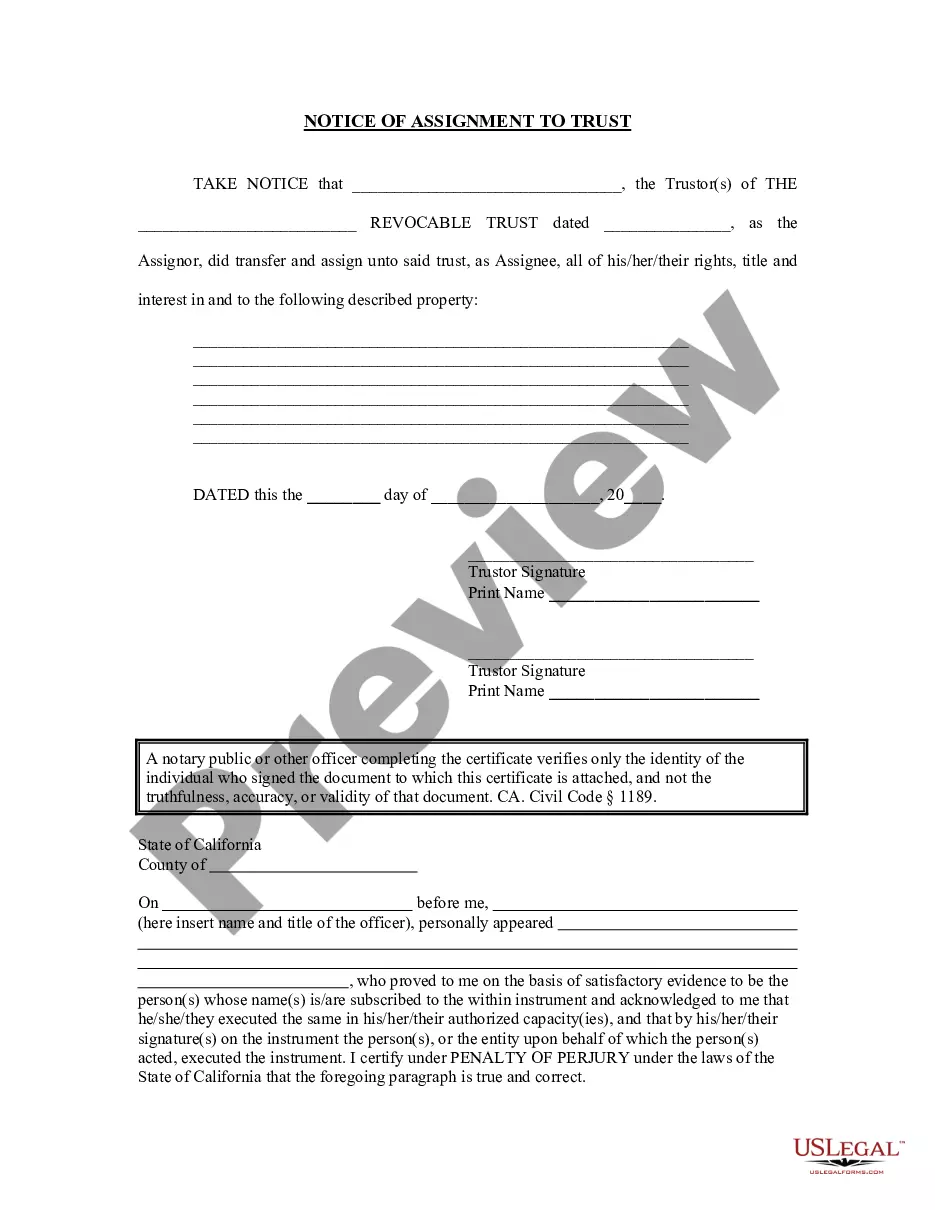

Notice of Assignment to Living Trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form serves as notice that the trustor(s) of the revocable trust transferred and assigned his or her or their rights, title and interest in and to certain described property to the trust.

