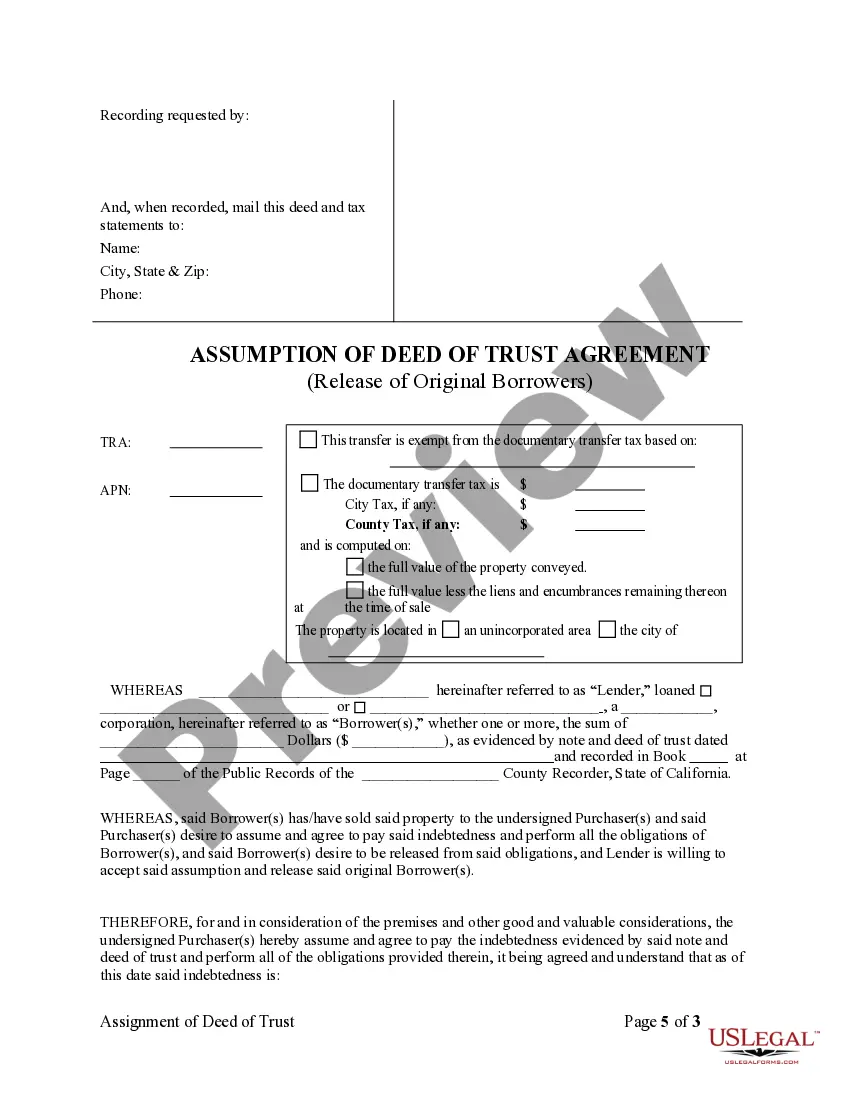

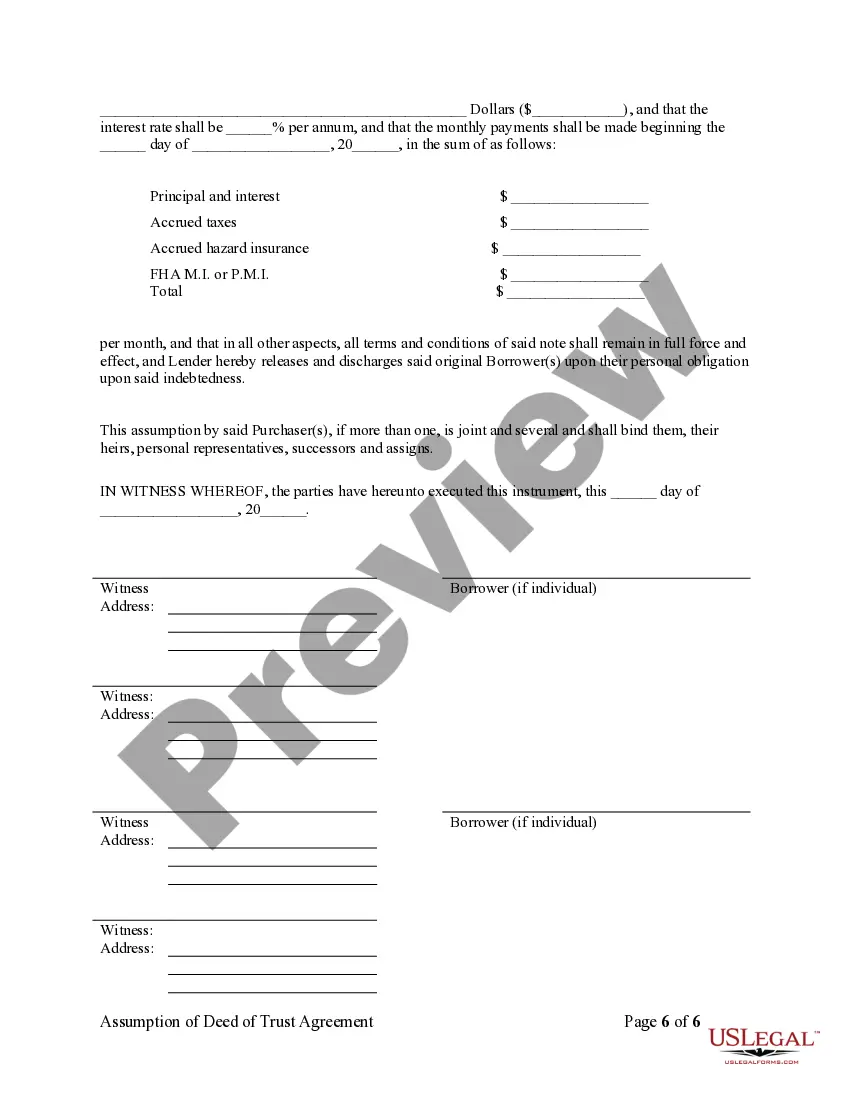

San Bernardino California Assumption Agreement of Deed of Trust and Release of Original Mortgagors is a legal document pertaining to the transfer of a mortgaged property in San Bernardino, California. This agreement allows a new borrower (the "assuming party") to take on the responsibilities and liabilities of the original borrower (the "original mortgagor") under the terms of the existing deed of trust and mortgage. In essence, this agreement provides a legal framework for a property transfer without requiring the full repayment of the existing mortgage. The assuming party agrees to assume all obligations outlined in the original deed of trust, including making timely mortgage payments, maintaining homeowner's insurance, and fulfilling any other conditions set forth in the agreement. The San Bernardino California Assumption Agreement of Deed of Trust and Release of Original Mortgagors establishes a contractual relationship between the assuming party, the original lender, and any other relevant parties involved in the mortgage transaction. It ensures that the assuming party acknowledges and consents to the terms and conditions of the original mortgage, while formally releasing the original mortgagor from any future obligations or liabilities. There can be different types of San Bernardino California Assumption Agreement of Deed of Trust and Release of Original Mortgagors, including: 1. Full Assumption Agreement: Under this type of agreement, the assuming party assumes all obligations and liabilities of the original borrower, including the repayment of the full outstanding loan balance and any interest accrued. 2. Partial Assumption Agreement: In this case, the assuming party only assumes part of the obligations and liabilities of the original borrower, typically based on a predetermined agreed-upon amount, while the original mortgagor remains partially responsible for the remaining balance. 3. Subject-To Assumption Agreement: This form of assumption agreement allows the assuming party to take over the property with the existing mortgage in place, without formally assuming the liability for the loan. The original mortgagor remains financially responsible for the mortgage, and any default by the assuming party may impact the original mortgagor's credit and financial standing. Overall, the San Bernardino California Assumption Agreement of Deed of Trust and Release of Original Mortgagors facilitates the transfer of a mortgaged property while ensuring that all parties involved are aware of their rights, obligations, and liabilities. It provides a clear and legally binding framework to protect the interests of both the assuming party and the lending institution.

