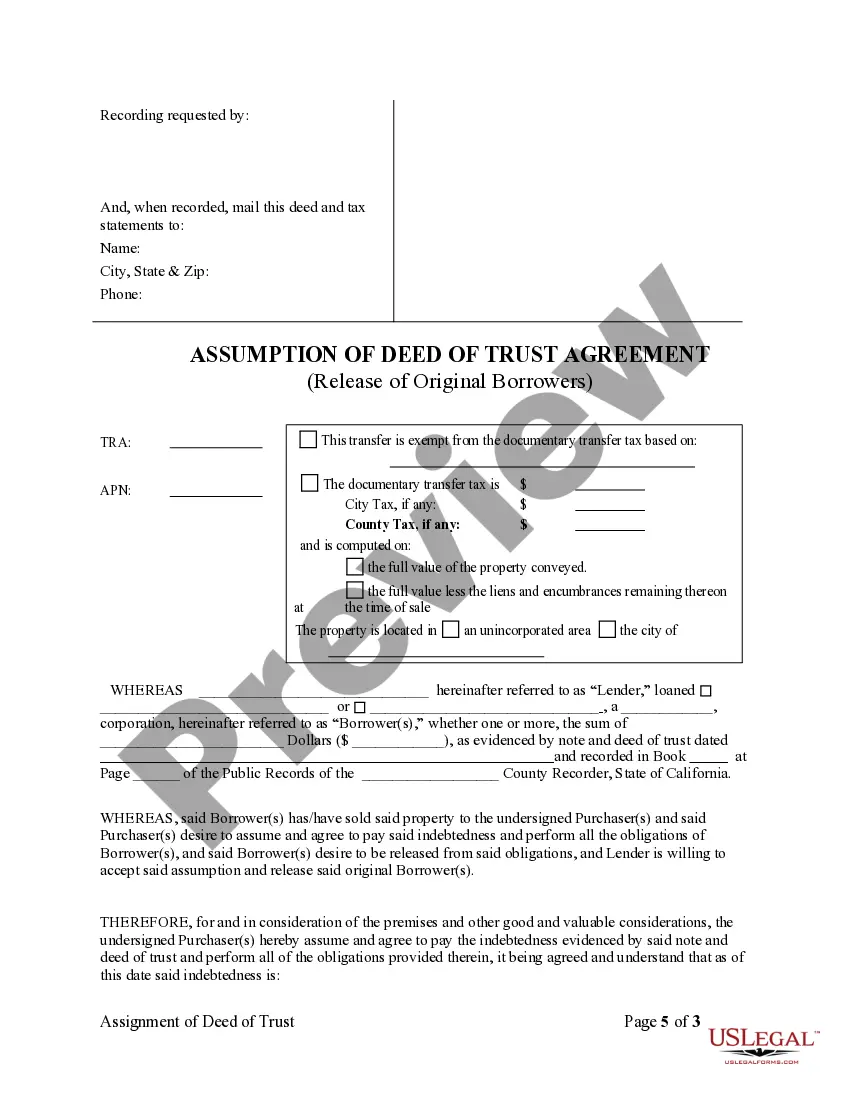

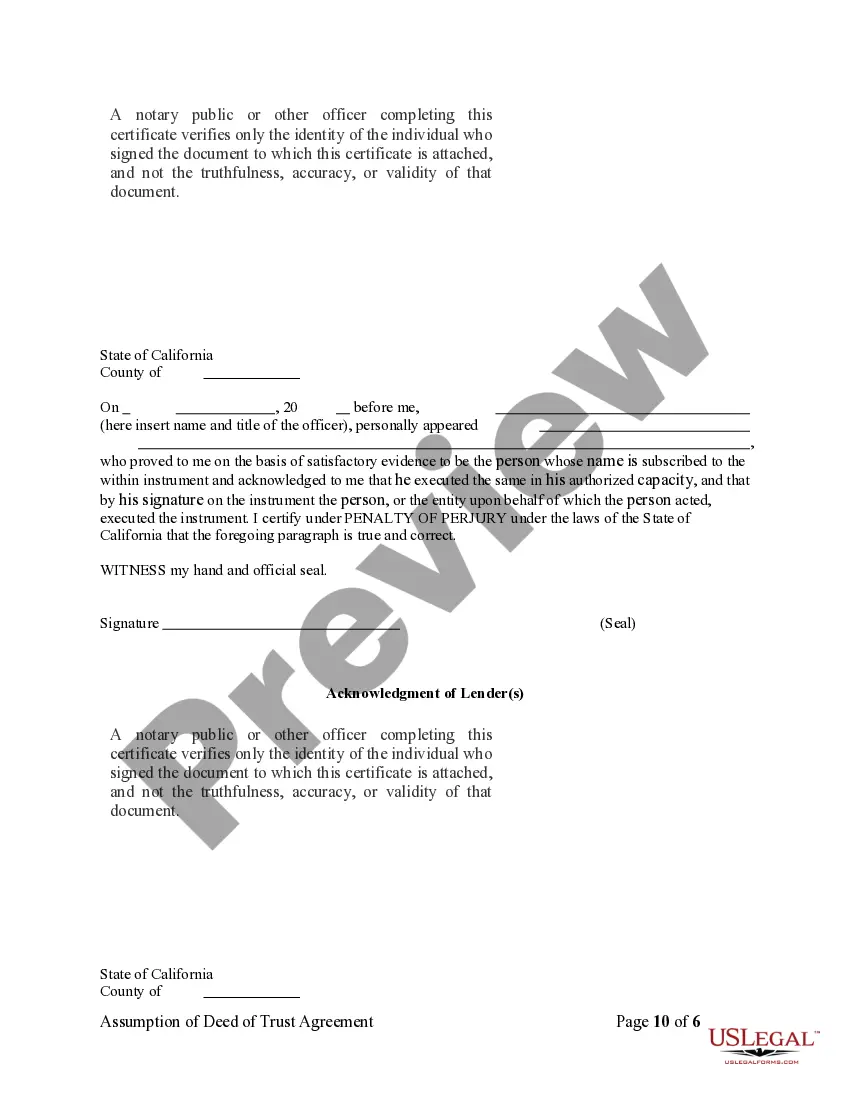

Irvine California Assumption Agreement of Deed of Trust and Release of Original Mortgagors: A Detailed Explanation The Irvine California Assumption Agreement of Deed of Trust and Release of Original Mortgagors is a legal document that outlines the terms and conditions for the transfer of a mortgage from the original borrower (mortgagor) to a new borrower (assumption). This agreement plays a crucial role in facilitating the assumption of a mortgage by a new party, while releasing the original mortgagors from their obligations. In Irvine, California, there are two primary types of Assumption Agreement of Deed of Trust and Release of Original Mortgagors: 1. Full Assumption Agreement: This type of agreement involves a complete transfer of the mortgage from the original mortgagors to the assumption. Under a full assumption, the assumption becomes solely responsible for the mortgage payments, adherence to the original mortgage terms, and any associated liabilities. The original mortgagors are effectively released from their obligations, freeing them from future liability and involvement in the mortgage. 2. Qualified Assumption Agreement: Unlike a full assumption, a qualified assumption agreement allows the original mortgagor to retain some level of liability for the mortgage. In this scenario, both the original mortgagor and the assumption become jointly and severally liable for the mortgage obligations. This means that if the assumption defaults on the payments, the lender has the right to pursue both parties for any outstanding debts. Key Features of the Irvine California Assumption Agreement of Deed of Trust and Release of Original Mortgagors: 1. Principal Terms: The agreement outlines the principal amount of the mortgage, the interest rate, and the original terms of the loan. These terms are critical as they form the basis for the assumption and subsequent repayment. 2. Release of Original Mortgagors: The agreement clearly stipulates the release of the original mortgagors from any further obligations related to the mortgage. This ensures that they are no longer liable for any future payments or repercussions arising from the mortgage. 3. Responsibilities of the Assumption: The agreement details the responsibilities and obligations of the assumption. This includes making timely payments, maintaining the property, paying property taxes and insurance, and adhering to any other conditions specified in the original mortgage. 4. Lender's Consent: The agreement typically requires the lender's consent before the assumption can take place. This is because the lender must vet the assumption's financial capabilities and determine their eligibility to assume the mortgage. 