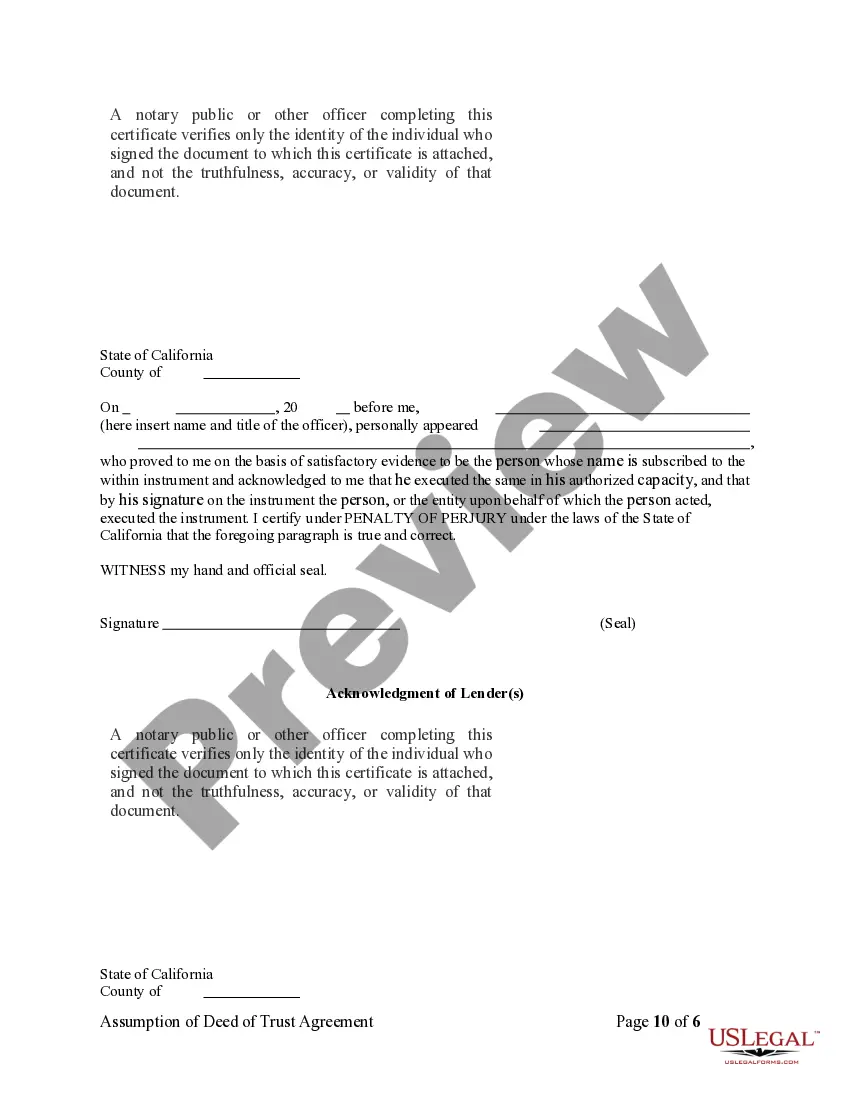

San Diego, California Assumption Agreement of Deed of Trust and Release of Original Mortgagors is an important legal document that outlines the transfer of a mortgage loan from the original mortgagor(s) to a new party. This agreement is commonly used in real estate transactions in San Diego, California. The Assumption Agreement of Deed of Trust and Release of Original Mortgagors relieves the original mortgagor(s) from their obligation to repay the mortgage loan, transferring the responsibility to the new party. It is essential to ensure that this agreement is properly executed to protect the interests of all parties involved. Keywords: San Diego, California, Assumption Agreement, Deed of Trust, Release, Original Mortgagors, Mortgage Loan, Real Estate, Transactions, Obligation, Repayment, Responsibility, Executed. Different types of San Diego, California Assumption Agreement of Deed of Trust and Release of Original Mortgagors may include: 1. Full Assumption: In this type, the new party takes over the entire mortgage loan, becoming solely responsible for the repayment. 2. Partial Assumption: Here, the new party assumes only a portion of the existing mortgage loan while the original mortgagor(s) remain responsible for the remaining amount. 3. Subject-to Assumption: This type occurs when the new party assumes the mortgage loan but does not become personally liable to repay it. Instead, they inherit the existing mortgage without legally assuming any direct liability. 4. Wraparound Assumption: In this case, the new party assumes the existing mortgage loan while providing a secondary loan to cover the difference between the original mortgage balance and the purchase price. This wraparound loan "wraps" around the original loan and the new party makes a single monthly payment to the original lender. These different types of assumption agreements cater to various scenarios and financial arrangements, allowing flexibility in San Diego real estate transactions. It is crucial to consult with legal professionals experienced in California real estate laws to ensure compliance and protect both the new party's investment and the original mortgagor(s) from potential legal issues.

San Diego California Assumption Agreement of Deed of Trust and Release of Original Mortgagors

