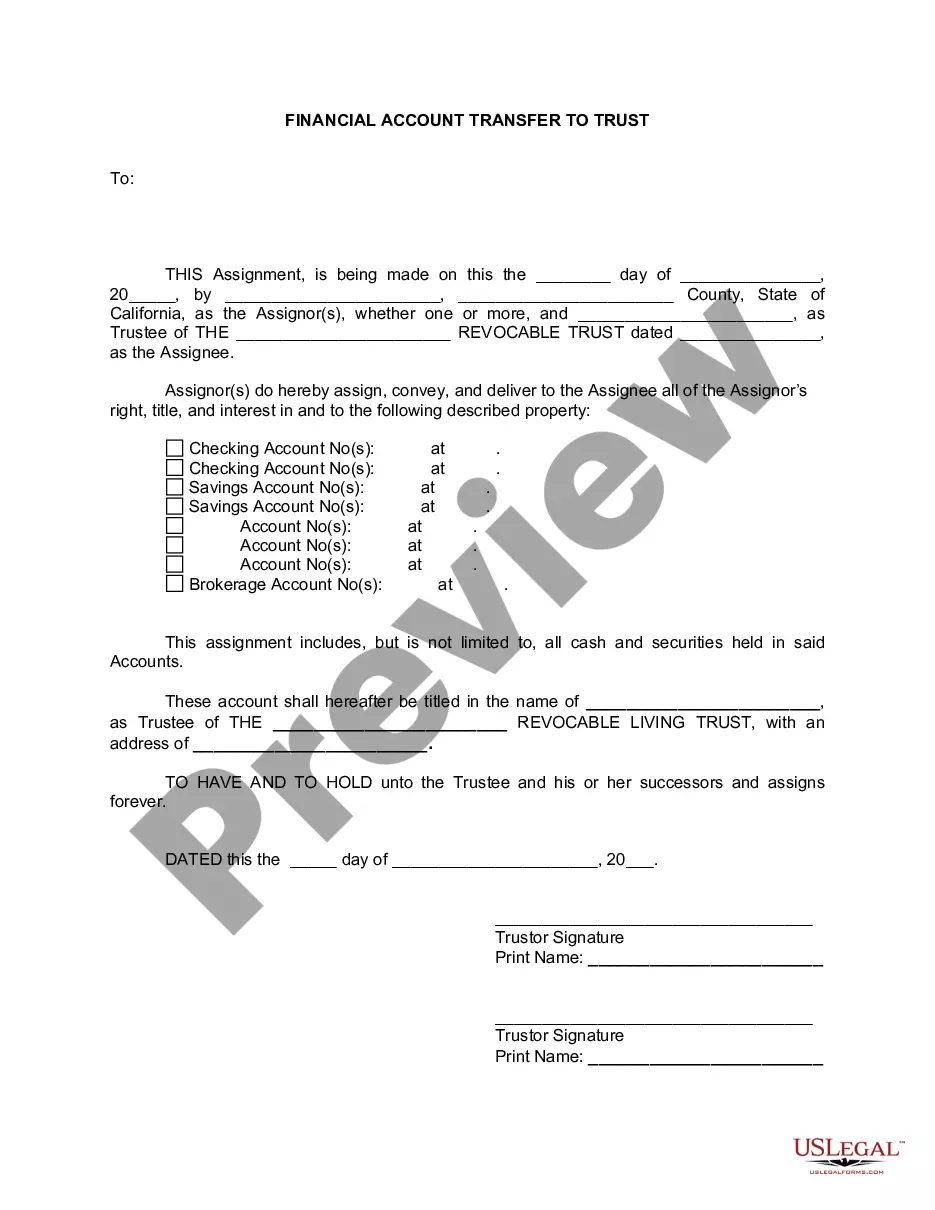

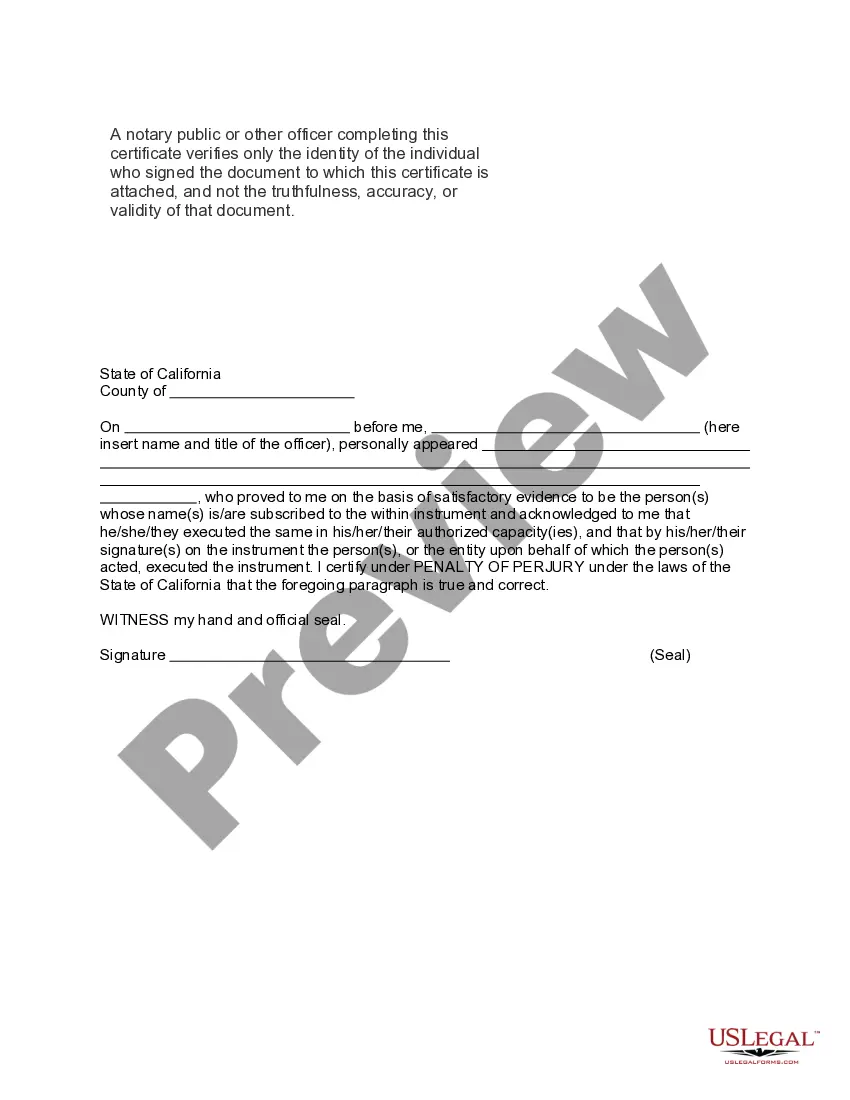

Title: Riverside California Financial Account Transfer to Living Trust — Comprehensive Guide Introduction: In Riverside, California, one of the essential estate planning strategies is transferring financial accounts to a living trust. This process ensures seamless management and distribution of assets while minimizing probate. In this detailed description, we will explore the steps involved in a Riverside financial account transfer to a living trust, its benefits, and the different types of accounts that can be transferred. 1. What is a Living Trust? A living trust, also known as a revocable trust, is a legal document enabling individuals to transfer their assets into a trust during their lifetime to be managed and distributed to beneficiaries. It allows the creator (trust or) to retain control over their assets while avoiding probate. 2. Process of Riverside Financial Account Transfer to Living Trust: a. Determine eligibility: Not all financial accounts can be transferred to a living trust. Research which types of accounts can be included. b. Create a living trust: Consult with an estate planning attorney in Riverside to establish a valid living trust. c. Funding the trust: Transfer ownership of assets, including financial accounts, into the trust's name. This typically involves notifying financial institutions and completing appropriate paperwork. d. Update beneficiary designations: Ensure that all beneficiary designations on the financial accounts align with the provisions in the living trust. e. Ongoing management: After the transfer, continue to oversee and manage the accounts within the trust. 3. Benefits of Financial Account Transfer to Living Trust in Riverside: a. Avoidance of probate: By placing assets in a living trust, individuals can bypass the lengthy and costly probate process. b. Privacy: Probate records are public, whereas living trusts maintain privacy for both the trust or and beneficiaries. c. Efficient asset distribution: Living trusts enable quicker transfer of assets to beneficiaries, eliminating potential delays in accessing funds. d. Incapacity planning: A living trust can provide instructions on managing assets in the event of the trust or's incapacity, ensuring seamless continuity. e. Flexibility: Living trusts can be modified or revoked during the trust or's lifetime, allowing for flexibility in changing circumstances. 