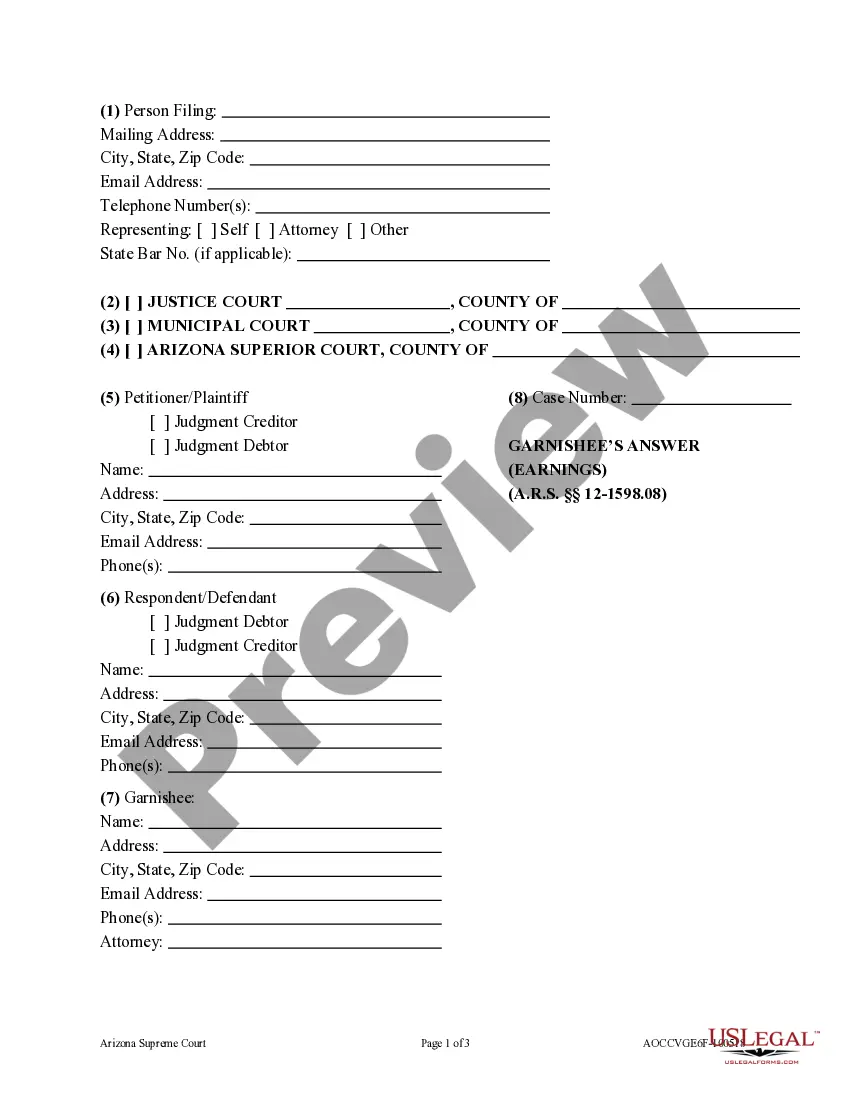

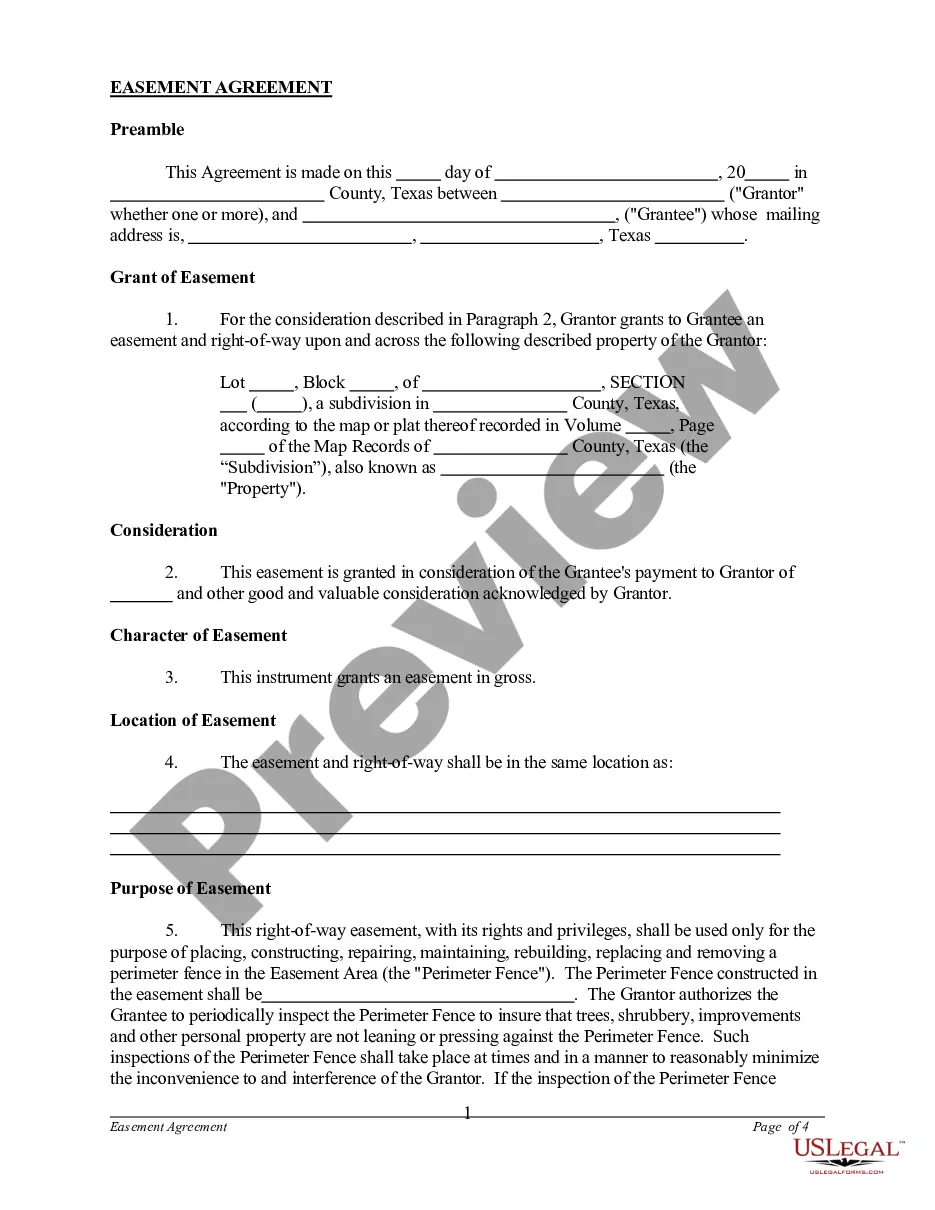

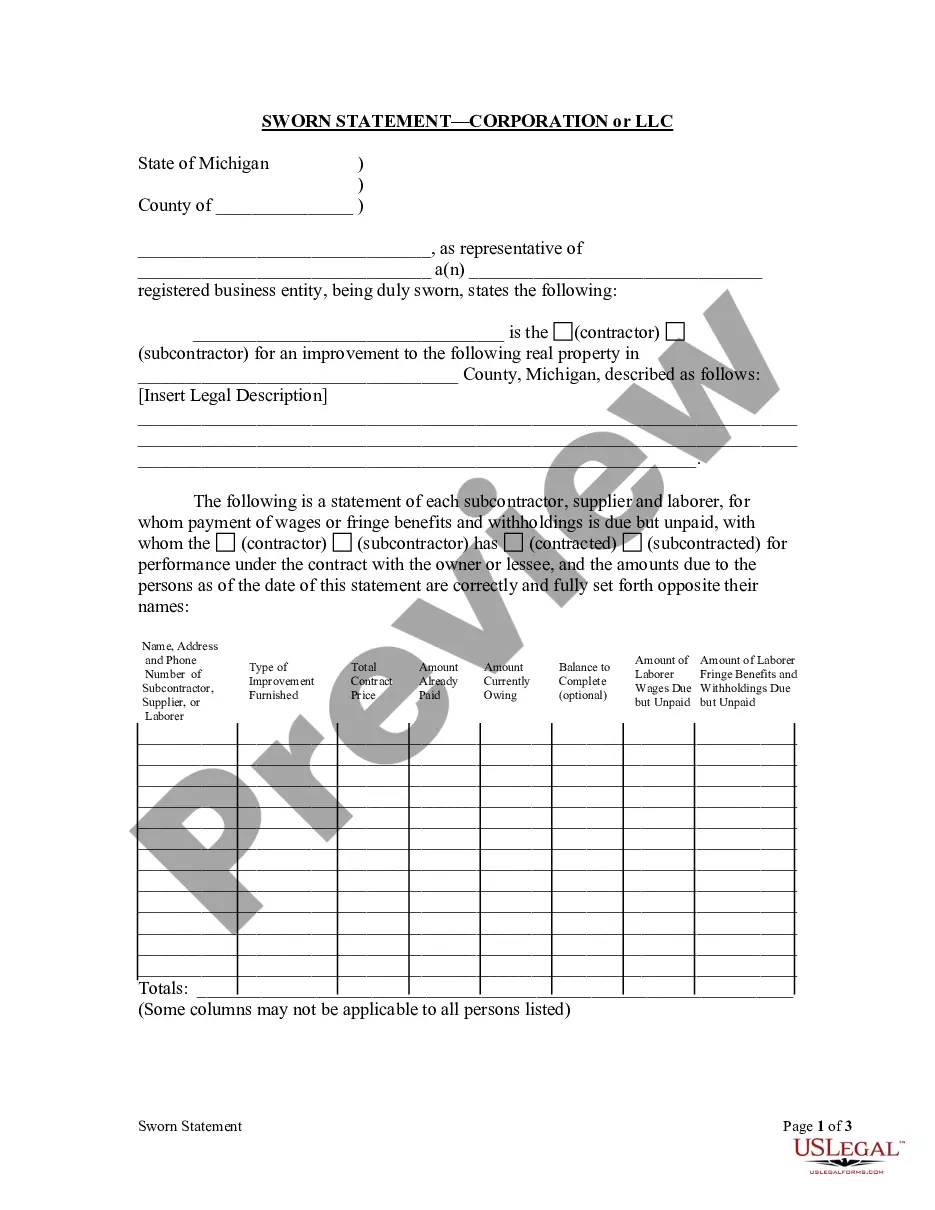

Title: Inglewood, California Notice of Levy — Enforcement of Judgment Explained: Types and Implications Introduction: The Inglewood, California Notice of Levy — Enforcement of Judgment is a legal document used in the state's judicial system to enforce the collection of a court-ordered judgment against a debtor. This crucial step aims to recover funds owed by individuals or entities who have failed to fully satisfy their legal obligations. Inglewood offers two primary types of Notices of Levy with distinct characteristics and consequences. This article will provide a comprehensive understanding of these notices, their significance, and their implications for both debtors and creditors. 1. Notice of Levy on Wages: This type of Notice of Levy empowers creditors to garnish specified amounts from an individual debtor's wages or salary. Serving this notice directly to the debtor's employer requires compliance with strict legal procedures outlined by California law. The Notice of Levy on Wages aims to systematically collect funds from the debtor's income until the judgment is satisfied or other legal arrangements are made. 2. Notice of Levy on Bank Accounts: The Notice of Levy on Bank Accounts allows creditors to freeze and potentially seize funds from the debtor's bank account(s). After receiving this notice, banks are