5. Consequences of Default: The agreement highlights the consequences of default by the assumption. If the assumption fails to meet their obligations, the lender has the right to foreclose on the property and pursue legal action against both the assumption and the original mortgagor, if applicable. In conclusion, the Irvine California Assumption Agreement of Deed of Trust and Release of Original Mortgagors is a legally binding document that enables the transfer of a mortgage from the original mortgagor to a new assumption. This agreement brings about significant changes in the liability and responsibility for mortgage repayments, ensuring a smooth transition while safeguarding the interests of all parties involved.

Irvine California Assumption Agreement of Deed of Trust and Release of Original Mortgagors

Description

How to fill out Irvine California Assumption Agreement Of Deed Of Trust And Release Of Original Mortgagors?

If you are searching for a relevant form template, it’s extremely hard to find a more convenient place than the US Legal Forms site – probably the most comprehensive online libraries. With this library, you can get a large number of templates for organization and individual purposes by types and regions, or keywords. With the advanced search option, getting the newest Irvine California Assumption Agreement of Deed of Trust and Release of Original Mortgagors is as elementary as 1-2-3. Moreover, the relevance of each and every file is proved by a team of professional attorneys that regularly check the templates on our platform and update them in accordance with the newest state and county demands.

If you already know about our platform and have a registered account, all you need to get the Irvine California Assumption Agreement of Deed of Trust and Release of Original Mortgagors is to log in to your profile and click the Download option.

If you utilize US Legal Forms for the first time, just refer to the instructions below:

- Make sure you have chosen the form you want. Look at its information and make use of the Preview option (if available) to check its content. If it doesn’t meet your requirements, utilize the Search field near the top of the screen to find the needed file.

- Affirm your choice. Click the Buy now option. Following that, choose your preferred subscription plan and provide credentials to register an account.

- Process the financial transaction. Use your credit card or PayPal account to complete the registration procedure.

- Get the template. Pick the format and save it to your system.

- Make modifications. Fill out, revise, print, and sign the acquired Irvine California Assumption Agreement of Deed of Trust and Release of Original Mortgagors.

Each and every template you save in your profile does not have an expiration date and is yours forever. You can easily gain access to them using the My Forms menu, so if you want to get an additional copy for modifying or printing, you may come back and download it once again whenever you want.

Take advantage of the US Legal Forms professional library to get access to the Irvine California Assumption Agreement of Deed of Trust and Release of Original Mortgagors you were seeking and a large number of other professional and state-specific samples on a single platform!