Vacaville California Financial Account Transfer to Living Trust: A Comprehensive Guide Introduction: In Vacaville, California, the process of transferring financial accounts to a living trust is an essential step in estate planning. By establishing a living trust, individuals can ensure the orderly distribution of their assets to their chosen beneficiaries while avoiding probate. This detailed description aims to provide an overview of Vacaville California financial account transfer to living trust, including the types of transfers involved and the significance of this process. 1. Understanding Living Trusts: A living trust, also known as an interviews trust, is a legal entity created during one's lifetime to manage and distribute assets. It comprises three main parties: the settler (the individual creating the trust), the trustee (the person responsible for managing the trust), and the beneficiaries (the individuals who will inherit the assets). By transferring financial accounts to a living trust, individuals gain control over the management and distribution of their wealth. 2. Financial Accounts Transfer Process: a. Identifying Financial Accounts: Begin by identifying all financial accounts to be transferred, such as bank accounts, investment portfolios, retirement accounts, stocks, bonds, or any other relevant assets. b. Consult an Estate Planning Attorney: Seek guidance from an experienced estate planning attorney who specializes in living trusts. They will help assess your specific needs, draft necessary legal documents, and guide you through the transfer process. c. Amend Trust Documents: Once a trust is established, it is essential to amend the trust documents by adding the financial accounts to be transferred. This step ensures that the ownership and management of these assets are duly assigned to the trust. d. Notify Financial Institutions: Notify the financial institutions holding your respective accounts about the transfer. They may require specific documentation, such as a certification of the living trust, copies of trust documents, or account transfer request forms. e. Transfer Process Completion: After receiving confirmation from the financial institutions, the actual transfer process can be initiated. This might involve filling out transfer forms, gathering relevant paperwork, and following any additional procedures mandated by each institution. 3. Importance of Living Trust Financial Account Transfer: a. Avoidance of Probate: One of the primary purposes of transferring financial accounts to a living trust is to bypass the lengthy and costly probate process. Assets held within a living trust can be distributed immediately upon the death of the settler, avoiding probate court intervention. b. Privacy: Unlike probate, living trusts are private documents that do not become part of public records. This offers additional confidentiality to individuals, keeping the details of their wealth and beneficiaries undisclosed. c. Enhanced Control and Flexibility: By transferring financial accounts to a living trust, individuals retain control over their assets during their lifetime. They can modify or revoke the trust at any time, ensuring flexibility in managing their wealth. d. Incapacity Protection: Living trusts provide protection in the event of the settler's incapacity or inability to manage their financial affairs. Trustees appointed in living trusts can seamlessly take over the management and continue to act on the settler's behalf. Types of Vacaville California Financial Account Transfers to Living Trust: 1. Bank Account Transfers: This involves transferring funds held within checking, savings, or money market accounts into the living trust. 2. Investment Portfolio Transfers: Transferring stocks, bonds, mutual funds, or other investment accounts ensures seamless management and distribution under the living trust. 3. Retirement Account Transfers: Safeguard retirement funds, such as IRAs or 401(k)s, within the living trust, enabling precise control and distribution according to the settler's wishes. Conclusion: Transferring financial accounts to a living trust in Vacaville, California, is an important step in effective estate planning. Through proper account identification, consultation with an estate planning attorney, and adhering to the transfer process, individuals can gain numerous benefits. By avoiding probate, maintaining privacy, and ensuring enhanced control, transferring financial accounts to a living trust offers long-term financial security and peace of mind.

