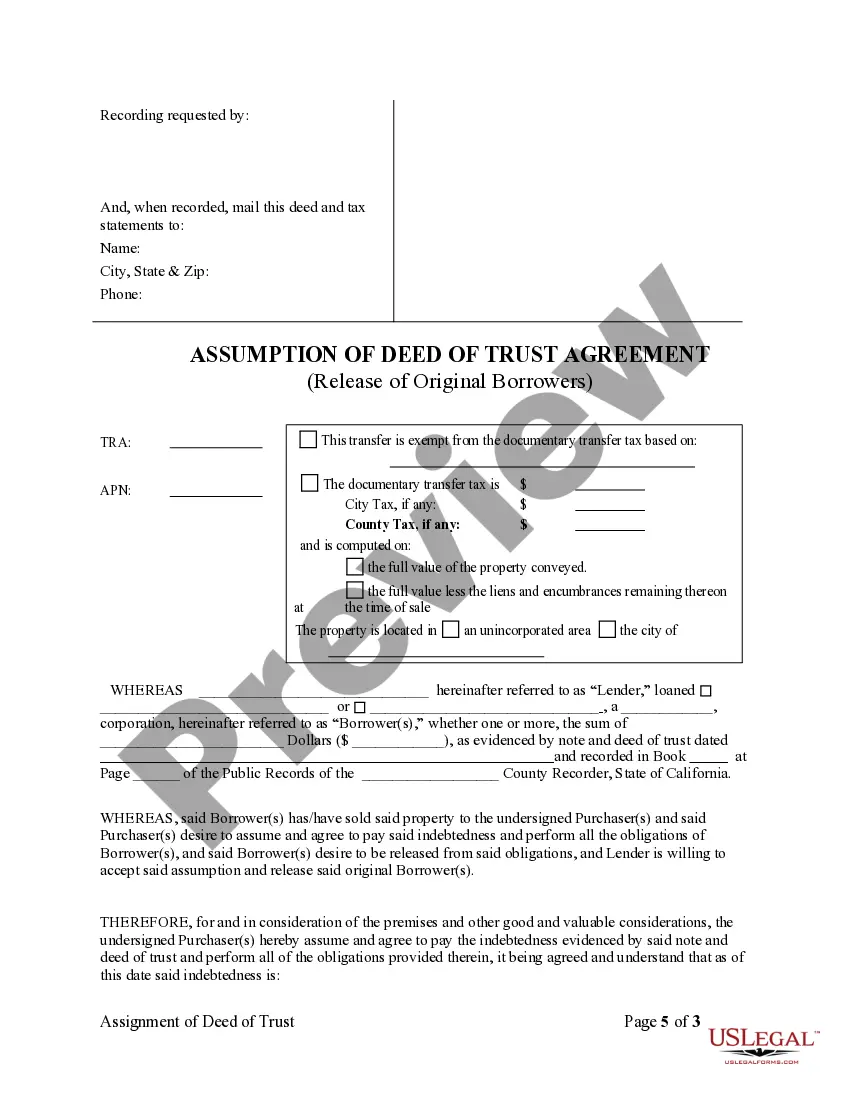

Los Angeles California Assumption Agreement of Deed of Trust and Release of Original Mortgagors is a legal document that outlines the transfer of responsibility for a mortgage loan from the original borrowers (mortgagors) to a new individual or entity (the assumption). This agreement is executed when the mortgagors wish to transfer their obligations and rights under the original mortgage to a new party, relieving themselves of any further liability. The purpose of the Assumption Agreement is to formally release the original mortgagors from their obligations and transfer the responsibility for loan repayment to the assumption. The agreement typically includes pertinent details such as the names and addresses of the original mortgagors, the assumption, and the lender, as well as the original loan amount, interest rate, and repayment terms. In Los Angeles, California, there are several types of Assumption Agreements of Deed of Trust and Release of Original Mortgagors, each differing based on specific circumstances: 1. Residential Assumption Agreement: This type of agreement is commonly used when residential properties are being transferred to new owners. It typically involves the assumption of a mortgage by the buyer, allowing the original mortgagors to be released from their mortgage obligations. 2. Commercial Assumption Agreement: When commercial properties are involved, this type of agreement comes into play. It allows for the assumption of a commercial mortgage by a new party, thus transferring the liability and ownership of the property. 3. Assumption Agreement with Novation: In some cases, an assumption agreement is accompanied by a novation, which refers to the substitution of an old party with a new one. This occurs when both the original mortgagors and the lender agree to substitute the assumption as the new debtor under the mortgage agreement. It is important to note that the Assumption Agreement of Deed of Trust and Release of Original Mortgagors in Los Angeles, California, must comply with the state's real estate laws and regulations. Parties involved should consult with legal professionals to ensure they navigate the process correctly and protect their interests.

