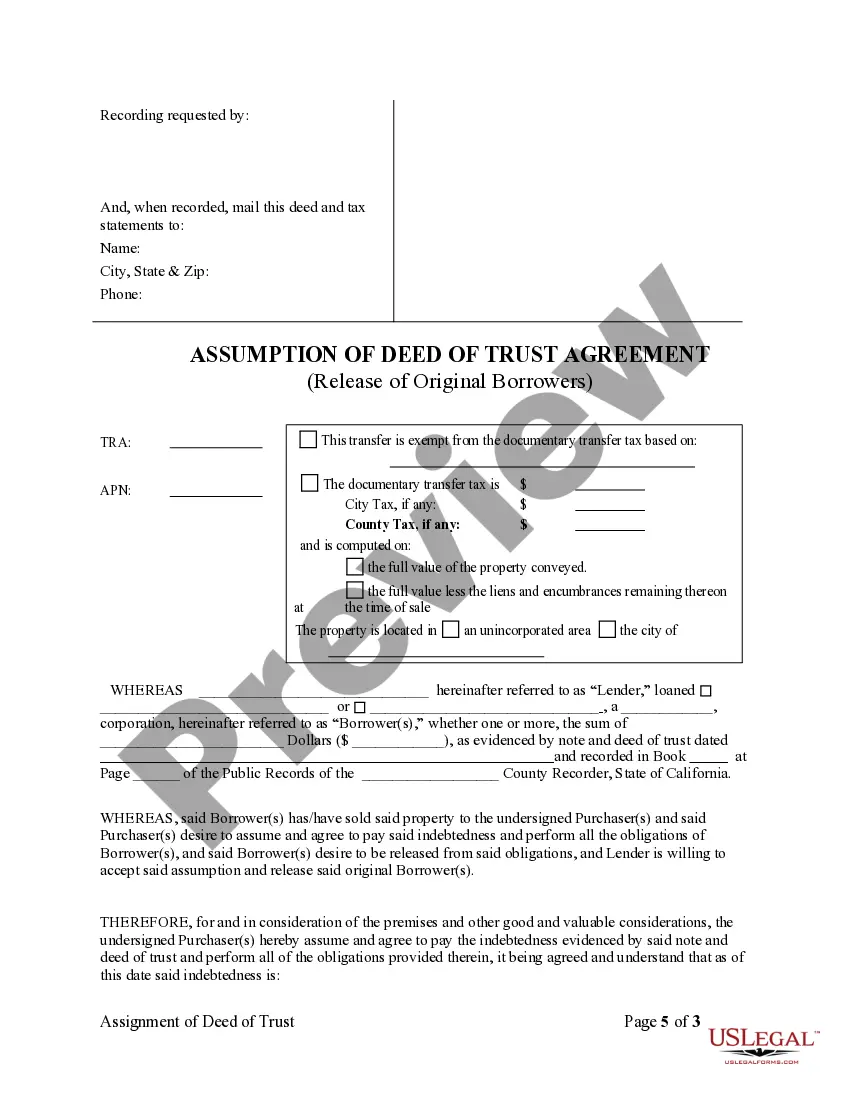

Title: Understanding the Antioch California Assumption Agreement of Deed of Trust and Release of Original Mortgagors — A Comprehensive Overview Keywords: Antioch California Assumption Agreement, Deed of Trust, Release of Original Mortgagors, types, mortgage transfer process, legal obligations, rights and responsibilities Introduction: The Antioch California Assumption Agreement of Deed of Trust and Release of Original Mortgagors is a legally binding document that outlines the transfer of mortgage obligations from the original mortgagors to a new party. This agreement plays a crucial role in real estate transactions, ensuring a smooth transfer of ownership and the assumption of all associated responsibilities. In this article, we will provide a detailed description of this agreement, its significance, and explore any potential variations it may have. What is the Antioch California Assumption Agreement of Deed of Trust and Release of Original Mortgagors? The Antioch California Assumption Agreement of Deed of Trust and Release of Original Mortgagors is a legal contract that permits the existing mortgagors to assign their mortgage debt to a new individual or entity (the assumption) while releasing themselves from any liability towards the mortgage. This agreement is commonly used when a property is sold or transferred, allowing the assumption to assume the mortgage and become the new debtor. Types of Antioch California Assumption Agreement of Deed of Trust and Release of Original Mortgagors: 1. Full Assumption Agreement: In a full assumption agreement, the assumption takes over the mortgage debt entirely, becoming solely responsible for repayment and assuming all rights and obligations associated with the original mortgage contract. The original mortgagors are fully released from any responsibility. 2. Partial Assumption Agreement: Under a partial assumption agreement, the assumption assumes a portion of the mortgage debt, usually in conjunction with the original mortgagors. This type of agreement allows for shared responsibility for mortgage payments, with the original mortgagors still retaining some liability. Key Components of the Assumption Agreement: 1. Parties Involved: The agreement identifies the original mortgagors, the assumption, and any other relevant parties involved in the transaction. 2. Terms of the Assumption: This section outlines the terms and conditions of the mortgage assumption, including the principal amount, interest rate, repayment period, and any agreed-upon modifications. 3. Release of Liability: The agreement specifies the release of the original mortgagors from any future obligations, effectively transferring all mortgage-related responsibilities to the assumption. 4. Consent from Lender: To ensure the validity of the assumption, the agreement seeks the lender's consent. The lender's approval is crucial, as they must agree to transfer the mortgage to the assumption. Conclusion: The Antioch California Assumption Agreement of Deed of Trust and Release of Original Mortgagors is a vital legal document in real estate transactions. It facilitates the transfer of mortgage obligations from the original mortgagors to a new individual or entity, ensuring a seamless transition of ownership. Whether it is a full or partial assumption agreement, this agreement plays a significant role in clarifying the rights and responsibilities of all parties involved and protects the interests of the assumption and the original mortgagors alike.