Vacaville California Financial Account Transfer to Living Trust

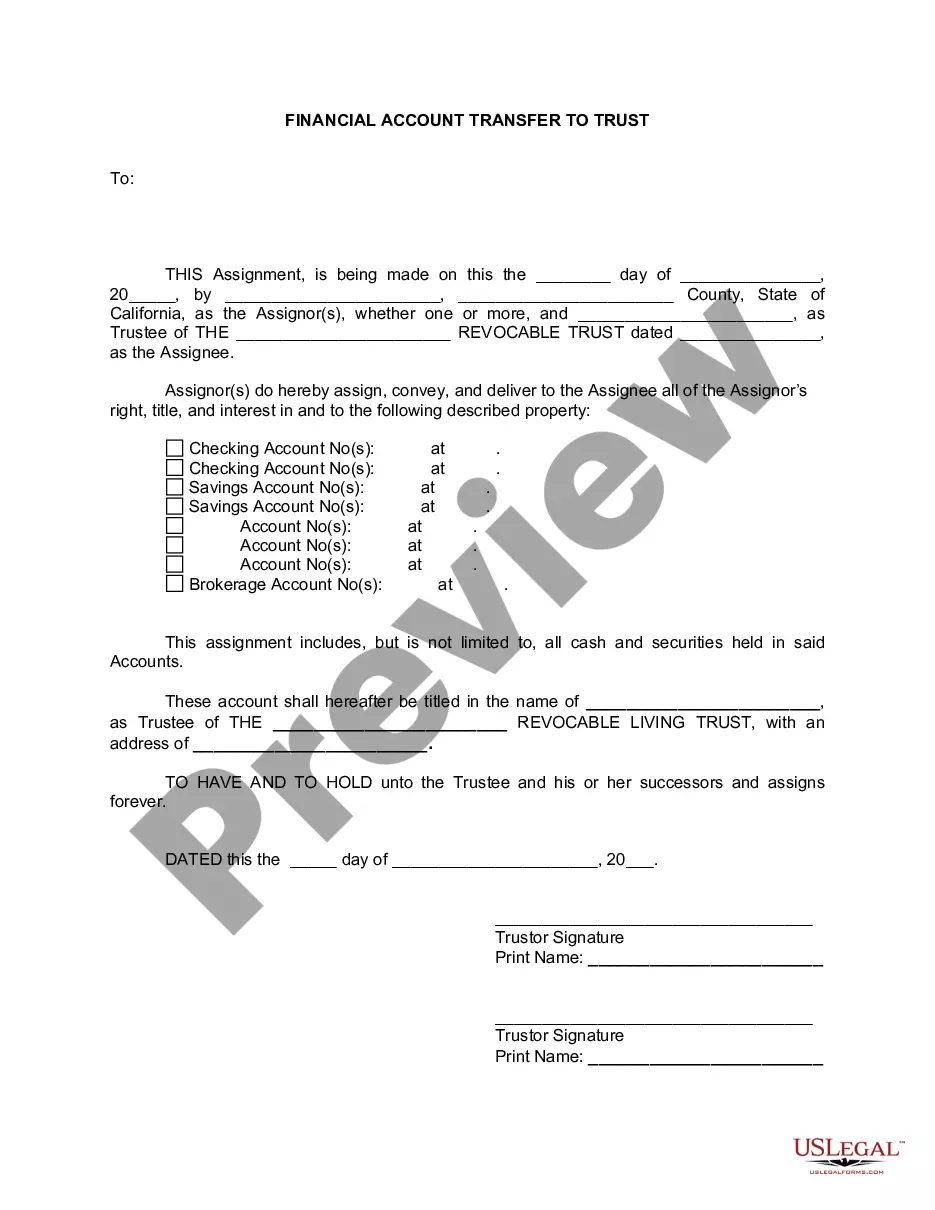

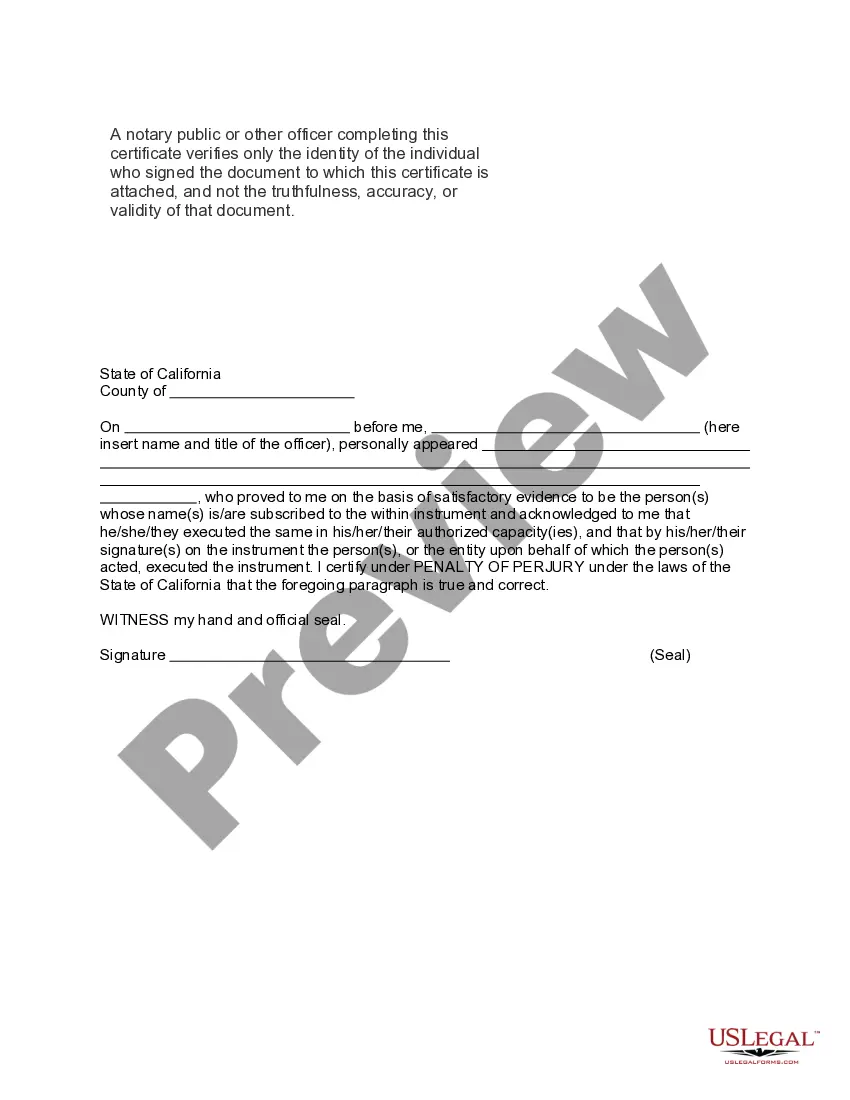

Description

How to fill out Vacaville California Financial Account Transfer To Living Trust?

Finding verified templates specific to your local laws can be difficult unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both individual and professional needs and any real-life scenarios. All the documents are properly grouped by area of usage and jurisdiction areas, so locating the Vacaville California Financial Account Transfer to Living Trust becomes as quick and easy as ABC.

For everyone already acquainted with our catalogue and has used it before, obtaining the Vacaville California Financial Account Transfer to Living Trust takes just a couple of clicks. All you need to do is log in to your account, choose the document, and click Download to save it on your device. This process will take just a few additional steps to complete for new users.

Follow the guidelines below to get started with the most extensive online form collection:

- Check the Preview mode and form description. Make sure you’ve picked the right one that meets your needs and fully corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you see any inconsistency, use the Search tab above to obtain the right one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and select the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the subscription.

- Download the Vacaville California Financial Account Transfer to Living Trust. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Benefit from the US Legal Forms library to always have essential document templates for any needs just at your hand!