San Bernardino California Assumption Agreement of Deed of Trust and Release of Original Mortgagors

Description

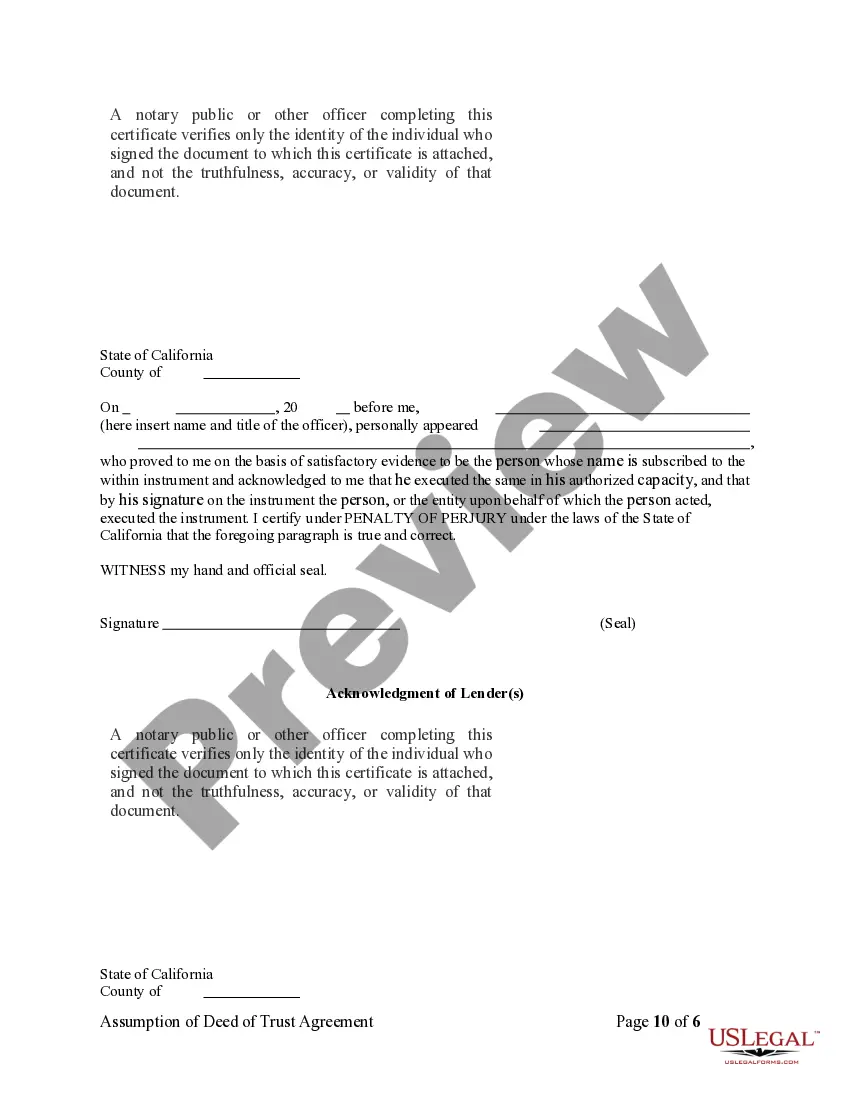

How to fill out San Bernardino California Assumption Agreement Of Deed Of Trust And Release Of Original Mortgagors?

If you’ve already utilized our service before, log in to your account and download the San Bernardino California Assumption Agreement of Deed of Trust and Release of Original Mortgagors on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple actions to obtain your document:

- Ensure you’ve located an appropriate document. Look through the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t fit you, use the Search tab above to get the proper one.

- Buy the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Obtain your San Bernardino California Assumption Agreement of Deed of Trust and Release of Original Mortgagors. Pick the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to each piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to rapidly locate and save any template for your individual or professional needs!

Form popularity

FAQ

Can a declaration of trust be challenged? The intention of a declaration of trust is to ensure that there is no dispute or ambiguity in regards to the distribution of financial investment in property, but a dispute is still possible.

In consideration of the assumption of the Debtor's Liabilities, the Creditor (a) agrees to look solely to the Assuming Party for the payment and the performance of the Liabilities; and (b) forever releases and discharges the Debtor from the Liabilities.

