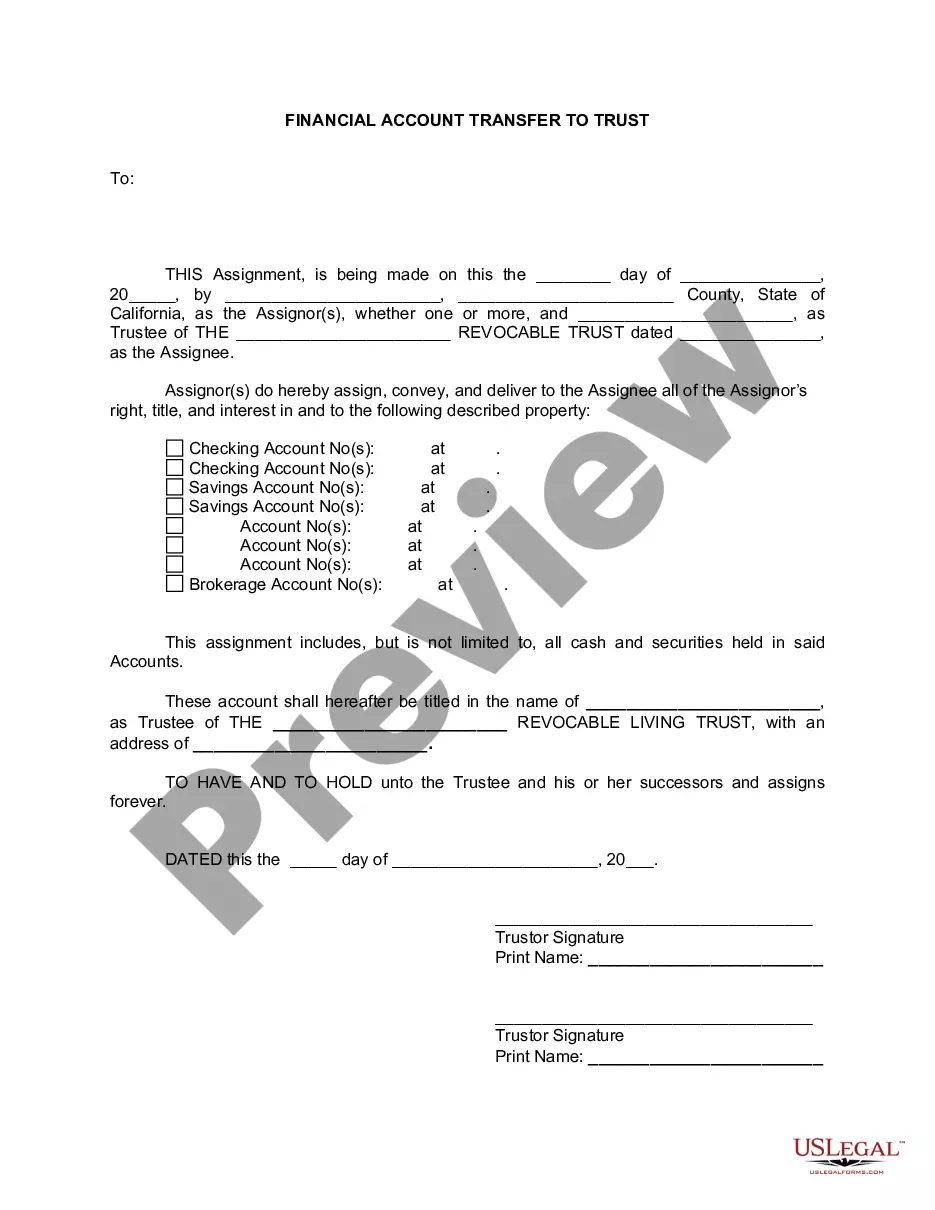

Palmdale California Financial Account Transfer to Living Trust: A Comprehensive Guide In Palmdale, California, transferring financial accounts to living trusts has become an increasingly vital aspect of estate planning. By understanding the intricacies of this process, residents can ensure a seamless transition of their financial assets to their chosen beneficiaries while minimizing legal complexities and avoiding probate. What is a Living Trust? A living trust, also known as a revocable trust, is a legal document that allows individuals (known as granters or settlers) to transfer their assets into a trust during their lifetime. It provides clear instructions regarding the distribution of these assets to their beneficiaries, known as trustees, after their passing. Unlike a will, a living trust can bypass probate, resulting in faster and more private asset distribution. Types of Palmdale California Financial Account Transfers to Living Trust: 1. Bank Accounts: — Checking Accounts: This involves transferring the granter's checking account into a living trust, which allows the successor trustee to access funds for managing daily expenses and settling financial obligations. — Savings Accounts: Similar to checking accounts, savings accounts can be transferred to a living trust to maintain liquidity and easily manage funds. — Money Market Accounts: These accounts typically offer higher interest rates, and transferring them into a living trust ensures the efficient handling of investment gains and dividends. 2. Investment Accounts: — Stocks and Bonds: By transferring stocks and bonds to a living trust, the trust or ensures a seamless transition of investment holdings to their beneficiaries, along with any accrued earnings. — Mutual Funds: Mutual fund accounts can be transferred to a living trust, enabling the successor trustee to manage and update the investment portfolio according to the trust's guidelines. — Retirement Accounts: While retirement accounts like IRAs and 401(k)s typically have designated beneficiaries, it is advisable to discuss with a financial advisor whether it makes sense to include them in the living trust for better control and convenience. 3. Real Estate: — Residential Properties: By transferring their primary residence or secondary homes into a living trust, homeowners in Palmdale can prevent their properties from undergoing probate and ensure a smooth transition of ownership to their chosen beneficiaries. — Rental Properties: Investors who own rental properties can transfer them into a living trust, allowing the successor trustee to manage rental income, property maintenance, and other aspects related to real estate management. 4. Additional Financial Assets: — Business Interests: If thgranteror owns a business, its shares or ownership interest can be transferred to the living trust, ensuring a smooth transition of control and decision-making authority. — Intellectual Property: Creators of intellectual property, such as patents, copyrights, or trademarks, can transfer these assets into a living trust, ensuring their continued management and benefit by the trust beneficiaries. — Debt Instruments: Loans, promissory notes, or other debt instruments held by the granter can be transferred into a living trust, streamlining the repayment process and allowing for better debt management by the successor trustee. In conclusion, a Palmdale California Financial Account Transfer to Living Trust involves the efficient and strategic transfer of various financial accounts and assets into a living trust, thereby facilitating easier management and seamless distribution of assets to beneficiaries while avoiding probate. It is crucial to consult with licensed professionals, such as estate planning attorneys and financial advisors, to navigate this process successfully and customize it according to specific needs and circumstances.