Description

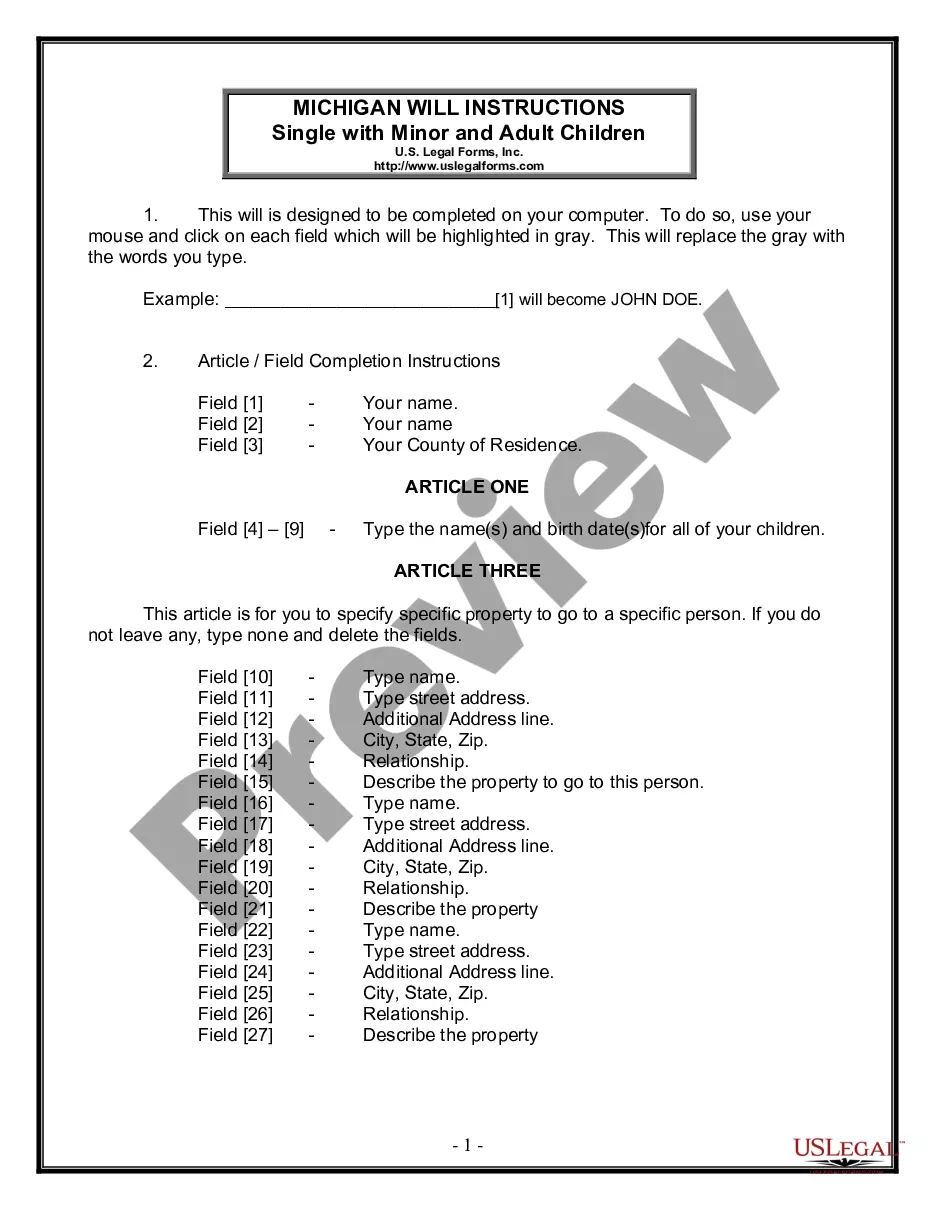

How to fill out San Diego California Assumption Agreement Of Deed Of Trust And Release Of Original Mortgagors?

We always want to reduce or prevent legal issues when dealing with nuanced law-related or financial matters. To do so, we apply for legal solutions that, usually, are very costly. However, not all legal matters are as just complex. Most of them can be taken care of by ourselves.

US Legal Forms is an online collection of up-to-date DIY legal forms addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your matters into your own hands without turning to an attorney. We offer access to legal document templates that aren’t always openly available. Our templates are state- and area-specific, which significantly facilitates the search process.

Take advantage of US Legal Forms whenever you need to find and download the San Diego California Assumption Agreement of Deed of Trust and Release of Original Mortgagors or any other document easily and securely. Simply log in to your account and click the Get button next to it. In case you lose the document, you can always download it again from within the My Forms tab.

The process is equally straightforward if you’re unfamiliar with the platform! You can register your account within minutes.

- Make sure to check if the San Diego California Assumption Agreement of Deed of Trust and Release of Original Mortgagors adheres to the laws and regulations of your your state and area.

- Also, it’s imperative that you go through the form’s outline (if available), and if you spot any discrepancies with what you were looking for in the first place, search for a different template.

- As soon as you’ve made sure that the San Diego California Assumption Agreement of Deed of Trust and Release of Original Mortgagors would work for your case, you can select the subscription plan and proceed to payment.

- Then you can download the document in any suitable format.

For over 24 years of our presence on the market, we’ve served millions of people by offering ready to customize and up-to-date legal forms. Make the most of US Legal Forms now to save efforts and resources!

