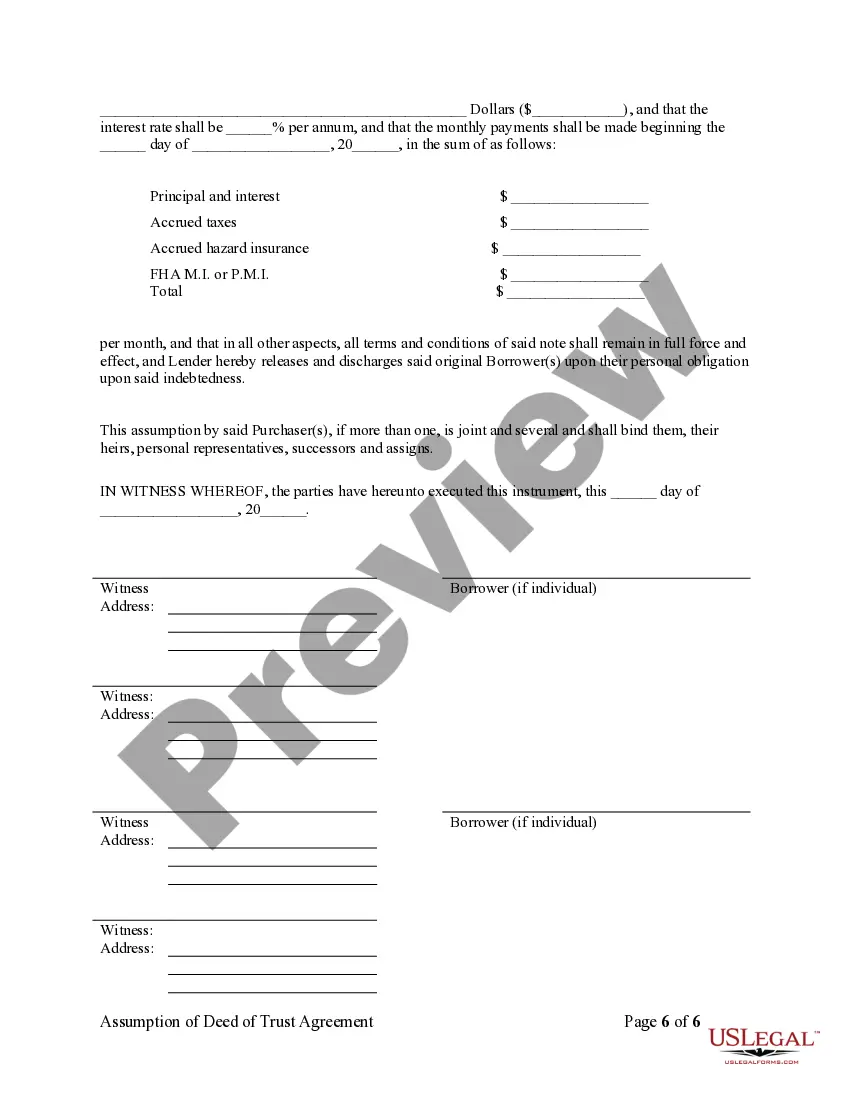

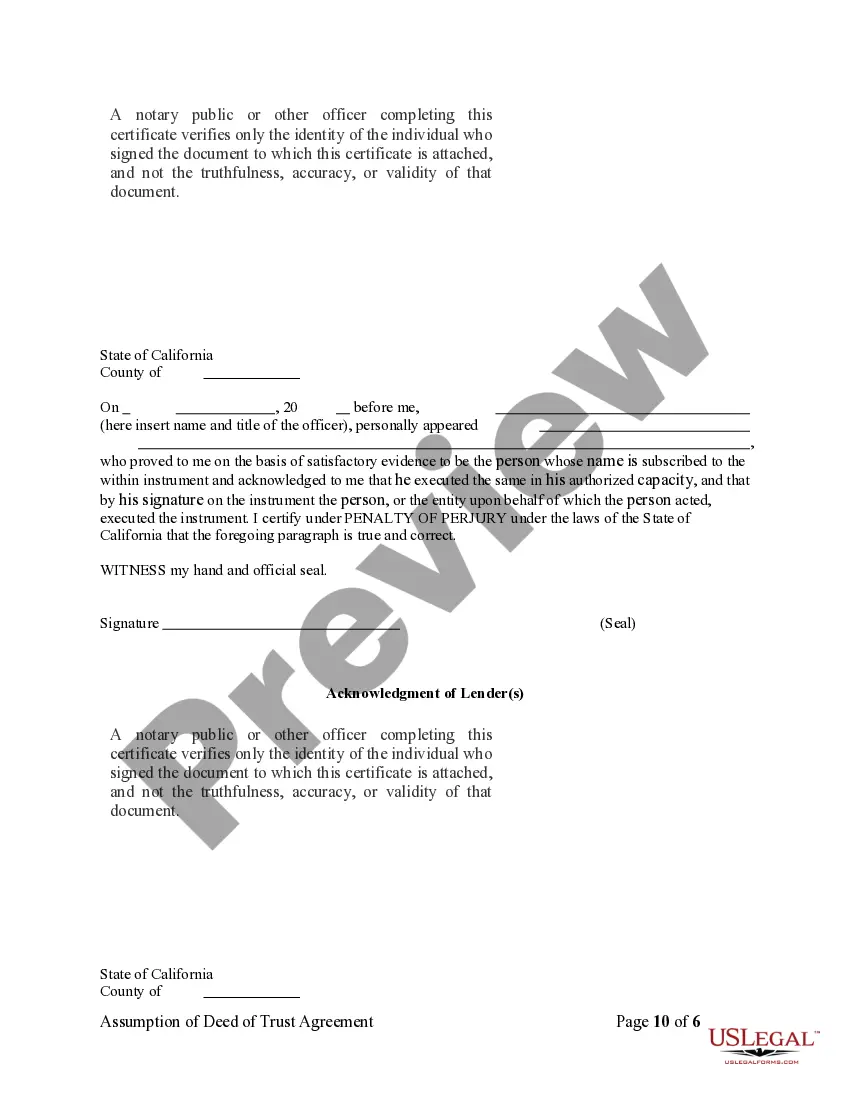

San Jose California Assumption Agreement of Deed of Trust and Release of Original Mortgagors

Description

How to fill out California Assumption Agreement Of Deed Of Trust And Release Of Original Mortgagors?

Finding validated templates tailored to your local laws can be difficult unless you utilize the US Legal Forms library.

It’s an online collection of over 85,000 legal documents for both personal and business requirements, covering a wide range of real-life scenarios.

All the paperwork is appropriately categorized by field of application and jurisdiction, making it easy and quick to find the San Jose California Assumption Agreement of Deed of Trust and Release of Original Mortgagors.

Maintaining documentation organized and compliant with legal regulations is crucial. Take advantage of the US Legal Forms library to always have necessary document templates readily available for any of your needs!

- Ensure you check the Preview mode and form details.

- Confirm that you’ve selected the correct one that fulfills your needs and aligns exactly with your local jurisdiction criteria.

- Search for an alternative template, if necessary.

- When you notice any discrepancies, use the Search tab above to find the correct one.

- If it meets your requirements, proceed to the subsequent step.

Form popularity

FAQ

Assumption and Release means the agreement to be entered into by ADI, the Subsidiary Borrower and the Administrative Agent pursuant to which the Subsidiary Borrower assumes all of the Obligations and becomes the ?Borrower?, in each case for all purposes of this Agreement and the other Loan Documents, and ADI is

: a deed by which a trustee assumes or appoints a new cotrustee.

- Acknowledgment (notorizatin) is not essential to the validity of the deed.