Palmdale California Financial Account Transfer to Living Trust

Description

How to fill out Palmdale California Financial Account Transfer To Living Trust?

Benefit from the US Legal Forms and get immediate access to any form template you require. Our useful website with a large number of templates makes it simple to find and obtain virtually any document sample you will need. It is possible to save, fill, and sign the Palmdale California Financial Account Transfer to Living Trust in a few minutes instead of surfing the Net for several hours looking for a proper template.

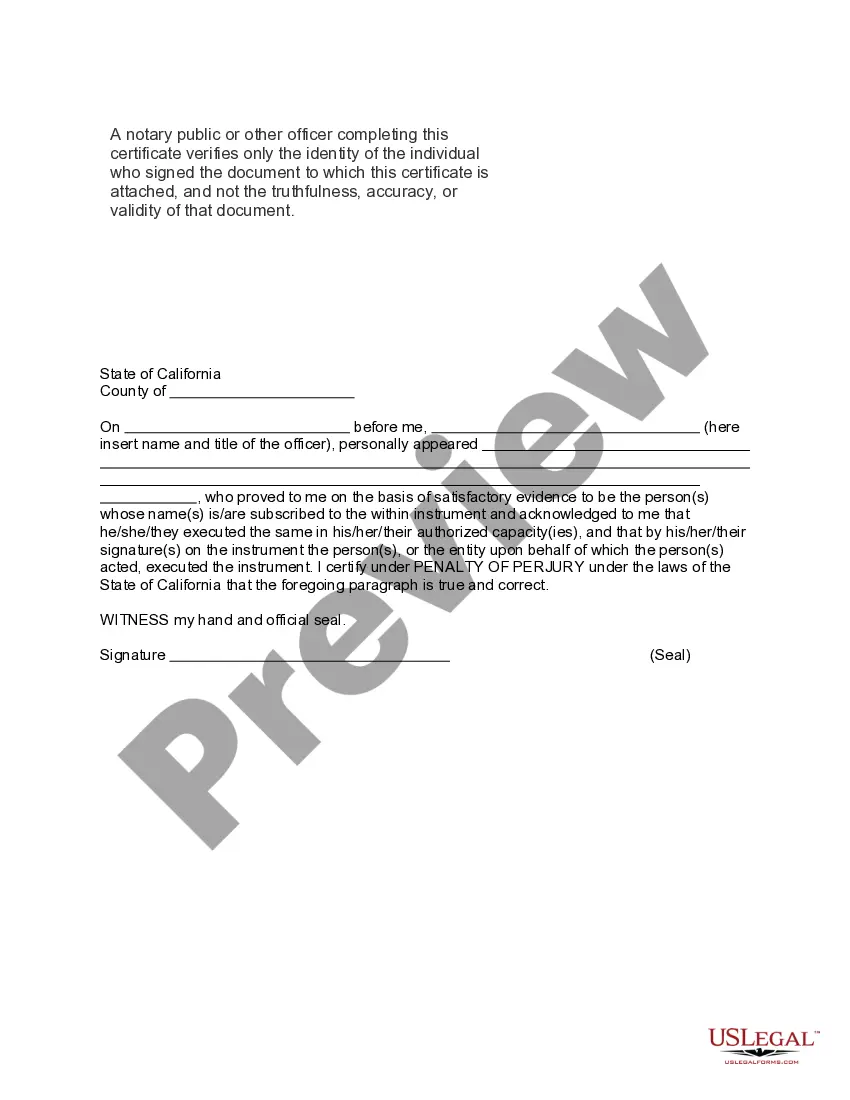

Utilizing our collection is a great way to increase the safety of your record submissions. Our experienced lawyers on a regular basis check all the documents to make certain that the forms are appropriate for a particular region and compliant with new acts and polices.

How do you obtain the Palmdale California Financial Account Transfer to Living Trust? If you have a subscription, just log in to the account. The Download button will be enabled on all the samples you look at. Additionally, you can find all the earlier saved files in the My Forms menu.

If you don’t have an account yet, follow the instruction listed below:

- Find the form you require. Ensure that it is the template you were hoping to find: verify its headline and description, and make use of the Preview function if it is available. Otherwise, make use of the Search field to find the appropriate one.

- Launch the saving process. Click Buy Now and choose the pricing plan you like. Then, create an account and pay for your order using a credit card or PayPal.

- Download the document. Select the format to get the Palmdale California Financial Account Transfer to Living Trust and modify and fill, or sign it for your needs.

US Legal Forms is one of the most considerable and reliable document libraries on the web. We are always ready to help you in virtually any legal case, even if it is just downloading the Palmdale California Financial Account Transfer to Living Trust.

Feel free to make the most of our platform and make your document experience as straightforward as possible!