obligated to hold the funds for a specified period while the creditor investigates the available balance. The notice aims to ensure that the judgment is paid promptly, typically by deducting the owed amount directly from the debtor's account. Implications for Debtors: Receiving a Notice of Levy can have significant consequences for debtors. It restricts their access to certain financial resources, potentially disrupting their ability to meet daily expenses and financial obligations. Debtors should act expeditiously upon receiving the notice to explore legal options, including filing exemptions or negotiating an alternative resolution with the creditor. Implications for Creditors: The Notice of Levy empowers creditors with a compelling tool for enforcing judgment and ensuring repayment for monetary damages awarded by the court. By serving this notice, creditors can legally collect owed funds, providing a measure of relief and financial redress. It is imperative for creditors to follow the Inglewood-specific legal procedures when serving these notices to maximize their chances of recovery. Conclusion: The Inglewood, California Notice of Levy — Enforcement of Judgment is a vital legal instrument that promotes the enforcement of court-ordered judgments in matters of debt collections. Understanding the different types of notices, such as the Notice of Levy on Wages and the Notice of Levy on Bank Accounts, is crucial for both debtors and creditors. Debtors should take prompt action upon receipt of the notice to explore potential exemptions or negotiate alternatives, while creditors can utilize the notice to effectively recover the funds they are owed in a court-ordered judgment.

Inglewood California Notice of Levy - Enforcement of Judgment

Description

How to fill out Inglewood California Notice Of Levy - Enforcement Of Judgment?

No matter the social or professional status, completing law-related forms is an unfortunate necessity in today’s professional environment. Very often, it’s almost impossible for a person with no legal education to draft this sort of paperwork cfrom the ground up, mainly because of the convoluted jargon and legal subtleties they entail. This is where US Legal Forms can save the day. Our platform offers a huge library with over 85,000 ready-to-use state-specific forms that work for practically any legal situation. US Legal Forms also is an excellent asset for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI forms.

Whether you need the Inglewood California Notice of Levy - Enforcement of Judgment or any other document that will be good in your state or area, with US Legal Forms, everything is at your fingertips. Here’s how to get the Inglewood California Notice of Levy - Enforcement of Judgment quickly employing our trusted platform. If you are presently an existing customer, you can go ahead and log in to your account to download the appropriate form.

