Notice of Assignment to Living Trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form serves as notice that the

trustor(s) of the revocable trust transferred and assigned his or her or their rights, title and interest in and to certain described property to the trust.

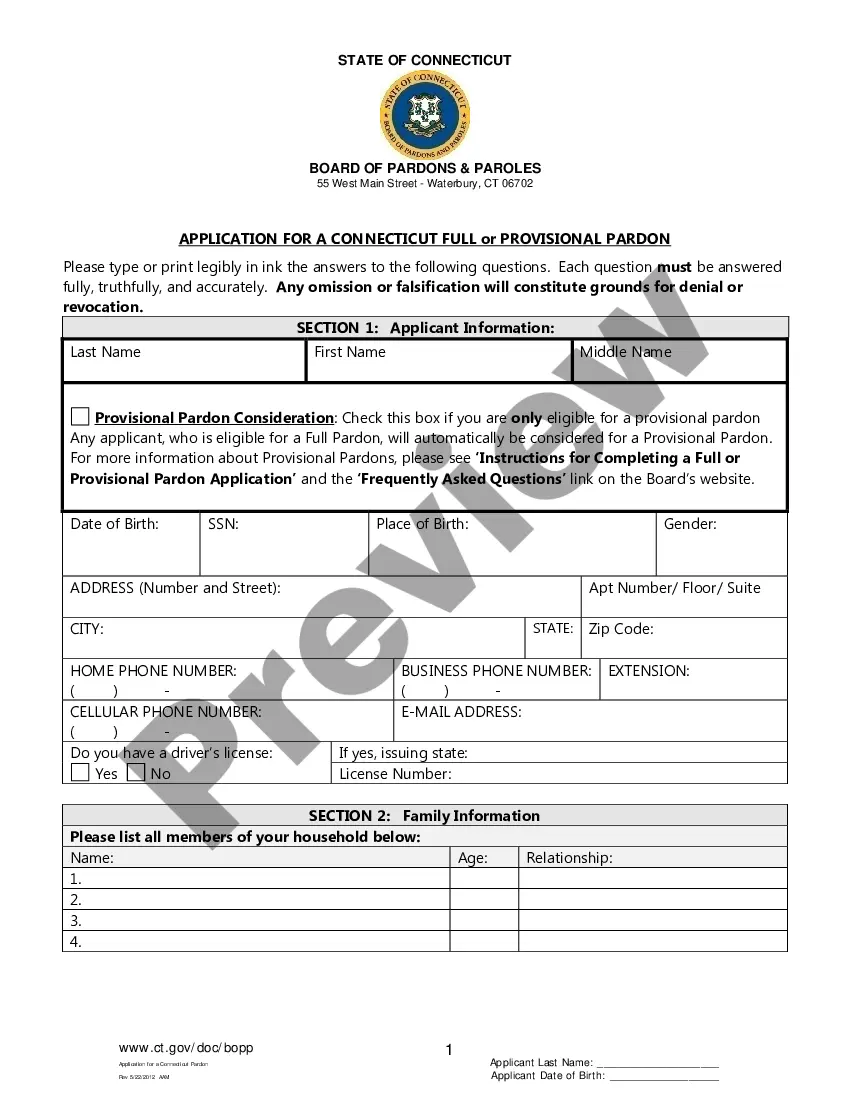

Alameda California Notice of Assignment to Living Trust

Description

How to fill out California Notice Of Assignment To Living Trust?

Take advantage of US Legal Forms and gain instant access to any form template you desire.

Our user-friendly platform, featuring thousands of templates, simplifies the process of locating and obtaining nearly any document sample you may require.

You can download, fill out, and sign the Alameda California Notice of Assignment to Living Trust in mere minutes, rather than spending hours online searching for a suitable template.

Using our catalog is a fantastic method to enhance the security of your record submissions. Our skilled legal experts frequently review all documents to confirm the templates are suitable for a specific state and adhere to updated laws and regulations.

US Legal Forms is one of the most comprehensive and reliable template libraries available online.

Our team is always here to assist you with virtually any legal issue, even if it only involves downloading the Alameda California Notice of Assignment to Living Trust.

- How can you acquire the Alameda California Notice of Assignment to Living Trust.

- If you are already a subscriber, simply Log In to your account. The Download button will be activated for all the samples you view. Additionally, all your previously saved documents can be found in the My documents section.

- If you do not have an account yet, follow the steps below.

- Locate the form you need. Ensure it is the template you seek: check its title and description, and take advantage of the Preview feature when available. Otherwise, use the Search bar to find the required one.

- Initiate the saving process. Click Buy Now and select your preferred pricing plan. Then, create an account and complete your order using a credit card or PayPal.

- Download the document. Choose the format to obtain the Alameda California Notice of Assignment to Living Trust and edit and complete, or sign it as you see fit.

Form popularity

FAQ

To transfer your property to a living trust in California, you must first create the trust document. Then, complete an Alameda California Notice of Assignment to Living Trust to formally assign your property to the trust. You will need to change the title on the property to reflect the name of the trust, which might involve filing forms with your county recorder's office. For assistance and streamlined processes, you can use platforms like US Legal Forms, which provide templates and guidance for these steps.

To ensure a trust is valid, you must have a legal purpose, a settlor who creates the trust, a clear description of the assets, and at least one beneficiary. Additionally, the trust must be executed following state laws to be enforceable. When setting up your Alameda California Notice of Assignment to Living Trust, consider using resources from US Legal to confirm that you meet these essential requirements.

To fill out a certificate of trust, begin by gathering all the essential information about the trust, including its date and the trustee's name. Clearly state the powers granted to the trustee and the details of any assets held in the trust. This certificate, which can be created using forms from US Legal, helps validate your Alameda California Notice of Assignment to Living Trust, providing an official record of the trust's existence.

Filling out trust paperwork requires careful attention to detail. Gather the necessary documents like your will and any relevant identification, then follow the prompts on the forms. Using services like US Legal can simplify this process, especially when dealing with an Alameda California Notice of Assignment to Living Trust, guiding you step-by-step through the requirements.

Writing a trust document involves clearly outlining your wishes regarding asset distribution. Start by identifying the assets you wish to place in the trust and specifying the beneficiaries. You can utilize online tools or resources, such as the US Legal platform, to help you draft a legally valid Alameda California Notice of Assignment to Living Trust, ensuring compliance with state laws.

One of the biggest mistakes parents make when setting up a trust fund is failing to fund the trust properly. They may create a trust but neglect to transfer assets into it, rendering the trust ineffective. This oversight can lead to complications during the estate distribution process. To avoid this pitfall, make sure to follow through with the Alameda California Notice of Assignment to Living Trust and ensure your assets are accurately transferred.

The 120-day notice in California refers to the requirement for a trustee to notify beneficiaries after the trust has become irrevocable. This notice informs beneficiaries of their rights and the contents of the estate plan. Understanding this notice is crucial for beneficiaries to avoid any surprises regarding their inheritance. If you are navigating these complexities, consider using uslegalforms to get the right guidance for Alameda California Notice of Assignment to Living Trust.

To transfer property to a living trust in California, you first need to create the trust document outlining its terms. Then, you need to execute a deed that transfers ownership of the property from you to the trust. This deed must be signed, notarized, and recorded with your county's recorder office. By completing these steps, you will have successfully initiated the Alameda California Notice of Assignment to Living Trust.