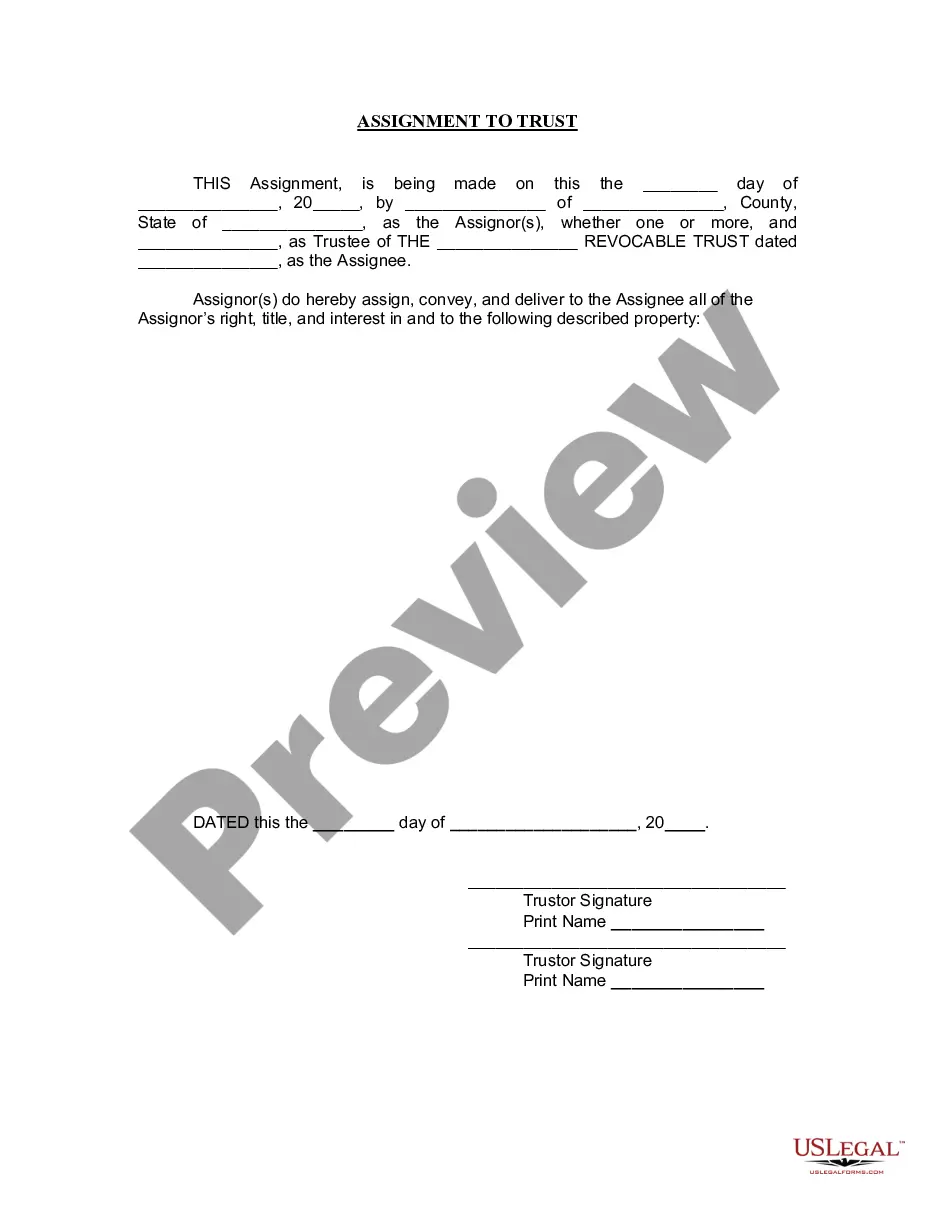

Pomona California Assignment to Living Trust

Description

How to fill out California Assignment To Living Trust?

Are you seeking a trustworthy and affordable provider of legal documents to obtain the Pomona California Assignment to Living Trust? US Legal Forms is your ideal option.

Whether you need a simple agreement to establish rules for living with your partner or a collection of documents to facilitate your divorce process through the court, we have everything you need. Our site offers over 85,000 current legal document templates for individual and commercial use.

All the templates we provide are not one-size-fits-all and are tailored to meet the requirements of particular states and counties.

To obtain the document, you must Log In to your account, find the desired template, and click the Download button adjacent to it. Please remember that you can access your previously acquired document templates at any time in the My documents tab.

Now you can establish your account. Then select the subscription option and proceed to payment. Once the payment is completed, you can download the Pomona California Assignment to Living Trust in any available file format. You can revisit the website as needed and redownload the document at no additional cost.

Locating current legal forms has never been simpler. Give US Legal Forms a shot today, and put an end to wasting hours searching for legal documents online forever.

- Are you unfamiliar with our platform? No problem.

- You can create an account with great ease, but prior to that, ensure to do the following.

- Verify if the Pomona California Assignment to Living Trust aligns with the laws of your state and locality.

- Review the document’s description (if available) to understand who and what the document is meant for.

- Restart the search if the template doesn’t fit your legal needs.

Form popularity

FAQ

One downside of a living trust in California is the potential for higher initial costs. Setting up a Pomona California Assignment to Living Trust may involve legal fees for attorney consultations and document preparation. Additionally, if you do not transfer all assets into the trust, those assets will still be subject to probate, defeating the purpose of the trust. Therefore, it's essential to ensure that everything is properly allocated to avoid complications later.

