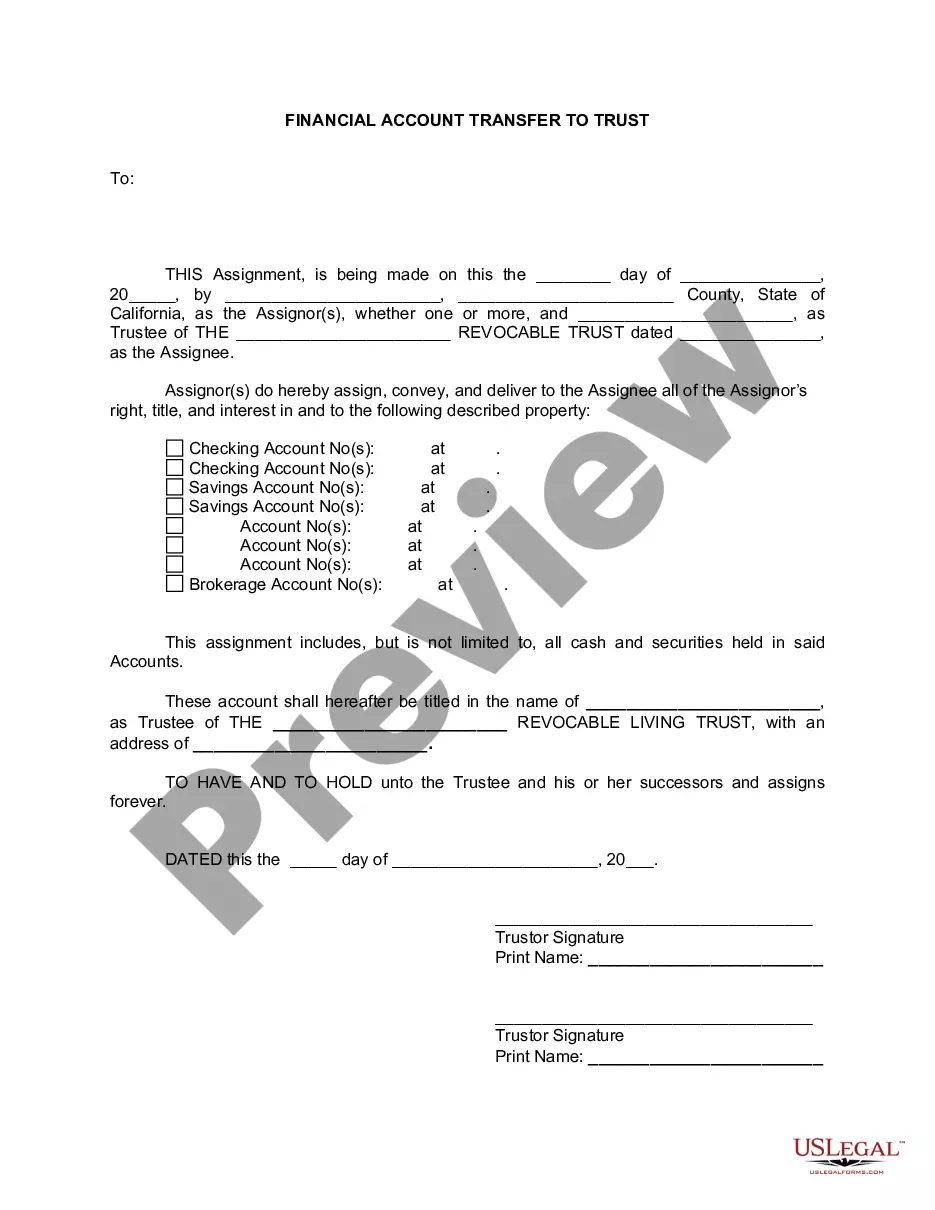

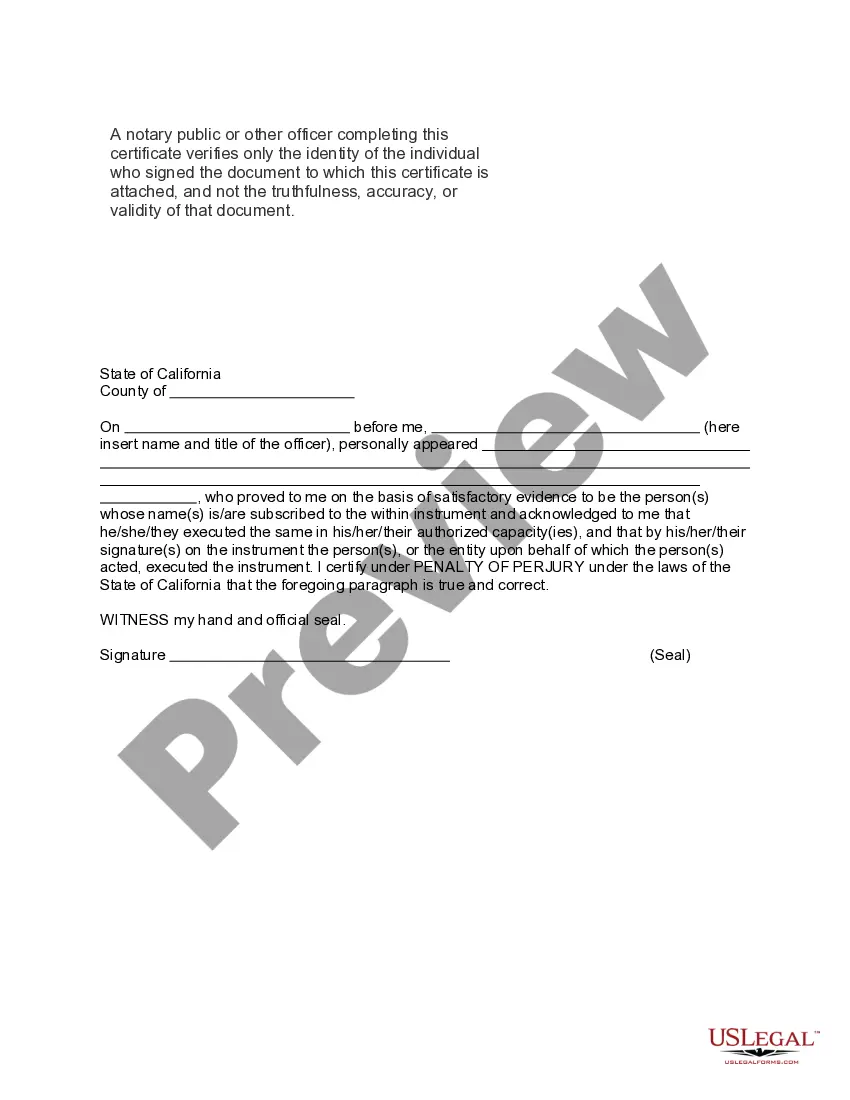

Title: West Covina California Financial Account Transfer to Living Trust: Exploring the Process and Benefits Introduction: In West Covina, California, transferring financial accounts to a living trust is a crucial step in estate planning. This detailed description will shed light on what entails a financial account transfer to a living trust in West Covina, highlighting its significance, the types involved, and the associated benefits. 1. Understanding Financial Account Transfer to Living Trust: a. Definition: A financial account transfer to a living trust refers to the process of renaming or re-titling financial accounts to be owned by a revocable living trust, instead of an individual's name. b. Objective: The primary purpose is to ensure seamless management and distribution of assets in the event of the trust creator's incapacity or death. 2. Types of West Covina California Financial Account Transfer to Living Trust: a. Bank Accounts: This includes checking, savings, certificates of deposit (CDs), money market accounts, and any other financial accounts held at banks or credit unions. b. Investment Accounts: These involve brokerage accounts, stocks, bonds, mutual funds, individual retirement accounts (IRAs), and other investment vehicles. c. Retirement Accounts: Accounts such as 401(k)s, annuities, pension plans, and other retirement savings accounts can be transferred into a living trust's ownership. d. Real Estate: While not considered a 'financial account,' properties can be titled in the name of a living trust, allowing for easier management and potential property tax benefits. 3. Process of Financial Account Transfer to Living Trust: a. Establishing a Living Trust: First, an individual needs to create a valid living trust document with the help of an estate planning attorney, outlining their intentions, trustees, and beneficiaries. b. Identifying Financial Accounts: The trust creator must identify the relevant financial accounts they wish to