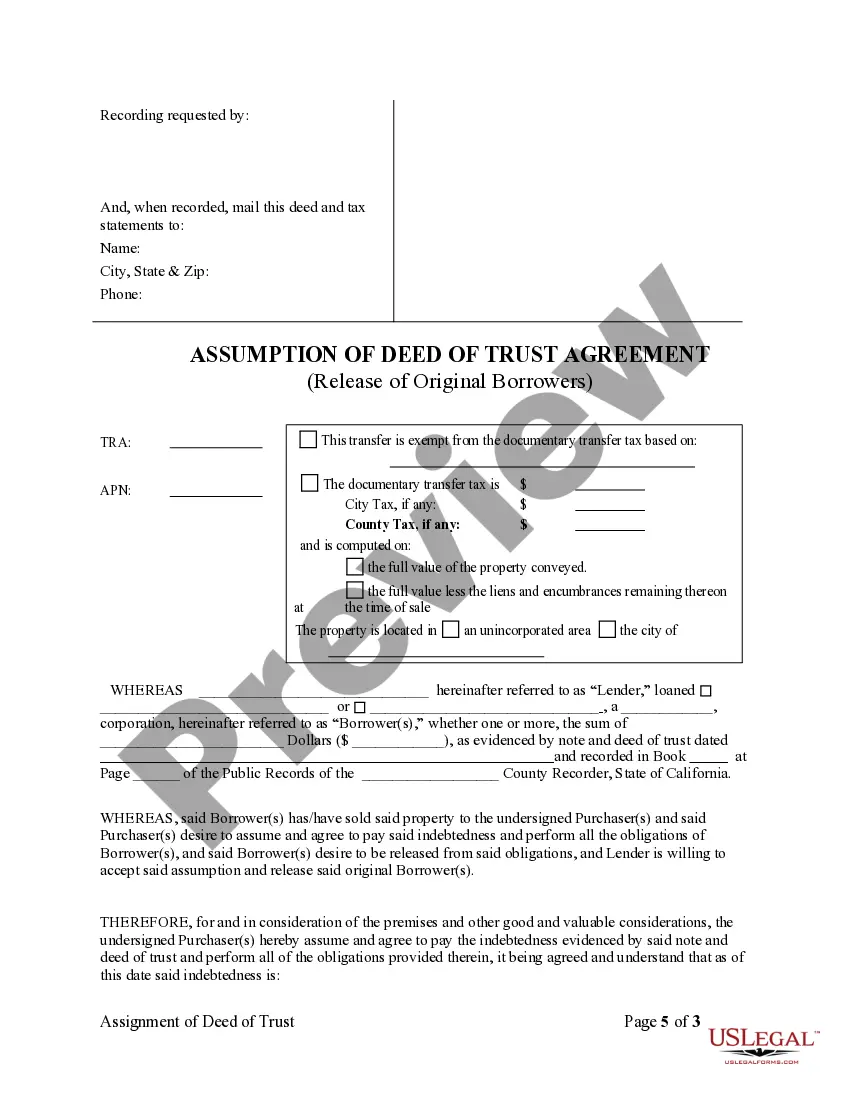

The Bakersfield California Assumption Agreement of Deed of Trust and Release of Original Mortgagors is a legal document that facilitates the transfer of ownership of a property subject to an existing mortgage. In this agreement, the original mortgagor (the borrower) releases their rights and obligations under the mortgage, allowing a new buyer (the assumption) to assume the loan and become the new borrower. This document is essential when a property is sold, and the buyer intends to assume the existing mortgage instead of obtaining new financing. There are different types of Bakersfield California Assumption Agreement of Deed of Trust and Release of Original Mortgagors based on the specific circumstances. Some variations may include: 1. Voluntary Assumption Agreement: This type of agreement occurs when the original mortgagor willingly transfers their mortgage obligations to a new buyer. It requires the consent of the lender and typically involves creditworthiness evaluation of the assumption. 2. Non-Assumption Agreement: In this scenario, the original mortgagor wishes to sell the property but does not want the buyer to assume their mortgage. Instead, the original loan must be paid off in full before the property can be transferred. 3. Novation Agreement: This type of assumption agreement may be used when the sale of the property involves a change in the original mortgage terms, such as adjusting the interest rate or extending the loan term. A novation agreement allows the new buyer to assume the mortgage with the updated terms, often requiring lender approval. 4. Partial Assumption Agreement: In some cases, the original mortgagor may seek to transfer only a portion of their obligations under the mortgage to the new buyer. This occurs when the property being sold is part of a larger property covered by the mortgage, and the original borrower retains ownership of the remaining parcel. The Bakersfield California Assumption Agreement of Deed of Trust and Release of Original Mortgagors protects the rights and interests of all parties involved—the original mortgagor, the new buyer, and the lender. It typically includes clauses related to the terms of the assumption, the responsibilities of the new buyer, any financial arrangements between parties, and the release of liability for the original mortgagor.

Bakersfield California Assumption Agreement of Deed of Trust and Release of Original Mortgagors

Description

How to fill out Bakersfield California Assumption Agreement Of Deed Of Trust And Release Of Original Mortgagors?

No matter the social or professional status, filling out law-related documents is an unfortunate necessity in today’s professional environment. Too often, it’s virtually impossible for someone with no legal education to draft this sort of papers cfrom the ground up, mostly because of the convoluted terminology and legal nuances they entail. This is where US Legal Forms comes to the rescue. Our platform provides a massive catalog with more than 85,000 ready-to-use state-specific documents that work for practically any legal scenario. US Legal Forms also serves as a great resource for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI forms.

No matter if you require the Bakersfield California Assumption Agreement of Deed of Trust and Release of Original Mortgagors or any other document that will be good in your state or area, with US Legal Forms, everything is at your fingertips. Here’s how to get the Bakersfield California Assumption Agreement of Deed of Trust and Release of Original Mortgagors quickly using our trusted platform. In case you are presently a subscriber, you can go on and log in to your account to download the needed form.

Nevertheless, in case you are a novice to our platform, ensure that you follow these steps prior to obtaining the Bakersfield California Assumption Agreement of Deed of Trust and Release of Original Mortgagors:

- Be sure the template you have chosen is suitable for your location since the regulations of one state or area do not work for another state or area.

- Review the form and go through a brief description (if provided) of scenarios the document can be used for.

- In case the form you selected doesn’t meet your requirements, you can start over and look for the necessary document.

- Click Buy now and pick the subscription plan you prefer the best.

- with your login information or create one from scratch.

- Choose the payment method and proceed to download the Bakersfield California Assumption Agreement of Deed of Trust and Release of Original Mortgagors once the payment is done.

You’re good to go! Now you can go on and print out the form or fill it out online. In case you have any issues locating your purchased documents, you can quickly access them in the My Forms tab.

Whatever case you’re trying to sort out, US Legal Forms has got you covered. Give it a try now and see for yourself.