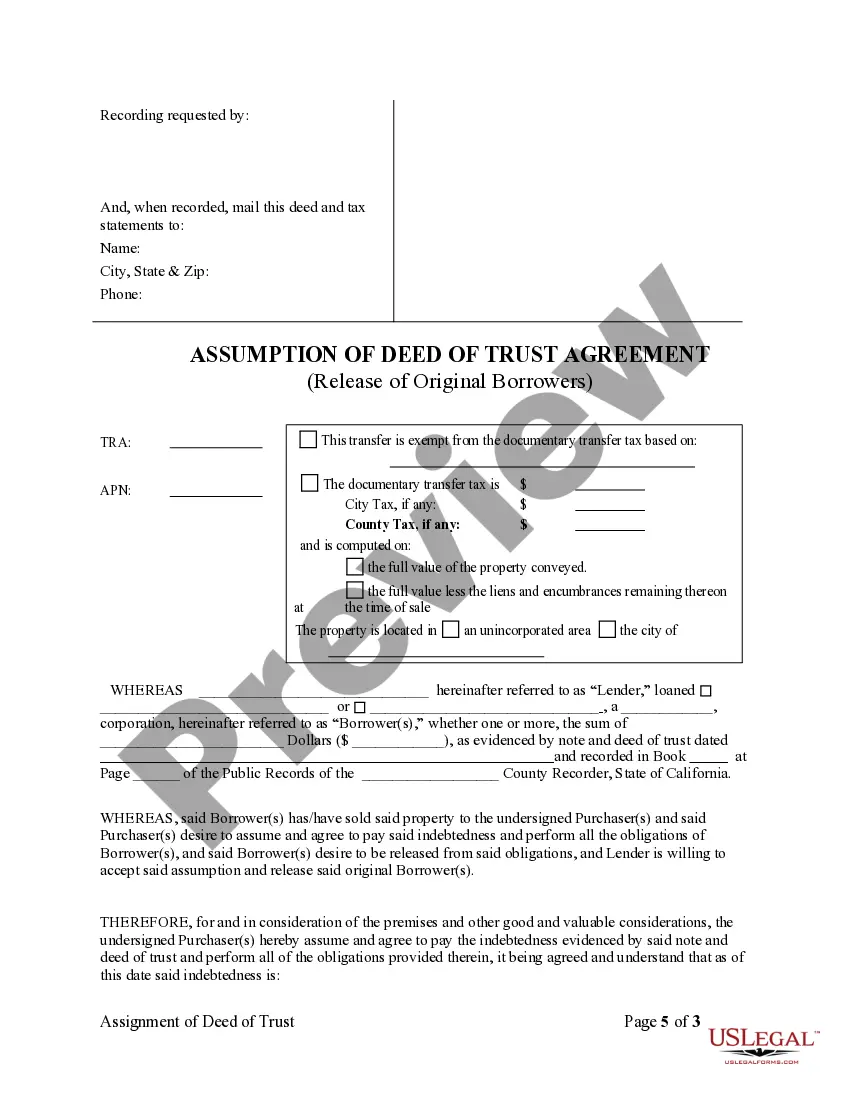

The Anaheim California Assumption Agreement of Deed of Trust and Release of Original Mortgagors is a legal document that pertains to the transfer of a mortgage from the original mortgagor (borrower) to a new party (the assumption). This agreement allows a new individual or entity to take over the existing mortgage on a property in Anaheim, California. The assumption agreement is typically used when the original mortgagor wants to transfer their mortgage responsibilities to a new owner, commonly seen in real estate transactions. The key purpose of the assumption agreement is to protect the lender's interests by ensuring that the new party assumes and agrees to fulfill all the obligations and terms mentioned in the original deed of trust. This typically involves making timely mortgage payments, maintaining homeowner's insurance, paying property taxes, and not violating any terms that could negatively impact the security of the mortgage. There are a few different types of Anaheim California Assumption Agreement of Deed of Trust and Release of Original Mortgagors: 1. Pre-Approved Assumption Agreement: In some cases, the original lender may allow for pre-approved assumptions where a potential buyer can assume the existing mortgage without needing to qualify for a new loan separately. This type of assumption agreement can save time and effort for both the seller and the buyer. 2. Qualifying Assumption Agreement: This type of assumption agreement requires the buyer (assumption) to undergo a qualification process similar to obtaining a new mortgage. The lender will assess the buyer's creditworthiness, income, and other financial factors to ensure they can maintain the mortgage payments. 3. Partial Assumption Agreement: In situations where there is more than one borrow on the original mortgage, a partial assumption agreement can be used to release one or more of the original mortgagors from their obligations. This typically occurs during divorce, separation, or other situations where one party wants to relinquish their responsibility for the mortgage. Regardless of the specific type, an Anaheim California Assumption Agreement of Deed of Trust and Release of Original Mortgagors is a legal contract that must be executed by all parties involved, including the original mortgagor, the assumption, and the lender. It is crucial to consult with legal professionals or experienced professionals in real estate transactions to ensure that the agreement meets all legal requirements in California and adequately protects the interests of all parties involved.

