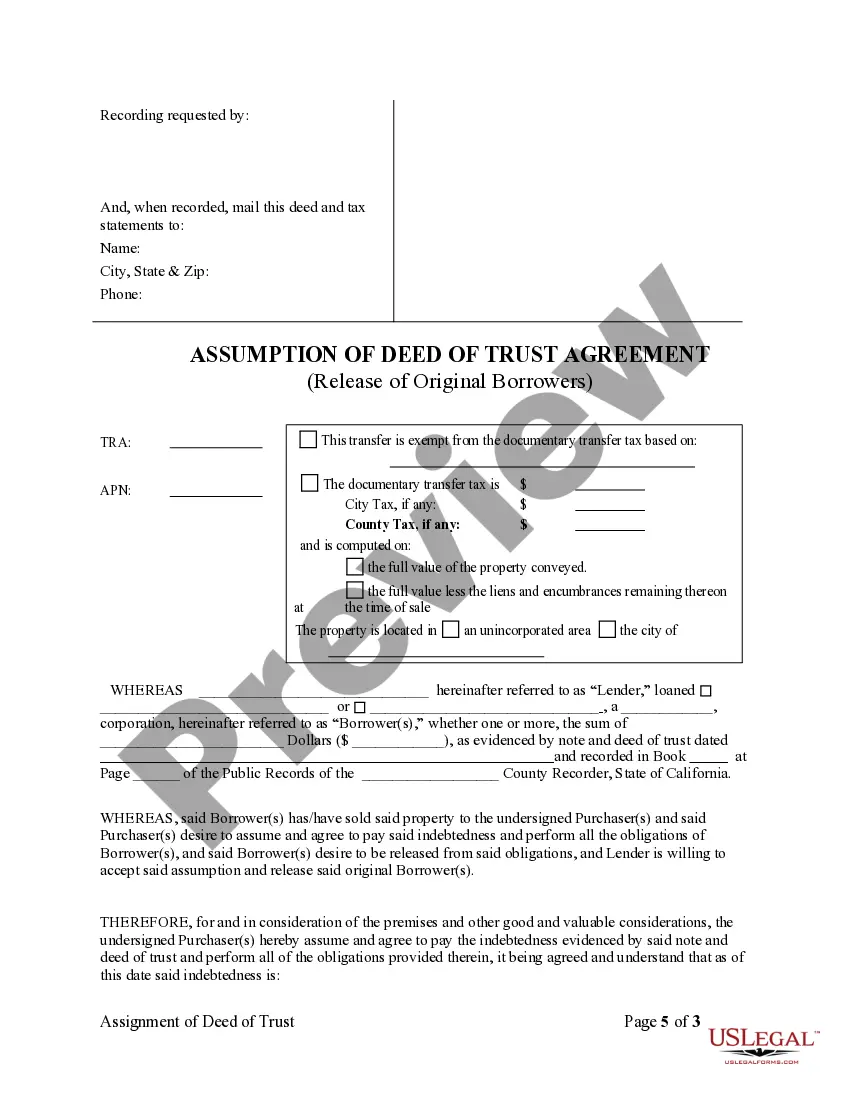

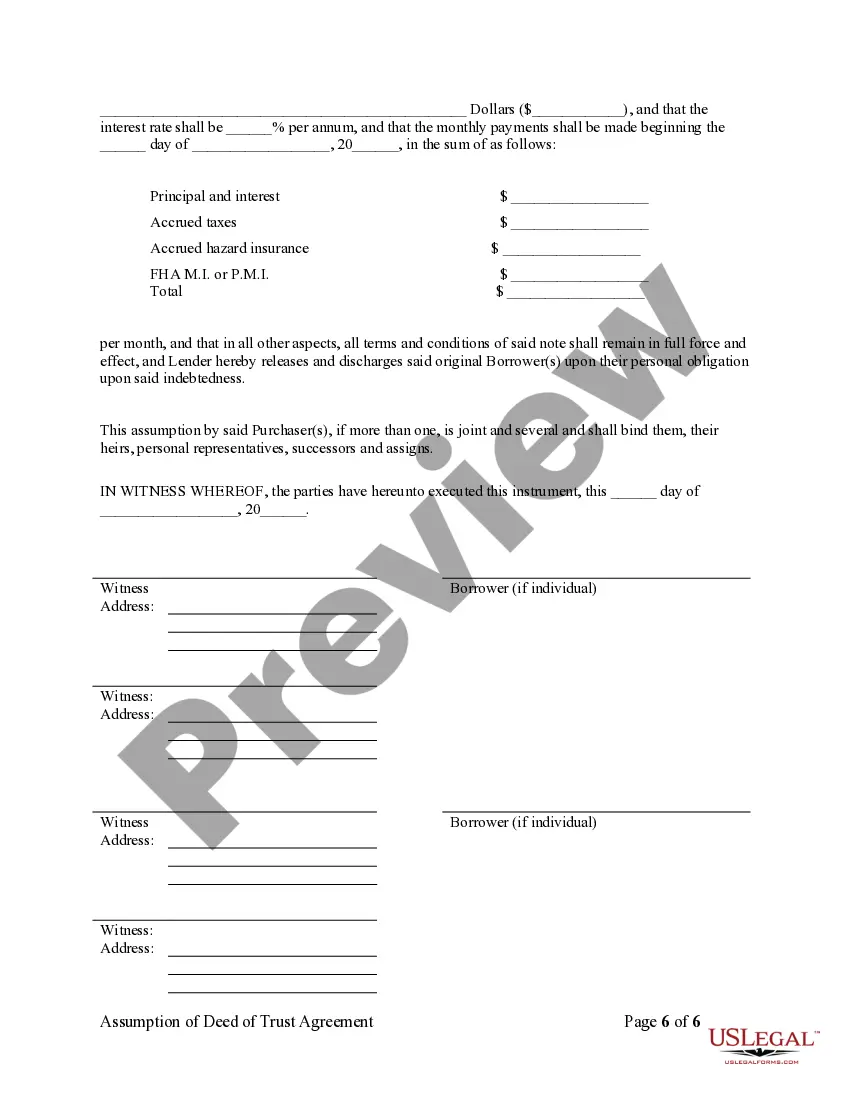

Clovis California Assumption Agreement of Deed of Trust and Release of Original Mortgagors is a legal document outlining the process of transferring a mortgage to a new borrower and releasing the original mortgagors from their obligations. This agreement allows for the assumption of an existing mortgage by a new individual or entity, relieving the original borrowers from their responsibility while allowing the new borrower to take over the mortgage terms. Keywords: Clovis California, assumption agreement, deed of trust, release of original mortgagors, legal document, transferring mortgage, new borrower, obligations, existing mortgage, assumption, terms. There are different types of Clovis California Assumption Agreement of Deed of Trust and Release of Original Mortgagors depending on the specific conditions and parties involved: 1. Partial Assumption Agreement: This type of agreement occurs when one or more original mortgagors wish to be released from their obligations, while the remaining party or parties agree to assume the responsibility for the mortgage. 2. Complete Assumption Agreement: In this situation, the original mortgagors are fully released from their obligations, and a new borrower assumes the entire mortgage, including all terms and conditions set forth in the original deed of trust. 3. Commercial Assumption Agreement: This type of assumption agreement pertains to commercial properties, such as office buildings, retail spaces, or industrial facilities. It involves the transfer of a mortgage and the release of original mortgagors in a commercial real estate context. 4. Residential Assumption Agreement: Specifically designed for residential properties, this type of assumption agreement enables the transfer of a mortgage on a home or residential property, allowing the original mortgagors to be released from their obligations while the new borrower assumes the mortgage. In conclusion, the Clovis California Assumption Agreement of Deed of Trust and Release of Original Mortgagors is a legal document that facilitates the transfer of a mortgage and eliminates the obligations of the original debtors. It is crucial for individuals or entities involved in such transactions to understand the terms and conditions outlined in the agreement to ensure a smooth transfer of ownership and mortgage responsibility.

Clovis California Assumption Agreement of Deed of Trust and Release of Original Mortgagors

Description

How to fill out Clovis California Assumption Agreement Of Deed Of Trust And Release Of Original Mortgagors?

Take advantage of the US Legal Forms and get instant access to any form template you want. Our helpful website with thousands of document templates simplifies the way to find and get almost any document sample you require. You can save, complete, and sign the Clovis California Assumption Agreement of Deed of Trust and Release of Original Mortgagors in just a matter of minutes instead of surfing the Net for many hours attempting to find a proper template.