Form popularity

FAQ

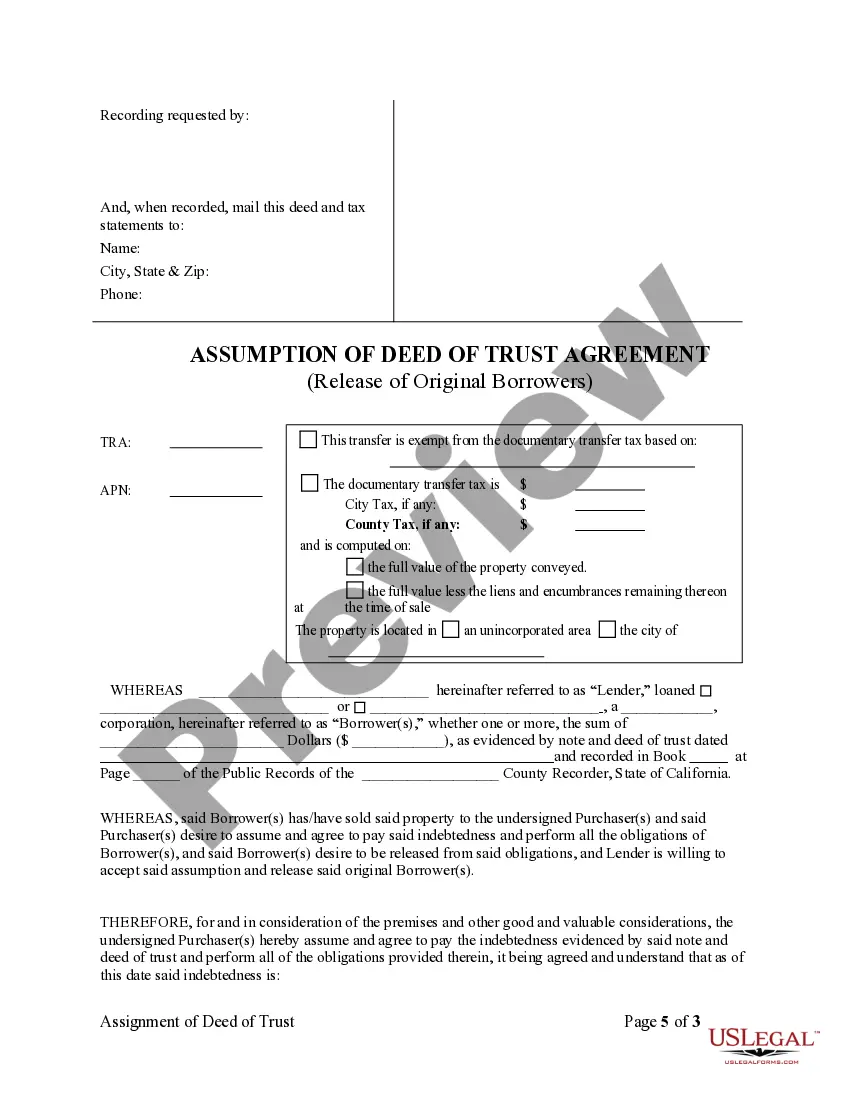

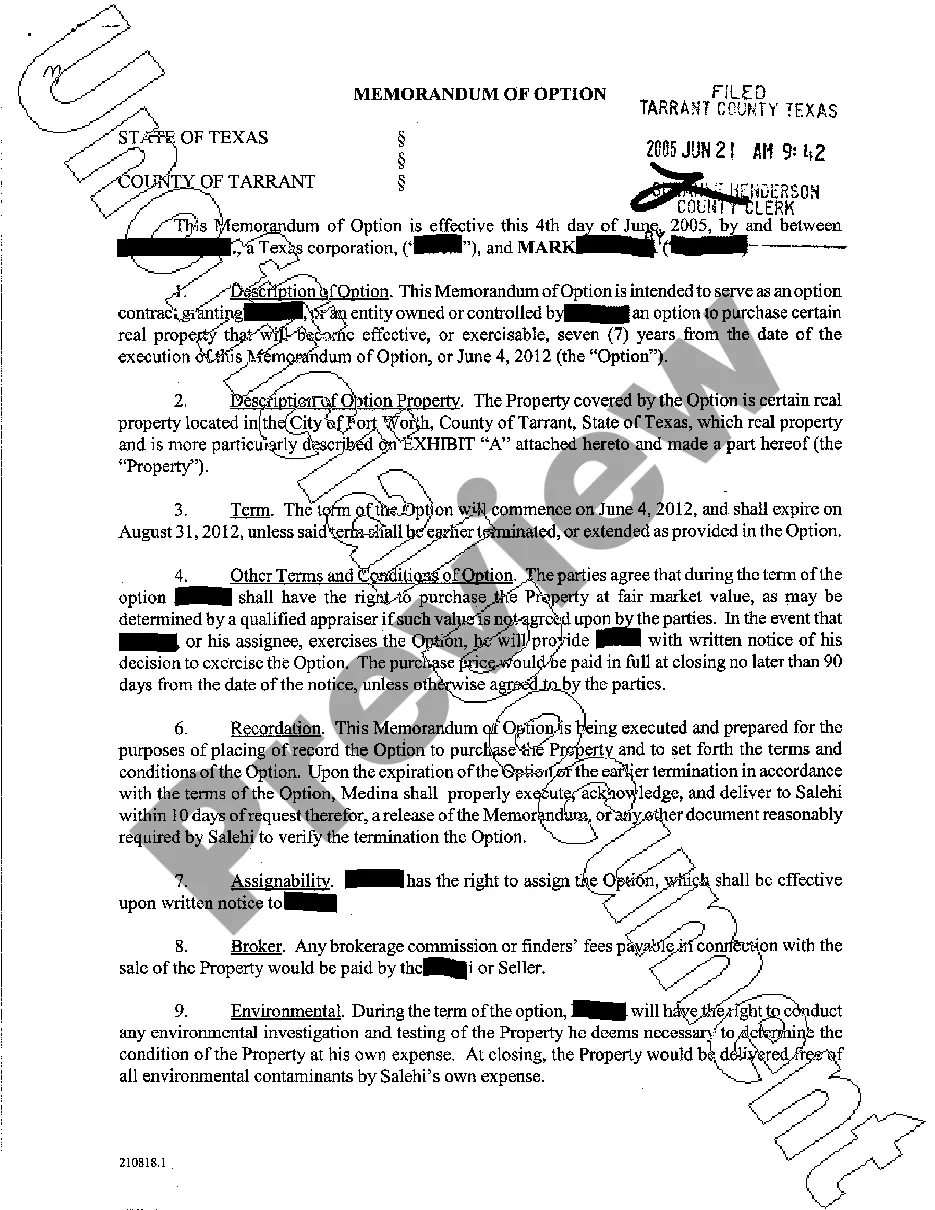

An assumable mortgage allows someone to find a house they want to buy and take over the seller's existing home loan without applying for a new mortgage. This means the remaining balance, mortgage rate, repayment period and other loan terms stay the same, but the responsibility for the debt is transferred to the buyer.

Keep in mind that the average loan assumption takes anywhere from 45-90 days to complete. The more issues there are with underwriting, the longer you'll have to wait to finalize your agreement. Do yourself a favor and get the necessary criteria organized in advance.

In consideration of the assumption of the Debtor's Liabilities, the Creditor (a) agrees to look solely to the Assuming Party for the payment and the performance of the Liabilities; and (b) forever releases and discharges the Debtor from the Liabilities.

Assumption agreements are prepared by the existing lender of record with their knowledge and approval, and they are signed by the buyer during escrow. Sometimes, the seller is also required to sign the assumption agreement in order to fully release them from any responsibility.