Los Angeles California Assumption Agreement of Deed of Trust and Release of Original Mortgagors

Description

How to fill out Los Angeles California Assumption Agreement Of Deed Of Trust And Release Of Original Mortgagors?

Take advantage of the US Legal Forms and get immediate access to any form you need. Our helpful website with thousands of documents simplifies the way to find and obtain virtually any document sample you need. You can export, complete, and sign the Los Angeles California Assumption Agreement of Deed of Trust and Release of Original Mortgagors in just a couple of minutes instead of surfing the Net for hours attempting to find an appropriate template.

Using our collection is a great strategy to raise the safety of your form filing. Our professional lawyers regularly check all the records to make sure that the templates are appropriate for a particular state and compliant with new acts and regulations.

How do you get the Los Angeles California Assumption Agreement of Deed of Trust and Release of Original Mortgagors? If you already have a profile, just log in to the account. The Download option will appear on all the samples you look at. Additionally, you can get all the previously saved files in the My Forms menu.

If you haven’t registered a profile yet, stick to the instructions below:

- Open the page with the template you require. Make sure that it is the template you were looking for: verify its title and description, and take take advantage of the Preview function when it is available. Otherwise, make use of the Search field to find the appropriate one.

- Start the saving procedure. Select Buy Now and choose the pricing plan that suits you best. Then, sign up for an account and pay for your order utilizing a credit card or PayPal.

- Export the file. Indicate the format to get the Los Angeles California Assumption Agreement of Deed of Trust and Release of Original Mortgagors and change and complete, or sign it according to your requirements.

US Legal Forms is probably the most significant and trustworthy template libraries on the web. We are always happy to assist you in virtually any legal case, even if it is just downloading the Los Angeles California Assumption Agreement of Deed of Trust and Release of Original Mortgagors.

Feel free to benefit from our platform and make your document experience as straightforward as possible!

Form popularity

FAQ

Assumption and Release means the agreement to be entered into by ADI, the Subsidiary Borrower and the Administrative Agent pursuant to which the Subsidiary Borrower assumes all of the Obligations and becomes the ?Borrower?, in each case for all purposes of this Agreement and the other Loan Documents, and ADI is

Assumption agreements are prepared by the existing lender of record with their knowledge and approval, and they are signed by the buyer during escrow. Sometimes, the seller is also required to sign the assumption agreement in order to fully release them from any responsibility.

An assumption clause is a provision in a mortgage contract that allows the seller of a home to pass responsibility for the existing mortgage to the buyer of the property. In other words, the new homeowner assumes the existing mortgage and?along with it?ownership of the property that secures the loan.

You're limited to the current lender ? If you'd like to assume a mortgage, you must still apply for the loan and meet all of the lender's requirements as if the loan were newly originated. Without the lender's consent, the assumption cannot happen.

How much does a loan assumption cost? You'll have to pay closing costs on a loan assumption, which are typically 2-5% of the loan amount. But some of those may be capped. And you're unlikely to need a new appraisal.

An assumable mortgage allows someone to find a house they want to buy and take over the seller's existing home loan without applying for a new mortgage. This means the remaining balance, mortgage rate, repayment period and other loan terms stay the same, but the responsibility for the debt is transferred to the buyer.

In consideration of the assumption of the Debtor's Liabilities, the Creditor (a) agrees to look solely to the Assuming Party for the payment and the performance of the Liabilities; and (b) forever releases and discharges the Debtor from the Liabilities.

In real estate transactions, an assumption agreement allows a third party to ?assume? or take over the loan of the property's seller. Mortgages may be assumed when the house is sold, a divorcing spouse is awarded the property in a settlement or when someone inherits property.