Anaheim California Assumption Agreement of Deed of Trust and Release of Original Mortgagors

Description

How to fill out Anaheim California Assumption Agreement Of Deed Of Trust And Release Of Original Mortgagors?

If you are looking for an applicable form, it’s challenging to select a more suitable location than the US Legal Forms site – likely the most extensive collection available online.

With this collection, you can discover numerous templates for commercial and personal use by category and region, or keywords.

Utilizing our premium search function, obtaining the most current Anaheim California Assumption Agreement of Deed of Trust and Release of Original Mortgagors is as simple as 1-2-3.

Obtain the form. Select the format and download it to your device.

Make adjustments. Complete, alter, print, and sign the acquired Anaheim California Assumption Agreement of Deed of Trust and Release of Original Mortgagors.

- If you are already acquainted with our platform and possess an account, all you need to do to acquire the Anaheim California Assumption Agreement of Deed of Trust and Release of Original Mortgagors is to Log In to your account and select the Download option.

- If you are using US Legal Forms for the very first time, just adhere to the instructions below.

- Ensure you have located the sample you desire. Review its details and use the Preview option to examine its contents. If it does not fulfill your requirements, utilize the Search bar at the top of the page to find the necessary document.

- Confirm your choice. Choose the Buy now option. After that, pick your desired subscription plan and provide the information needed to create an account.

- Complete the transaction. Utilize your credit card or PayPal account to finalize the registration process.

Form popularity

FAQ

: a deed by which a trustee assumes or appoints a new cotrustee.

In consideration of the assumption of the Debtor's Liabilities, the Creditor (a) agrees to look solely to the Assuming Party for the payment and the performance of the Liabilities; and (b) forever releases and discharges the Debtor from the Liabilities.

A Debt Assignment and Assumption Agreement is a very simple document whereby one party assigns their debt to another party, and the other party agrees to take that debt on. The party that is assigning the debt is the original debtor; they are called the assignor.

An assumable mortgage allows someone to find a house they want to buy and take over the seller's existing home loan without applying for a new mortgage. This means the remaining balance, mortgage rate, repayment period and other loan terms stay the same, but the responsibility for the debt is transferred to the buyer.

A letter of assumption is a written agreement between a current homeowner and a prospective buyer. The letter states that the buyer agrees to take over the homeowner's debt in the home in exchange for ownership.

Assuming a mortgage is a financial arrangement between the seller, the seller's lender, and the buyer, and involves transferring the seller's current mortgage to the buyer. As a seller, offering to allow the buyer to assume your mortgage can make your property more attractive.

Assumption and Release means the agreement to be entered into by ADI, the Subsidiary Borrower and the Administrative Agent pursuant to which the Subsidiary Borrower assumes all of the Obligations and becomes the ?Borrower?, in each case for all purposes of this Agreement and the other Loan Documents, and ADI is

Assuming a mortgage makes sense if you are selling your home without buying another. As well, if your current mortgage rate is low, and rates are on the rise, giving your buyer the opportunity to assume your mortgage might make your property that much more attractive.