transfer ownership to the trust. c. Contacting Financial Institutions: The next step involves informing each financial institution (banks, brokerages, etc.) about the decision to transfer ownership to the living trust. d. Completing Required Documentation: The financial institutions will provide forms or requirements to initiate the transfer process, which usually includes submitting trust documents, account ownership change forms, and supporting identification. e. Updating Account Titles: After the necessary paperwork is submitted, the financial accounts will be re-titled in the name of the living trust, legitimizing the transfer. 4. Benefits of West Covina California Financial Account Transfer to Living Trust: a. Asset Protection: Transferring accounts to a living trust helps safeguard assets against potential creditors, lawsuits, and probate. b. Privacy: Since a living trust is not a public document like a will, the transfer ensures the privacy of personal and financial information. c. Probate Avoidance: Assets held in a living trust avoid the probate process, saving time and expenses associated with probate court proceedings. d. Uninterrupted Management: In the event of incapacity, a designated trustee can seamlessly manage the financial accounts held within the living trust, ensuring financial stability and avoiding legal complications. e. Efficient Distribution: Upon the trust creator's passing, a living trust allows for a smooth transition of assets to the intended beneficiaries, following the predetermined distribution plan. Conclusion: Understanding the West Covina California financial account transfer process to a living trust provides individuals with the knowledge necessary to make informed estate planning decisions. By considering the different types of financial accounts and the associated benefits, residents can strategically safeguard their assets and achieve long-term financial security. Consulting with an experienced estate planning attorney is recommended to ensure a seamless and legally sound transfer process.