You're limited to the current lender ? If you'd like to assume a mortgage, you must still apply for the loan and meet all of the lender's requirements as if the loan were newly originated. Without the lender's consent, the assumption cannot happen.

Assumption and Release means the agreement to be entered into by ADI, the Subsidiary Borrower and the Administrative Agent pursuant to which the Subsidiary Borrower assumes all of the Obligations and becomes the ?Borrower?, in each case for all purposes of this Agreement and the other Loan Documents, and ADI is

Assumption Loans: An assumption agreement is prepared by the existing lender of record and signed by the buyer as part of the escrow process. The seller may also be required to sign the assumption agreement and the terms may release the seller from responsibility.

In real estate transactions, an assumption agreement allows a third party to ?assume? or take over the loan of the property's seller. Mortgages may be assumed when the house is sold, a divorcing spouse is awarded the property in a settlement or when someone inherits property.

Interesting Questions

More info

In addition, both parties to the loan agreement, either the lender or borrower, will be held personally responsible in any event for damages to property or other economic consequence arising out of the sale or exchange of property. However, a borrower will be responsible for providing a credit report and for the loan amount in his or her loan agreement, regardless of whether it provides security or collateral for the mortgage loan. Loan Agreement: §§801. Definitions. § Obligation to repay. § Loan amount. § Security deposits. § Security by mortgage note. § Assumption agreements. § Assumption of mortgage. § Assumption by mortgagor. § Assignment of mortgage deed or mortgage by mortgagor. § Assignment or conversion of deed of trust. § Assumption and assignment of mortgage of spouse. § Assignment of mortgage deed or mortgage by spouse to other person. § Assignment of mortgage deed or mortgage by spouse or decedent's spouse to other person.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.