Nevertheless, if you are a novice to our library, ensure that you follow these steps prior to obtaining the Inglewood California Notice of Levy - Enforcement of Judgment:

- Ensure the template you have chosen is specific to your location considering that the regulations of one state or area do not work for another state or area.

- Review the document and read a quick outline (if provided) of cases the paper can be used for.

- If the form you selected doesn’t meet your needs, you can start over and look for the necessary form.

- Click Buy now and choose the subscription plan you prefer the best.

- Log in to your account login information or create one from scratch.

- Pick the payment gateway and proceed to download the Inglewood California Notice of Levy - Enforcement of Judgment as soon as the payment is completed.

You’re good to go! Now you can go ahead and print out the document or fill it out online. Should you have any problems getting your purchased forms, you can easily access them in the My Forms tab.

Regardless of what situation you’re trying to solve, US Legal Forms has got you covered. Try it out today and see for yourself.

Form popularity

FAQ

When a court issues a 'judgment enforcement stayed' order, it temporarily halts the actions taken to collect a judgment. This means that parties involved cannot proceed with measures like a Notice of Levy in Inglewood, California, that would enforce the judgment. Often, this stay occurs when a party appeals the decision or files for bankruptcy. Understanding this term is crucial for anyone navigating the complexities of judgment enforcement and ensures that you protect your rights.

A motion to enforce judgment is a formal request made to the court to compel compliance with a previously issued judgment. In the context of the Inglewood California Notice of Levy - Enforcement of Judgment, this motion seeks to ensure that the debtor fulfills their obligation. The motion may involve the use of various legal tools to gather payment or recover property. Understanding how to navigate this process can be complex, but resources like US Legal Forms can assist you in preparing the necessary documents.

Responding to a notice of levy requires you to act promptly, often by filing a claim of exemption if you believe certain funds or property are exempt from seizure. This response is part of the Inglewood California Notice of Levy - Enforcement of Judgment process and is vital in protecting your rights. You should also consider reaching out to the creditor or seeking court advice for further clarification. Using US Legal Forms can provide you with the necessary templates and guidance.

Receiving a notice of levy indicates that someone is trying to collect a debt you owe through legal means. This is a crucial step in the Inglewood California Notice of Levy - Enforcement of Judgment, signaling an official attempt to seize your property or funds. It is essential to take this notice seriously, as it outlines your rights and obligations in response. Ignoring it could lead to further legal complications.

A levy judgment occurs when a court authorizes a creditor to collect on a judgment through the seizure of a debtor's property. This process is part of the Inglewood California Notice of Levy - Enforcement of Judgment, allowing creditors to recover outstanding debts. It can involve garnishing wages or seizing bank accounts and personal belongings. Understanding this process is vital for both creditors and debtors alike.

A notice of entry of judgment signifies that a court has officially entered a judgment and that all parties involved have been informed of this decision. This notice is essential in the enforcement process, as it marks the point at which the debtor's obligations become enforceable under the law. In relation to the Inglewood California Notice of Levy - Enforcement of Judgment, it is the basis that triggers subsequent actions, such as writs of execution or levies on property. Understanding this notice is crucial for both creditors seeking payment and debtors aiming to comprehend their legal standing.

A writ of execution of judgment in California is a court order that authorizes the enforcement of a judgment awarded to a creditor. This legally empowers the sheriff or another appointed officer to seize property from the debtor to satisfy the debts. When referring to the Inglewood California Notice of Levy - Enforcement of Judgment, this writ is a critical step in the collection process and outlines the specifics of how the judgment will be executed. It serves as an official means of ensuring that debts are recovered in a lawful manner.

After a writ of execution is served in California, the levying officer, typically a sheriff, will proceed to enforce the judgment by seizing assets or property from the debtor. This process is part of the Inglewood California Notice of Levy - Enforcement of Judgment, which aims to ensure that the creditor receives the amount owed. The debtor will be notified of the action, and they have the opportunity to respond or contest the seizure before any property is taken. Understanding this process can significantly help both creditors and debtors in navigating post-judgment scenarios.

The EJ-130 form is a request for a court order to enforce a judgment through the Inglewood California Notice of Levy - Enforcement of Judgment. This form allows you to formally notify the court of your intent to implement various forms of enforcement, like garnishing wages or levying bank accounts. Completing the EJ-130 accurately is essential for a successful enforcement process. US Legal Forms provides guidance and templates to ensure you fill out the EJ-130 correctly.

You should file a notice of entry of judgment soon after the court awards the judgment in your favor. Timely filing is critical, as it initiates the enforcement process, including the Inglewood California Notice of Levy - Enforcement of Judgment. Ensure that you follow the specific timelines set by the court to protect your rights. US Legal Forms offers resources to help you understand these timelines and procedures.