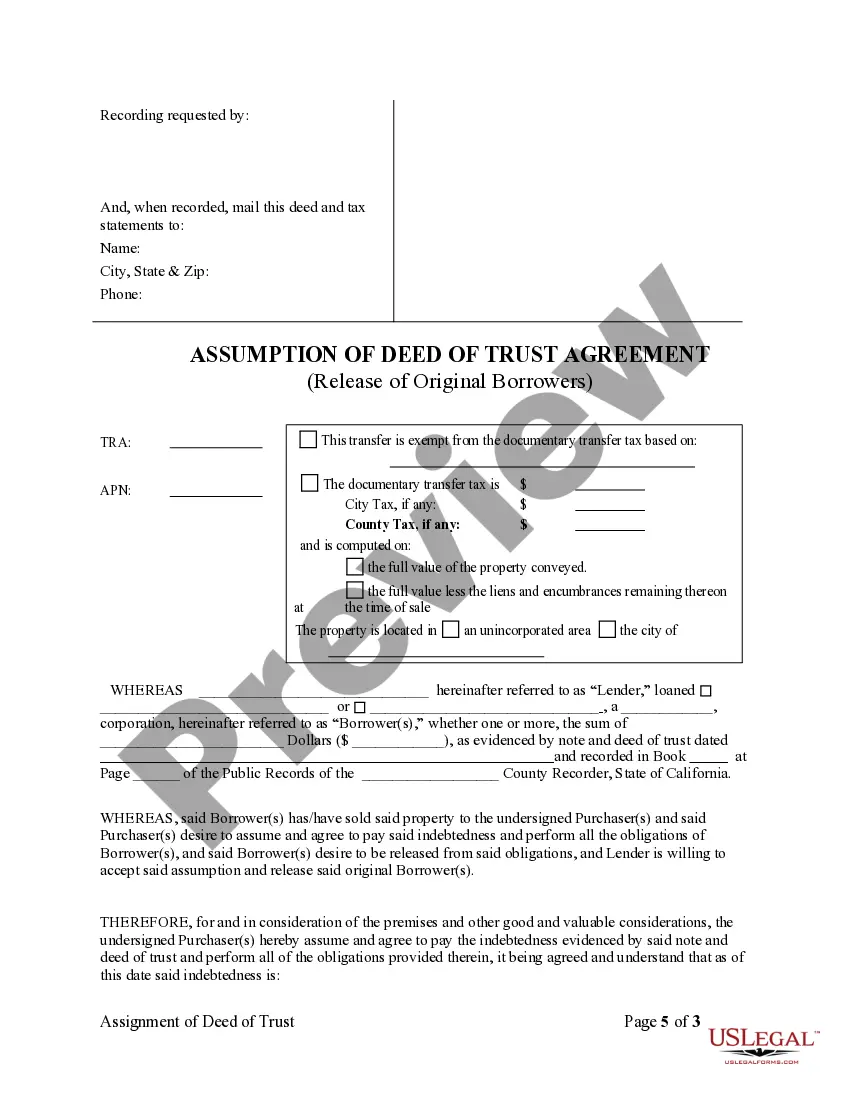

The Daly City California Assumption Agreement of Deed of Trust and Release of Original Mortgagors is a legal document that outlines the terms and conditions when transferring ownership and responsibility of a property from the original mortgagors to new buyers or assumptions. This agreement serves as a crucial component in real estate transactions, particularly when the original mortgagors can no longer fulfill their financial obligations or wish to transfer the property to someone else. By executing the Assumption Agreement of Deed of Trust and Release of Original Mortgagors, the assumptions become responsible for the mortgage payments and gain ownership rights. The Daly City California Assumption Agreement of Deed of Trust and Release of Original Mortgagors typically includes several key provisions and relevant information, such as: 1. Parties involved: The agreement clearly identifies the original mortgagors (the sellers) and the assumptions (the buyers). It also mentions the lender, who holds the original mortgage on the property. 2. Property details: The agreement includes a detailed description of the property being transferred, such as the address, legal description, and parcel number. 3. Assumption terms: This section outlines the terms for assuming the mortgage, including the assumption's agreement to take over the existing loan balance, interest rates, and repayment terms. It may also mention any additional costs or fees involved in the assumption process. 4. Release of original mortgagors: The agreement clarifies that upon the successful execution of the assumption, the original mortgagors are released from any further liability or obligation related to the mortgage. 5. Lender's consent: The agreement highlights the requirement for obtaining the lender's written consent for the assumption. This consent is essential to ensure that the lender recognizes the assumption as the new responsible party. 6. Indemnification clause: To protect both parties, this clause states that the original mortgagors will indemnify and hold the assumptions harmless from any claims or actions related to the mortgage occurring prior to the assumption. 7. Other provisions: Depending on the specific circumstances and requirements, additional clauses may be included, such as provisions for default, foreclosure, transfer taxes, or any local regulations specific to Daly City, California. Different types of Assumption Agreement of Deed of Trust and Release of Original Mortgagors in Daly City, California may vary slightly, depending on individual circumstances or unique requirements. However, the fundamental purpose of these agreements remains the same, which is to facilitate the transfer of ownership and liability from the original mortgagors to new buyers or assumptions.

Daly City California Assumption Agreement of Deed of Trust and Release of Original Mortgagors

Description

How to fill out Daly City California Assumption Agreement Of Deed Of Trust And Release Of Original Mortgagors?

We always strive to minimize or prevent legal issues when dealing with nuanced law-related or financial matters. To do so, we sign up for legal solutions that, as a rule, are very expensive. However, not all legal matters are equally complex. Most of them can be dealt with by ourselves.

US Legal Forms is an online collection of up-to-date DIY legal forms addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your matters into your own hands without the need of using services of legal counsel. We provide access to legal form templates that aren’t always publicly available. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to find and download the Daly City California Assumption Agreement of Deed of Trust and Release of Original Mortgagors or any other form quickly and safely. Simply log in to your account and click the Get button next to it. In case you lose the document, you can always re-download it in the My Forms tab.

The process is just as effortless if you’re unfamiliar with the platform! You can create your account within minutes.

- Make sure to check if the Daly City California Assumption Agreement of Deed of Trust and Release of Original Mortgagors complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you check out the form’s description (if available), and if you notice any discrepancies with what you were looking for in the first place, search for a different form.

- As soon as you’ve ensured that the Daly City California Assumption Agreement of Deed of Trust and Release of Original Mortgagors is suitable for your case, you can pick the subscription plan and make a payment.

- Then you can download the document in any suitable format.

For more than 24 years of our presence on the market, we’ve served millions of people by offering ready to customize and up-to-date legal forms. Take advantage of US Legal Forms now to save time and resources!