Antioch California Assumption Agreement of Deed of Trust and Release of Original Mortgagors

Description

How to fill out Antioch California Assumption Agreement Of Deed Of Trust And Release Of Original Mortgagors?

Regardless of social or professional status, filling out legal forms is an unfortunate necessity in today’s professional environment. Too often, it’s practically impossible for a person without any legal background to create this sort of papers cfrom the ground up, mostly due to the convoluted terminology and legal nuances they involve. This is where US Legal Forms comes in handy. Our service offers a huge catalog with over 85,000 ready-to-use state-specific forms that work for almost any legal situation. US Legal Forms also is an excellent asset for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI tpapers.

Whether you need the Antioch California Assumption Agreement of Deed of Trust and Release of Original Mortgagors or any other document that will be valid in your state or county, with US Legal Forms, everything is on hand. Here’s how you can get the Antioch California Assumption Agreement of Deed of Trust and Release of Original Mortgagors in minutes using our trusted service. In case you are already a subscriber, you can proceed to log in to your account to get the needed form.

Nevertheless, in case you are unfamiliar with our library, make sure to follow these steps before obtaining the Antioch California Assumption Agreement of Deed of Trust and Release of Original Mortgagors:

- Be sure the form you have chosen is specific to your area because the rules of one state or county do not work for another state or county.

- Preview the form and read a brief description (if available) of scenarios the paper can be used for.

- In case the form you picked doesn’t suit your needs, you can start again and search for the needed form.

- Click Buy now and choose the subscription option that suits you the best.

- Access an account {using your login information or create one from scratch.

- Pick the payment method and proceed to download the Antioch California Assumption Agreement of Deed of Trust and Release of Original Mortgagors as soon as the payment is through.

You’re good to go! Now you can proceed to print out the form or fill it out online. Should you have any issues getting your purchased forms, you can easily find them in the My Forms tab.

Whatever situation you’re trying to sort out, US Legal Forms has got you covered. Give it a try today and see for yourself.

Form popularity

FAQ

The Trustee in a Deed of Trust is the party who holds legal title to the property during the life of the loan. Trustees will most often have one of two jobs. If the property is sold before the loan is paid off, the Trustee will use the proceeds from the sale to pay the lender any outstanding portion of the loan.

In consideration of the assumption of the Debtor's Liabilities, the Creditor (a) agrees to look solely to the Assuming Party for the payment and the performance of the Liabilities; and (b) forever releases and discharges the Debtor from the Liabilities.

You're limited to the current lender ? If you'd like to assume a mortgage, you must still apply for the loan and meet all of the lender's requirements as if the loan were newly originated. Without the lender's consent, the assumption cannot happen.

An assumable mortgage allows someone to find a house they want to buy and take over the seller's existing home loan without applying for a new mortgage. This means the remaining balance, mortgage rate, repayment period and other loan terms stay the same, but the responsibility for the debt is transferred to the buyer.

How much does a loan assumption cost? You'll have to pay closing costs on a loan assumption, which are typically 2-5% of the loan amount. But some of those may be capped. And you're unlikely to need a new appraisal.

Assumption and Release means the agreement to be entered into by ADI, the Subsidiary Borrower and the Administrative Agent pursuant to which the Subsidiary Borrower assumes all of the Obligations and becomes the ?Borrower?, in each case for all purposes of this Agreement and the other Loan Documents, and ADI is

Assumption agreements are prepared by the existing lender of record with their knowledge and approval, and they are signed by the buyer during escrow. Sometimes, the seller is also required to sign the assumption agreement in order to fully release them from any responsibility.

In real estate transactions, an assumption agreement allows a third party to ?assume? or take over the loan of the property's seller. Mortgages may be assumed when the house is sold, a divorcing spouse is awarded the property in a settlement or when someone inherits property.