Assumption and Release means the agreement to be entered into by ADI, the Subsidiary Borrower and the Administrative Agent pursuant to which the Subsidiary Borrower assumes all of the Obligations and becomes the ?Borrower?, in each case for all purposes of this Agreement and the other Loan Documents, and ADI is

Keep in mind that the average loan assumption takes anywhere from 45-90 days to complete. The more issues there are with underwriting, the longer you'll have to wait to finalize your agreement. Do yourself a favor and get the necessary criteria organized in advance.

Some of the most common reasons trusts are invalid include: Legal formalities were not followed when executing the trust instrument. The trust was created or modified through forgery or another type of fraud.

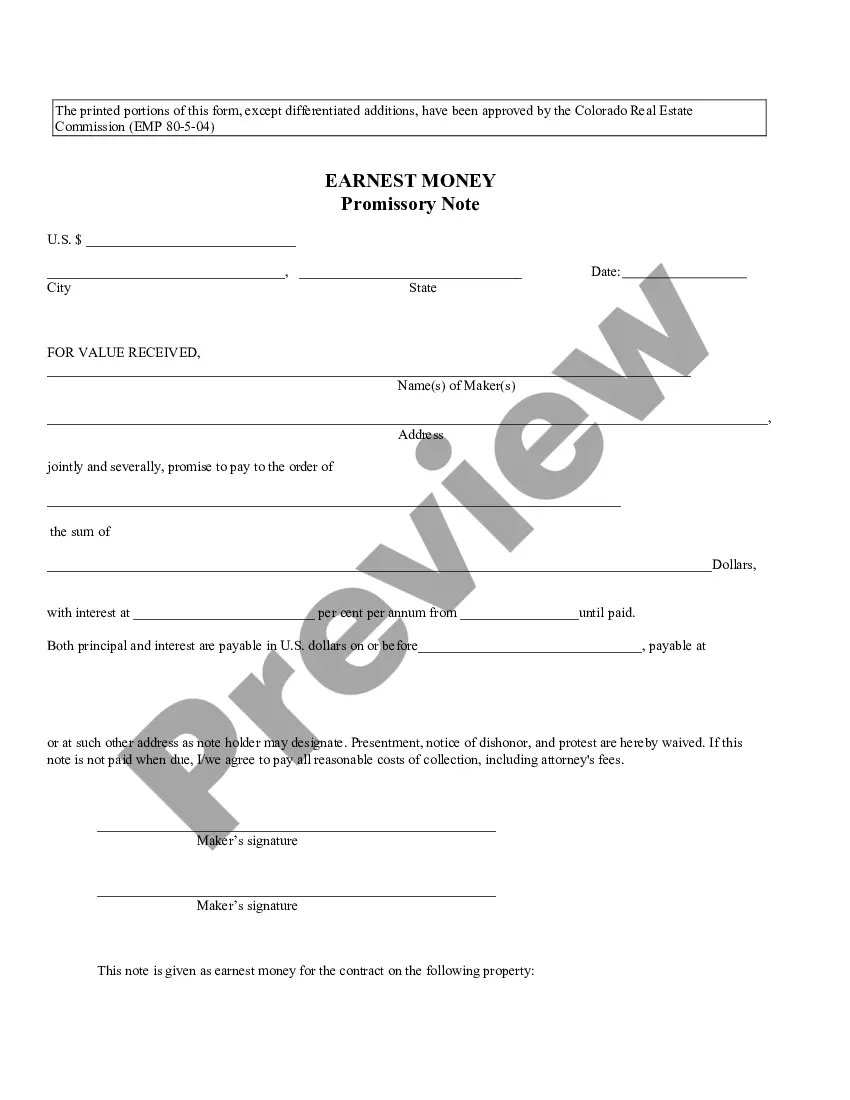

In real estate transactions, an assumption agreement allows a third party to ?assume? or take over the loan of the property's seller. Mortgages may be assumed when the house is sold, a divorcing spouse is awarded the property in a settlement or when someone inherits property.

Assumption agreements are prepared by the existing lender of record with their knowledge and approval, and they are signed by the buyer during escrow. Sometimes, the seller is also required to sign the assumption agreement in order to fully release them from any responsibility.