An assumable mortgage allows someone to find a house they want to buy and take over the seller's existing home loan without applying for a new mortgage. This means the remaining balance, mortgage rate, repayment period and other loan terms stay the same, but the responsibility for the debt is transferred to the buyer.

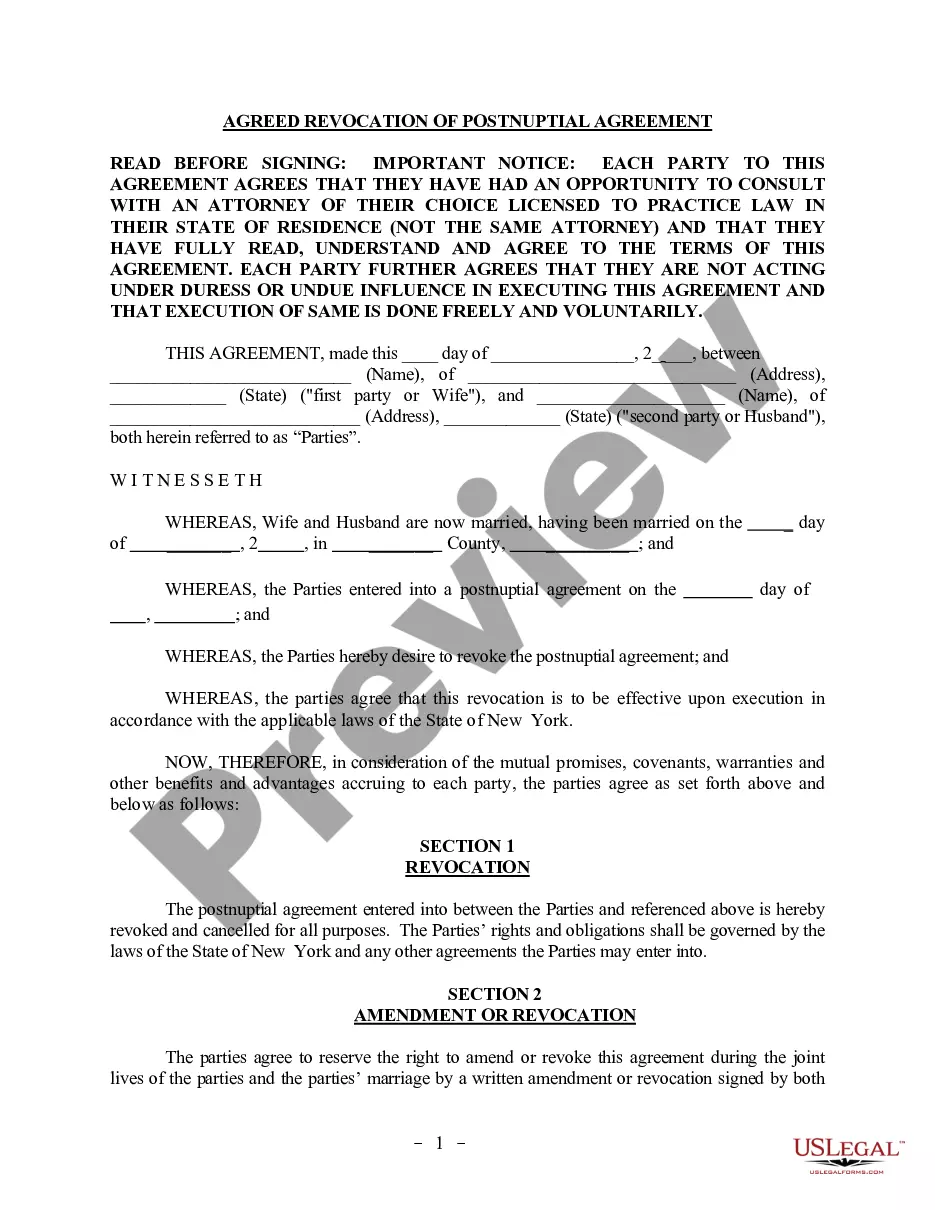

In real estate transactions, an assumption agreement allows a third party to ?assume? or take over the loan of the property's seller. Mortgages may be assumed when the house is sold, a divorcing spouse is awarded the property in a settlement or when someone inherits property.