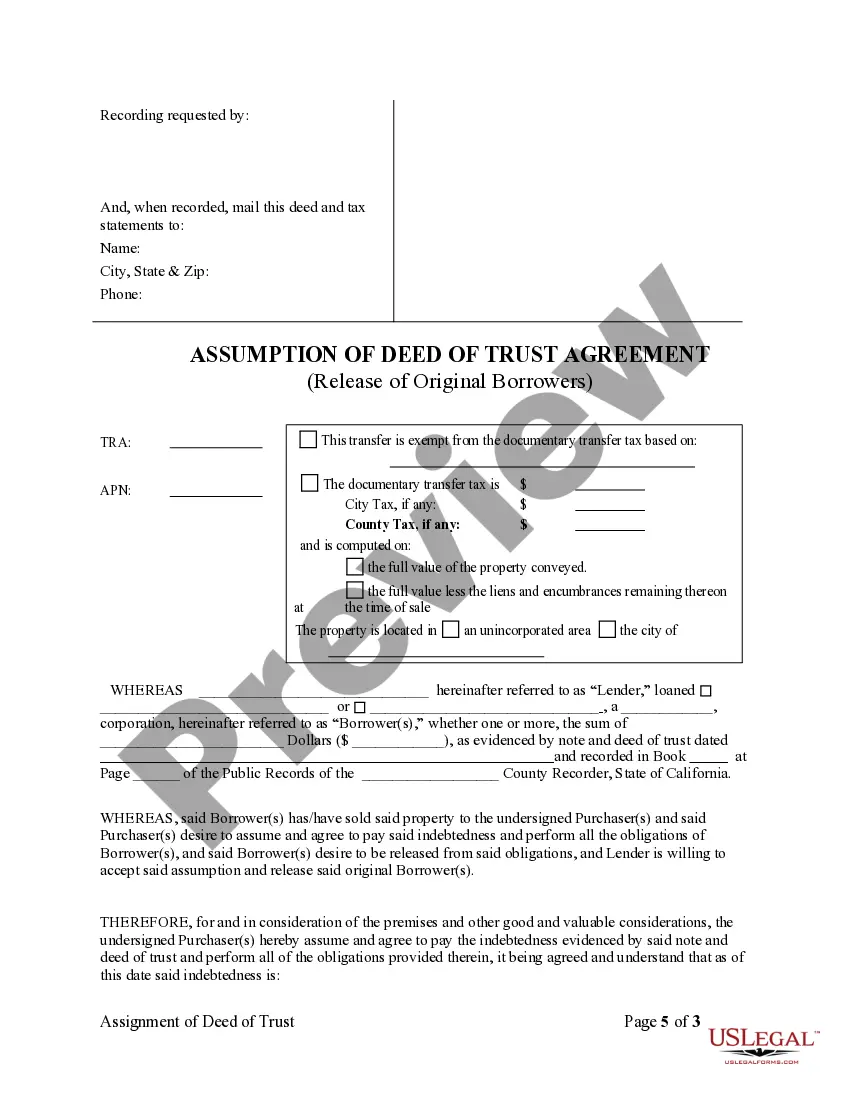

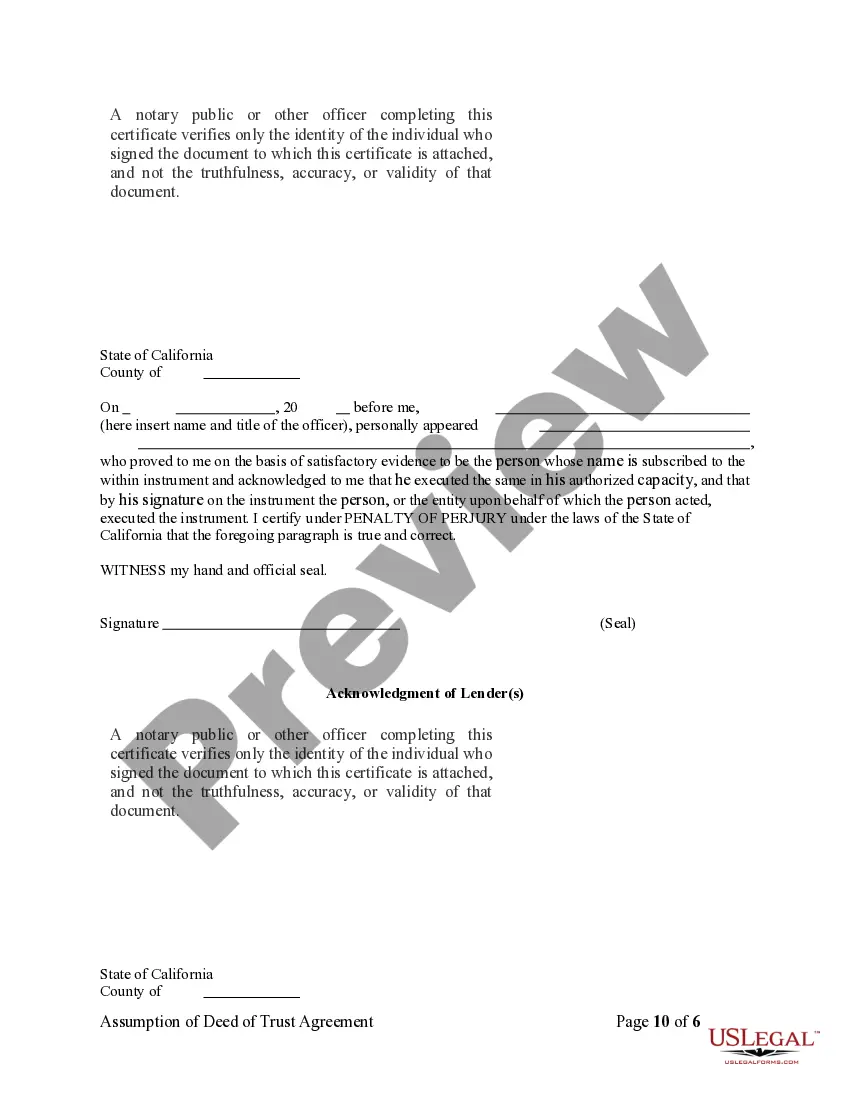

The Norwalk California Assumption Agreement of Deed of Trust and Release of Original Mortgagors is a legal document that outlines the transfer of a mortgage from one party to another in Norwalk, California. It serves as a binding agreement between the original mortgagors, the new borrowers, and the lender involved in the transaction. This agreement is crucial for those who want to assume an existing mortgage and release the original borrowers from their obligations. In Norwalk, California, there are two main types of Assumption Agreement of Deed of Trust and Release of Original Mortgagors that are commonly utilized: 1. Full Assumption Agreement: This type of agreement occurs when the new borrower wants to fully take over the existing mortgage, assuming all the rights and responsibilities associated with it. In this case, the original mortgagors are completely released from the mortgage obligation, and the new borrower becomes solely responsible for repaying the outstanding loan. 2. Partial Assumption Agreement: In some situations, the new borrower may wish to assume only a portion of the original mortgage. This could involve assuming a specific principal amount or a specific duration of the loan. In such cases, the original mortgagors would still remain partially responsible for the remaining loan balance, while the new borrower assumes responsibility for the agreed-upon portion. The Norwalk California Assumption Agreement of Deed of Trust and Release of Original Mortgagors typically contains several key components. Firstly, it includes the identification details of all parties involved, such as their names, addresses, and contact information. Additionally, it provides a comprehensive description of the original mortgage, including the loan amount, interest rate, repayment terms, and any existing liens or encumbrances on the property. The agreement also outlines the terms and conditions of the assumption, including the responsibilities of the new borrower regarding loan repayment, property maintenance, and compliance with local laws and regulations. It specifies the rights and obligations of the original mortgagors during and after the assumption process, ensuring their release from any further liability once the transfer is complete. Furthermore, the Norwalk California Assumption Agreement includes provisions related to the lender's consent and approval of the assumption. This ensures that the lender agrees to transfer the mortgage to the new borrower and that they consent to release the original mortgagors from their obligations. In conclusion, the Norwalk California Assumption Agreement of Deed of Trust and Release of Original Mortgagors is an essential legal document used when transferring an existing mortgage from one party to another. Understanding the different types and components of this agreement is crucial for those involved in Norwalk's real estate market to ensure a smooth and legally binding mortgage assumption process.