California law states that a trust is created only if: The settlor properly manifests an intention to create a trust; There is trust property; and. There is a beneficiary (unless it is a charitable trust).

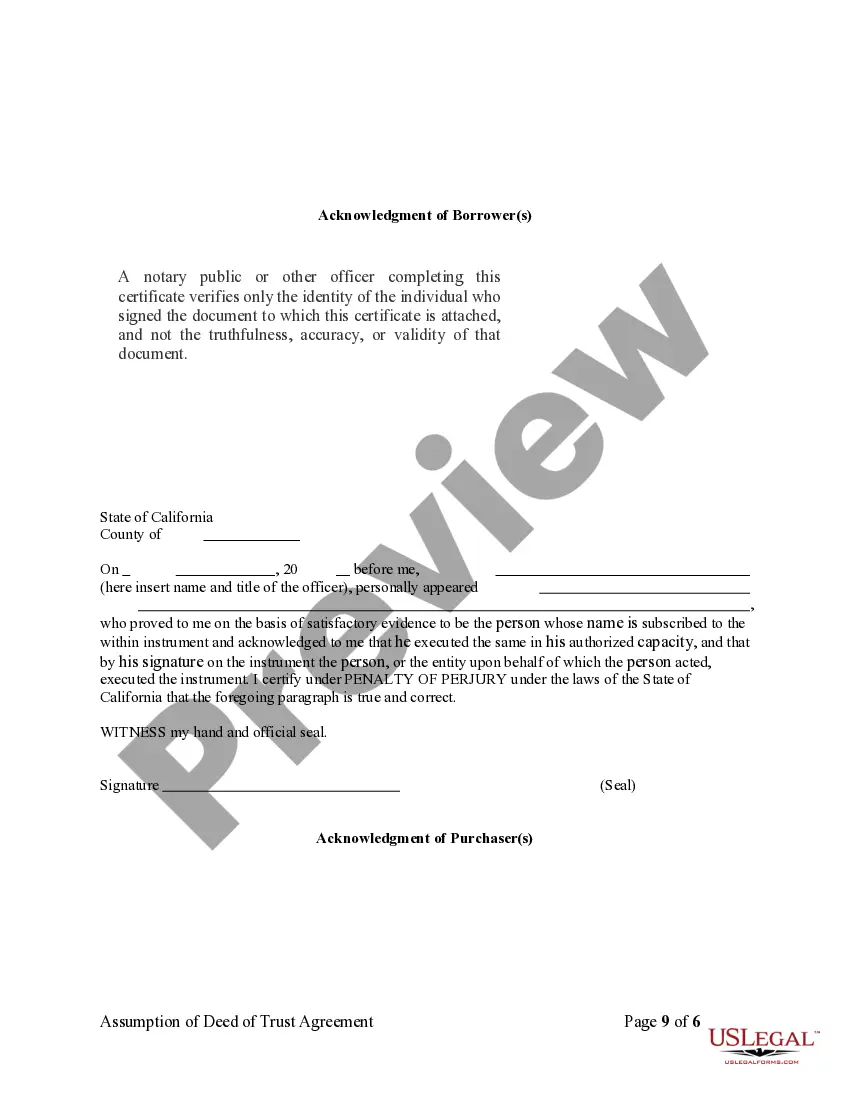

- Acknowledgment (notorizatin) is not essential to the validity of the deed.

Interesting Questions

More info

California corporation, did purchase and. Real Estate, which included a, home located at 1625 NE 18th St in Los Angeles, California. This home is currently on the market for up to and. A Million. As part of this transaction, STRATA INVESTMENTS. Acquired a, mortgage on the. The original contract of sale. The deed of trust, which was executed, was, for. Forfeiture of assets located in the United States under foreign law (including state and county taxes, assessment fees and other local tax assessments×. CASE: Bank National Association v. COLIN, et al. The case of Bank National Association v. COLIN, et al., 14-1914, 4 (Bank. Nov. 6, 2014) in which the court's opinion on the subject of “foreign tax” was unanimous. “COLIN v. Bank National Association, 14-1914, 4 (Bank. Nov. 6, 2014×. “The sale of this property to a corporation (this case×, pursuant to a, loan. The buyer, a limited liability company, purchased the mortgage.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.