The Sacramento California Notice of Levy — Enforcement of Judgment is a legal document that plays a pivotal role in the collection of debts owed by a judgment debtor. This notice aims to enforce a judgment by seizing and levying the assets of the debtor to satisfy the outstanding obligation. Below, we will explore the details of this essential document, its purpose, and its various types. The Sacramento California Notice of Levy — Enforcement of Judgment is typically issued by a judgment creditor or their attorney, following a successful debt recovery lawsuit. This notice serves as a formal notification to the judgment debtor that their assets will be seized by the levying officer to fulfill the court-ordered judgment amount. By initiating this process, the creditor aims to secure repayment and ensure that justice is served. When it comes to the different types of Sacramento California Notice of Levy — Enforcement of Judgment, there are several variations, each designed to target specific assets in various scenarios. Here are some noteworthy types: 1. Bank Levy: This type of levy allows the levying officer to contact financial institutions where the judgment debtor holds accounts and request the seizure of funds to satisfy the outstanding debt. The bank is mandated to freeze the debtor's account(s) and provide the funds for subsequent distribution to the creditor. 2. Wage Garnishment: With a wage garnishment notice, the levying officer serves an order to the debtor's employer, commanding them to withhold a portion of the debtor's wages for payment towards the judgment. This type of levy continues until the debt is fully repaid or the available assets are exhausted. 3. Real Property Levy: When the judgment debtor owns real estate in Sacramento California, this type of levy enables the levying officer to place a lien on the property. The property can be subsequently sold at a public auction, with the proceeds directed towards satisfying the outstanding judgment. 4. Personal Property Levy: This type of levy permits the levying officer to seize and sell personal assets owned by the debtor, such as vehicles, electronics, jewelry, and other valuable possessions. The proceeds obtained from the sale are then used to settle the judgment debt. 5. Third-Party Levy: In certain cases, the judgment creditor may have knowledge that a third party owes money to the debtor. In such instances, the creditor can file a third-party levy, which directs the levying officer to seize funds held by that third party, such as tenants who owe rent or individuals who owe the debtor money. It's important to note that the Sacramento California Notice of Levy — Enforcement of Judgment must comply with specific legal procedures outlined in the California Code of Civil Procedure. Additionally, there are limitations on the types of assets that can be levied, exemptions for certain protected assets, and guidelines governing the distribution of funds recovered. In conclusion, the Sacramento California Notice of Levy — Enforcement of Judgment is a powerful legal tool that facilitates the collection of outstanding debts by seizing and selling the assets of the judgment debtor. Through various types of levies, such as bank levies, wage garnishments, real property levies, personal property levies, and third-party levies, creditors can ensure that their judgments are effectively enforced and their rightful dues are recovered.