Corona California is a city located in Riverside County. In the realm of estate planning and asset distribution, one essential document that plays a significant role is the Corona California Notice of Assignment to Living Trust. This legal instrument effectively transfers ownership of assets to a living trust, ensuring an organized and streamlined process for asset distribution upon one's demise. By designating specific assets to a living trust, individuals can avoid probate, simplify asset management, and maintain privacy. There are various types of Corona California Notice of Assignment to Living Trust, each serving different purposes based on the nature and complexity of the assets involved. Some key forms include: 1. Real Estate Notice of Assignment to Living Trust: This document focuses on transferring ownership of real estate properties such as residential homes, commercial buildings, or land parcels to a living trust. It ensures the seamless transfer of these assets to designated beneficiaries and allows for the efficient management of such properties in the event of the granter's incapacity or death. 2. Financial Account Notice of Assignment to Living Trust: This type of notice pertains to the transfer of financial accounts, including bank accounts, brokerage accounts, retirement accounts, and investment portfolios, to a living trust. By assigning these assets to the trust, individuals can ensure the continuity of financial management and provide clear instructions on their distribution after their passing. 3. Personal Property Notice of Assignment to Living Trust: This notice addresses the assignment of personal belongings and valuable assets such as automobiles, jewelry, artwork, collectibles, and other items of sentimental or monetary value to the living trust. By documenting and assigning ownership of personal property, individuals can ensure that these items are distributed according to their wishes and avoid potential disputes among heirs. 4. Business Interest Notice of Assignment to Living Trust: This form focuses on the transfer of ownership interests in businesses, including sole proprietorship, partnerships, or shares in corporations, to the living trust. By appropriately assigning these interests, business owners can ensure a smooth transition of management and ownership in case of incapacitation or death. It is crucial to consult with a qualified attorney experienced in estate planning and living trusts to draft and execute the Corona California Notice of Assignment to Living Trust that aligns with one's specific circumstances and objectives. Professional guidance will ensure compliance with California state laws and guarantee the efficacy of the living trust in asset management and distribution.Corona California is a city located in Riverside County. In the realm of estate planning and asset distribution, one essential document that plays a significant role is the Corona California Notice of Assignment to Living Trust. This legal instrument effectively transfers ownership of assets to a living trust, ensuring an organized and streamlined process for asset distribution upon one's demise. By designating specific assets to a living trust, individuals can avoid probate, simplify asset management, and maintain privacy. There are various types of Corona California Notice of Assignment to Living Trust, each serving different purposes based on the nature and complexity of the assets involved. Some key forms include: 1. Real Estate Notice of Assignment to Living Trust: This document focuses on transferring ownership of real estate properties such as residential homes, commercial buildings, or land parcels to a living trust. It ensures the seamless transfer of these assets to designated beneficiaries and allows for the efficient management of such properties in the event of the granter's incapacity or death. 2. Financial Account Notice of Assignment to Living Trust: This type of notice pertains to the transfer of financial accounts, including bank accounts, brokerage accounts, retirement accounts, and investment portfolios, to a living trust. By assigning these assets to the trust, individuals can ensure the continuity of financial management and provide clear instructions on their distribution after their passing. 3. Personal Property Notice of Assignment to Living Trust: This notice addresses the assignment of personal belongings and valuable assets such as automobiles, jewelry, artwork, collectibles, and other items of sentimental or monetary value to the living trust. By documenting and assigning ownership of personal property, individuals can ensure that these items are distributed according to their wishes and avoid potential disputes among heirs. 4. Business Interest Notice of Assignment to Living Trust: This form focuses on the transfer of ownership interests in businesses, including sole proprietorship, partnerships, or shares in corporations, to the living trust. By appropriately assigning these interests, business owners can ensure a smooth transition of management and ownership in case of incapacitation or death. It is crucial to consult with a qualified attorney experienced in estate planning and living trusts to draft and execute the Corona California Notice of Assignment to Living Trust that aligns with one's specific circumstances and objectives. Professional guidance will ensure compliance with California state laws and guarantee the efficacy of the living trust in asset management and distribution.