Norwalk California Assumption Agreement of Deed of Trust and Release of Original Mortgagors

Description

How to fill out Norwalk California Assumption Agreement Of Deed Of Trust And Release Of Original Mortgagors?

No matter what social or professional status, completing legal documents is an unfortunate necessity in today’s professional environment. Very often, it’s practically impossible for a person without any legal education to create such paperwork from scratch, mostly due to the convoluted jargon and legal subtleties they involve. This is where US Legal Forms comes in handy. Our service provides a huge collection with over 85,000 ready-to-use state-specific documents that work for pretty much any legal scenario. US Legal Forms also serves as an excellent asset for associates or legal counsels who want to to be more efficient time-wise using our DYI tpapers.

No matter if you require the Norwalk California Assumption Agreement of Deed of Trust and Release of Original Mortgagors or any other document that will be valid in your state or area, with US Legal Forms, everything is on hand. Here’s how you can get the Norwalk California Assumption Agreement of Deed of Trust and Release of Original Mortgagors quickly using our trusted service. If you are presently an existing customer, you can go on and log in to your account to download the needed form.

However, in case you are a novice to our library, make sure to follow these steps prior to downloading the Norwalk California Assumption Agreement of Deed of Trust and Release of Original Mortgagors:

- Ensure the form you have found is suitable for your area considering that the regulations of one state or area do not work for another state or area.

- Review the document and read a quick description (if provided) of scenarios the paper can be used for.

- If the one you picked doesn’t meet your needs, you can start over and search for the suitable form.

- Click Buy now and choose the subscription option that suits you the best.

- Log in to your account credentials or register for one from scratch.

- Select the payment method and proceed to download the Norwalk California Assumption Agreement of Deed of Trust and Release of Original Mortgagors as soon as the payment is completed.

You’re all set! Now you can go on and print the document or complete it online. Should you have any issues getting your purchased documents, you can quickly access them in the My Forms tab.

Regardless of what situation you’re trying to sort out, US Legal Forms has got you covered. Give it a try today and see for yourself.