West Covina California Financial Account Transfer to Living Trust

Description

How to fill out West Covina California Financial Account Transfer To Living Trust?

Do you need a reliable and affordable legal forms supplier to get the West Covina California Financial Account Transfer to Living Trust? US Legal Forms is your go-to solution.

No matter if you need a simple arrangement to set regulations for cohabitating with your partner or a package of documents to move your separation or divorce through the court, we got you covered. Our platform offers over 85,000 up-to-date legal document templates for personal and business use. All templates that we offer aren’t generic and frameworked based on the requirements of specific state and area.

To download the document, you need to log in account, locate the needed template, and hit the Download button next to it. Please keep in mind that you can download your previously purchased form templates at any time from the My Forms tab.

Is the first time you visit our platform? No worries. You can create an account in minutes, but before that, make sure to do the following:

- Check if the West Covina California Financial Account Transfer to Living Trust conforms to the regulations of your state and local area.

- Read the form’s description (if available) to learn who and what the document is intended for.

- Start the search over if the template isn’t good for your specific scenario.

Now you can create your account. Then select the subscription option and proceed to payment. As soon as the payment is done, download the West Covina California Financial Account Transfer to Living Trust in any available file format. You can return to the website at any time and redownload the document without any extra costs.

Finding up-to-date legal documents has never been easier. Give US Legal Forms a go now, and forget about spending hours researching legal paperwork online for good.

Form popularity

FAQ

Transferring property to a living trust in California involves drafting a deed that names the trust as the new owner. You will need to file this deed with your local county recorder's office to make the transfer official. This step is crucial for a successful West Covina California financial account transfer to living trust. Consider leveraging US Legal Forms to streamline the documentation and ensure compliance with California laws.

To transfer bank accounts into a living trust, first, contact your bank and inquire about their specific procedures. Typically, you will need to complete a trust transfer form and provide documentation of your living trust. This process ensures that your West Covina California financial account transfer to living trust is smooth and legally binding. Using tools like US Legal Forms can help you prepare the necessary paperwork efficiently.

A trust does not need to be recorded in California. However, it is essential to maintain accurate records of the trust's assets and any transactions made. This documentation helps ensure that your financial account transfers to the living trust are valid and executed correctly. For more information on how to set this up smoothly, consider using the tools available from US Legal Forms for a successful West Covina California Financial Account Transfer to Living Trust.

No, you do not have to file a living trust with the court in California. This privacy benefit allows you to manage your assets without public scrutiny. It is essential, though, to ensure that all your assets are properly transferred into the trust to achieve your estate planning goals. For assistance, explore the options that US Legal Forms offers to help with your West Covina California Financial Account Transfer to Living Trust.

In California, a living trust typically does not need to be filed with the court. This feature allows for a more private and simpler management of your assets during your lifetime and after your death. However, putting your financial accounts and assets into your trust is crucial for ensuring they are properly handled. US Legal Forms can guide you through the process of creating a West Covina California Financial Account Transfer to Living Trust, keeping you informed every step of the way.

Transferring your checking account to your living trust involves a few straightforward steps. First, contact your bank to inquire about their specific process for transferring accounts to a trust. Generally, you will need to provide a copy of your trust document and complete any necessary forms. By utilizing the information from US Legal Forms, you can simplify the West Covina California Financial Account Transfer to Living Trust process.

One of the biggest mistakes parents make when setting up a trust fund is failing to clearly define their wishes. Without specific instructions, trustees might struggle to manage the assets effectively. Additionally, parents often overlook updating the trust to reflect changes in family dynamics or financial situations. To avoid these pitfalls, consider using the resources available through US Legal Forms for the West Covina California Financial Account Transfer to Living Trust.

The trustee controls the bank account of a trust. This individual is responsible for managing trust assets and distributing funds according to the terms of the trust. It's crucial to select a trustworthy trustee who understands the responsibilities involved in managing your West Covina California Financial Account Transfer to Living Trust effectively.

To transfer property to a living trust in California, you will need to complete a deed transfer. This deed should be filed with the county recorder’s office to officially record the change in ownership. Ensure that all legal requirements are met to maintain the integrity of your property within the living trust.

Typically, retirement accounts and certain tax-advantaged accounts should not be placed directly in a trust. Therefore, keeping accounts like IRAs and 401(k)s outside of your living trust may be beneficial to avoid potential tax complications. Understanding these distinctions is essential in the West Covina California Financial Account Transfer to Living Trust process.