4. Types of Financial Accounts Transferable to Living Trust: a. Bank accounts: Checking accounts, savings accounts, money market accounts. b. Investment accounts: Individual brokerage accounts, investment portfolios, stocks, bonds, mutual funds. c. Retirement accounts: Traditional and Roth IRAs, 401(k)s, pension plans. d. Life insurance policies: Accounts with cash value or policies with death benefit proceeds can be transferred to a living trust. e. Real estate: Properties owned individually can be transferred to the trust, ensuring seamless management and distribution. Conclusion: Riverside California's financial account transfer to a living trust simplifies asset management, minimizes probate, ensures efficient distribution, and provides greater privacy. Consult an experienced estate planning attorney in Riverside to achieve a smooth and effective transfer of financial accounts to a living trust, tailored to your specific financial situation and goals.

Riverside Trust

Description

How to fill out Riverside California Financial Account Transfer To Living Trust?

Getting verified templates specific to your local regulations can be challenging unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both personal and professional needs and any real-life situations. All the documents are properly grouped by area of usage and jurisdiction areas, so searching for the Riverside California Financial Account Transfer to Living Trust becomes as quick and easy as ABC.

For everyone already acquainted with our service and has used it before, getting the Riverside California Financial Account Transfer to Living Trust takes just a couple of clicks. All you need to do is log in to your account, opt for the document, and click Download to save it on your device. This process will take just a couple of more actions to make for new users.

Adhere to the guidelines below to get started with the most extensive online form catalogue:

- Check the Preview mode and form description. Make certain you’ve picked the correct one that meets your needs and fully corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you find any inconsistency, use the Search tab above to get the correct one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and select the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the service.

- Download the Riverside California Financial Account Transfer to Living Trust. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Benefit from the US Legal Forms library to always have essential document templates for any demands just at your hand!