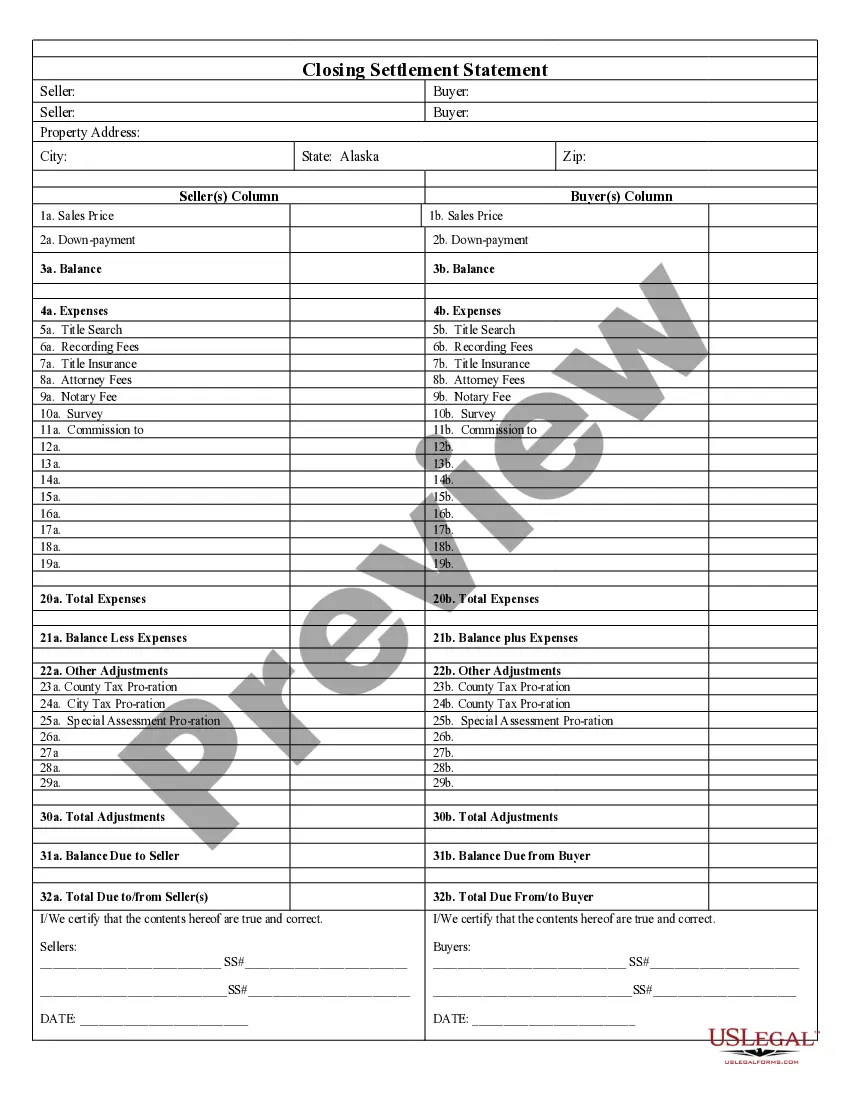

In real estate transactions, an assumption agreement allows a third party to ?assume? or take over the loan of the property's seller. Mortgages may be assumed when the house is sold, a divorcing spouse is awarded the property in a settlement or when someone inherits property.

Can a declaration of trust be challenged? The intention of a declaration of trust is to ensure that there is no dispute or ambiguity in regards to the distribution of financial investment in property, but a dispute is still possible.

In consideration of the assumption of the Debtor's Liabilities, the Creditor (a) agrees to look solely to the Assuming Party for the payment and the performance of the Liabilities; and (b) forever releases and discharges the Debtor from the Liabilities.

The first step in dissolving a revocable trust is to remove all the assets that have been transferred into it. The second step is to fill out a formal revocation form, stating the grantor's desire to dissolve the trust.

California law states that a trust is created only if: The settlor properly manifests an intention to create a trust; There is trust property; and. There is a beneficiary (unless it is a charitable trust).

A Debt Assignment and Assumption Agreement is a very simple document whereby one party assigns their debt to another party, and the other party agrees to take that debt on. The party that is assigning the debt is the original debtor; they are called the assignor.

Some of the most common reasons trusts are invalid include: Legal formalities were not followed when executing the trust instrument. The trust was created or modified through forgery or another type of fraud. The trust maker was not mentally competent when they created or modified the trust.