While placing your house in a trust can offer benefits, there are some disadvantages to consider. One issue is the potential for upfront costs associated with setting up and managing the Pomona California Assignment to Living Trust. You may also face some limitations on refinancing or selling the property held in trust. Additionally, maintaining trust documentation requires ongoing attention and legal compliance, which can complicate property management.

Transferring property to a living trust in California involves a few key steps. First, you should review the existing property title to ensure it can be transferred. For the Pomona California Assignment to Living Trust, prepare a deed that explicitly states the property is now owned by the trust. Once completed, file the deed with the county recorder's office. This process not only secures ownership but also simplifies asset management for your beneficiaries.

One significant mistake parents often make when establishing a trust fund is failing to properly fund the trust. Many assume that simply creating the trust document is enough, but without transferring assets into it, the trust serves no purpose. To effectively secure their assets through a Pomona California Assignment to Living Trust, parents should identify and transfer all relevant properties and accounts into the trust. Proper funding ensures that the trust operates as intended, protecting family interests.

Transferring your property to a living trust in Pomona, California, involves a few crucial steps. First, you must organize your documents, including the trust agreement and property details. Next, complete a deed transfer, which you will record with the local county office. For a seamless process, consider using the uslegalforms platform, where you can find templates and guides specifically for Pomona California Assignment to Living Trust.

If you do it yourself by buying a book or an online guide, it will likely cost less than $100. However, there are pitfalls to DIY estate planning. The downside of working with a professional, however, is the cost. If you choose to use an attorney to help you draft your trust documents, it could cost more than $1,000.

A trust may also be set up by a will, which leaves property in trust for a beneficiary. These trusts are called testamentary trusts and are usually irrevocable. Trusts are not filed or registered with the Court. You may wish to contact the County Recorder or the attorney who prepared the trust to obtain copies.

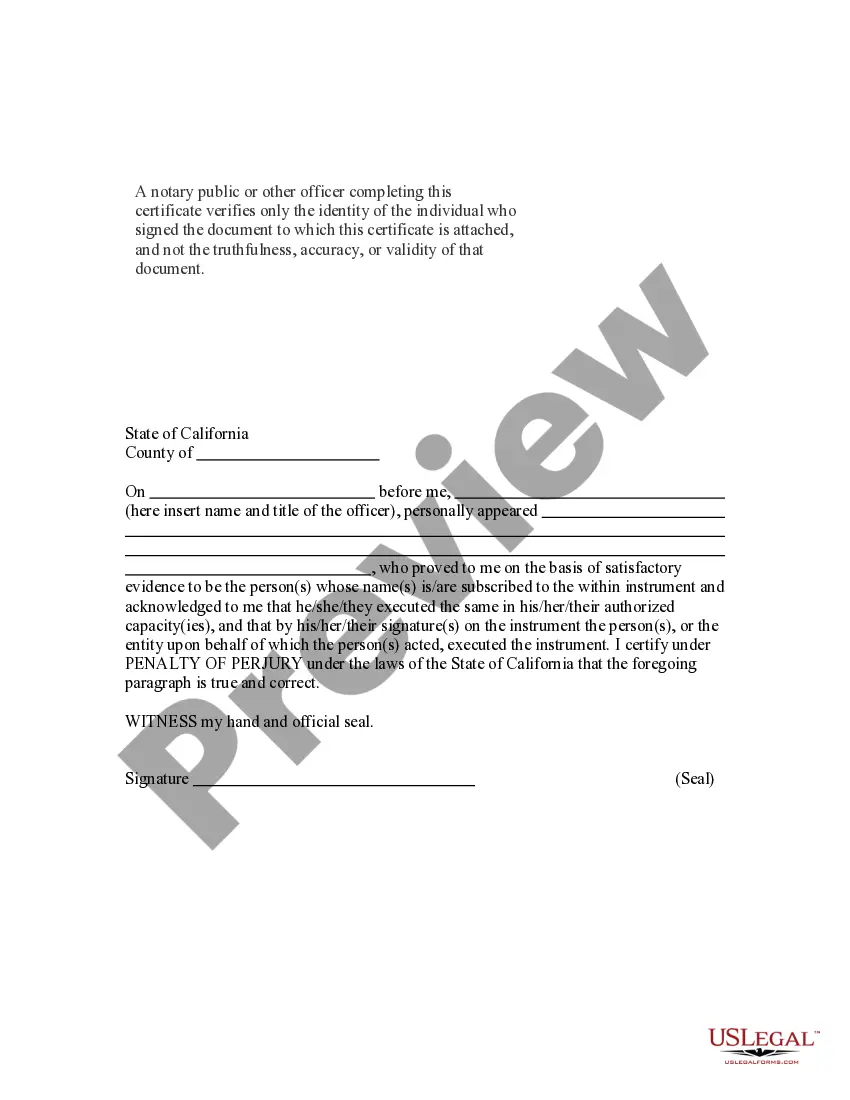

How to Create a Living Trust in the State of California Take an inventory of your assets. Select your trustee. Designate your Beneficiaries. Write up your Declaration of Trust. Sign your Trust in front of a Notary Public (optional). Transfer assets and property to the Trust.

You will need all of the titles and deeds of property, stock certificates, and life insurance policies in order to ?fund the trust,? that is, to transfer the property into the trust, discussed more fully below. Gather them now and have them ready so the process can go more smoothly and quickly.

To transfer real property into your Trust, a new deed reflecting the name of the Trust must be executed, notarized and recorded with the County Recorder in the County where the property is located. Care must be taken that the exact legal description in the existing deed appears on the new deed.