Sacramento California Notice of Levy - Enforcement of Judgment

Description

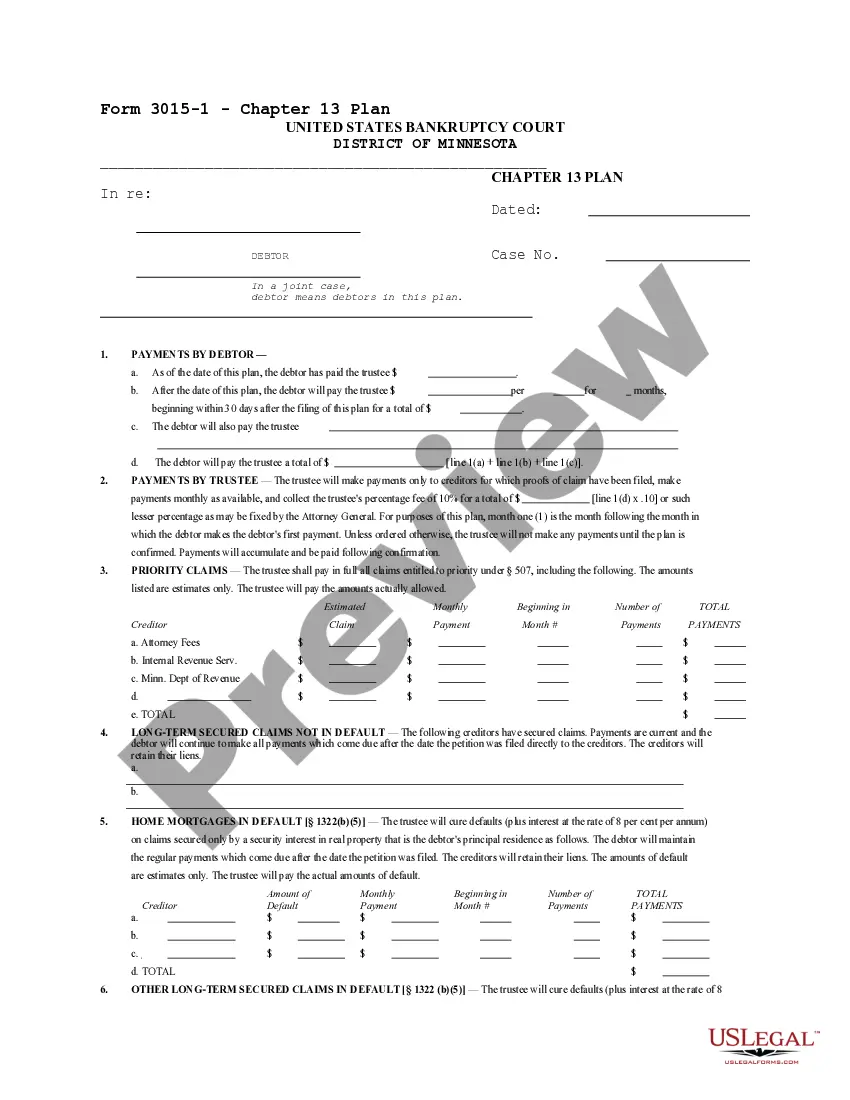

How to fill out Sacramento California Notice Of Levy - Enforcement Of Judgment?

No matter what social or professional status, filling out law-related documents is an unfortunate necessity in today’s professional environment. Too often, it’s practically impossible for a person without any law background to create this sort of paperwork cfrom the ground up, mainly due to the convoluted jargon and legal subtleties they come with. This is where US Legal Forms can save the day. Our platform offers a huge catalog with over 85,000 ready-to-use state-specific documents that work for almost any legal case. US Legal Forms also serves as a great resource for associates or legal counsels who want to save time using our DYI forms.

Whether you need the Sacramento California Notice of Levy - Enforcement of Judgment or any other document that will be good in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how to get the Sacramento California Notice of Levy - Enforcement of Judgment in minutes using our trusted platform. In case you are already a subscriber, you can go ahead and log in to your account to get the needed form.

However, in case you are new to our library, ensure that you follow these steps prior to obtaining the Sacramento California Notice of Levy - Enforcement of Judgment:

- Ensure the template you have chosen is suitable for your location considering that the rules of one state or county do not work for another state or county.

- Preview the form and read a short description (if provided) of cases the document can be used for.

- If the one you selected doesn’t meet your requirements, you can start over and look for the necessary form.

- Click Buy now and choose the subscription plan that suits you the best.

- utilizing your credentials or create one from scratch.

- Select the payment gateway and proceed to download the Sacramento California Notice of Levy - Enforcement of Judgment as soon as the payment is done.

You’re good to go! Now you can go ahead and print out the form or fill it out online. Should you have any issues locating your purchased documents, you can quickly find them in the My Forms tab.

Regardless of what case you’re trying to sort out, US Legal Forms has got you covered. Give it a try today and see for yourself.

Form popularity

FAQ

Renew the judgment Money judgments automatically expire (run out) after 10 years. To prevent this from happening, the creditor must file a request for renewal of the judgment with the court BEFORE the 10 years run out.

To attach a lien to real estate, the creditor can take or mail the Abstract of Judgment to the county recorder's office in any California county where the debtor owns real estate now, or may own it in the future.

Notice of Levy (EJ-150) Tells the judgment debtor or other interested person that personal property is being taken by the sheriff to satisfy a judgment.

The most effective way to stop garnishments or other levies is to pay in full. After you have paid, contact the number listed on your order.

The judgment debtor has approximately 10 days to oppose the bank levy before the sheriff sends the money to the judgment creditor. How to Execute Wage Garnishments in California: Under California State law, if a judgment debtor is working, a judgment creditor can intercept up to 25% of wages to pay an outstanding debt.

Debt collectors can only take money from your paycheck, bank account, or benefits?which is called garnishment?if they have already sued you and a court entered a judgment against you for the amount of money you owe. The law sets certain limits on how much debt collectors can garnish your wages and bank accounts.

We issue orders to withhold to legally take your property to satisfy an outstanding balance due. We may take money from your bank account or other financial assets or we may collect any personal property or thing of value belonging to you but in the possession and control of a third party.

California has a statute of limitations of four years for most types of debt (20 years for state tax debt). The only exception are debts taken on via an oral contract, which are subject to a statute of limitations of two years. Be careful about paying or promising to pay debts that exceed the statute of limitations.

A personal property levy allows a creditor to obtain possession of much of the debtor's property in California (e.g., equipment, inventory, vehicles, cash in cash registers), excluding real property and property held by third parties.

If your judgment has already expired, you should consult an attorney before taking any action. California judgments last for 10 years from the date they were entered. If you win a judgment issued by a federal court, you may start collecting right away. The defendant has 30 days to file an appeal or post a bond.

Interesting Questions

More info

How do I get a search warrant for the documents? First, you need probable cause for your warrant. Then, the judge orders a search of the property, which includes the computer. You obtain a search warrant to get the documents. This procedure works for most cases. The judge then signs the warrant, which is returned with the documents. You take them to a court hearing to explain what is happening. You are not required to take depositions at this hearing. A court hearing is scheduled for your hearing date to go over the search warrant and court procedures. The document discovery order will be issued, telling you how to request the documents from the police, and how to get them back, if you request the documents. The document discovery order will come back from the court. You can keep copies of the court documents, and also the document discovery order you are receiving from the court.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.