Title: Understanding Vista California Assignment to Living Trust: A Comprehensive Guide Keywords: Vista California, Assignment to Living Trust, types, living trust, estate planning, beneficiaries, assets, property, legal document, probate, trust administration Introduction: In Vista, California, Assignment to Living Trust is a vital component of estate planning. It allows individuals to seamlessly transfer their assets to a trust, enabling efficient distribution to beneficiaries while avoiding probate. This article aims to provide an in-depth understanding of Vista California Assignment to Living Trust, including its different types and the benefits it offers. 1. What is Vista California Assignment to Living Trust? Vista California Assignment to Living Trust refers to the legal process in which an individual transfers their assets, such as property, bank accounts, investments, and personal belongings, into a living trust. A living trust is a legal document that serves as an alternative to a will, outlining how assets will be managed during one's lifetime and distributed after death. 2. Types of Vista California Assignment to Living Trust: a. Revocable Living Trust: A revocable living trust allows individuals to retain control and make changes to the trust during their lifetime. It can be altered or revoked entirely if circumstances change, granting flexibility to the trust creator. Furthermore, a revocable living trust avoids probate, ensuring privacy, and efficient asset distribution. b. Irrevocable Living Trust: An irrevocable living trust is a permanent legal agreement that cannot be modified or revoked without the consent of beneficiaries. Once assets are transferred to an irrevocable trust, the trust creator relinquishes control. This type of trust provides enhanced asset protection, minimizes estate taxes, and shields assets from potential creditors. 3. Benefits of Vista California Assignment to Living Trust: a. Avoidance of Probate: One of the prevailing advantages of Assignment to Living Trust is the avoidance of probate. Probate is a lengthy and costly legal process that oversees the distribution of assets after someone's passing. By transferring assets to a living trust, beneficiaries can receive their inheritance promptly, avoiding probate expenses and maintaining privacy. b. Flexibility in Asset Management: Living trusts provide great flexibility in managing assets since the trust creator can adapt the trust's terms at any time. It allows the assignment of a successor trustee to manage the assets if the creator becomes incapacitated or passes away. c. Privacy: Unlike probate, which is a public process, the Assignment to Living Trust maintains the privacy of the trust creator and their beneficiaries. Trust administration occurs privately, reducing public scrutiny and potentially avoiding family disputes. d. Estate Tax Planning: For individuals with substantial estates, an Assignment to Living Trust can be utilized as an effective tool for estate tax planning. It helps minimize estate taxes by properly structuring the trust and leveraging exemptions and deductions. Conclusion: Vista California Assignment to Living Trust is a significant step for individuals looking to secure their assets, protect their beneficiaries, and avoid the complexities of probate. Whether it's a revocable or irrevocable living trust, this legal process offers various benefits that make estate planning more efficient and seamless. Consulting an experienced estate planning attorney is advisable to ensure the successful creation and execution of an Assignment to Living Trust tailored to individual needs and circumstances.

Vista California Assignment to Living Trust

Description

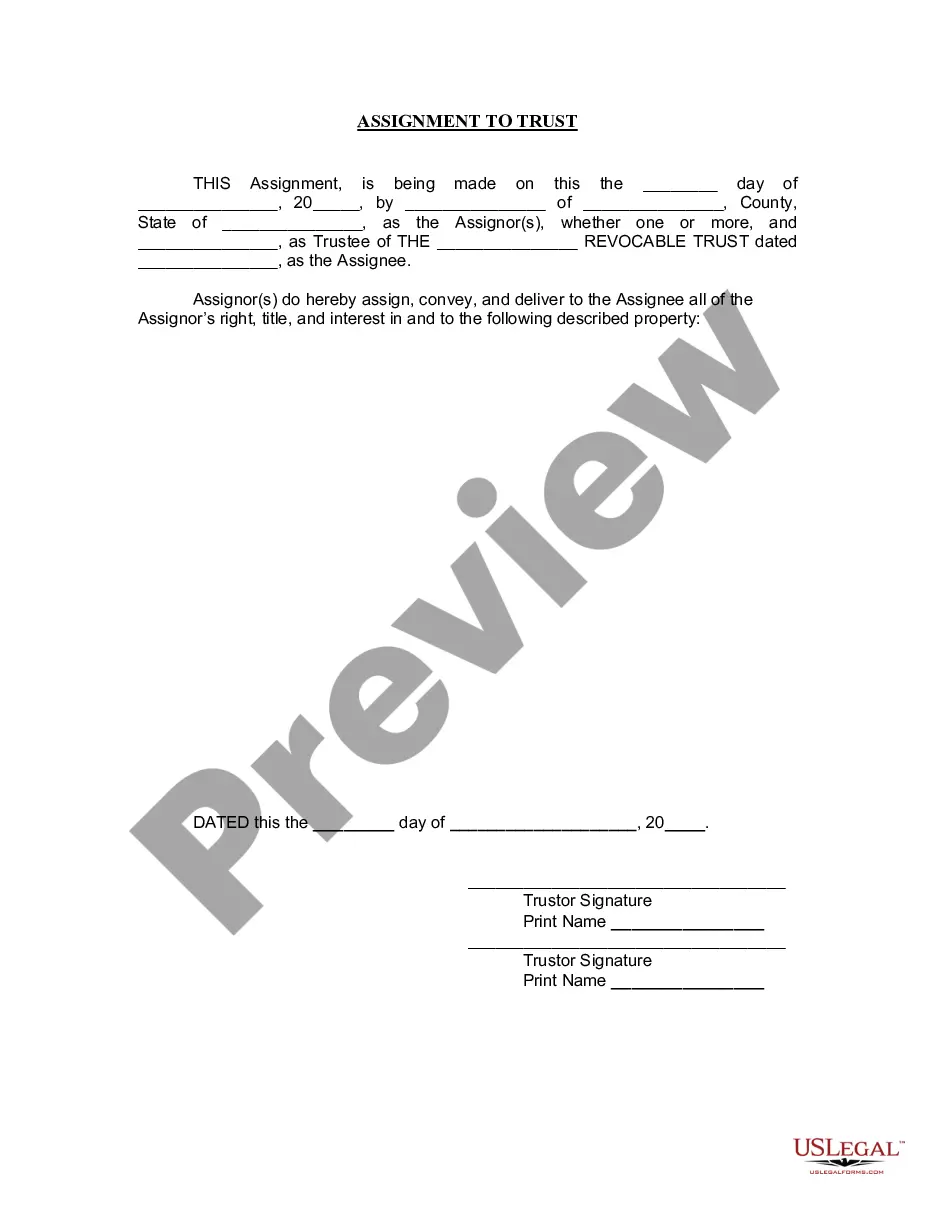

How to fill out Vista California Assignment To Living Trust?

Locating verified templates specific to your local regulations can be difficult unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both personal and professional needs and any real-life situations. All the documents are properly grouped by area of usage and jurisdiction areas, so locating the Vista California Assignment to Living Trust becomes as quick and easy as ABC.

For everyone already acquainted with our catalogue and has used it before, getting the Vista California Assignment to Living Trust takes just a few clicks. All you need to do is log in to your account, pick the document, and click Download to save it on your device. The process will take just a few additional steps to make for new users.

Follow the guidelines below to get started with the most extensive online form collection:

- Check the Preview mode and form description. Make sure you’ve selected the right one that meets your needs and totally corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you see any inconsistency, use the Search tab above to find the correct one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and select the subscription plan you prefer. You should sign up for an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the subscription.

- Download the Vista California Assignment to Living Trust. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Take advantage of the US Legal Forms library to always have essential document templates for any needs just at your hand!