Using our collection is a superb strategy to improve the safety of your record filing. Our professional lawyers on a regular basis review all the documents to ensure that the forms are appropriate for a particular state and compliant with new laws and regulations.

How can you get the Clovis California Assumption Agreement of Deed of Trust and Release of Original Mortgagors? If you already have a profile, just log in to the account. The Download button will appear on all the samples you look at. Additionally, you can get all the previously saved records in the My Forms menu.

If you haven’t registered an account yet, follow the instruction below:

- Open the page with the form you need. Ensure that it is the template you were seeking: examine its headline and description, and utilize the Preview feature when it is available. Otherwise, use the Search field to find the appropriate one.

- Start the saving procedure. Click Buy Now and select the pricing plan you like. Then, sign up for an account and process your order using a credit card or PayPal.

- Export the document. Select the format to get the Clovis California Assumption Agreement of Deed of Trust and Release of Original Mortgagors and modify and complete, or sign it according to your requirements.

US Legal Forms is one of the most considerable and trustworthy form libraries on the web. Our company is always happy to help you in any legal process, even if it is just downloading the Clovis California Assumption Agreement of Deed of Trust and Release of Original Mortgagors.

Feel free to take full advantage of our form catalog and make your document experience as straightforward as possible!

Form popularity

FAQ

One disadvantage of a deed of trust is that the borrower may face limited rights compared to those provided by a traditional mortgage. For instance, in some cases, the borrower could be foreclosed upon with less notice. It is crucial to understand the terms of a Clovis California Assumption Agreement of Deed of Trust and Release of Original Mortgagors fully, as these agreements can vary and carry specific implications for both borrowers and lenders.

Using a deed of trust can provide simpler and faster foreclosure options, which benefits lenders and buyers alike. This type of agreement often appeals to those seeking a clearer title transfer process. The Clovis California Assumption Agreement of Deed of Trust and Release of Original Mortgagors exemplifies how this legal instrument can simplify real estate transactions while ensuring protection for all parties involved.

Yes, assumption agreements do get recorded, ensuring that all parties involved are legally protected. Recording the agreement in Clovis, California, provides public notice of the transfer of obligations from one party to another. This makes the Assumption Agreement of Deed of Trust and Release of Original Mortgagors an essential document to maintain transparency and safeguard interests in real estate transactions.

Lenders often prefer a deed of trust because it allows for a quicker and more efficient foreclosure process. Unlike traditional mortgages, a deed of trust involves a third-party trustee who can act swiftly in the event of default. This setup minimizes legal complexities, making it easier for lenders in Clovis, California, to manage their investment through an Assumption Agreement of Deed of Trust and Release of Original Mortgagors.

To release a deed of trust, the lender must provide a formal release document, often called a 'deed of release,' which states that the borrower has fulfilled their obligations. This document must then be recorded with the county clerk's office to formally remove the lien from your property. In Clovis, California, understanding the Assumption Agreement of Deed of Trust and Release of Original Mortgagors can help streamline this process and ensure all legal aspects are addressed accurately.

You can access your trust deed by visiting the county recorder's office where it was recorded. Many counties also offer online databases, allowing you to search for your trust deed using your name or property address. For convenience, USLegalForms offers tools that can help you navigate this process for the Clovis California Assumption Agreement of Deed of Trust and Release of Original Mortgagors.

To obtain a copy of your deed of trust in California, you can visit your county recorder's office where the deed was filed. Additionally, you can check online resources or request the document through mail. If you want an efficient solution, consider using the USLegalForms platform, which provides templates and guidance specific to the Clovis California Assumption Agreement of Deed of Trust and Release of Original Mortgagors.

Filing a deed of trust is generally the responsibility of the trustee or the attorney handling the transaction. They ensure that the document is properly recorded with the county recorder's office to establish the lender's security interest in the property. This step is crucial in a Clovis California Assumption Agreement of Deed of Trust and Release of Original Mortgagors, as it provides public notice of the financial interest in the property.

Typically, a title company or a real estate attorney handles the deed of trust process. These professionals ensure that all legal requirements are met and that the documentation is accurately prepared. When dealing with a Clovis California Assumption Agreement of Deed of Trust and Release of Original Mortgagors, their expertise helps prevent errors and ensures a smooth transaction.